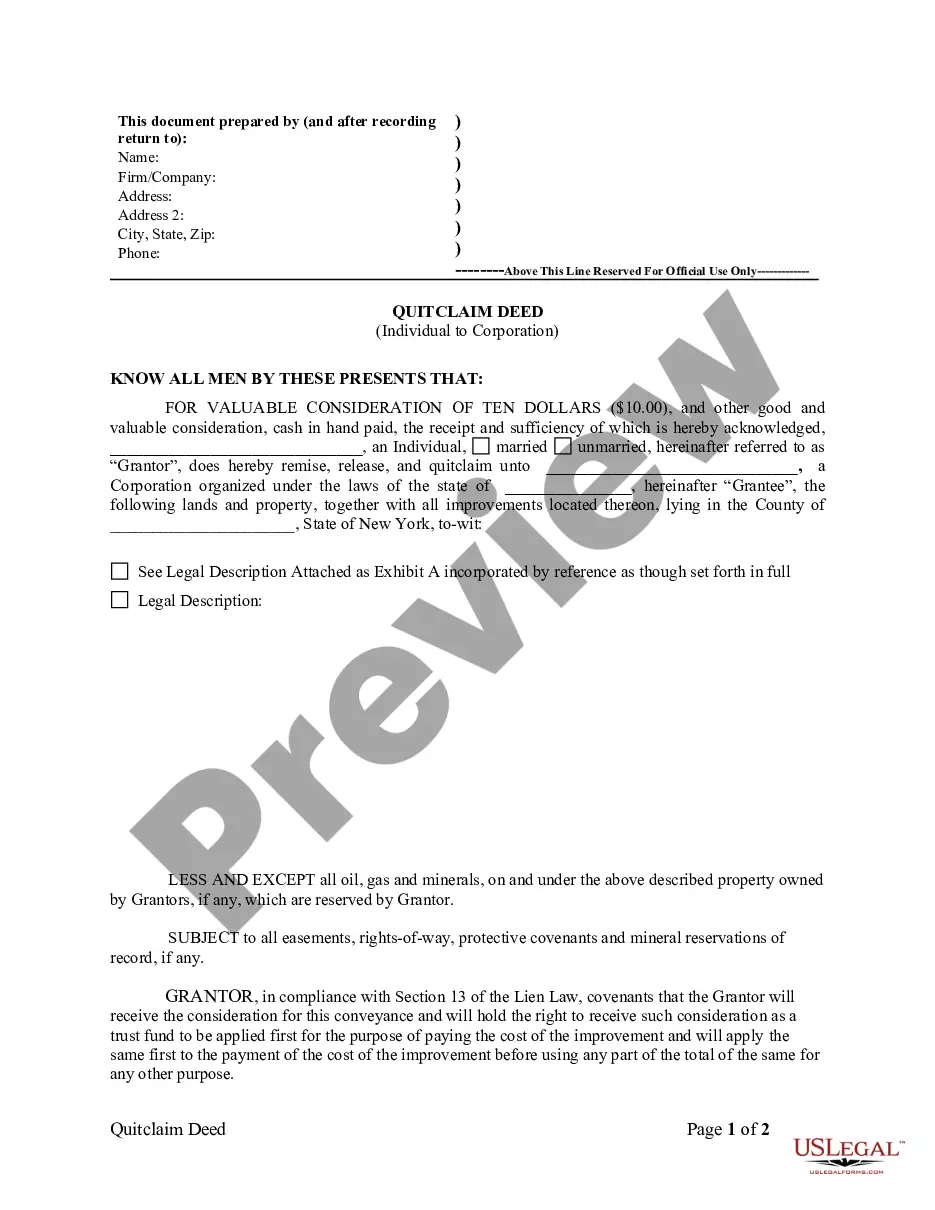

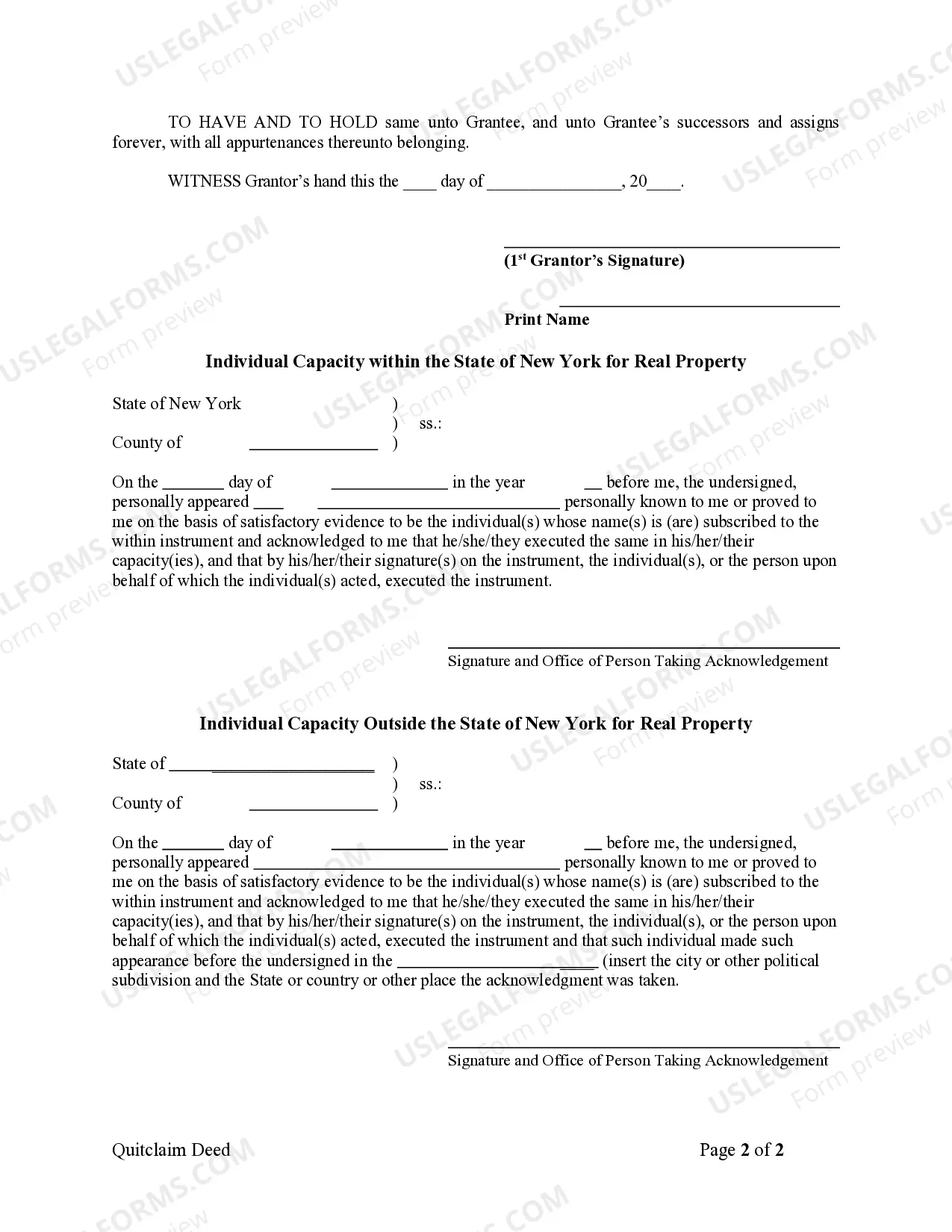

A Nassau New York Quitclaim Deed from Individual to Corporation is a legal document that transfers property ownership from an individual to a corporation in Nassau County, New York. This type of deed is commonly used when a property owner wishes to transfer their ownership interest in a property to a corporation. The Nassau New York Quitclaim Deed from Individual to Corporation requires specific information to be included. This includes the name and address of the individual transferring the property (the granter) and the name and address of the corporation receiving the property (the grantee). Additionally, the deed should have a clear legal description of the property, including the boundaries and any notable features. It is important to note that a quitclaim deed only transfers whatever interest the granter has in the property, without making any guarantees about the property's title or any potential liens or defects. This means that the grantee may not receive a full warranty of title and should conduct their own due diligence before accepting the transfer. In Nassau County, New York, there may be variations of the Nassau New York Quitclaim Deed from Individual to Corporation based on specific circumstances. Some examples of these variations include: 1. Nassau New York Quitclaim Deed from Individual to Corporation with Consideration: This type of quitclaim deed includes the transfer of the property from an individual to a corporation for a specified amount of money or other valuable consideration. 2. Nassau New York Quitclaim Deed from Individual to Corporation without Consideration: In this case, the transfer of the property from an individual to a corporation occurs without any monetary payments or consideration. 3. Nassau New York Quitclaim Deed from Individual to Corporation for Real Estate Investment: This type of deed is used when an individual transfers property to a corporation specifically formed for real estate investment purposes, such as managing rental properties or real estate development projects. 4. Nassau New York Quitclaim Deed from Individual to Corporation for Estate Planning: This type of quitclaim deed is used when an individual wishes to transfer property to a corporation as part of their estate planning strategy, ensuring a smooth transition of ownership upon their passing. Before completing and executing a Nassau New York Quitclaim Deed from Individual to Corporation, it is highly recommended consulting with a qualified attorney to ensure that all legal requirements are met, and the transfer is conducted smoothly and legally.

Nassau New York Quitclaim Deed from Individual to Corporation

Description

How to fill out Nassau New York Quitclaim Deed From Individual To Corporation?

If you are looking for a valid form, it’s impossible to choose a better place than the US Legal Forms site – one of the most considerable libraries on the internet. Here you can get a huge number of templates for organization and personal purposes by categories and states, or key phrases. Using our high-quality search feature, getting the newest Nassau New York Quitclaim Deed from Individual to Corporation is as elementary as 1-2-3. Additionally, the relevance of each file is confirmed by a team of skilled lawyers that regularly review the templates on our website and revise them based on the most recent state and county demands.

If you already know about our platform and have a registered account, all you should do to receive the Nassau New York Quitclaim Deed from Individual to Corporation is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the form you need. Read its information and use the Preview option (if available) to see its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to find the needed record.

- Confirm your selection. Click the Buy now option. Next, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Get the template. Choose the format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the acquired Nassau New York Quitclaim Deed from Individual to Corporation.

Each and every template you save in your profile has no expiry date and is yours forever. You can easily access them via the My Forms menu, so if you want to have an extra copy for enhancing or creating a hard copy, feel free to return and save it again whenever you want.

Take advantage of the US Legal Forms professional library to gain access to the Nassau New York Quitclaim Deed from Individual to Corporation you were seeking and a huge number of other professional and state-specific templates on one platform!

Form popularity

FAQ

The quitclaim deed must be in writing. For real estate in New York City, quitclaim deeds typically require two main forms: Form RP-5217NYC and Form TP-584. Many parties hire attorneys to prepare these documents for them. Most quitclaim deeds in New York require the grantor's signature.

The alternative spellings quit claim deed and quit-claim deed are generally acceptable?though used less frequently. Oklahoma legal professionals also use the word quitclaim as a verb indicating that an owner is transferring an interest without warranty. Release deed can be a synonym for quitclaim deed in some contexts.

A real property transfer form?RP-5217, RP-5217-NYC, or RP-5217-PDF (pilot project)?is required for all real property transfers where a deed is filed. A filing fee is also required.

The quitclaim deed must be in writing. For real estate in New York City, quitclaim deeds typically require two main forms: Form RP-5217NYC and Form TP-584. Many parties hire attorneys to prepare these documents for them. Most quitclaim deeds in New York require the grantor's signature.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

The quitclaim deed must be in writing. For real estate in New York City, quitclaim deeds typically require two main forms: Form RP-5217NYC and Form TP-584. Many parties hire attorneys to prepare these documents for them. Most quitclaim deeds in New York require the grantor's signature.

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

The most common way to transfer land ownership, especially residential property, is with a warranty deed. Warranty deeds not only make it possible for a property owner to transfer ownership to the buyer. But this type of deed also explicitly promises that the title is good and clear of all liens or other issues.

A quit claim deed, or what's also spelled as a quitclaim deed, is a New York legal document that transfers title to a real estate property but makes no promises at all about the owner's title.