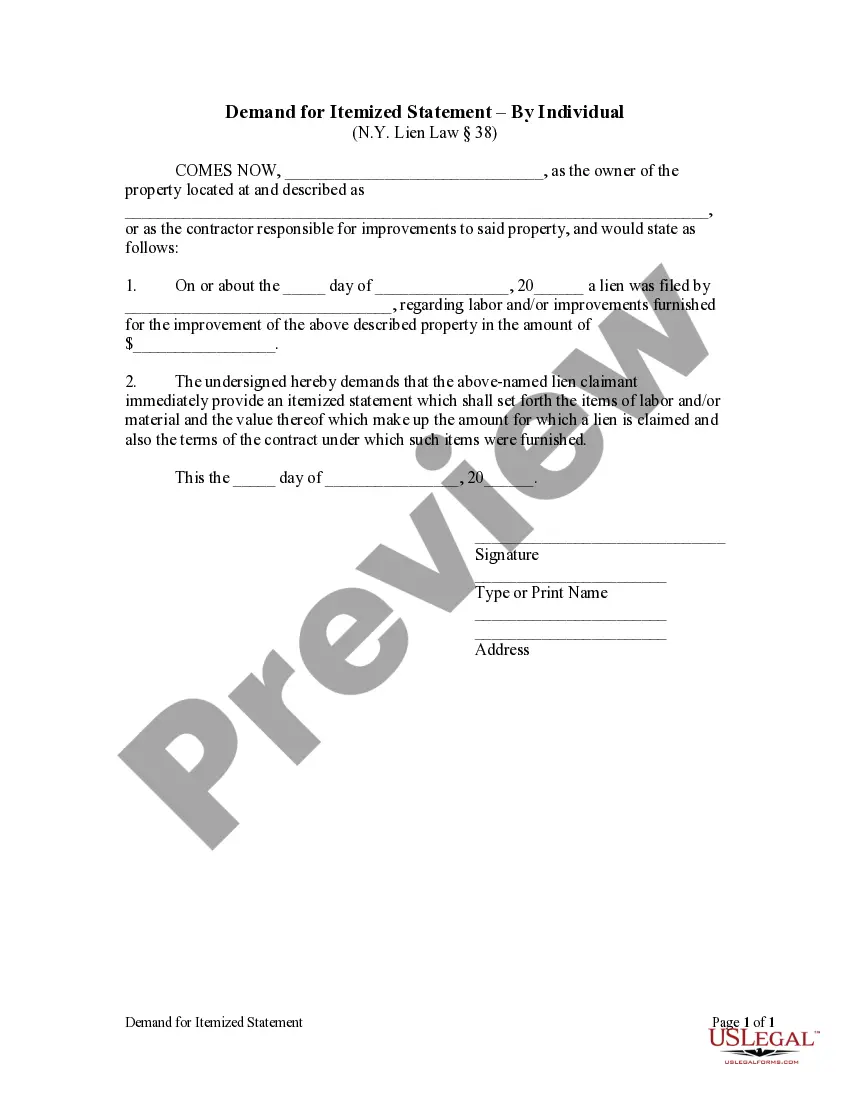

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Queens New York Demand for Itemized Statement - Individual

Description

How to fill out New York Demand For Itemized Statement - Individual?

Regardless of one's social or professional standing, filling out legal documents is a regrettable requirement in the current business landscape.

Frequently, it becomes almost unfeasible for individuals lacking legal knowledge to draft such documents independently, primarily due to the intricate language and legal nuances they encompass.

This is the point at which US Legal Forms can be a lifesaver.

Verify that the template you select is appropriate for your state, as the laws of one jurisdiction do not apply to another.

Examine the document and read a brief summary (if available) regarding the scenarios for which the paperwork can be utilized.

- Our platform offers an extensive library with over 85,000 pre-prepared state-specific forms suitable for nearly any legal circumstance.

- US Legal Forms serves as a valuable resource for associates or legal advisors aiming to enhance their time efficiency with our DYI documents.

- Whether you're searching for the Queens New York Demand for Itemized Statement - Individual or any other paperwork applicable in your state or locality, everything you need is readily available at US Legal Forms.

- Here’s how to swiftly acquire the Queens New York Demand for Itemized Statement - Individual using our reliable platform.

- If you’re already a subscriber, simply Log In to your account to retrieve the required form.

- In case you’re new to our collection, make sure to follow these steps before obtaining the Queens New York Demand for Itemized Statement - Individual.

Form popularity

FAQ

New York allows itemized deductions, giving taxpayers a chance to manage their tax liability effectively. You can deduct expenses related to medical bills, mortgage interests, and more, depending on your eligibility. To maximize your deductions, look into the Queens New York Demand for Itemized Statement - Individual to ensure you are taking full advantage of what New York offers. Understanding these deductions can have a positive impact on your overall tax situation.

Yes, New York does allow itemized deductions, enabling taxpayers to claim various expenses to reduce their taxable income. Common itemized deductions in New York include state and local taxes, mortgage interest, and medical expenses. Make sure to refer to the Queens New York Demand for Itemized Statement - Individual to help guide your claims effectively. This can be a valuable tool for those looking to optimize their taxes.

Yes, itemized deductions are still allowed, although changes in tax laws might affect the limits and eligibility. Many taxpayers choose standard deductions instead, but significant expenditures may make itemizing worthwhile for you. Utilize the resources related to the Queens New York Demand for Itemized Statement - Individual to navigate this process. Knowing your options is key to maximizing your tax return.

You can itemize various state taxes, including state income taxes and property taxes, when filing your taxes. Be sure to also include any local taxes applicable to your situation. By understanding the specifics of the Queens New York Demand for Itemized Statement - Individual, you can optimize your itemizing process. Keeping track of these deductions can substantially reduce your tax burden.

To itemize deductions, you'll need to collect documentation of all of your eligible expenses throughout the year. This typically includes items like medical bills, property taxes, and charitable donations. Fill out the appropriate forms, like IT-196, to report these deductions when you file your taxes. Consider using the resources offered by uslegalforms to simplify this process.

In New York, the form used for itemizing deductions is IT-196. This form allows you to list qualified expenses such as medical expenses, state taxes, and mortgage interest. By utilizing the Queens New York Demand for Itemized Statement - Individual, you can ensure that your itemized deductions are properly calculated. Remember to keep records of your expenses for verification.

To file form IT-201, start by gathering all necessary financial documents for your income year. You can find the form on the New York State Department of Taxation and Finance website. Complete the form accurately, ensuring to include your claim for itemized deductions if applicable. Finally, submit your form online or by mail, depending on your preference.

The Order to Show Cause eviction in New York is a legal document that requires the landlord to demonstrate why they should be permitted to evict a tenant. This process often arises when a tenant contests the eviction, such as failing to provide a required itemized statement of balances due. This order can allow tenants to present their case in court and defend against eviction actions. If facing an eviction issue in Queens, using UsLegalForms can help guide you through filing the appropriate papers.

To fill out an Order to Show Cause in New York, start by including the court's name and address. Next, clearly state your name and the name of the opposing party, followed by a title for your motion. Detail your reasons for the order, specify your request, and include any necessary dates and signatures. Using UsLegalForms can significantly simplify this process, particularly for those preparing a Queens New York Demand for Itemized Statement - Individual.

Writing an Order to Show Cause requires you to follow a structured format. Start by identifying the parties involved, clearly stating the legal basis for your request, and outlining the specific relief you are seeking. Additionally, include any supporting documents and relevant evidence, all while keeping the language clear and direct. To ensure your Order to Show Cause meets legal standards, you can utilize resources from UsLegalForms, especially for creating documents related to a Queens New York Demand for Itemized Statement - Individual.