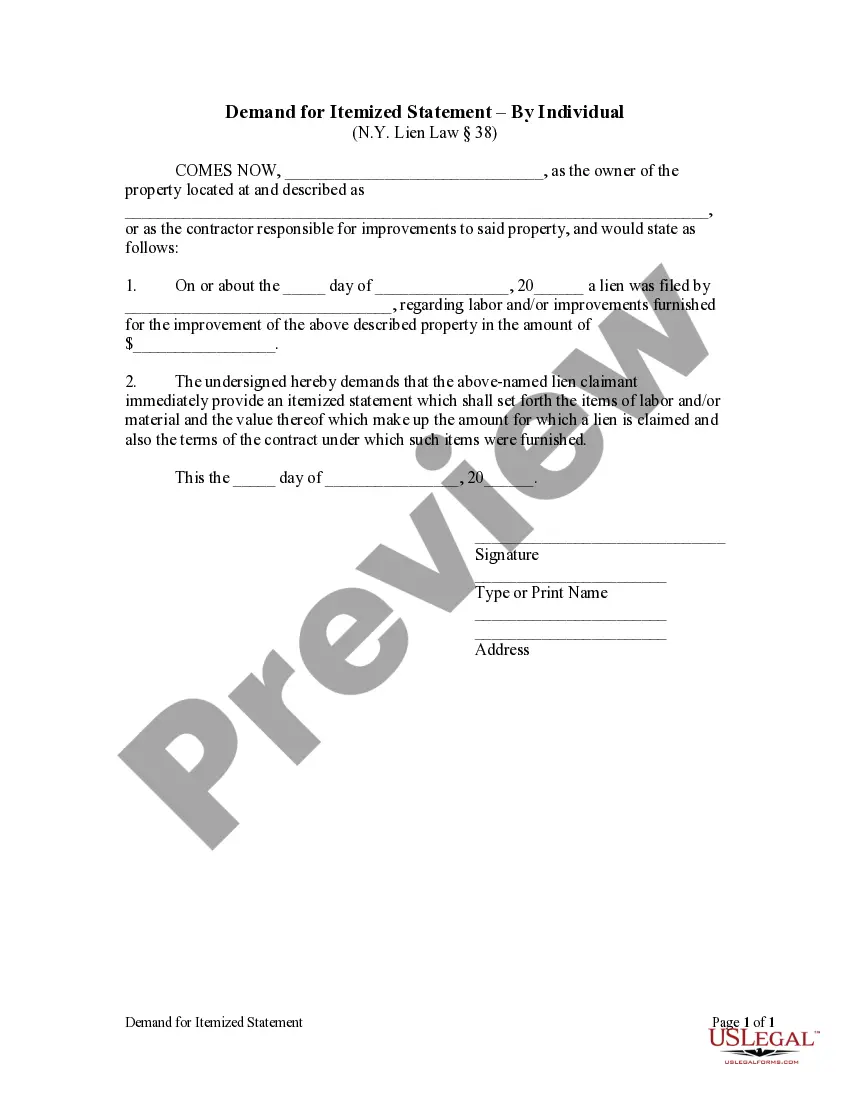

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Yonkers New York Demand for Itemized Statement - Individual

Description

How to fill out New York Demand For Itemized Statement - Individual?

Do you require a trustworthy and affordable supplier of legal documents to purchase the Yonkers New York Demand for Itemized Statement - Individual? US Legal Forms is your preferred option.

Whether you need a basic agreement to establish rules for living with your partner or a set of documents to facilitate your separation or divorce process through the court, we have what you need. Our platform offers over 85,000 current legal document templates for personal and business requirements. All templates we provide are not generic and are tailored to meet the rules of specific states and counties.

To obtain the form, you must Log In to your account, locate the desired form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time in the My documents section.

Are you new to our service? No need to worry. You can create an account in just a few minutes, but before you do that, ensure you follow these steps.

Now you can register for your account. Then choose the subscription plan and proceed to payment. Upon completion of the payment, download the Yonkers New York Demand for Itemized Statement - Individual in any available format. You can revisit the website whenever needed and redownload the form at no additional cost.

Acquiring current legal documents has never been more straightforward. Try US Legal Forms today, and put an end to wasting your precious time searching for legal papers online.

- Check if the Yonkers New York Demand for Itemized Statement - Individual meets the regulations of your state and locality.

- Review the form’s specifications (if available) to determine its intended use and suitability.

- Restart your search if the form is not suitable for your legal needs.

Form popularity

FAQ

Yes, there are limits on how much you can deduct, based mainly on your income and the type of deduction. Certain deductions may be subject to phase-outs based on adjusted gross income. To navigate these limits effectively, consider completing a Yonkers New York Demand for Itemized Statement - Individual to ensure you maximize your allowable deductions.

New York State does allow miscellaneous itemized deductions, but there are specific criteria to be aware of. Some deductions may have been affected by federal tax law changes, so it's vital to stay informed. To gain insight into how this applies to your situation, utilize a Yonkers New York Demand for Itemized Statement - Individual for tailored advice.

Yes, New York City imposes an individual income tax on residents, which is separate from state income tax. The rate varies based on income brackets, so it's essential to understand how this affects your overall tax liability. If you need guidance on navigating this, consider submitting a Yonkers New York Demand for Itemized Statement - Individual for clarity.

Receiving a letter from the New York State Department of Taxation and Finance usually indicates a need for clarification or additional information about your tax return. This could relate to discrepancies, missing documentation, or requests for further details regarding deductions. Responding promptly with a Yonkers New York Demand for Itemized Statement - Individual may help resolve any issues efficiently.

Limits for certain itemized deductions are calculated using your adjusted gross income (AGI) and specific IRS rules. These rules dictate how much of various deductions can be claimed based on income thresholds. For assistance in navigating these calculations, a Yonkers New York Demand for Itemized Statement - Individual can provide clarity and guidance.

The limit on Schedule A itemized deductions primarily depends on your income and the type of deductions you are claiming. For the 2023 tax year, the standard deduction may affect how much you can deduct. To ensure you maximize your benefits, you can make a Yonkers New York Demand for Itemized Statement - Individual to review your deductions accurately.

The Yonkers tax form Y 203 is used for reporting local taxes owed by residents. This form is specifically for individuals living in Yonkers and needs to be filled out in conjunction with your New York State tax return. The information gathered here may also relate to the Yonkers New York Demand for Itemized Statement - Individual, ensuring compliance with local tax laws.

While Yonkers is adjacent to New York City, it is not considered part of it. This separation means different regulations for taxes and local government. As a Yonkers resident, it's essential to understand these differences, especially when dealing with tax forms like the Yonkers New York Demand for Itemized Statement - Individual.

No, Yonkers is not part of New York City for tax purposes, even though it is located nearby. The city has its own tax regulations, including the unique Yonkers New York Demand for Itemized Statement - Individual. Understanding these distinctions can help you navigate your tax filings more effectively.

New York tax authorities inquire about your association with Yonkers to assess local tax obligations. Since Yonkers has a unique income tax structure, the information is crucial for determining any local tax liabilities. This helps ensure that residents meet their financial responsibilities properly.