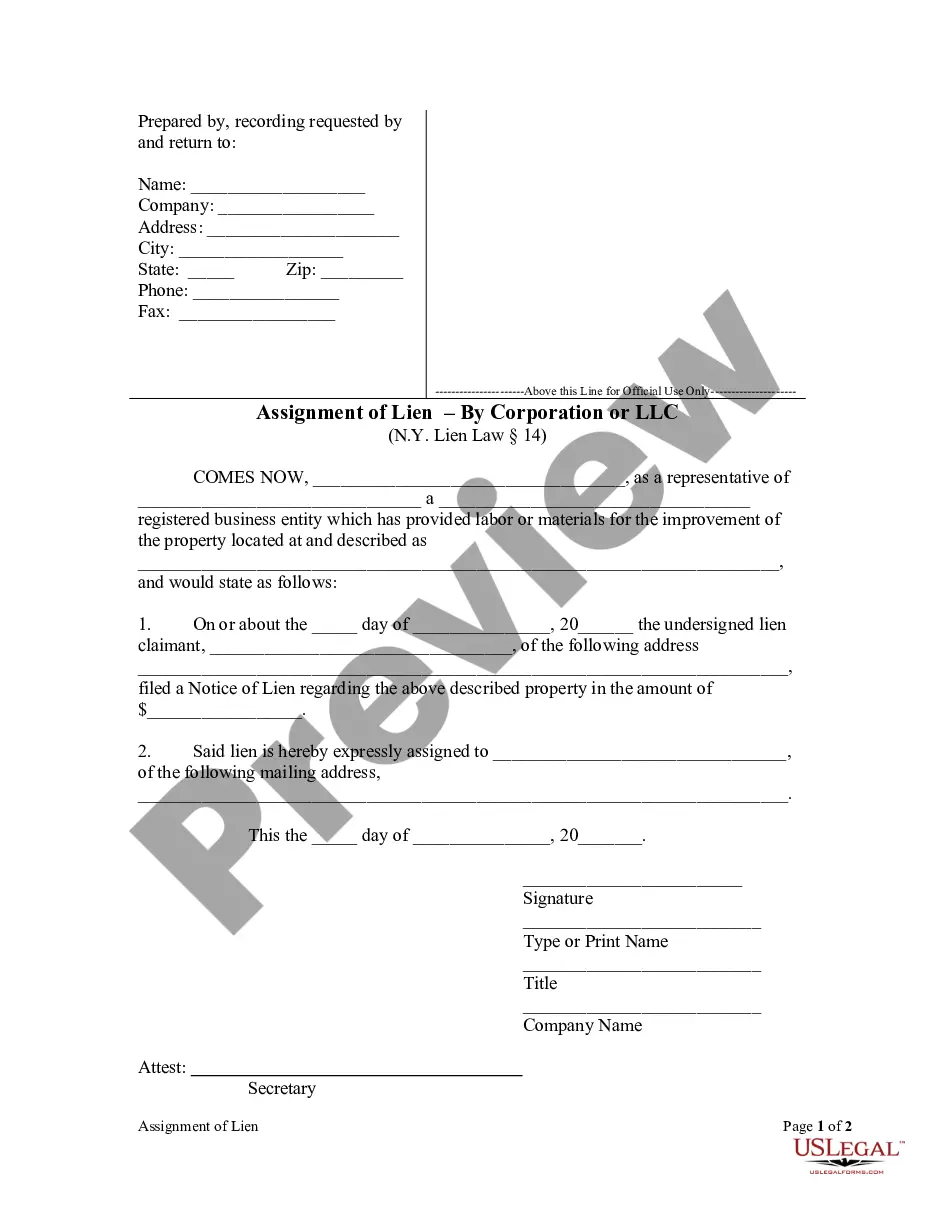

New York law permits a party to assign a lien using a written form signed and acknowledged by the lien holder.

Kings New York Assignment of Lien by Corporation

Description

How to fill out New York Assignment Of Lien By Corporation?

We consistently endeavor to reduce or avert legal harm when engaging with intricate legal or financial situations.

To achieve this, we enroll in attorney services that are typically very costly.

However, not every legal issue is equally intricate. Most of them can be managed by ourselves.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button beside it. If you happen to misplace the document, you can always re-download it from the My documents tab.

- Our collection empowers you to take charge of your affairs without the necessity of hiring a lawyer.

- We provide access to legal form templates that aren't always publicly accessible.

- Our templates are specific to states and regions, greatly simplifying the search process.

- Take advantage of US Legal Forms whenever you require the Kings New York Assignment of Lien by Corporation or LLC or any other document rapidly and securely.

Form popularity

FAQ

In Rhode Island, a lien typically lasts for ten years from the date it is filed. However, it can be renewed if the creditor takes appropriate steps before the expiration. Knowing the duration of a lien is crucial for both creditors and debtors in managing their financial obligations. For specific guidelines and renewal processes, consider consulting with a legal expert or utilizing resources like uslegalforms.

The three main types of liens are consensual liens, statutory liens, and judicial liens. Consensual liens arise from agreements between parties, statutory liens are imposed by law, and judicial liens result from court judgments. Understanding these types is essential when dealing with the Kings New York Assignment of Lien by Corporation, as each type has different regulations and implications.

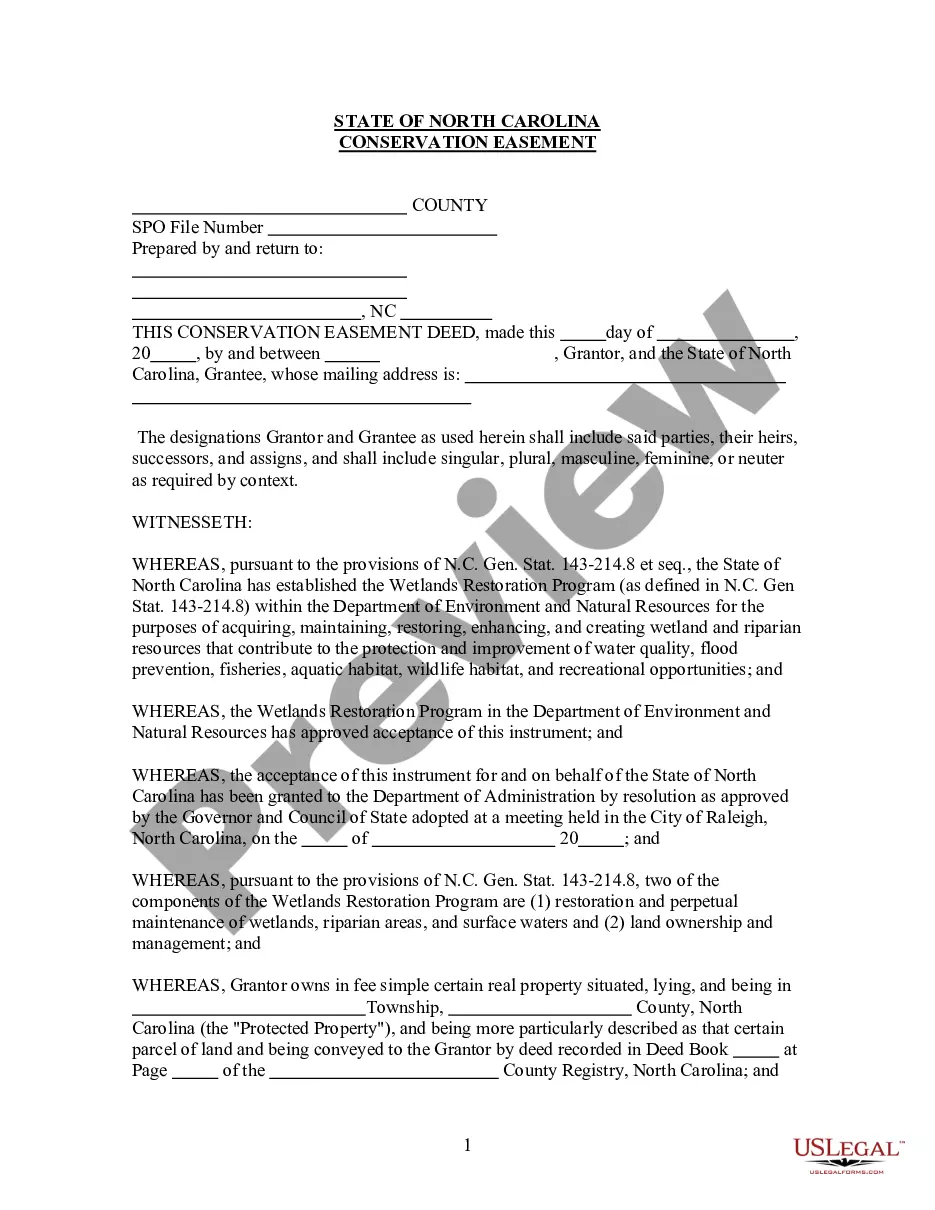

Filing a lien in New York involves several steps. First, you must prepare the required documentation that outlines the lien and the parties involved. Then, you file it with the appropriate county clerk’s office. Utilizing platforms like uslegalforms can simplify this process, providing you with the templates and guidance needed for a successful filing.

Yes, you can put a lien on a corporation under certain circumstances. The Kings New York Assignment of Lien by Corporation process allows creditors to secure their interest against a corporate entity. However, specific rules and requirements must be followed to ensure the lien is enforceable against the corporation's assets. Consulting a legal professional can help navigate this process effectively.

Yes, liens are public record in New York. When a lien is filed, it becomes part of the public records, accessible to anyone who wishes to view them. This transparency helps maintain a fair system, allowing potential creditors to discover existing liens before proceeding with lending. To check these records, you can visit the local county clerk's office or search online databases.

Yes, you can assign a lien in New York. The Kings New York Assignment of Lien by Corporation allows you to transfer rights associated with a lien to another party. This process ensures that the new party can enforce the lien just like the original holder. It’s important to follow the proper legal procedures to ensure the assignment is valid.

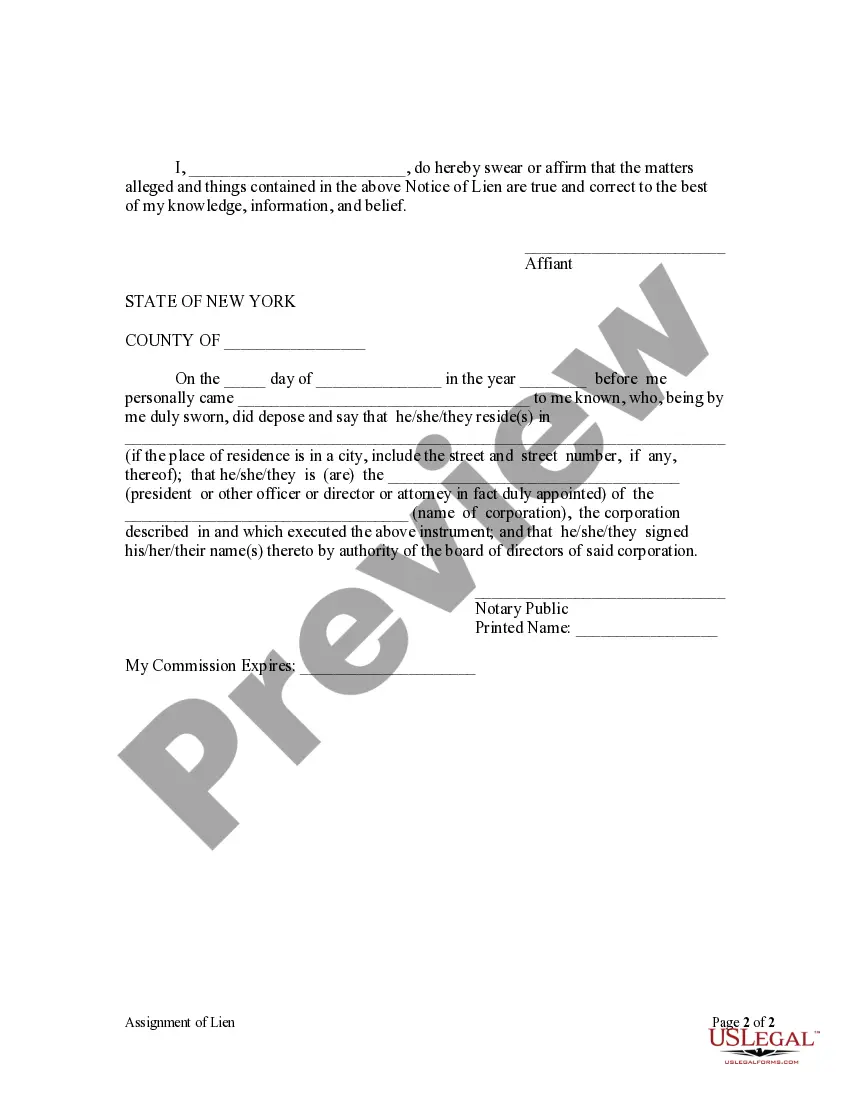

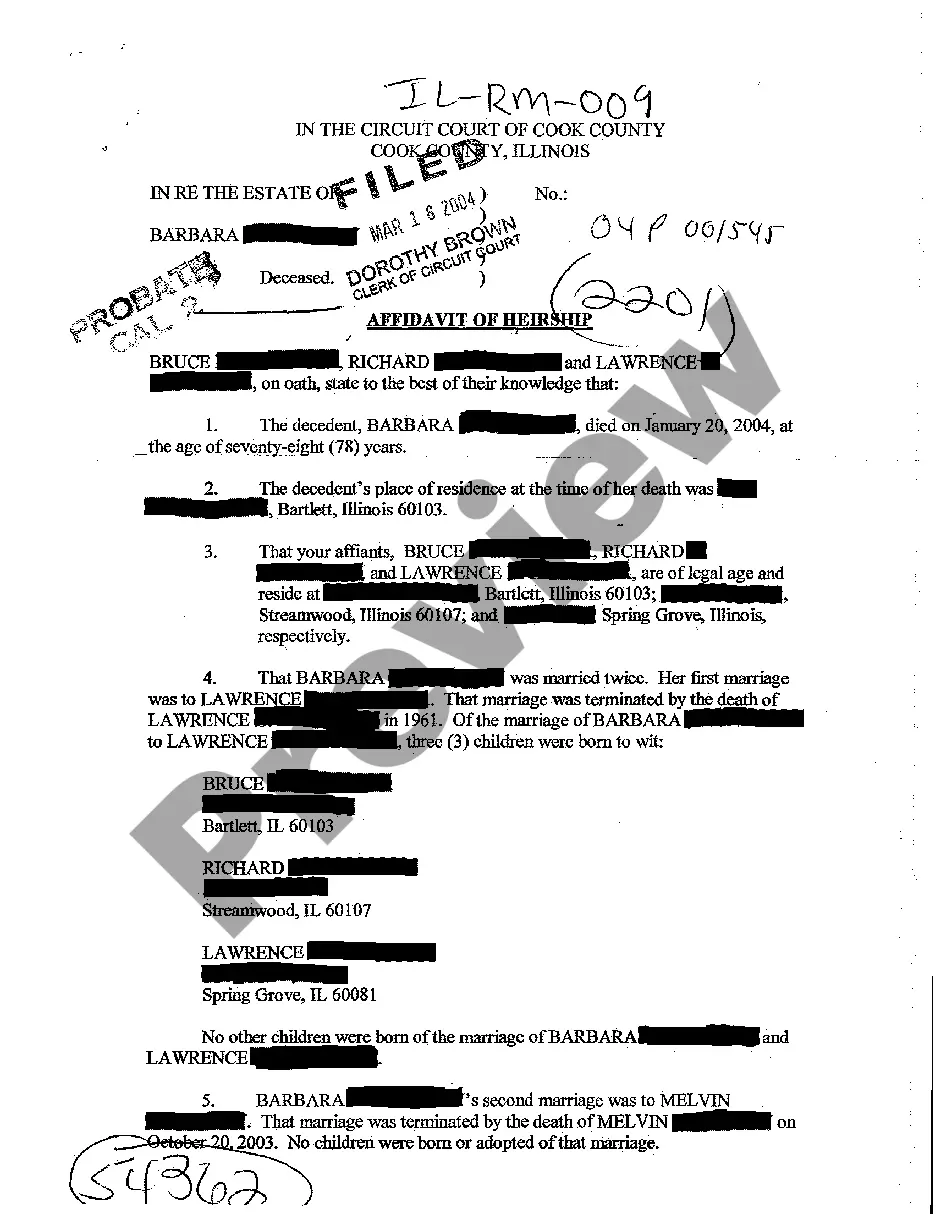

Filling out a lien affidavit involves several key steps, including gathering relevant property information and details about the debt owed. Ensure that you include accurate legal descriptions and the names of the involved parties in your Kings New York Assignment of Lien by Corporation. It is essential to follow the prescribed format required by New York state law. For added convenience, consider using US Legal Forms, which provides templates and guidance to help you complete your affidavit correctly.

To file a lien on property in New York, you need to prepare a lien document that outlines your claim. After completing the paperwork, submit it to the appropriate county clerk's office where the property is located. Make sure to include any required fees and adhere to the specific filing procedures for a Kings New York Assignment of Lien by Corporation. Utilizing an online platform like US Legal Forms can simplify this process and ensure accuracy.

An assignment of lien refers to the legal transfer of a lien from one party to another. In the context of a Kings New York Assignment of Lien by Corporation, this process allows corporations to manage their outstanding debts effectively. When a corporation assigns a lien, it gives another party the right to collect the debt associated with that lien. This practice helps streamline financial obligations and enhances business operations.

Filing a lien in New York requires you to complete the necessary forms specific to the type of lien you are filing. After filling out the forms, submit them to the appropriate county clerk's office along with any applicable fees. Ensure you keep copies of your submission for your records. For managing these legal processes, consider the US Legal platform for assistance with your Kings New York Assignment of Lien by Corporation.