Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession refers to the legal process by which an individual voluntarily gives up their right to inherit property from a deceased person who died without a valid will in Suffolk County, New York. This renouncement can occur for various reasons such as avoiding estate taxes, disclaiming debts or liabilities, or redirecting the inheritance to another eligible beneficiary. When a person dies without a will (intestate), their assets and properties are distributed according to the laws of intestate succession. However, if an heir or beneficiary wishes to disclaim or renounce their right to inherit, they can do so by filing a renunciation and disclaimer with the Suffolk County Surrogate's Court. This legal document effectively forfeits their claim to the property. Here are some key points to understand about Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession: 1. Process and Eligibility: To renounce and disclaim an inheritance, the person must file a written renunciation within a certain timeframe, usually within nine months from the date of the decedent's death. The renunciation must be signed, notarized, and filed with the Surrogate's Court, along with a copy of the death certificate. 2. Estate Distribution: When an heir renounces their inheritance, the property then passes to the next qualified beneficiary in line as per the intestacy laws. It is important to note that renouncing the inheritance does not allow the heir to choose who will receive the property; it simply means they are giving up their right to inherit it. 3. Tax Implications: Renouncing an inheritance may have significant tax consequences. The renouncing party should consult with a tax professional to understand potential implications, including gift tax or estate tax considerations. 4. Disclaimer of Debt and Liability: Renunciation not only involves disclaiming assets but also disclaiming the decedent's debts and liabilities. By renouncing the inheritance, the heir avoids assuming any financial obligations left behind. 5. Suffolk County Surrogate's Court: The renunciation document must be filed with the Suffolk County Surrogate's Court, which is responsible for overseeing the administration of decedents' estates. The court will review the renunciation and ensure it aligns with the applicable laws before approving it. Different types of Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession may include: 1. Full Renunciation: This type involves completely declining the right to inherit any portion of the decedent's estate, whether it is real estate, personal possessions, or financial assets. 2. Partial Renunciation: In some cases, an heir may choose to renounce only a specific asset or a portion of the inheritance while still accepting other assets or benefits from the estate. In conclusion, Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession is a legal process where an heir voluntarily gives up their right to inherit property from a deceased person who died without a valid will. This renouncement can have tax implications, helps in avoiding debts or liabilities, and must be filed with the Suffolk County Surrogate's Court.

Suffolk Property

State:

New York

County:

Suffolk

Control #:

NY-06-03

Format:

Word;

Rich Text

Instant download

Description

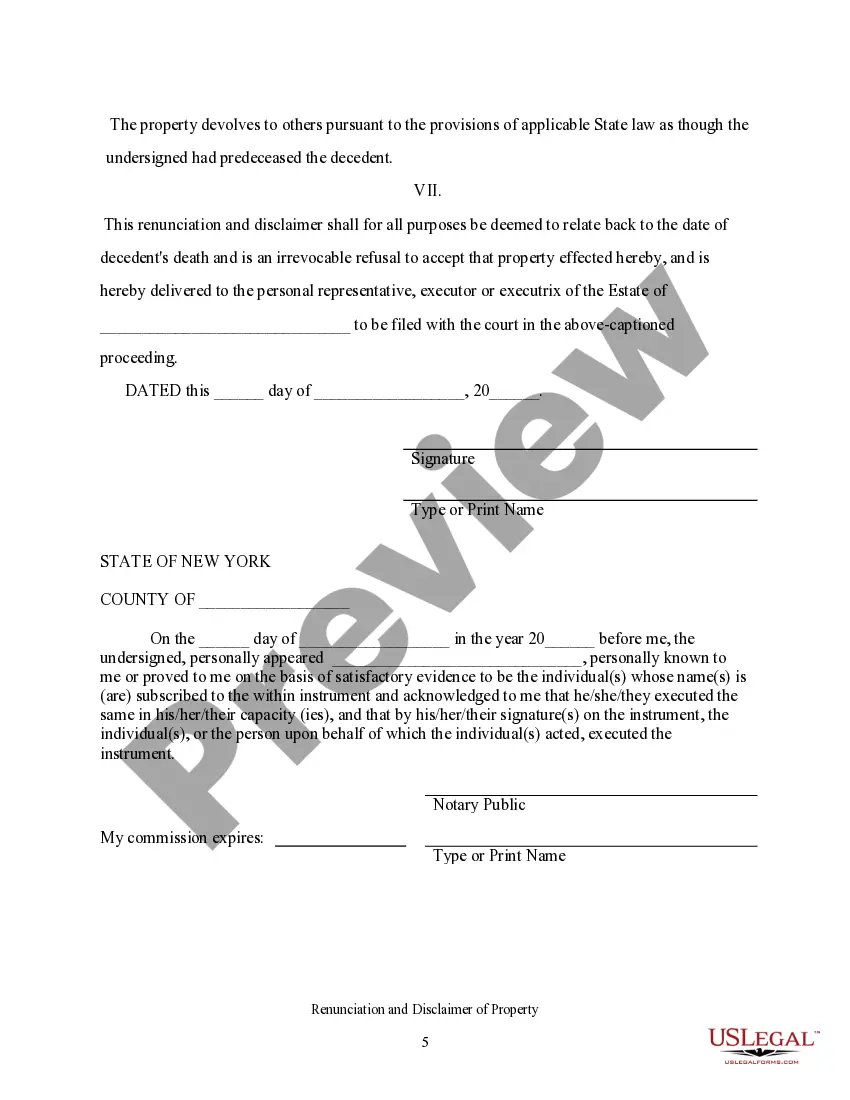

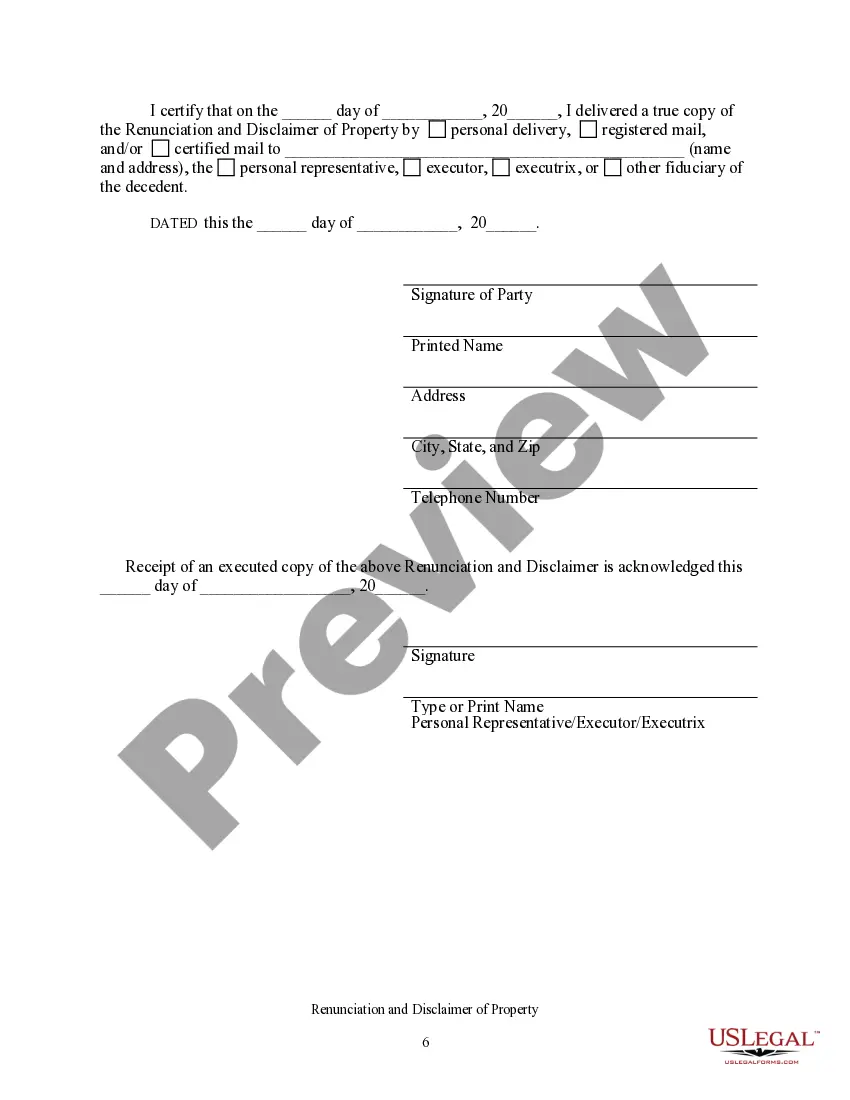

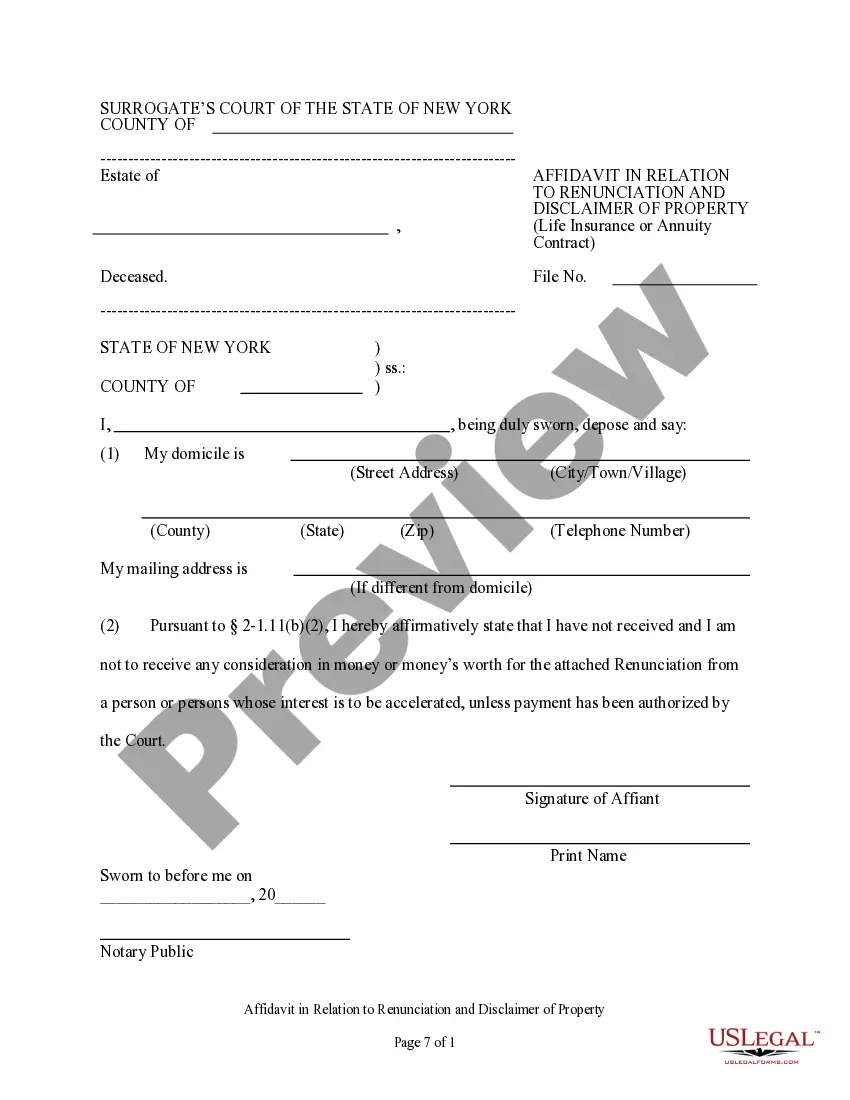

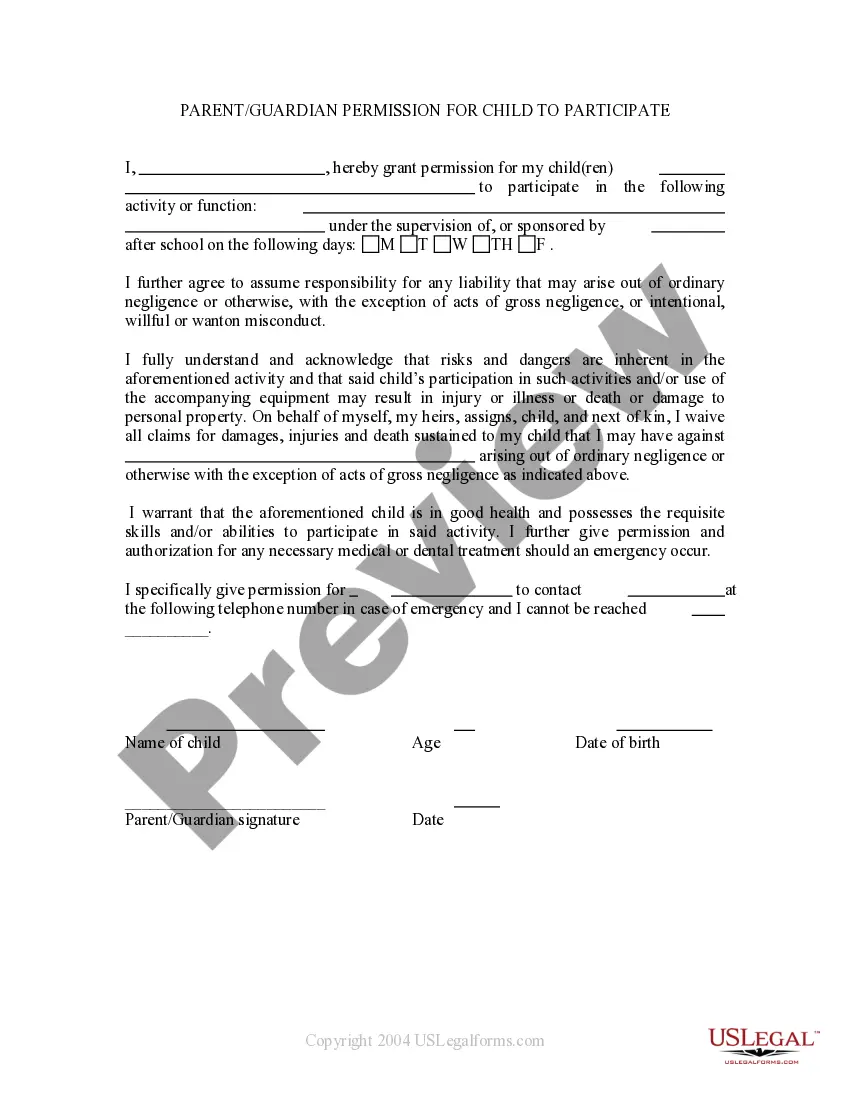

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate and the beneficiary gained an interest in the described property, but, pursuant to the New York State Consolidated Laws, Chapter 17-B, Article 2, Part 1, has decided to disclaim a portion of or the entire interest in the property. The property will now devolve to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify document delivery.

Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession refers to the legal process by which an individual voluntarily gives up their right to inherit property from a deceased person who died without a valid will in Suffolk County, New York. This renouncement can occur for various reasons such as avoiding estate taxes, disclaiming debts or liabilities, or redirecting the inheritance to another eligible beneficiary. When a person dies without a will (intestate), their assets and properties are distributed according to the laws of intestate succession. However, if an heir or beneficiary wishes to disclaim or renounce their right to inherit, they can do so by filing a renunciation and disclaimer with the Suffolk County Surrogate's Court. This legal document effectively forfeits their claim to the property. Here are some key points to understand about Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession: 1. Process and Eligibility: To renounce and disclaim an inheritance, the person must file a written renunciation within a certain timeframe, usually within nine months from the date of the decedent's death. The renunciation must be signed, notarized, and filed with the Surrogate's Court, along with a copy of the death certificate. 2. Estate Distribution: When an heir renounces their inheritance, the property then passes to the next qualified beneficiary in line as per the intestacy laws. It is important to note that renouncing the inheritance does not allow the heir to choose who will receive the property; it simply means they are giving up their right to inherit it. 3. Tax Implications: Renouncing an inheritance may have significant tax consequences. The renouncing party should consult with a tax professional to understand potential implications, including gift tax or estate tax considerations. 4. Disclaimer of Debt and Liability: Renunciation not only involves disclaiming assets but also disclaiming the decedent's debts and liabilities. By renouncing the inheritance, the heir avoids assuming any financial obligations left behind. 5. Suffolk County Surrogate's Court: The renunciation document must be filed with the Suffolk County Surrogate's Court, which is responsible for overseeing the administration of decedents' estates. The court will review the renunciation and ensure it aligns with the applicable laws before approving it. Different types of Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession may include: 1. Full Renunciation: This type involves completely declining the right to inherit any portion of the decedent's estate, whether it is real estate, personal possessions, or financial assets. 2. Partial Renunciation: In some cases, an heir may choose to renounce only a specific asset or a portion of the inheritance while still accepting other assets or benefits from the estate. In conclusion, Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession is a legal process where an heir voluntarily gives up their right to inherit property from a deceased person who died without a valid will. This renouncement can have tax implications, helps in avoiding debts or liabilities, and must be filed with the Suffolk County Surrogate's Court.

Free preview

How to fill out Suffolk New York Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you’ve already utilized our service before, log in to your account and download the Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Suffolk New York Renunciation And Disclaimer of Property received by Intestate Succession. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!