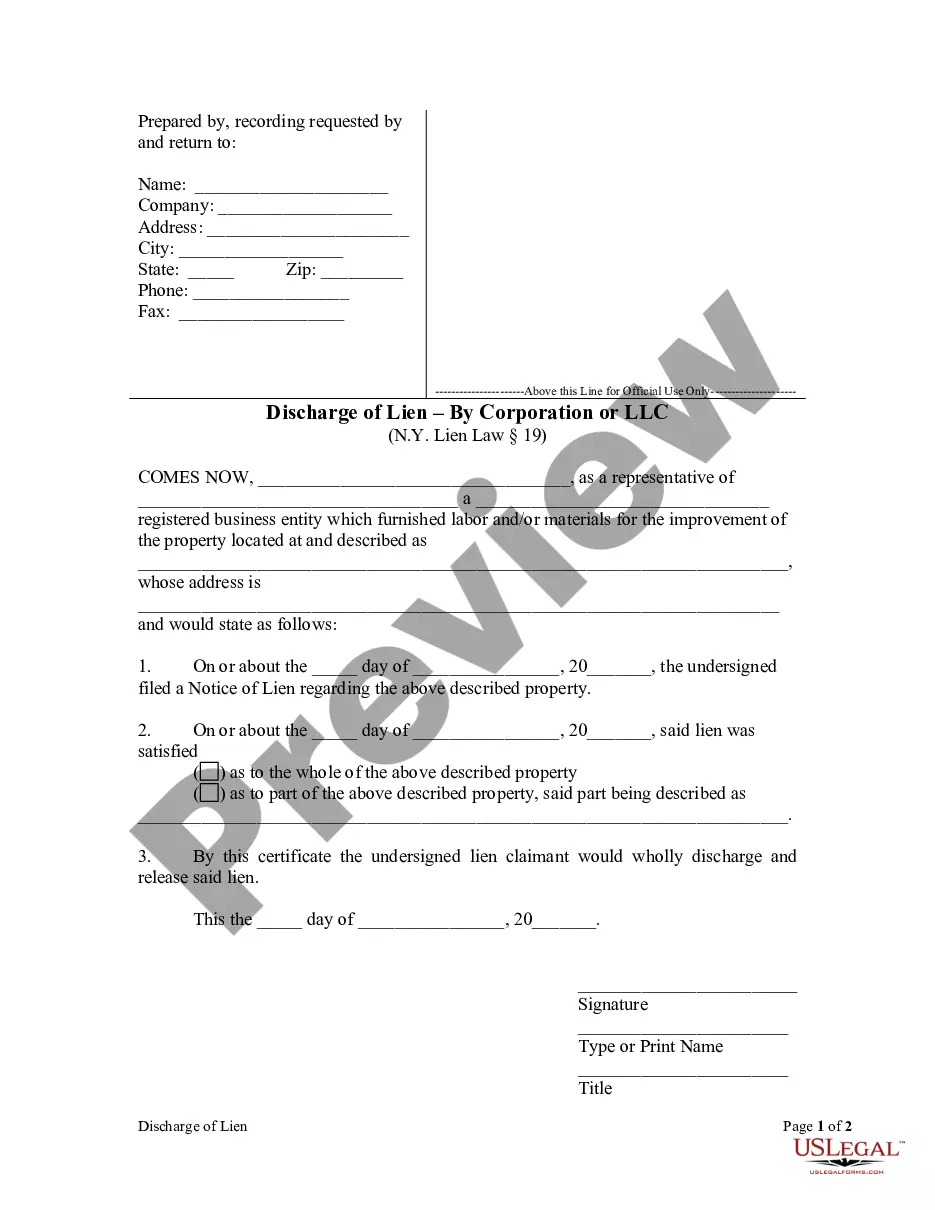

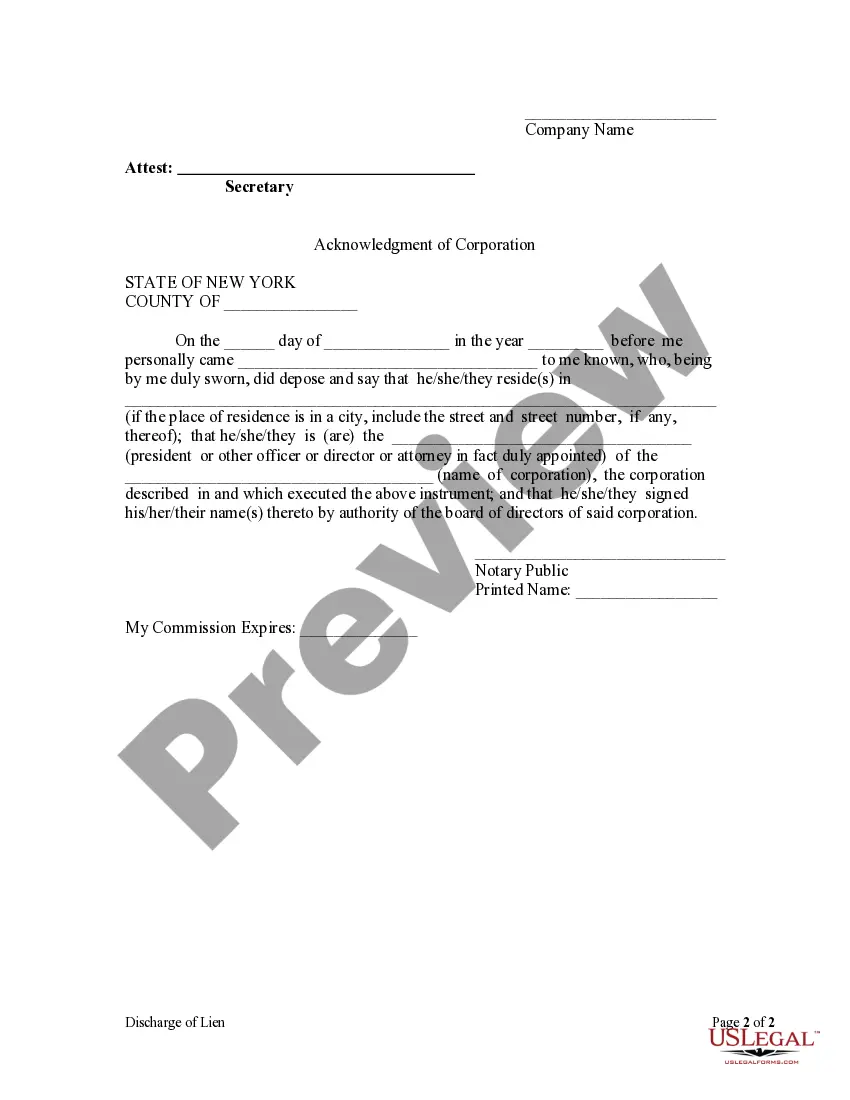

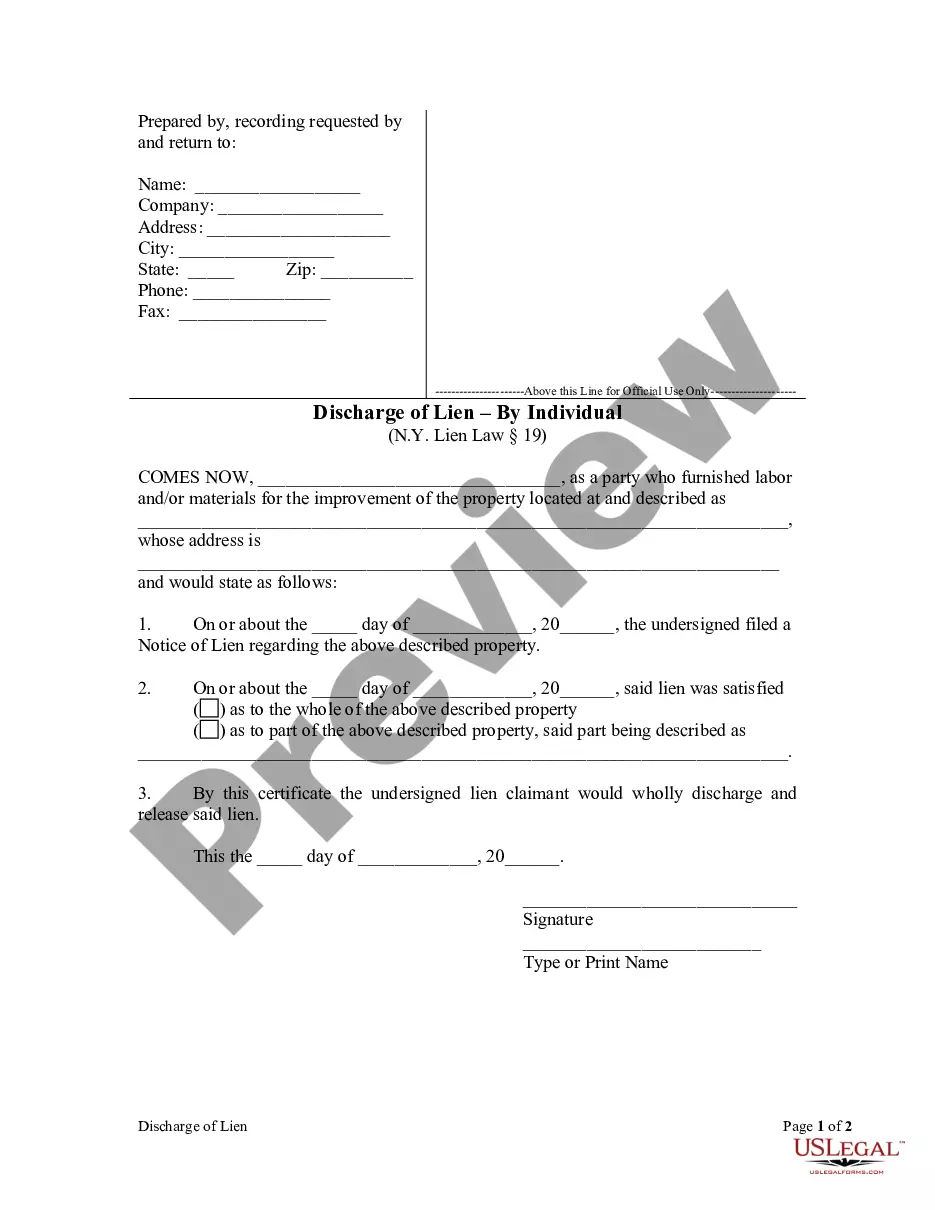

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

Suffolk New York Discharge of Lien by Corporation

Description

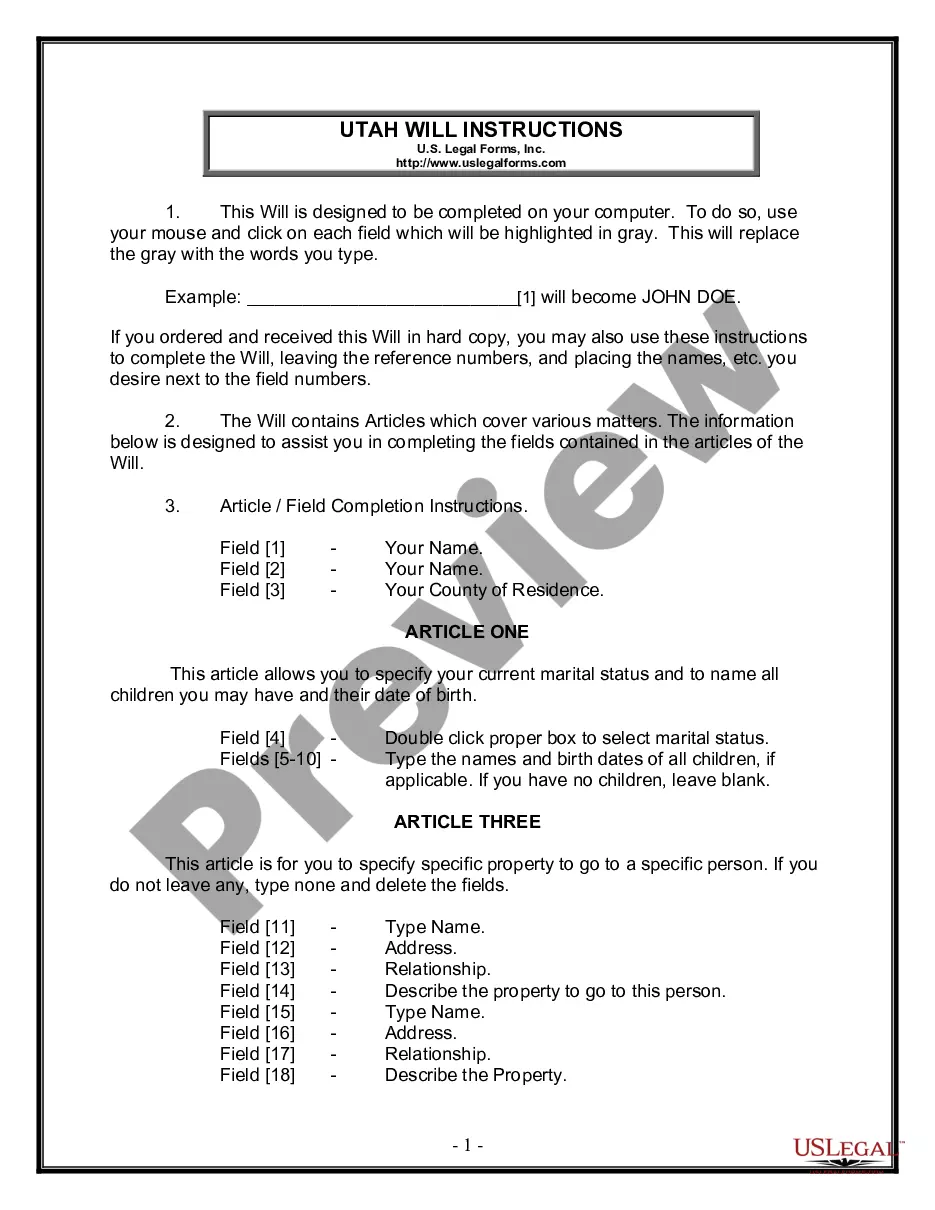

How to fill out New York Discharge Of Lien By Corporation?

Take advantage of the US Legal Forms and gain immediate access to any template sample you desire.

Our user-friendly website with an extensive collection of documents streamlines the process of locating and obtaining nearly any template sample you require.

You can save, fill out, and validate the Suffolk New York Discharge of Lien by Corporation or LLC in just a few minutes rather than spending hours searching the web for a suitable template.

Utilizing our collection is an excellent way to enhance the security of your filing process.

Moreover, you can access all the previously saved documents in the My documents section.

If you haven’t created an account yet, follow the steps below.

- Our knowledgeable legal professionals routinely review all records to ensure that the templates are suitable for a specific state and adhere to new laws and regulations.

- How can you access the Suffolk New York Discharge of Lien by Corporation or LLC? If you already have an account, simply Log In to your profile.

- The Download button will be visible on all the samples you examine.

Form popularity

FAQ

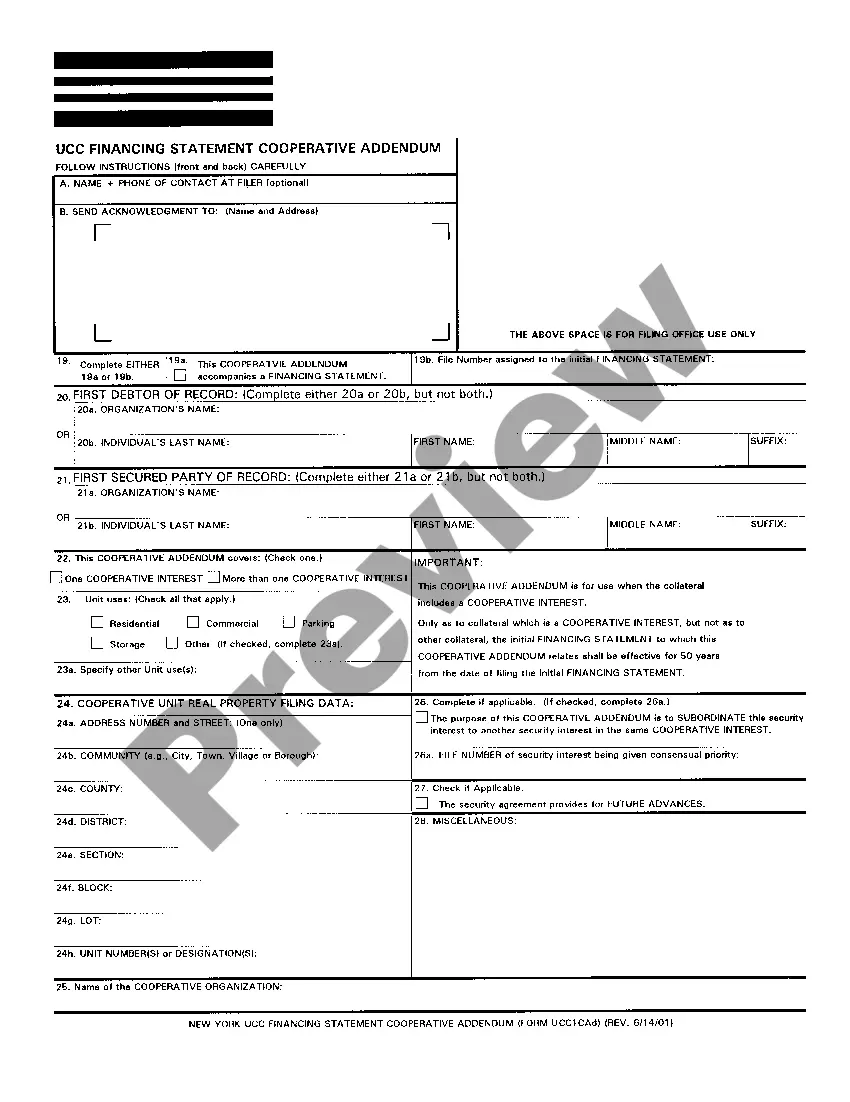

To file a lien in New York state, you must first prepare the necessary documents that establish your claim. This includes the lien form and any supporting materials that highlight the obligation owed. After completing these documents, you can submit them to the appropriate county clerk's office, ensuring you follow local guidelines. Consider using US Legal Forms to access accurate templates and streamline your filing process for Suffolk New York Discharge of Lien by Corporation.

A discharge lien serves to formally remove a lien against a property, often when a debt is satisfied. In Suffolk, New York, the discharge of lien by a corporation signifies the resolution of any financial obligation linked to that property. This legal process clears the way for future transactions, ensuring the property is unencumbered. If you find yourself needing assistance with the Suffolk New York Discharge of Lien by Corporation, US Legal Forms offers reliable templates and resources tailored to your needs.

Obtaining a lien release form typically involves contacting the creditor or the entity that placed the lien. They will provide the appropriate paperwork needed for release. If you need assistance navigating the process, US Legal Forms can help you find the Suffolk New York Discharge of Lien by Corporation form you require.

To find a lien on a property in New York, you should begin by conducting a title search or visiting the county clerk’s office. These resources provide access to public records outlining any liens associated with a property. Utilizing US Legal Forms can streamline this process and assist you with obtaining the Suffolk New York Discharge of Lien by Corporation.

In New York, a lien generally remains on a property for a specific duration, often until it is resolved or discharged. The time frame can vary depending on the type of lien. If you're looking to clear a claim, such as a Suffolk New York Discharge of Lien by Corporation, it's essential to act promptly.

Yes, liens are indeed public records in New York. This means anyone can access details about liens that are filed against properties. If you need to confirm a Suffolk New York Discharge of Lien by Corporation, checking public records may provide the information you need.

Yes, liens typically appear during a title search. A title search evaluates the historical ownership of a property, including any financial claims against it. If you are navigating property ownership or seeking a Suffolk New York Discharge of Lien by Corporation, it is crucial to review these findings.

In New York, various public records are available, including property deeds, liens, and court documents. These records provide insight into ownership and financial obligations of properties. If you're interested in understanding a property’s financial status, such as the Suffolk New York Discharge of Lien by Corporation, these records can be a valuable resource.

Filing a lien against a corporation requires submitting specific documentation to the appropriate authority, often the county clerk's office. You must provide details about the debt and the corporation involved. Using resources like the Suffolk New York Discharge of Lien by Corporation can help streamline the process and ensure you meet all necessary requirements.

If a lien is released, it means that the creditor's claim against your property has been removed. This typically occurs after the underlying debt has been satisfied or settled. A Suffolk New York Discharge of Lien by Corporation provides the necessary legal verification of this release, allowing you to move forward with confidence.