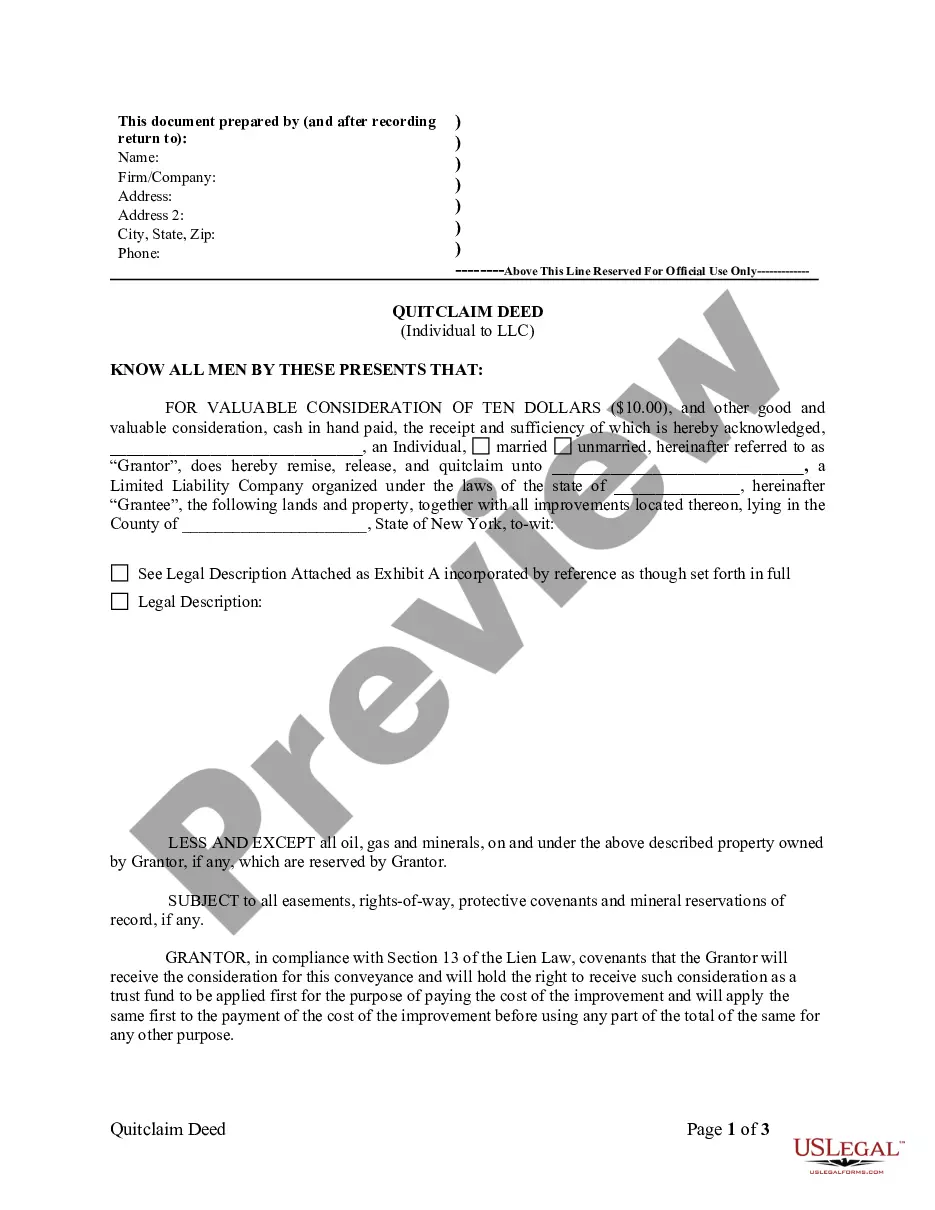

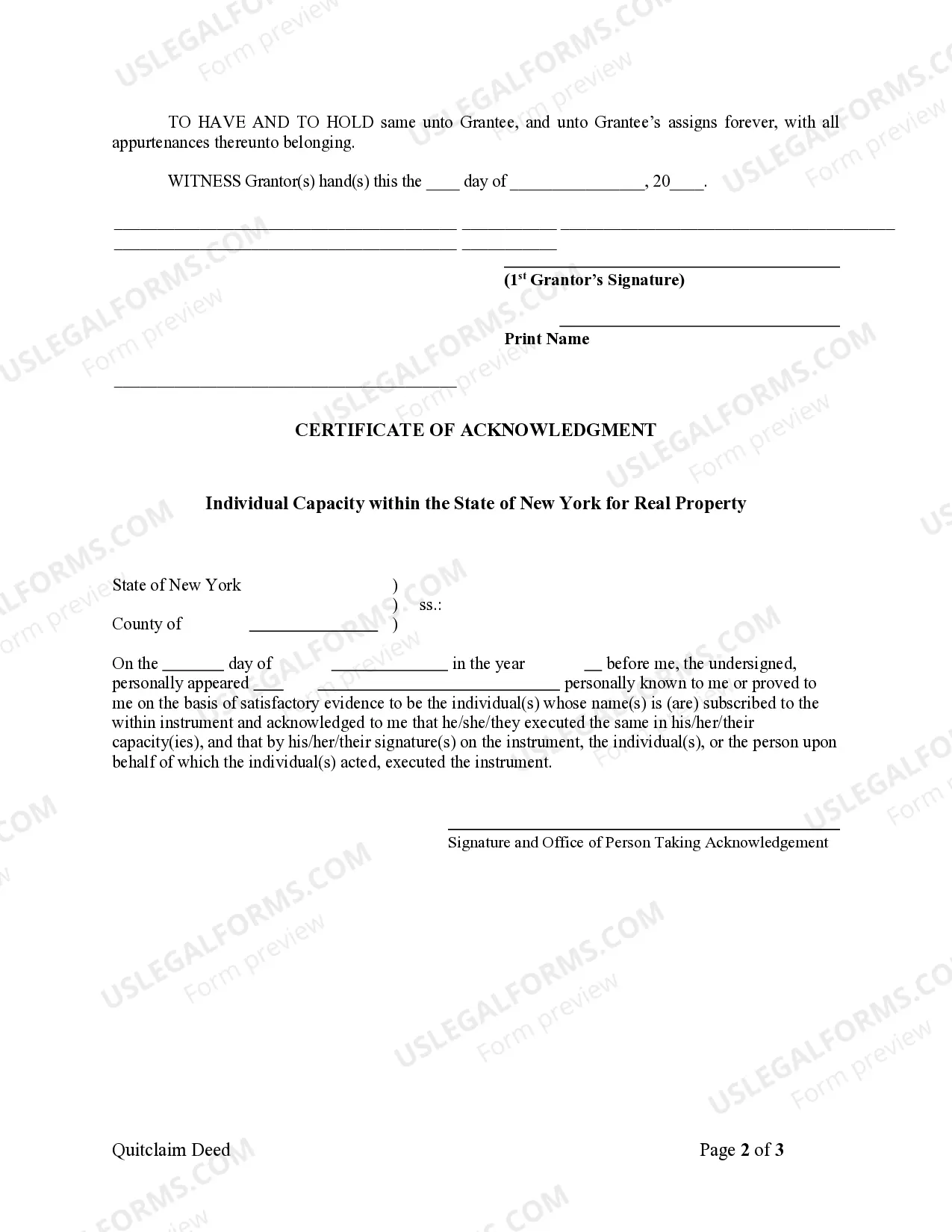

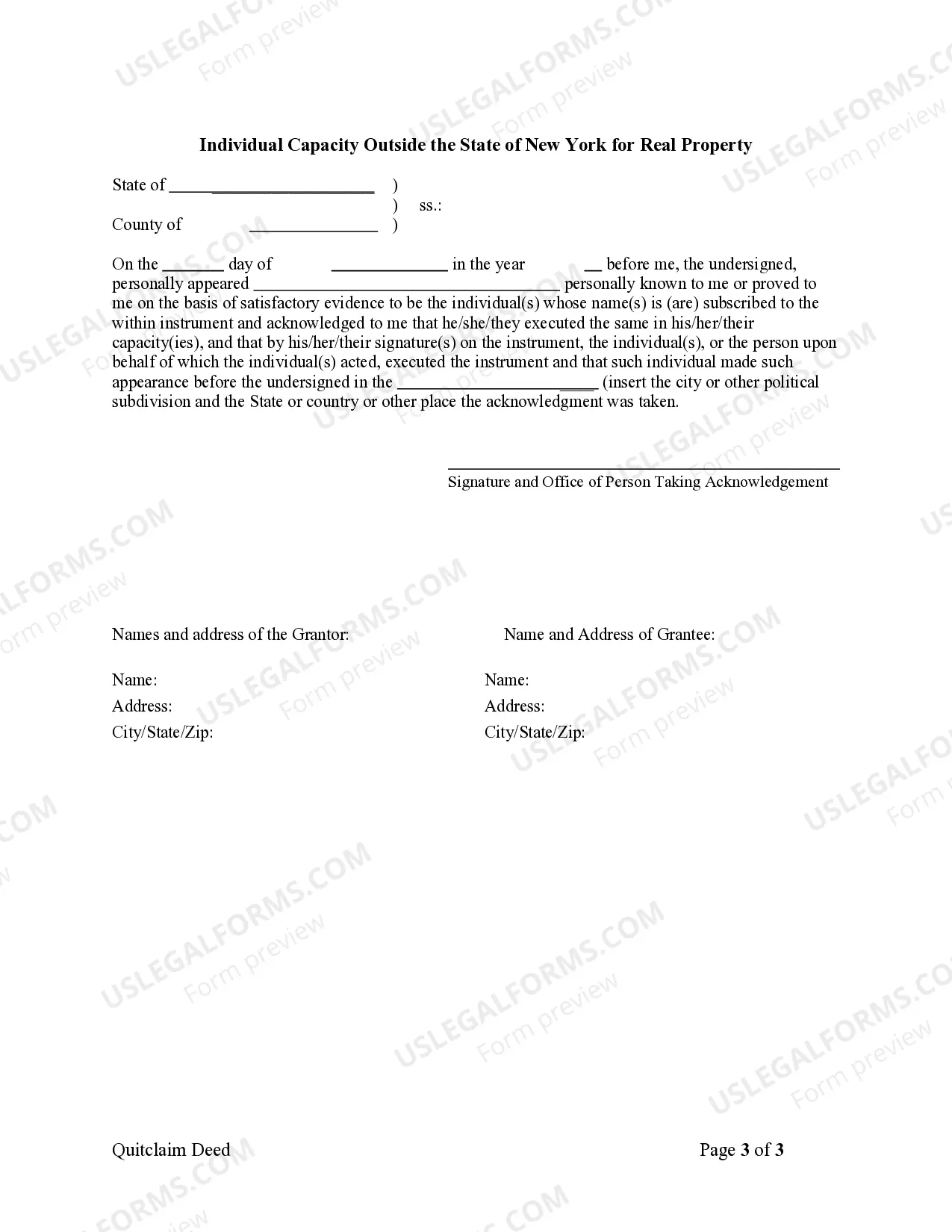

A Kings New York Quitclaim Deed from Individual to LLC is a legal document used to transfer ownership of a property from an individual to a limited liability company (LLC) based in Kings County, New York. This type of deed is commonly executed when a property owner wishes to transfer their personal interest in a property to an LLC they own or are affiliated with. Keywords: Kings New York, Quitclaim deed, Individual, LLC, property transfer, ownership, limited liability company, Kings County. There are no specific variations or subtypes of a Kings New York Quitclaim Deed from Individual to LLC, as the purpose and process remain the same regardless of any unique circumstances of the transfer. The Kings New York Quitclaim Deed is a legally binding document that ensures a clear transfer of ownership from the individual to the LLC. It should include relevant information about the property being transferred, including its legal description, address, and tax parcel identification number. The deed should also identify the individual granter who is relinquishing their ownership rights, along with the full legal name and address of the LLC that will be receiving ownership. Additionally, the deed may outline any financial considerations, such as the purchase price or any outstanding liens or encumbrances on the property. Executing a Kings New York Quitclaim Deed from Individual to LLC provides several benefits. First and foremost, it allows the individual to separate their personal ownership from the property, shielding their personal assets from potential liabilities connected to the property. This limited liability protection is a primary advantage of organizing a property under an LLC structure. Furthermore, moving property ownership to an LLC can have tax benefits, depending on the specific circumstances. It allows the LLC to deduct expenses related to the property and opens up opportunities for different tax strategies and planning. It is crucial to consult with a real estate attorney or legal professional well-versed in Kings County, New York, to ensure all legal requirements are met when drafting and executing the Quitclaim Deed. Professional guidance guarantees that the deed accurately reflects the intentions of both the individual granter and the LLC, minimizing any potential legal disputes or complications in the future. In conclusion, a Kings New York Quitclaim Deed from Individual to LLC is a legal document that facilitates the transfer of property ownership from an individual to an LLC based in Kings County, New York. This deed ensures a clear and legally binding transfer, protecting the individual's personal assets and providing tax advantages for the LLC. Seek professional legal advice when executing such a deed to ensure compliance with all applicable laws and regulations.

Quit Claim Deed Loopholes

Description

How to fill out Kings New York Quitclaim Deed From Individual To LLC?

Are you looking for a reliable and inexpensive legal forms provider to get the Kings New York Quitclaim Deed from Individual to LLC? US Legal Forms is your go-to solution.

No matter if you need a simple agreement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of separate state and area.

To download the document, you need to log in account, locate the required form, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Kings New York Quitclaim Deed from Individual to LLC conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the document is intended for.

- Restart the search in case the form isn’t suitable for your legal scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Kings New York Quitclaim Deed from Individual to LLC in any available format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.