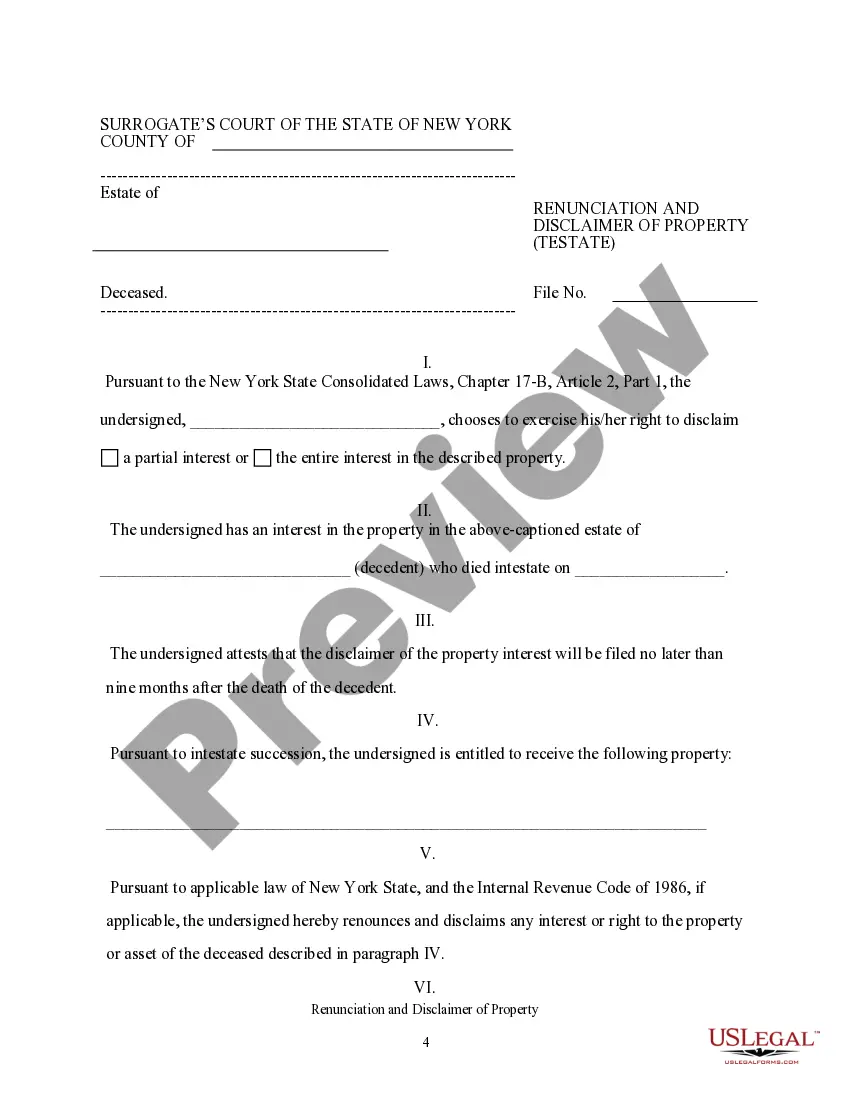

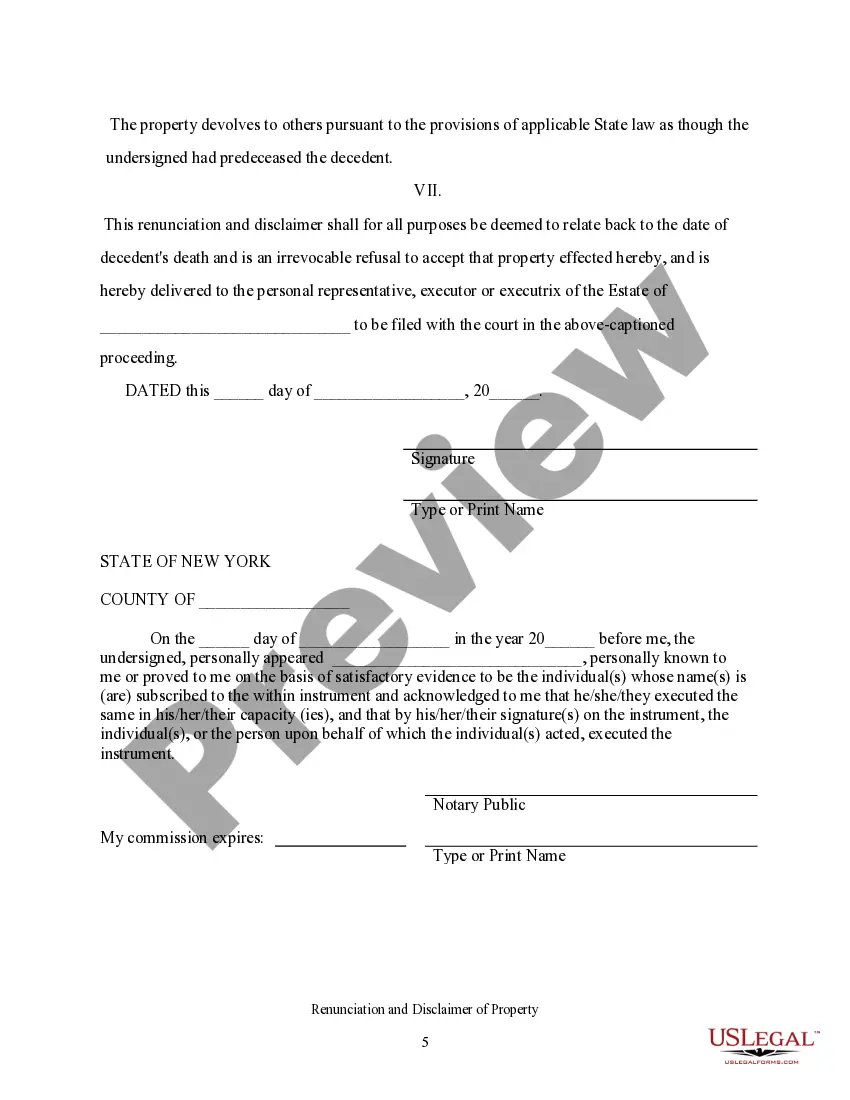

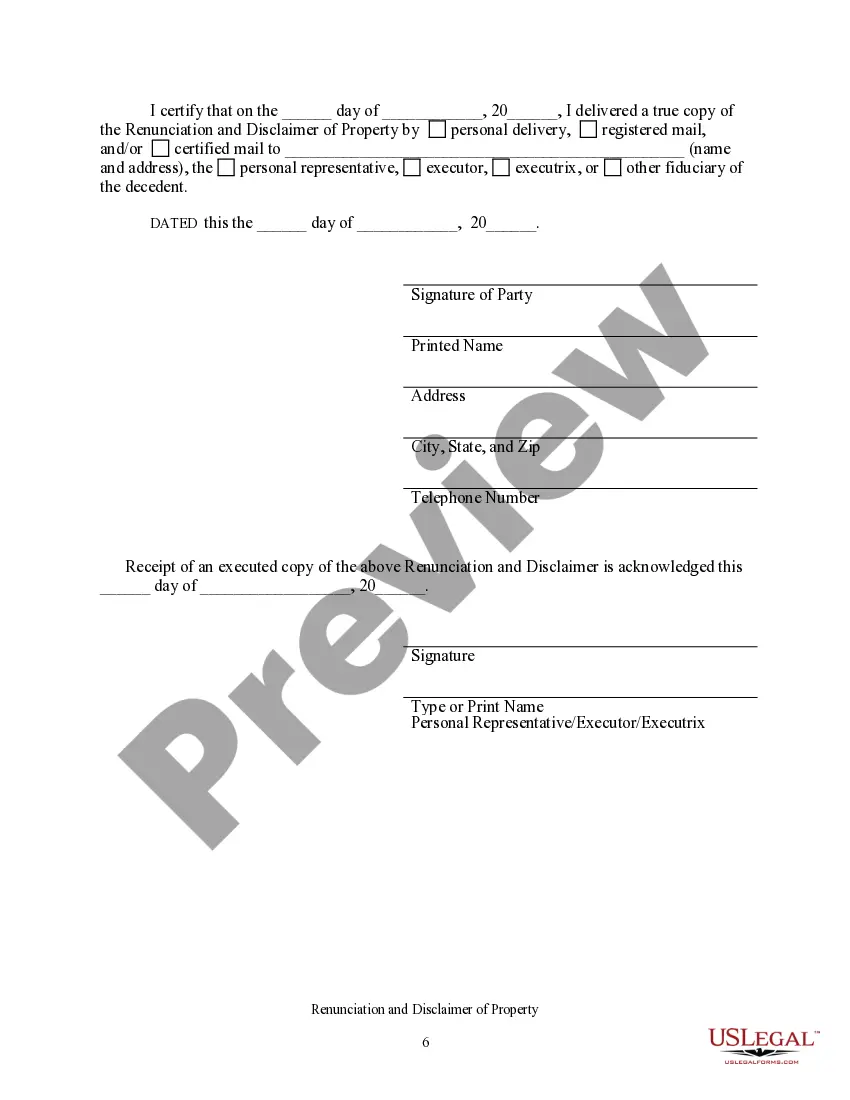

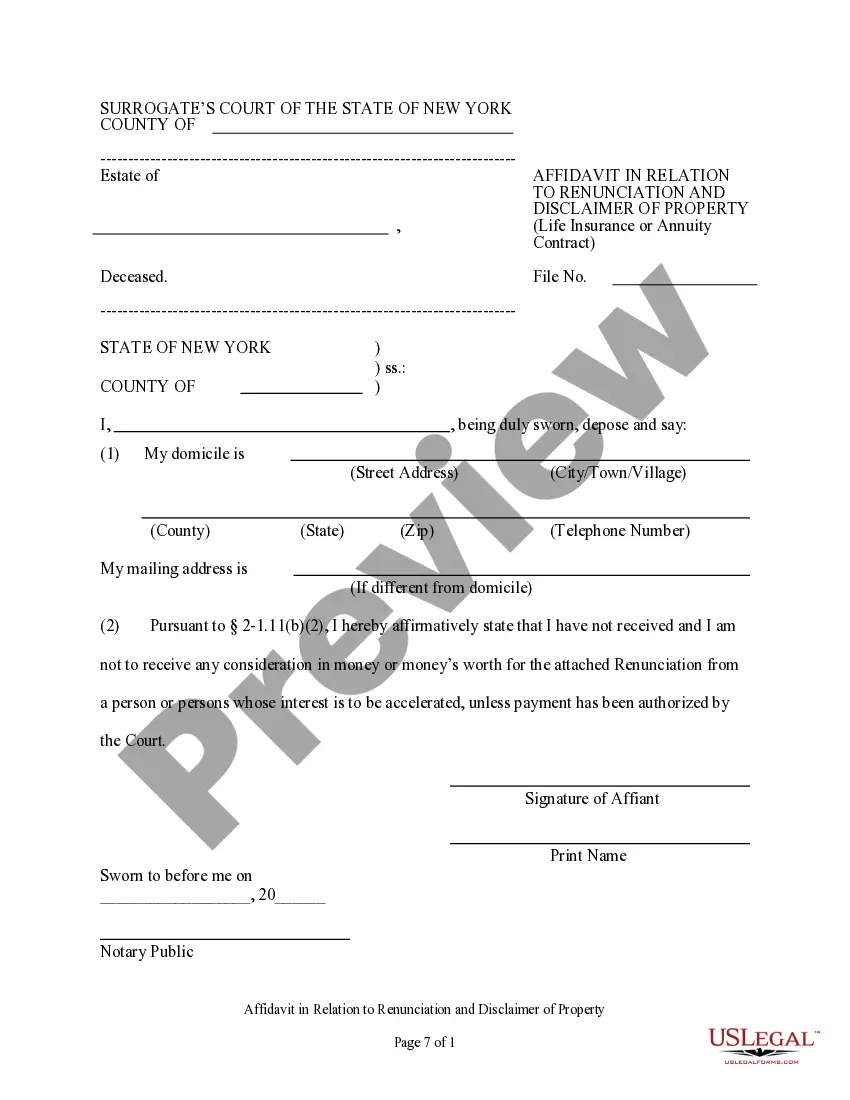

Title: Understanding Nassau New York Renunciation and Disclaimer of Property Received by Intestate Succession Introduction: In Nassau, New York, individuals have the option to renounce or disclaim property received through intestate succession. This legal process allows heirs or beneficiaries to decline their right to inherit property and instead have it pass to the next eligible person. This article explores the concept of renunciation and disclaimer of property under intestate succession in Nassau, New York. Keywords: Nassau, New York, renunciation, disclaimer, property, intestate succession, heirs, beneficiaries. 1. What is Renunciation and Disclaimer of Property? Renunciation and disclaimer of property refer to the legal act of formally declining the right to inherit property received through intestate succession, essentially forfeiting one's entitlement. 2. Purpose of Renunciation and Disclaimer: The primary purpose of renunciation and disclaimer is to allow individuals to willingly relinquish their claim to inherited property. This option provides flexibility in estate planning and ensures that the property flows to the next eligible person as per the intestate laws. 3. Renunciation and Disclaimer in Nassau, New York: Nassau, New York, follows specific laws governing renunciation and disclaimer of property under intestate succession. It allows heirs and beneficiaries to decline their inheritance, resulting in the property passing to the next eligible person. 4. Different Types of Nassau New York Renunciation and Disclaimer: While there may be various scenarios, two significant types of Nassau New York renunciation and disclaimer of property can take place under intestate succession: a. Full Renunciation: A full renunciation occurs when an heir or beneficiary declines their entire share of the inherited property. By doing so, the renouncing party voluntarily relinquishes all rights and interests in the estate. b. Partial Renunciation: In some cases, individuals may choose to disclaim only a portion of their inheritance while retaining the remaining share. This partial renunciation allows them to relinquish a certain asset or percentage without forfeiting their claim to the entire estate. 5. Importance of Nassau New York Renunciation and Disclaimer: Nassau New York renunciation and disclaimer of property provide beneficiaries with the power to control their share of the estate. This option helps them avoid potential tax liabilities, manage conflicts, and ensure property passes to those intended by the deceased. Conclusion: Nassau, New York, allows individuals to renounce or disclaim property inherited through intestate succession, providing flexibility and control over their share of the estate. By understanding the different types of renunciation and disclaimer, beneficiaries can make informed decisions that align with their individual circumstances. Keywords: Nassau, New York, renunciation, disclaimer, property, intestate succession, heirs, beneficiaries.

Nassau Property

Description

How to fill out Nassau New York Renunciation And Disclaimer Of Property Received By Intestate Succession?

Take advantage of the US Legal Forms and have immediate access to any form template you want. Our helpful website with a huge number of templates makes it easy to find and obtain virtually any document sample you will need. It is possible to export, complete, and sign the Nassau New York Renunciation And Disclaimer of Property received by Intestate Succession in a couple of minutes instead of surfing the Net for hours seeking the right template.

Utilizing our catalog is a great way to raise the safety of your document filing. Our experienced attorneys regularly check all the documents to make certain that the templates are appropriate for a particular region and compliant with new laws and regulations.

How do you obtain the Nassau New York Renunciation And Disclaimer of Property received by Intestate Succession? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. In addition, you can get all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Find the template you require. Make certain that it is the template you were looking for: check its headline and description, and make use of the Preview function if it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Download the file. Pick the format to get the Nassau New York Renunciation And Disclaimer of Property received by Intestate Succession and modify and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable document libraries on the web. We are always happy to assist you in any legal procedure, even if it is just downloading the Nassau New York Renunciation And Disclaimer of Property received by Intestate Succession.

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!