Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out New York Renunciation And Disclaimer Of Property Received By Intestate Succession?

Utilize the US Legal Forms and gain instant access to any sample document you desire.

Our user-friendly website, featuring a wide array of templates, makes it easy to locate and acquire almost any document sample you need.

You can download, complete, and sign the Rochester New York Renunciation And Disclaimer of Property obtained through Intestate Succession in just a few minutes instead of spending hours online searching for a suitable template.

Using our collection is an excellent method to enhance the security of your document submissions.

If you haven’t created an account yet, follow the steps outlined below.

Locate the form you need. Ensure that it is the template you were looking for: confirm its title and description, and utilize the Preview feature if available. Otherwise, use the Search bar to find the correct one.

- Our knowledgeable attorneys frequently review all documents to ensure that the forms are suitable for a specific area and adhere to new laws and regulations.

- How can you obtain the Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession.

- If you already have an account, simply Log In to your profile.

- The Download button will appear on all the samples you view.

- Furthermore, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

The best way to transfer property after death often involves clear estate planning through a will or trust. However, if someone passes without a will, following the intestate succession laws in New York becomes crucial. Engaging with legal services, such as those provided by uslegalforms, provides a streamlined approach to navigate the complexities of Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession.

Transferring real property after death without a will in New York hinges on intestate succession laws. An administrator will be appointed to handle the estate, which includes selling or transferring ownership of the property to eligible heirs. Working through this process can be supplemented by online resources like uslegalforms, which can provide guidance and necessary documentation.

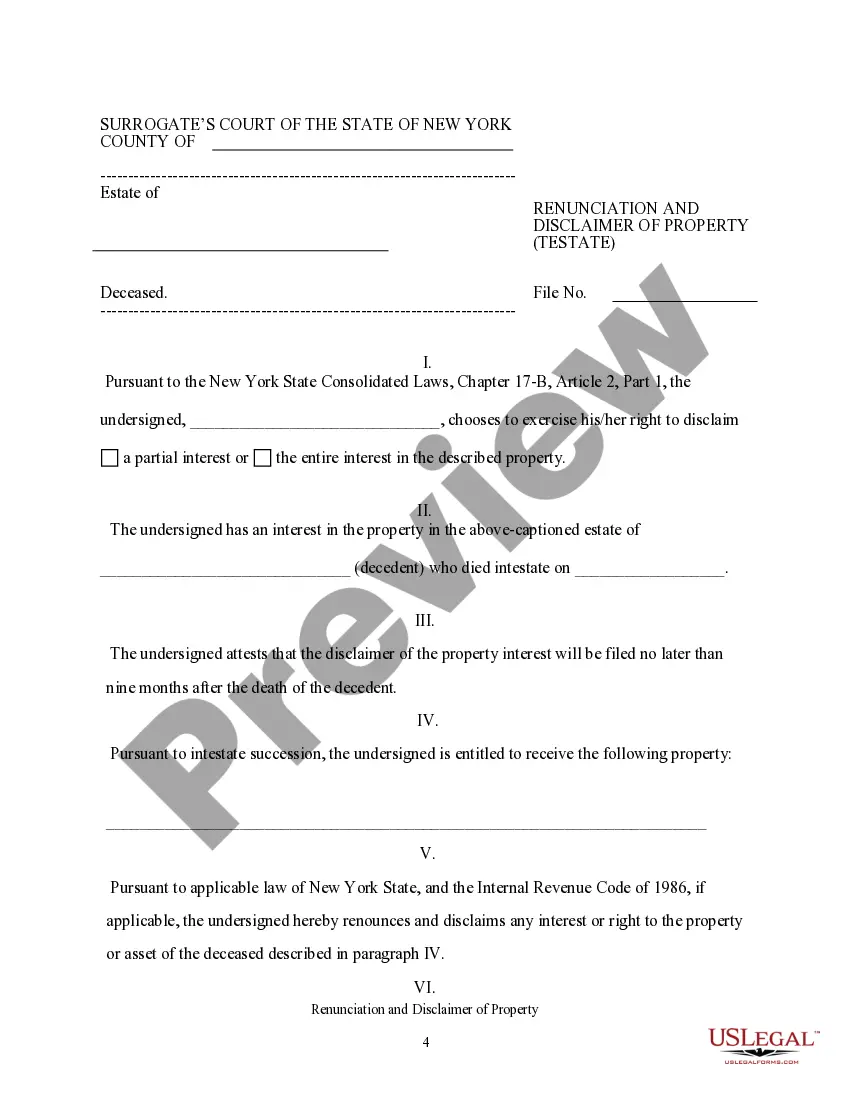

Disclaiming an inheritance in New York requires submitting a formal disclaimer to the relevant court. You must do this within nine months of the decedent's death and include specific information such as the decedent’s details and your relationship to them. This legal action ensures that the renounced property moves on to the next eligible heir, helping to streamline the estate distribution process.

To disclaim part of an inheritance in New York, you must file a written disclaimer with the probate court. This document should clearly state your intention to renounce the specified portion of your inheritance. It is important to comply with state laws and regulations, as this can affect the distribution of the estate under Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession.

When a homeowner dies intestate in New York, the house becomes part of the deceased's estate. It will be distributed according to the rules of intestate succession, which typically favors immediate family members. This process can be complex, often requiring legal guidance and potentially leading to a lengthy probate process.

In New York, when a person dies without a will, known as intestate succession, property is transferred based on state laws. Generally, the estate passes to the closest relatives, such as spouses or children. The process may involve court proceedings to appoint an administrator who will manage and distribute the estate according to New York's intestacy laws.

The renunciation of inheritance is a legal process where an individual chooses to decline their right to inherit property. This is particularly relevant in the context of Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession. By renouncing, the person effectively relinquishes any claims to the estate, allowing the property to pass to other heirs according to state laws.

In New York, intestate succession laws dictate how property is distributed when someone passes away without a valid will. Under these laws, the estate typically goes to the deceased person's closest relatives, such as spouses, children, or parents. If you receive property through intestate succession, you may want to consider the Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession. This process allows individuals to renounce their rights to the inheritance, which can clarify estate matters and may have tax implications.

New York inheritance laws govern how assets are distributed after a person's death, particularly when there is no will. These laws follow a structured hierarchy, prioritizing spouses and children. Understanding these rules is vital, especially when engaging in the Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession, as legal guidance can clarify your rights and responsibilities regarding inheritance. Resources like uslegalforms can be invaluable for navigating these complex laws.

In New York, heirs do not have a specific deadline to claim their inheritance after the probate process is complete. However, it is advisable to act promptly to avoid complications. When you are involved in the Rochester New York Renunciation And Disclaimer of Property received by Intestate Succession, timely action helps ensure you secure your benefits without unnecessary delays. Taking steps early is always a smart choice.