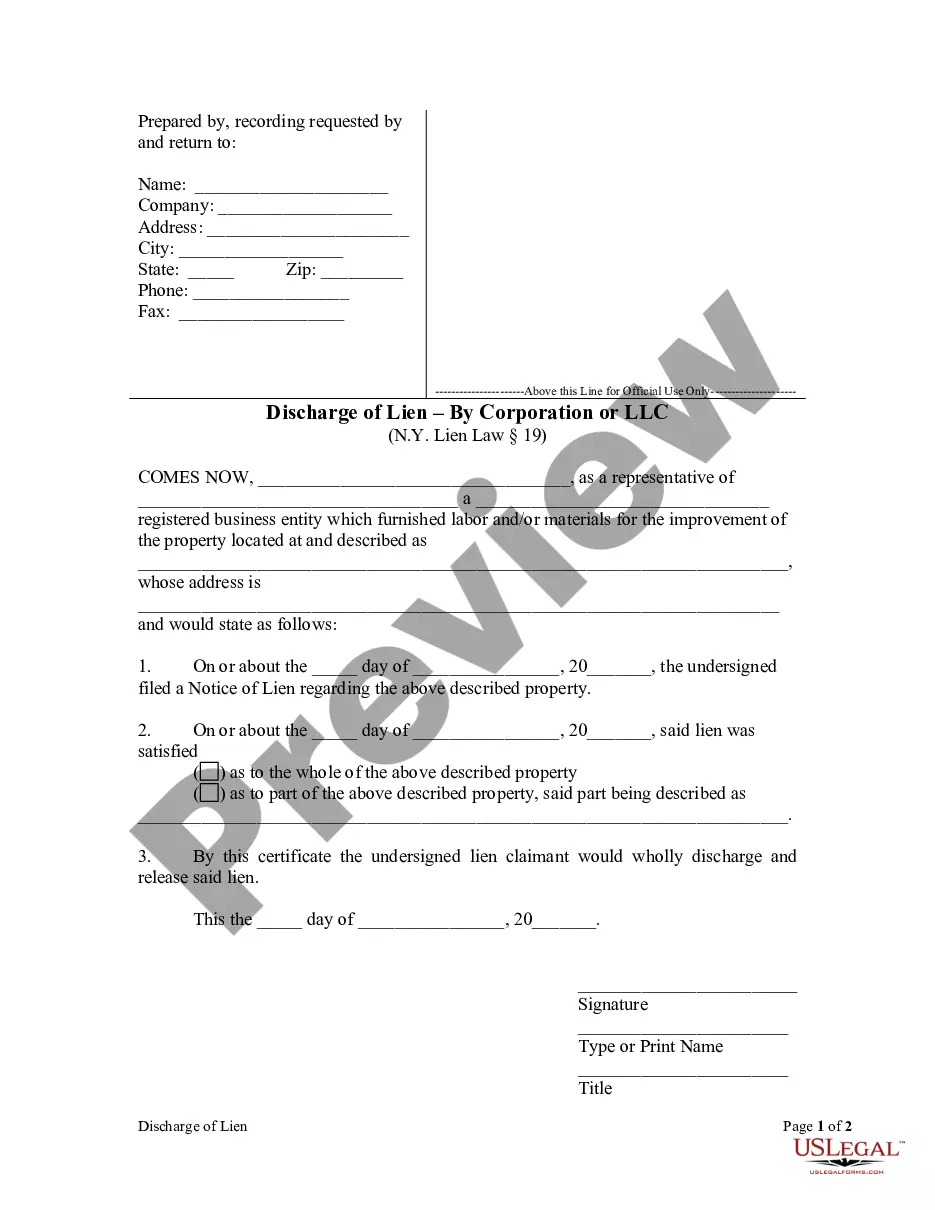

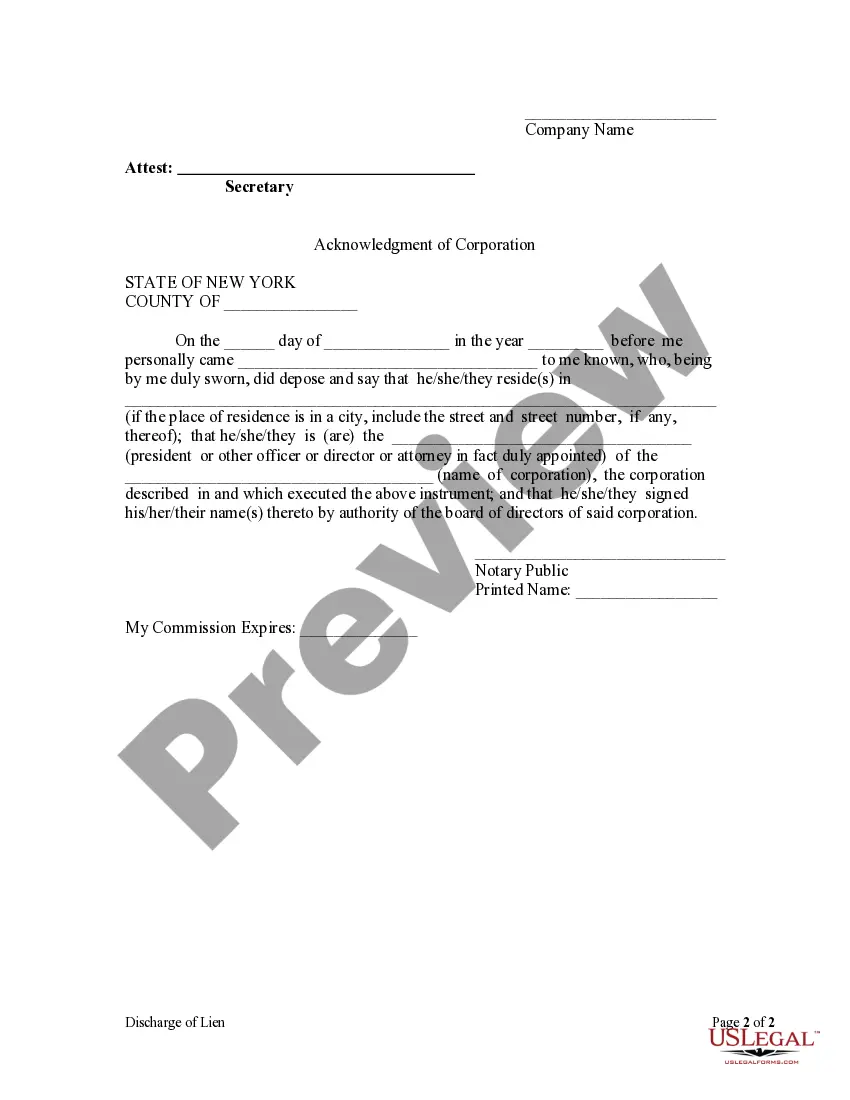

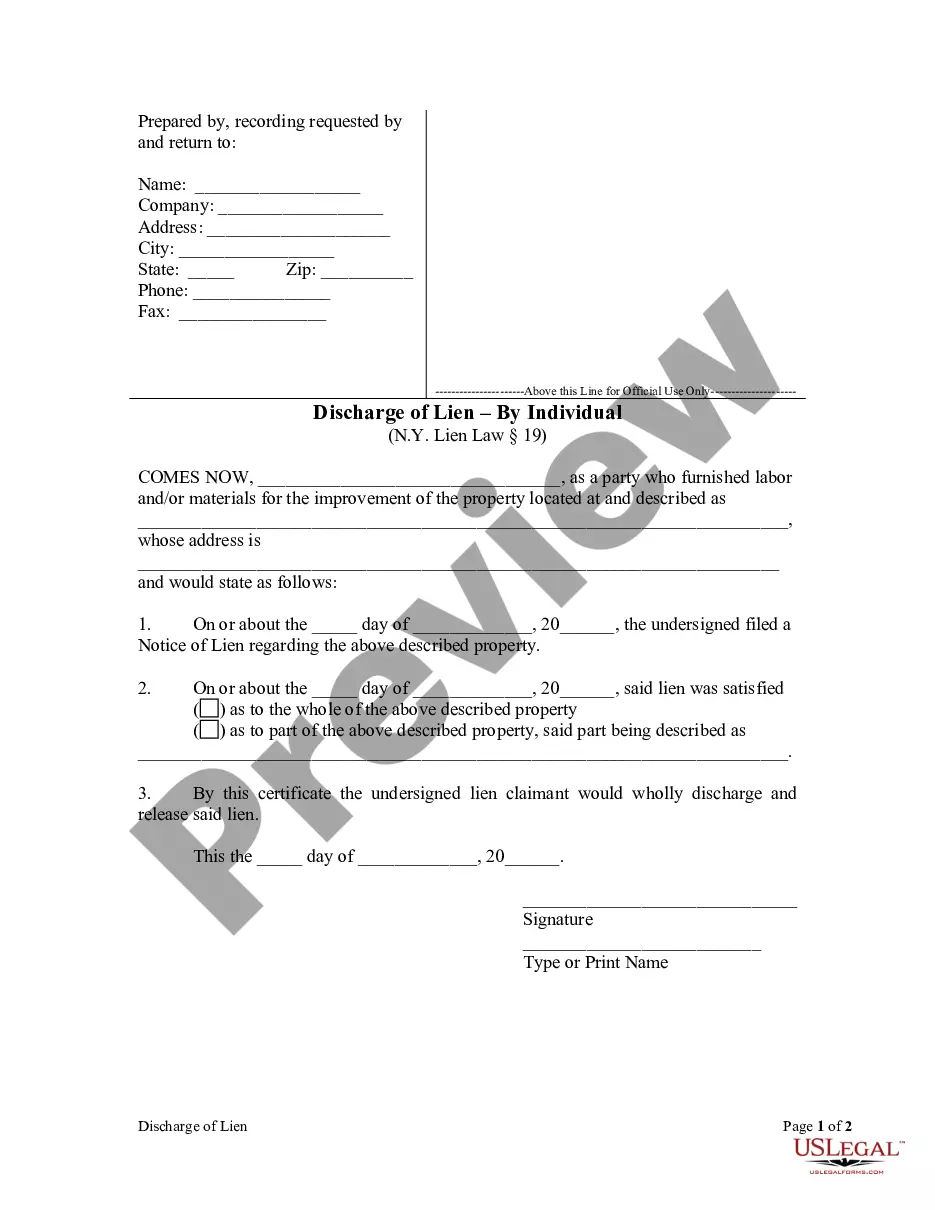

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

Nassau New York Discharge of Lien by Corporation

Description

How to fill out New York Discharge Of Lien By Corporation?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our beneficial website with an extensive collection of templates enables you to locate and obtain practically any document sample you need.

You can export, fill out, and validate the Nassau New York Discharge of Lien by Corporation or LLC in just a few minutes instead of spending hours online searching for the right form.

Utilizing our catalog is an excellent approach to enhance the security of your file submissions.

If you haven’t created an account yet, follow the steps outlined below.

Access the page containing the form you require. Ensure that it is the template you were searching for: review its title and description, and utilize the Preview option if available. Otherwise, employ the Search box to find the correct one.

- Our experienced attorneys frequently review all documents to ensure that the templates are applicable for a specific state and adhere to current laws and regulations.

- How can you acquire the Nassau New York Discharge of Lien by Corporation or LLC.

- If you have an account, just Log In to your account.

- The Download button will be present on all documents you access.

- Additionally, you can view all previously saved files in the My documents section.

Form popularity

FAQ

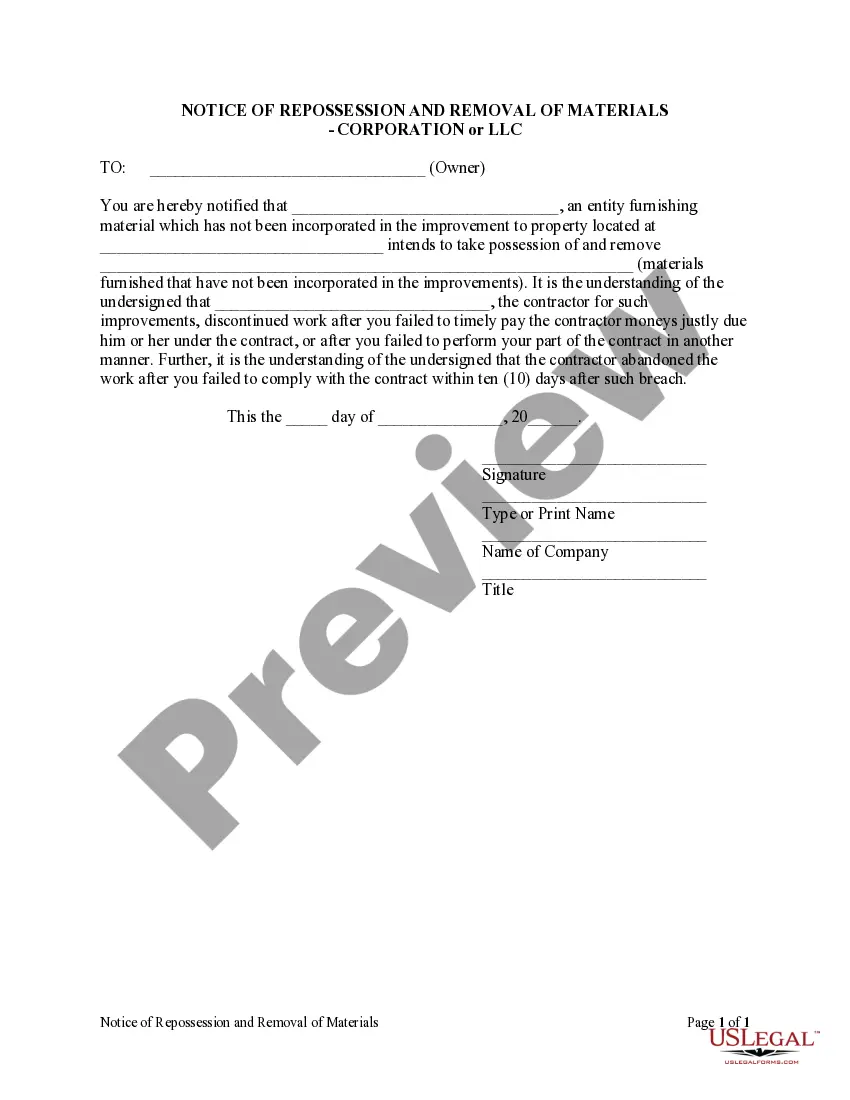

A discharge of claim of lien is a legal process that releases a property from a lien filed against it. In Nassau New York, a discharge of lien by a corporation is an essential step to clear any claims that might hinder property transactions. This process can prevent potential complications during the sale or refinancing of the property. For a seamless and efficient experience, consider using the US Legal Forms platform to guide you through the Nassau New York discharge of lien by corporation process.

If the company that issued the lien no longer exists, you may have a difficult time retrieving a lien release. Start by collecting documentation related to the lien and contacting the last known address or representatives of the company. In cases like this, obtaining a Nassau New York Discharge of Lien by Corporation can provide legal protection and clarification regarding your property interests.

To find an old lien release, you can search public records at your local county clerk's office or online databases. Gather as much information as possible about the lien, such as dates and the parties involved, to assist in your search. The Nassau New York Discharge of Lien by Corporation may also provide resources to help locate past releases efficiently.

To request a lien removal, you typically need to submit a formal request along with proof of payment or settlement. Contact the lien holder for specific instructions and required forms. Utilizing a Nassau New York Discharge of Lien by Corporation can help facilitate the lien removal process and ensure that all obligations are properly documented.

To get a copy of a lien release in New York, you can contact the office that issued the lien, often a county clerk's office. You may need to fill out a request form and provide identification. A Nassau New York Discharge of Lien by Corporation can ensure that you receive the correct documentation required for your records.

You can request your lien release letter directly from the creditor or entity that issued the lien. Provide necessary details such as the lien number and your identification information to facilitate the request. For streamlined processing, consider using a service specializing in Nassau New York Discharge of Lien by Corporation to support your needs.

After obtaining a lien release, you must apply for a new title through the New York Department of Motor Vehicles (DMV). Provide the lien release documentation and any required identification. Securing a Nassau New York Discharge of Lien by Corporation is critical, as it reaffirms that the debt has been settled before initiating your title application.

To obtain a copy of a lien release from the IRS, you should request it through Form 4506-T or by contacting your local IRS office. Make sure to have your tax identification information ready, as it will expedite the process. Achieving a Nassau New York Discharge of Lien by Corporation will also help clarify your standing with state and local authorities.

To file a lien in New York State, you must gather relevant information about the debt and the party you are filing against. You can then prepare the necessary documents, including a Nassau New York Discharge of Lien by Corporation, to submit to the county clerk. It's essential to follow state guidelines and deadlines, so consider using resources like USLegalForms for assistance.

You can obtain a lien release form from several sources, including legal document preparation services and websites like USLegalForms. This platform provides templates that specifically cater to the Nassau New York Discharge of Lien by Corporation. Ensure you fill out the form completely and accurately before submitting it to the appropriate county office.