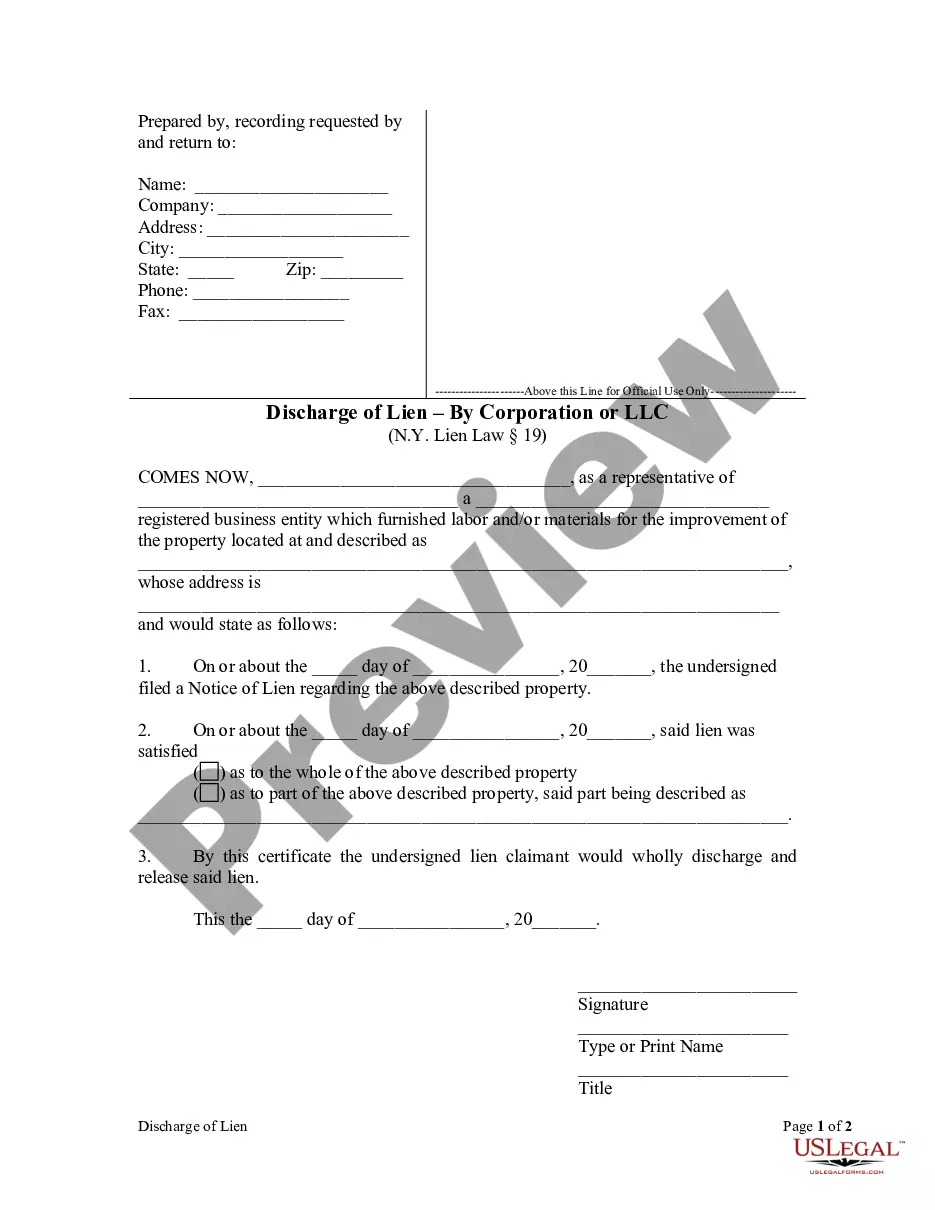

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

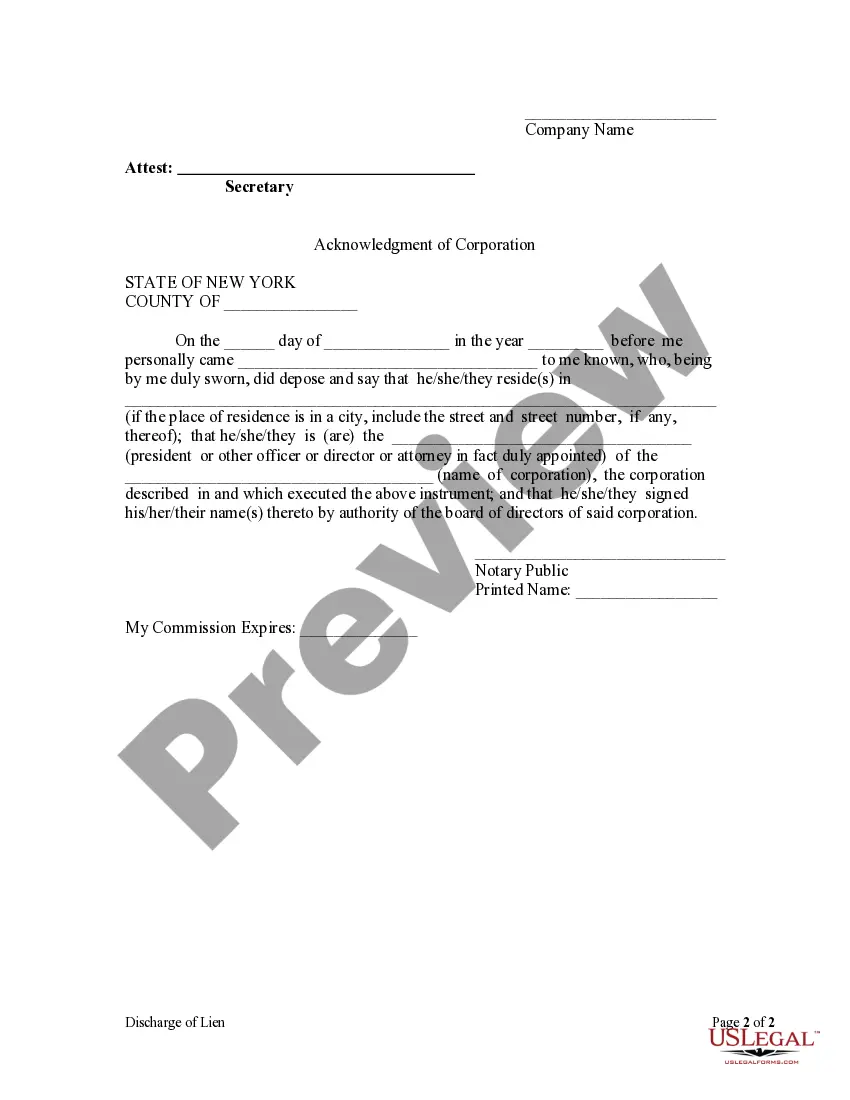

Queens New York Discharge of Lien by Corporation or LLC — A Detailed Description In Queens, New York, a discharge of lien by a corporation or limited liability company (LLC) is a legal procedure utilized to release a previously filed lien against a property. A lien is a claim or encumbrance placed on a property by an individual or entity to secure a debt or obligation owed to them. Discharging a lien removes the claim and restores the property's title to its original status, free from any encumbrances. When it comes to discharging a lien, different scenarios may arise depending on the circumstances and the parties involved. Here are a few common types of Queens New York Discharge of Lien by Corporation or LLC: 1. Voluntary Discharge of Lien: This occurs when the corporation or LLC that filed the lien willingly releases the claim after the underlying debt has been satisfied or resolved. The corporation or LLC would complete the necessary paperwork, including a lien release form, providing details about the lien and the property involved. This discharge is usually recorded with the Queens County Clerk's office. 2. Satisfaction of Judgment: In instances where a corporation or LLC has obtained a judgment against the property owner, they may file a lien to secure the debt owed. If the judgment is subsequently paid or otherwise satisfied, the corporation or LLC must file a satisfaction of judgment with the appropriate court to discharge the lien officially. 3. Invalid Liens Discharge: There may be cases where a lien filed by a corporation or LLC is deemed invalid due to errors, fraud, or lack of legal basis. In such situations, the entity responsible for the incorrect filing can initiate the process of discharging the lien by providing evidence and documentation supporting the invalidity of the lien claim. This may involve involving legal proceedings or negotiations. 4. Expiration of Lien: Depending on the nature of the lien, it may have a specific duration or expiration date. In some cases, a corporation or LLC may have filed a lien that automatically becomes void after a predetermined period, typically within a few years. Once the expiration date has passed, the lien is considered discharged without further action required. Regardless of the type of discharge, it is vital for corporations or LCS filing a discharge of lien to ensure that the appropriate documents are accurately completed and recorded with the relevant authorities. This might include submitting a discharge of lien form, copies of the original lien documents, and any additional supporting evidence or legal filings. By carefully navigating the discharge of lien process, corporations or LCS can effectively clear any encumbrances on a property title, ensuring its marketability and the establishment of clean ownership. It is advisable to consult legal professionals or seek expert advice to ensure compliance with all legal requirements and procedures specific to Queens, New York.Queens New York Discharge of Lien by Corporation or LLC — A Detailed Description In Queens, New York, a discharge of lien by a corporation or limited liability company (LLC) is a legal procedure utilized to release a previously filed lien against a property. A lien is a claim or encumbrance placed on a property by an individual or entity to secure a debt or obligation owed to them. Discharging a lien removes the claim and restores the property's title to its original status, free from any encumbrances. When it comes to discharging a lien, different scenarios may arise depending on the circumstances and the parties involved. Here are a few common types of Queens New York Discharge of Lien by Corporation or LLC: 1. Voluntary Discharge of Lien: This occurs when the corporation or LLC that filed the lien willingly releases the claim after the underlying debt has been satisfied or resolved. The corporation or LLC would complete the necessary paperwork, including a lien release form, providing details about the lien and the property involved. This discharge is usually recorded with the Queens County Clerk's office. 2. Satisfaction of Judgment: In instances where a corporation or LLC has obtained a judgment against the property owner, they may file a lien to secure the debt owed. If the judgment is subsequently paid or otherwise satisfied, the corporation or LLC must file a satisfaction of judgment with the appropriate court to discharge the lien officially. 3. Invalid Liens Discharge: There may be cases where a lien filed by a corporation or LLC is deemed invalid due to errors, fraud, or lack of legal basis. In such situations, the entity responsible for the incorrect filing can initiate the process of discharging the lien by providing evidence and documentation supporting the invalidity of the lien claim. This may involve involving legal proceedings or negotiations. 4. Expiration of Lien: Depending on the nature of the lien, it may have a specific duration or expiration date. In some cases, a corporation or LLC may have filed a lien that automatically becomes void after a predetermined period, typically within a few years. Once the expiration date has passed, the lien is considered discharged without further action required. Regardless of the type of discharge, it is vital for corporations or LCS filing a discharge of lien to ensure that the appropriate documents are accurately completed and recorded with the relevant authorities. This might include submitting a discharge of lien form, copies of the original lien documents, and any additional supporting evidence or legal filings. By carefully navigating the discharge of lien process, corporations or LCS can effectively clear any encumbrances on a property title, ensuring its marketability and the establishment of clean ownership. It is advisable to consult legal professionals or seek expert advice to ensure compliance with all legal requirements and procedures specific to Queens, New York.