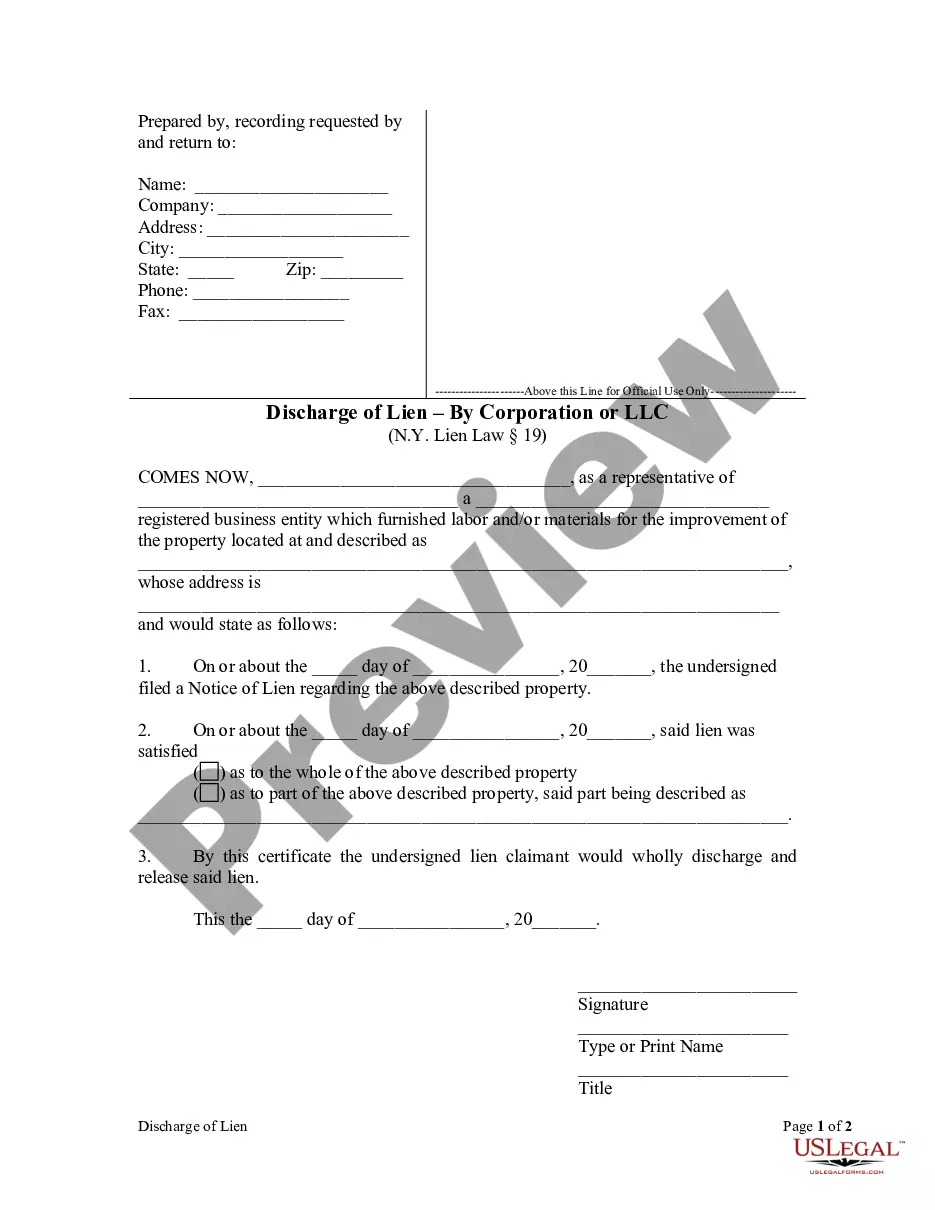

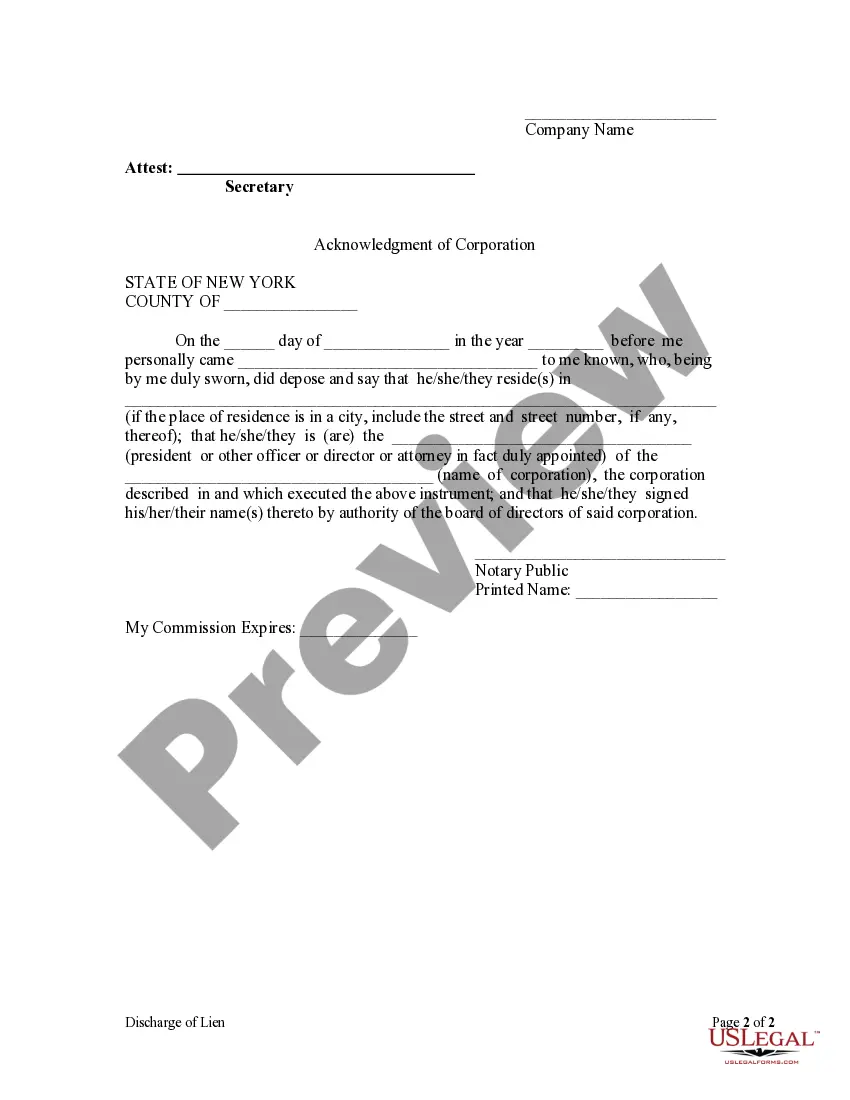

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

Yonkers New York Discharge of Lien by Corporation

Description

How to fill out Yonkers New York Discharge Of Lien By Corporation?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our advantageous website with a vast array of documents streamlines the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and validate the Yonkers New York Discharge of Lien by Corporation or LLC in just a few minutes rather than scouring the internet for hours searching for a suitable template.

Utilizing our library is an excellent way to enhance the security of your document submissions.

If you haven’t created a profile yet, follow these steps.

Visit the page with the form you require. Ensure that it is the template you were after: verify its title and description, and utilize the Preview option if it's available. Otherwise, use the Search field to find the appropriate one.

- Our skilled attorneys regularly examine all the documents to ensure that the templates are applicable for a specific state and adhere to new laws and regulations.

- How can you obtain the Yonkers New York Discharge of Lien by Corporation or LLC.

- If you have a subscription, simply sign in to your account. The Download button will appear on all the samples you browse.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

To file a lien in New York state, start by drafting the lien document that outlines the debt and property details. You must then file this document with the county clerk’s office in the location of the property. This process is essential for enforcing your rights, especially concerning the Yonkers New York Discharge of Lien by Corporation. Utilizing resources from uslegalforms can simplify this process and ensure all legal requirements are met.

Any creditor who has a court judgment against a property owner can place a lien on their house in New York. Additionally, contractors and suppliers can file mechanics' liens for unpaid work or materials. It's crucial to understand the implications of this, particularly when addressing the Yonkers New York Discharge of Lien by Corporation. For tailored assistance, uslegalforms equips users with necessary resources and forms to manage liens effectively.

In New York, a lien generally lasts for a period of 10 years, though it can be extended under certain circumstances. The duration may vary based on the type of lien and its specific conditions. Watching the timeline is vital, especially when considering the Yonkers New York Discharge of Lien by Corporation. Tools available on uslegalforms can offer guidance and support throughout this process.

The statute of limitations for enforcing a lien in New York is generally 10 years. This time period begins from the last date the payment was due. Once this time elapses, the lien cannot be enforced without legal action. If you're uncertain about your rights regarding liens in Yonkers, seeking advice would be beneficial, especially to understand how a discharge of lien by a corporation may come into play.

Removing a lien in NYC typically requires satisfaction of the debt that created the lien. Once the debt is settled, the creditor must file a discharge of lien by a corporation or individual to officially remove the claim. If you encounter difficulties during this process, platforms like uslegalforms can assist you in completing the necessary documentation. Knowing the exact steps to take will help streamline the removal process for you.

In New York, a lien can generally remain on a property for up to 10 years, unless it is renewed or extended. This timeframe allows credit holders to enforce their claims against property owners effectively. If you find yourself facing a lien in Yonkers, it is crucial to explore the process for a discharge of lien by a corporation to avoid extended hindrance in property dealings. Always stay informed about the duration of any lien.

The lien law in New York protects creditors by allowing them to place a claim on a property until the debt is resolved. This law can apply to various types of debts, including construction work and unpaid taxes. In Yonkers, a discharge of lien by a corporation occurs when the debt is satisfied, releasing the property from the lien. Understanding this law can help property owners manage their obligations effectively.

Discharging a lien in New York requires you to first settle the debt associated with it. Once resolved, request a Yonkers New York Discharge of Lien by Corporation from the entity that placed the lien. After obtaining this document, ensure you file it with the appropriate office to officially clear the record.

In New York, a lien typically remains on a property until the debt is settled or the lien is released. If unresolved, it can affect property ownership for many years, often up to 10 years. Keeping up with your obligations is essential to avoid unwanted complications.

Filing a lien in New York involves completing specific forms and submitting them to the appropriate authority, often the county clerk's office. Include all pertinent information regarding the property and the debt. You may find useful resources and guidance on platforms like uslegalforms to streamline the filing process.