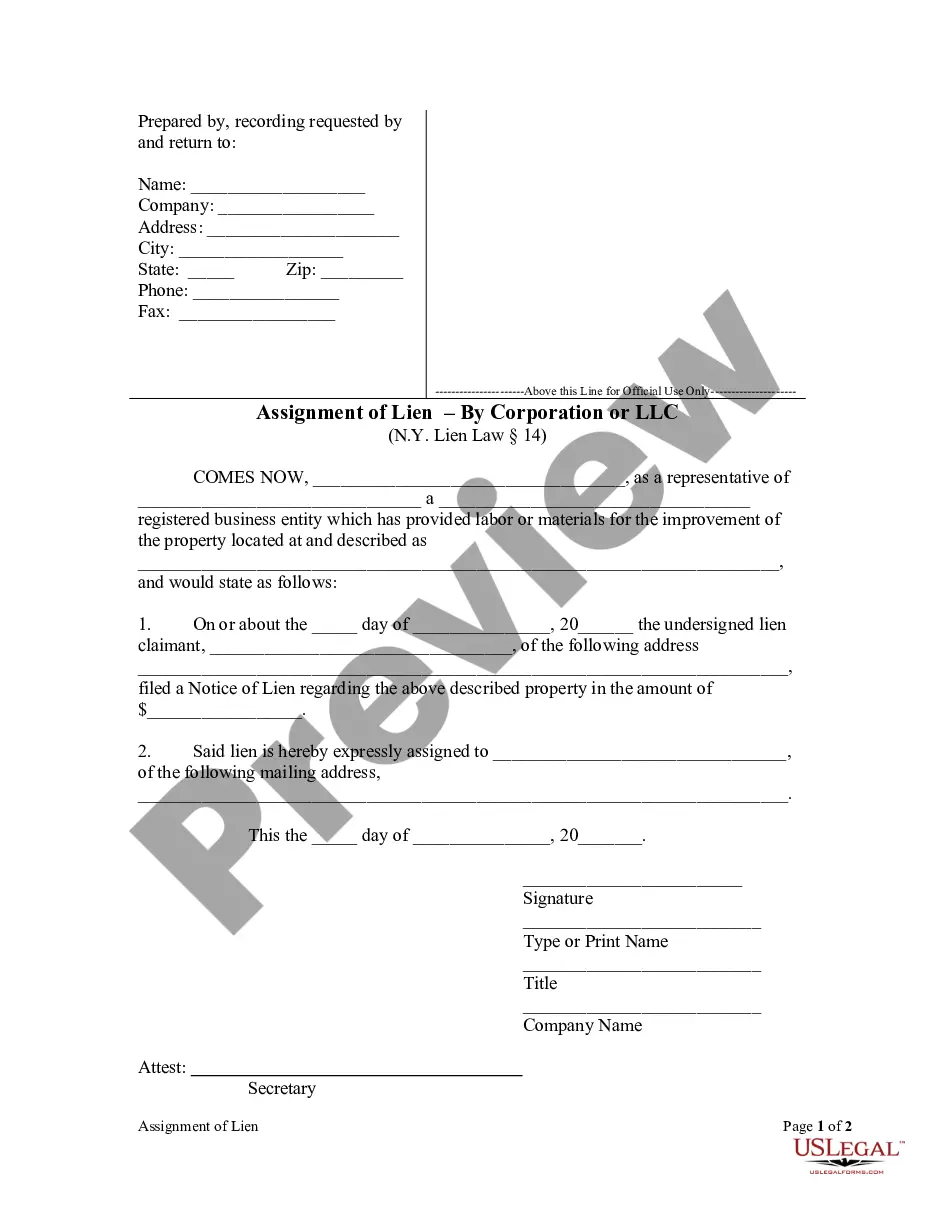

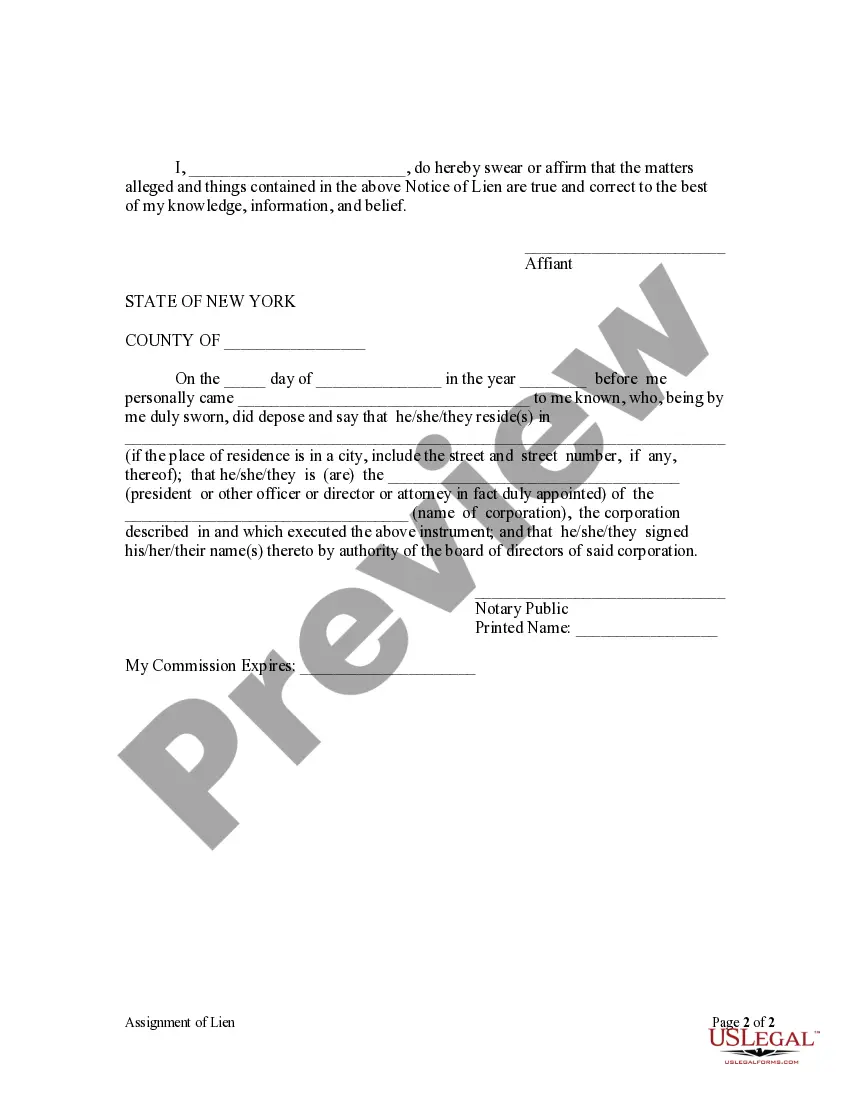

New York law permits a party to assign a lien using a written form signed and acknowledged by the lien holder.

Suffolk New York Assignment of Lien by Corporation

Description

How to fill out New York Assignment Of Lien By Corporation?

We consistently aim to reduce or evade legal repercussions when managing intricate legal or financial matters.

To achieve this, we seek legal counsel services that, typically, are quite expensive.

However, not every legal issue is equally intricate. The majority can be handled by ourselves.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button adjacent to it. If you happen to misplace the document, you can always retrieve it again in the My documents tab.

- Our repository empowers you to manage your affairs independently without the need for a lawyer.

- We offer access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, greatly easing the search process.

- Capitalize on US Legal Forms whenever you require obtaining and insuring the Suffolk New York Assignment of Lien by Corporation or LLC or any other document swiftly and securely.

Form popularity

FAQ

When you change your name, it is important to update various accounts and documents such as your Social Security card, driver’s license, bank accounts, and any legal documents. Moreover, ensure that you inform relevant authorities and institutions about your name change to prevent confusion. If your name change relates to legal processes, like a Suffolk New York Assignment of Lien by Corporation, making timely updates is crucial for legal accuracy.

To change your name at the Suffolk County Clerk's office, you need to fill out a petition and submit it along with any required forms and fees. It’s advisable to check their website or call ahead for specific instructions and required documents. Once you've changed your name legally, this can benefit any transactions, including those related to a Suffolk New York Assignment of Lien by Corporation, ensuring clarity in your legal affairs.

You cannot change your name at just any courthouse; you must go to the appropriate courthouse in Suffolk County that handles name changes. Typically, this is the Suffolk County Clerk's office where you can file a petition. If you intend to associate your name change with legal matters, such as a Suffolk New York Assignment of Lien by Corporation, having your documents processed correctly is essential.

To file a mechanics lien in Suffolk County, NY, you must first prepare your lien claim carefully, including the necessary details such as the property description and the amount owed. Next, you should file the lien with the Suffolk County Clerk’s office in a timely manner, as there are strict deadlines to adhere to. Using reliable services like US Legal Forms can simplify this process, ensuring that you meet all requirements for a Suffolk New York Assignment of Lien by Corporation.

To record a deed in Suffolk County, NY, you first need to prepare your deed document. Ensure it includes all necessary legal descriptions and signatures. Once your deed is ready, you can file it at the Suffolk County Clerk's office. If you're looking for assistance in the process, consider utilizing resources like US Legal Forms, which can guide you through the Suffolk New York Assignment of Lien by Corporation procedures.

To file a lien in New York State, you must prepare the lien documents and submit them to the County Clerk in the county where the property is located. It is crucial to include all relevant details to ensure the lien is correctly processed. For corporations, understanding the specifics of Suffolk New York Assignment of Lien by Corporation can help navigate this process effectively.

You can obtain a copy of your deed in Suffolk County, NY, by visiting the County Clerk’s office or using their online portal. The online system provides a simple search interface where you can access your deed using your property details. For those involved in Suffolk New York Assignment of Lien by Corporation, having a copy of your deed is essential for proper record-keeping.

To perform a lien search in New York, you can start by accessing the New York State Department of State’s online database. This resource allows you to search by name or business to identify existing liens. If you're specifically interested in Suffolk New York Assignment of Lien by Corporation, you can also find detailed information on how liens impact corporate entities.

In New York, a lien on your house can be placed by various parties such as contractors, creditors, or government entities. This typically occurs when debts remain unpaid or legal obligations are not met. If you find yourself dealing with a lien, understanding the Suffolk New York Assignment of Lien by Corporation can help clarify your options.

Filing a lien in New York State involves preparing the appropriate documentation and submitting it to the County Clerk where the property is located. You must include details like the debtor’s information and the amount owed. For businesses, the Suffolk New York Assignment of Lien by Corporation can offer guidance on this process, ensuring that all necessary steps are followed correctly.