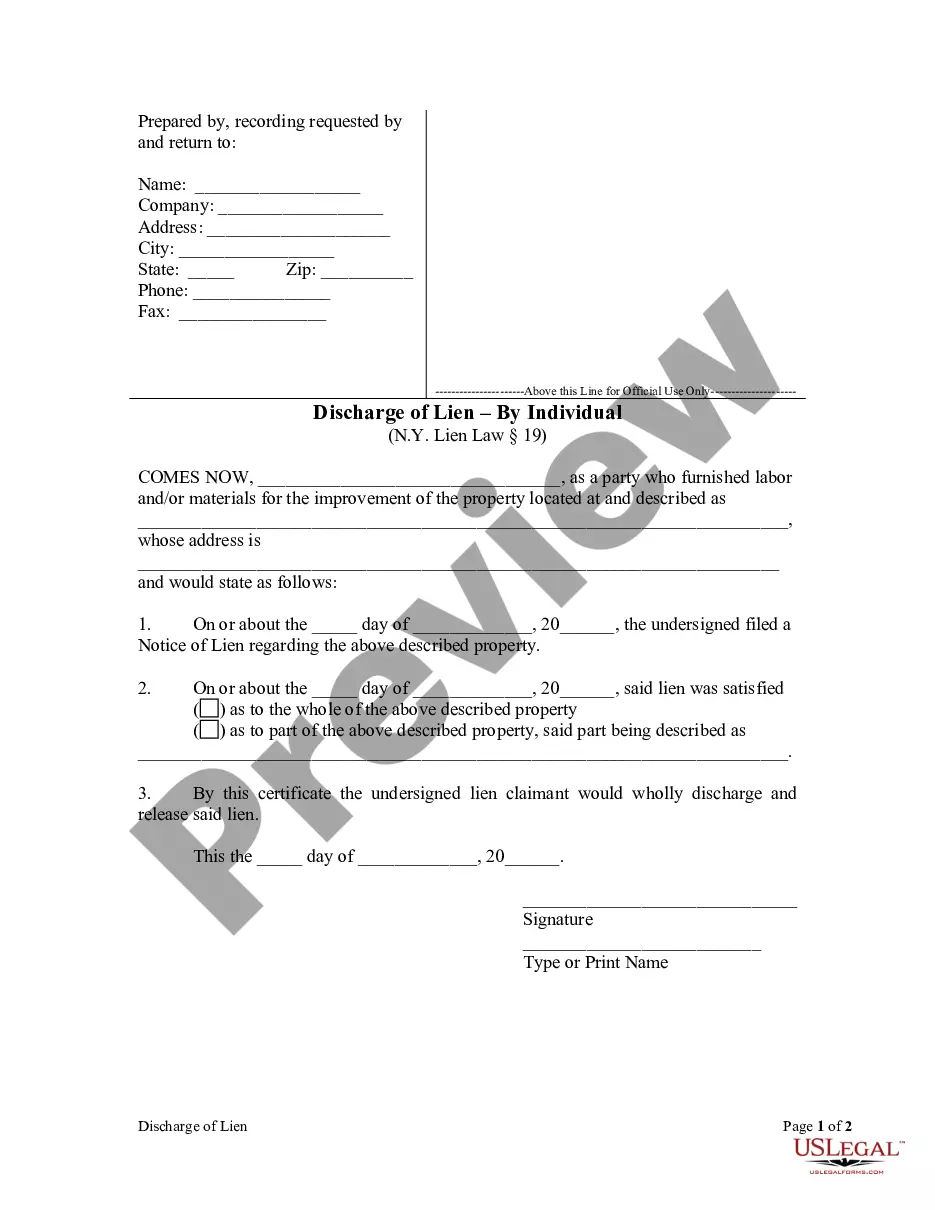

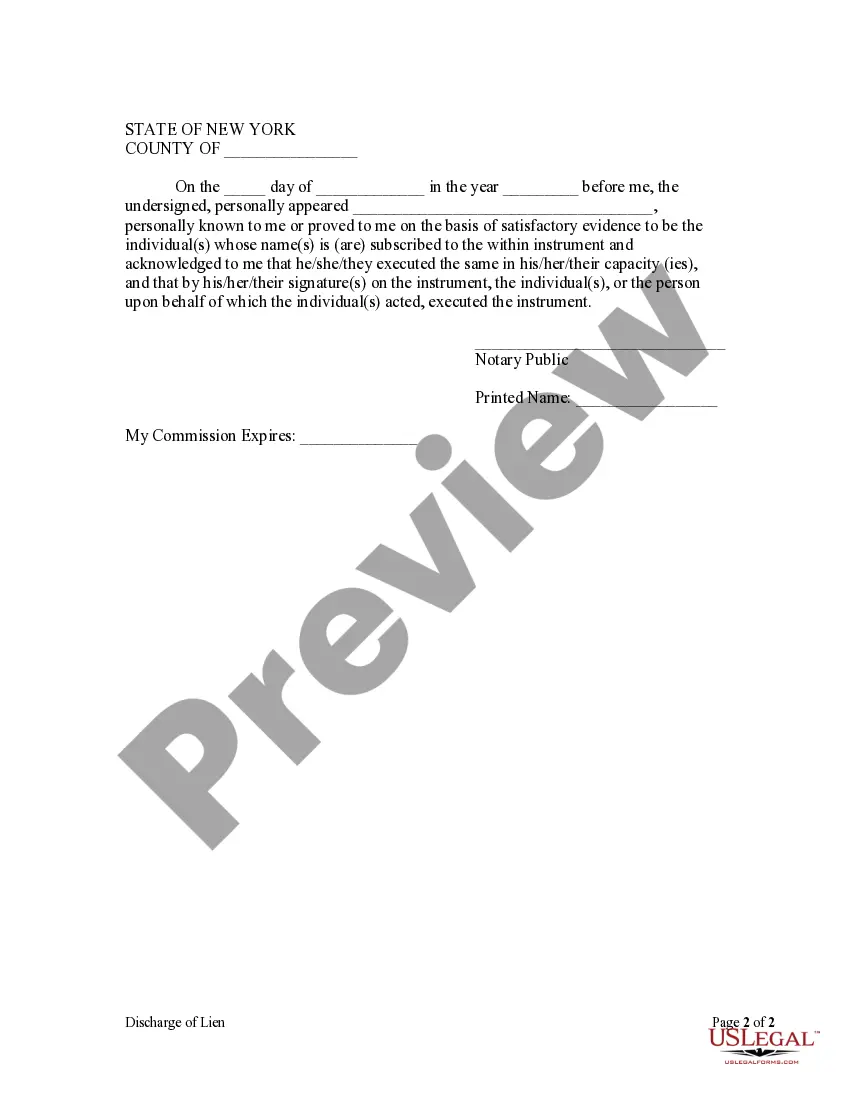

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

A discharge of lien by an individual in Yonkers, New York is a legal process that allows an individual to remove a lien from a property. Liens are often placed on properties to secure the payment of a debt or an obligation. However, when the debt has been fulfilled or the lien becomes invalid, it is necessary to have it discharged. This ensures that the property is no longer encumbered and can be freely transferred or sold without any legal complications. There are several types of Yonkers New York Discharge of Lien by Individual, each with specific requirements: 1. Mortgage Lien Discharge: This type of discharge occurs when an individual has fully paid off their mortgage debt, and the lien associated with it needs to be removed. It typically involves submitting a formal discharge document to the Yonkers County Clerk's office, along with required fees and supporting documentation. 2. Mechanic's Lien Discharge: Mechanic's liens are often placed on a property by contractors, subcontractors, or suppliers who haven't been paid for work or materials provided. When these debts are resolved, the lien holder is responsible for filing a discharge to free the property from the lien. The process usually involves submitting an affidavit of satisfaction to the Yonkers County Clerk's office. 3. Judgment Lien Discharge: If a court has issued a judgment against a property owner due to unpaid debts, a judgment lien can be placed on their property. Once the judgment has been satisfied, the individual can file for a discharge of the lien. This typically requires filing a satisfaction of judgment with the Yonkers County Clerk's office. 4. Tax Lien Discharge: When property taxes are unpaid, the municipality may place a tax lien on the property. The property owner must settle the outstanding taxes and any associated penalties before requesting a discharge of the tax lien. The process usually involves submitting proof of payment to the Yonkers Tax Assessor's office and obtaining a certificate of discharge. To successfully navigate the Yonkers New York Discharge of Lien by Individual process, it is highly recommended consulting with a legal professional familiar with the local laws and procedures. They can guide individuals through the specific requirements, assist in preparing the necessary documents, and ensure a smooth lien discharge process is achieved.A discharge of lien by an individual in Yonkers, New York is a legal process that allows an individual to remove a lien from a property. Liens are often placed on properties to secure the payment of a debt or an obligation. However, when the debt has been fulfilled or the lien becomes invalid, it is necessary to have it discharged. This ensures that the property is no longer encumbered and can be freely transferred or sold without any legal complications. There are several types of Yonkers New York Discharge of Lien by Individual, each with specific requirements: 1. Mortgage Lien Discharge: This type of discharge occurs when an individual has fully paid off their mortgage debt, and the lien associated with it needs to be removed. It typically involves submitting a formal discharge document to the Yonkers County Clerk's office, along with required fees and supporting documentation. 2. Mechanic's Lien Discharge: Mechanic's liens are often placed on a property by contractors, subcontractors, or suppliers who haven't been paid for work or materials provided. When these debts are resolved, the lien holder is responsible for filing a discharge to free the property from the lien. The process usually involves submitting an affidavit of satisfaction to the Yonkers County Clerk's office. 3. Judgment Lien Discharge: If a court has issued a judgment against a property owner due to unpaid debts, a judgment lien can be placed on their property. Once the judgment has been satisfied, the individual can file for a discharge of the lien. This typically requires filing a satisfaction of judgment with the Yonkers County Clerk's office. 4. Tax Lien Discharge: When property taxes are unpaid, the municipality may place a tax lien on the property. The property owner must settle the outstanding taxes and any associated penalties before requesting a discharge of the tax lien. The process usually involves submitting proof of payment to the Yonkers Tax Assessor's office and obtaining a certificate of discharge. To successfully navigate the Yonkers New York Discharge of Lien by Individual process, it is highly recommended consulting with a legal professional familiar with the local laws and procedures. They can guide individuals through the specific requirements, assist in preparing the necessary documents, and ensure a smooth lien discharge process is achieved.