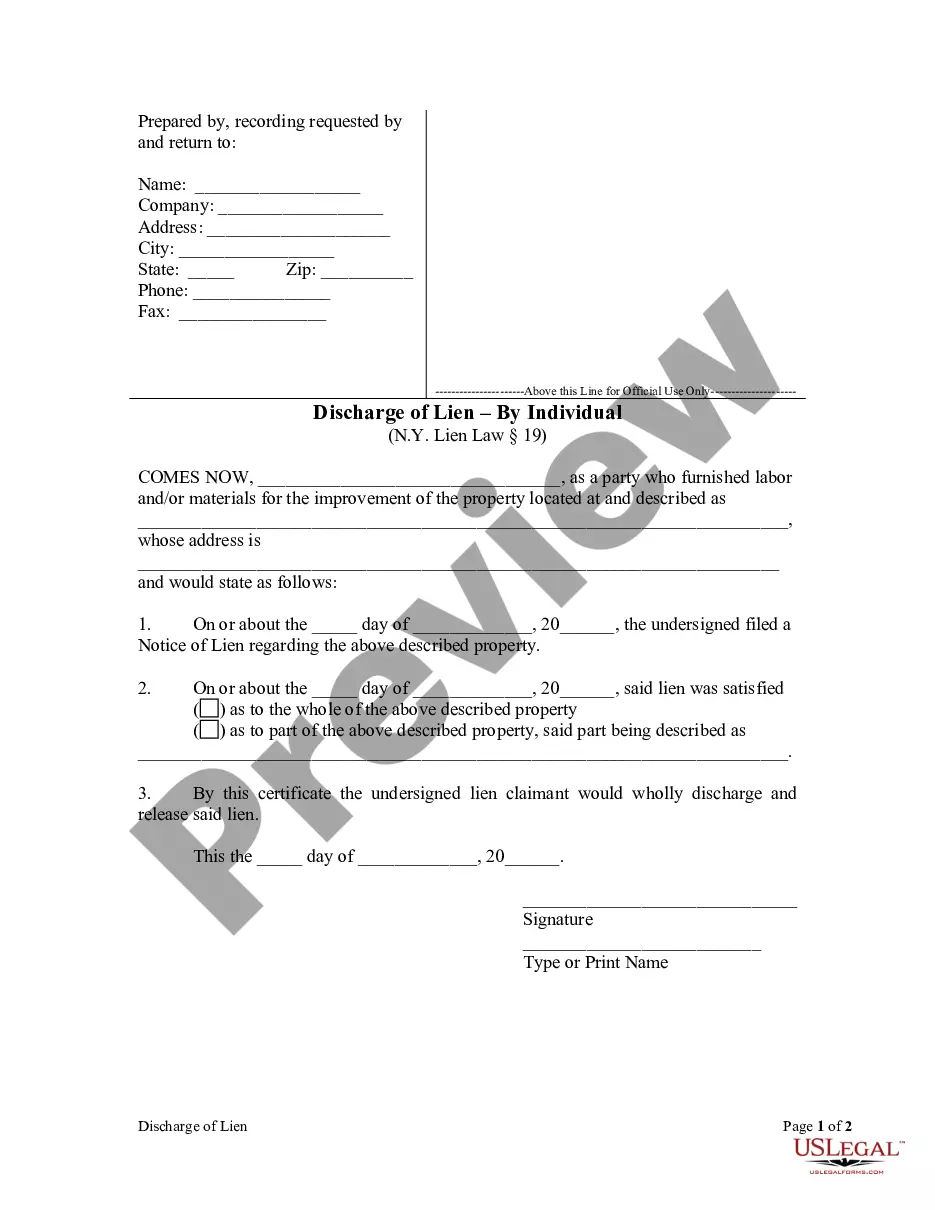

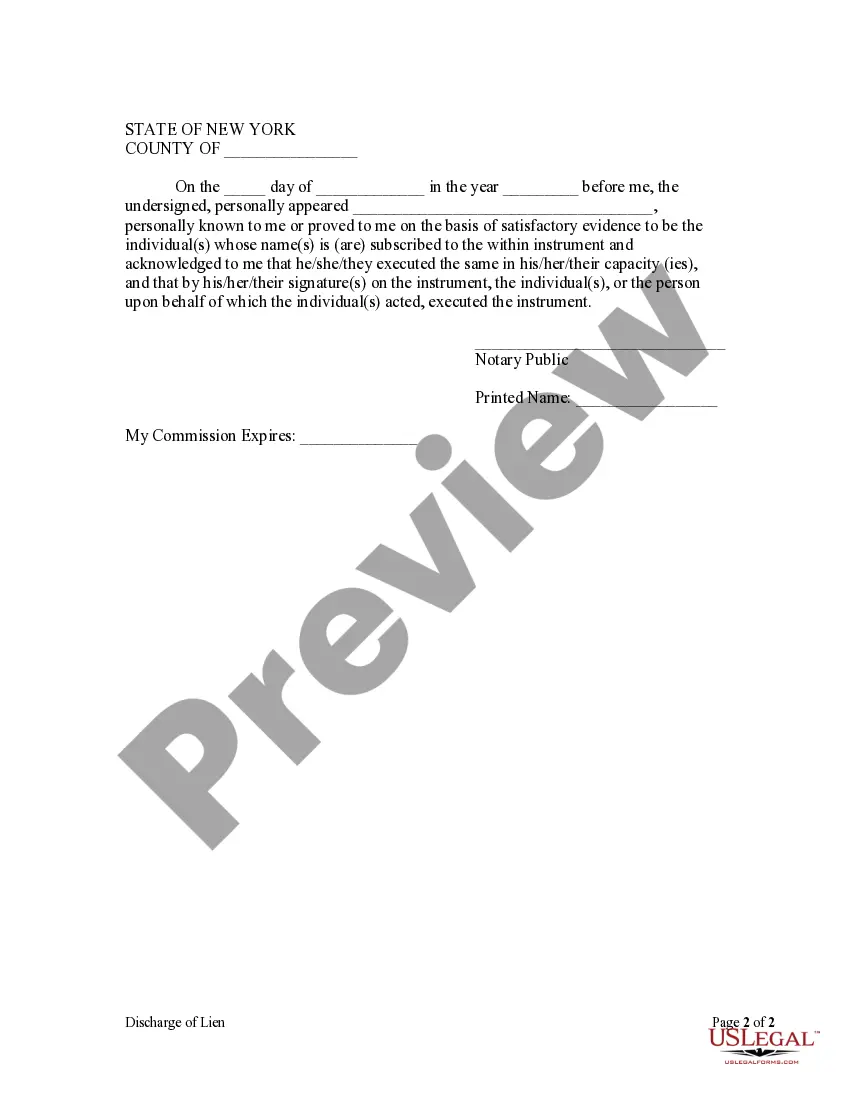

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

Queens New York Discharge of Lien by Individual — Detailed Description and Types In Queens, New York, a discharge of lien by an individual refers to the legal process of releasing a lien on a property. Liens can be placed on a property by individuals or entities to secure payment for debts or judgments. However, when the debt is satisfied or resolved, it becomes necessary to remove the lien to clear the property's title and enable its smooth transfer or refinancing. The discharge of lien is a crucial step in this process. Types of Queens New York Discharge of Lien by Individual: 1. Mechanic's Lien Discharge: A mechanic's lien discharge is specific to construction projects. It involves the removal or release of a lien placed on a property by a contractor, subcontractor, or supplier who has not received payment for their services or materials. By filing for a mechanic's lien discharge, the individual is essentially declaring that the outstanding debt has been settled, ensuring the property's lien-free status. 2. Judgment Lien Discharge: A judgment lien discharge occurs when an individual has obtained a court judgment against a property owner and placed a lien on their property as security for the debt. Once the judgment creditor receives their payment, they can file for a judgment lien discharge to remove the lien from the property title, allowing the owner to regain full control and legal rights over their property. 3. Tax Lien Discharge: Filing for a tax lien discharge is necessary when an individual has an outstanding tax debt owed to a government agency, such as the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance. By satisfying the tax obligation, the individual can apply for a discharge to remove the tax lien from their property, avoiding any potential foreclosure or additional legal consequences. 4. HOA Lien Discharge: Homeowners associations (Has) may place a lien on a property if the homeowner fails to pay their dues or violates the association's rules and bylaws. Once the homeowner resolves the outstanding debt or violation, they can request a discharge of the HOA lien, ensuring a clear title and avoiding complications during a property sale or refinancing. 5. Mortgage Lien Discharge: A mortgage lien discharge is applicable when an individual has paid off their mortgage in full. By filing for this discharge, the lien holder, typically a bank or financial institution, acknowledges that the loan has been satisfied, allowing the individual to have a lien-free title to their property. Keywords: Queens, New York, discharge of lien, individual, mechanic's lien, judgment lien, tax lien, HOA lien, mortgage lien, property, construction, contractor, subcontractor, supplier, court judgment, tax debt, government agency, IRS, New York State Department of Taxation and Finance, homeowners association, dues, violation, mortgage, lien holder.Queens New York Discharge of Lien by Individual — Detailed Description and Types In Queens, New York, a discharge of lien by an individual refers to the legal process of releasing a lien on a property. Liens can be placed on a property by individuals or entities to secure payment for debts or judgments. However, when the debt is satisfied or resolved, it becomes necessary to remove the lien to clear the property's title and enable its smooth transfer or refinancing. The discharge of lien is a crucial step in this process. Types of Queens New York Discharge of Lien by Individual: 1. Mechanic's Lien Discharge: A mechanic's lien discharge is specific to construction projects. It involves the removal or release of a lien placed on a property by a contractor, subcontractor, or supplier who has not received payment for their services or materials. By filing for a mechanic's lien discharge, the individual is essentially declaring that the outstanding debt has been settled, ensuring the property's lien-free status. 2. Judgment Lien Discharge: A judgment lien discharge occurs when an individual has obtained a court judgment against a property owner and placed a lien on their property as security for the debt. Once the judgment creditor receives their payment, they can file for a judgment lien discharge to remove the lien from the property title, allowing the owner to regain full control and legal rights over their property. 3. Tax Lien Discharge: Filing for a tax lien discharge is necessary when an individual has an outstanding tax debt owed to a government agency, such as the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance. By satisfying the tax obligation, the individual can apply for a discharge to remove the tax lien from their property, avoiding any potential foreclosure or additional legal consequences. 4. HOA Lien Discharge: Homeowners associations (Has) may place a lien on a property if the homeowner fails to pay their dues or violates the association's rules and bylaws. Once the homeowner resolves the outstanding debt or violation, they can request a discharge of the HOA lien, ensuring a clear title and avoiding complications during a property sale or refinancing. 5. Mortgage Lien Discharge: A mortgage lien discharge is applicable when an individual has paid off their mortgage in full. By filing for this discharge, the lien holder, typically a bank or financial institution, acknowledges that the loan has been satisfied, allowing the individual to have a lien-free title to their property. Keywords: Queens, New York, discharge of lien, individual, mechanic's lien, judgment lien, tax lien, HOA lien, mortgage lien, property, construction, contractor, subcontractor, supplier, court judgment, tax debt, government agency, IRS, New York State Department of Taxation and Finance, homeowners association, dues, violation, mortgage, lien holder.