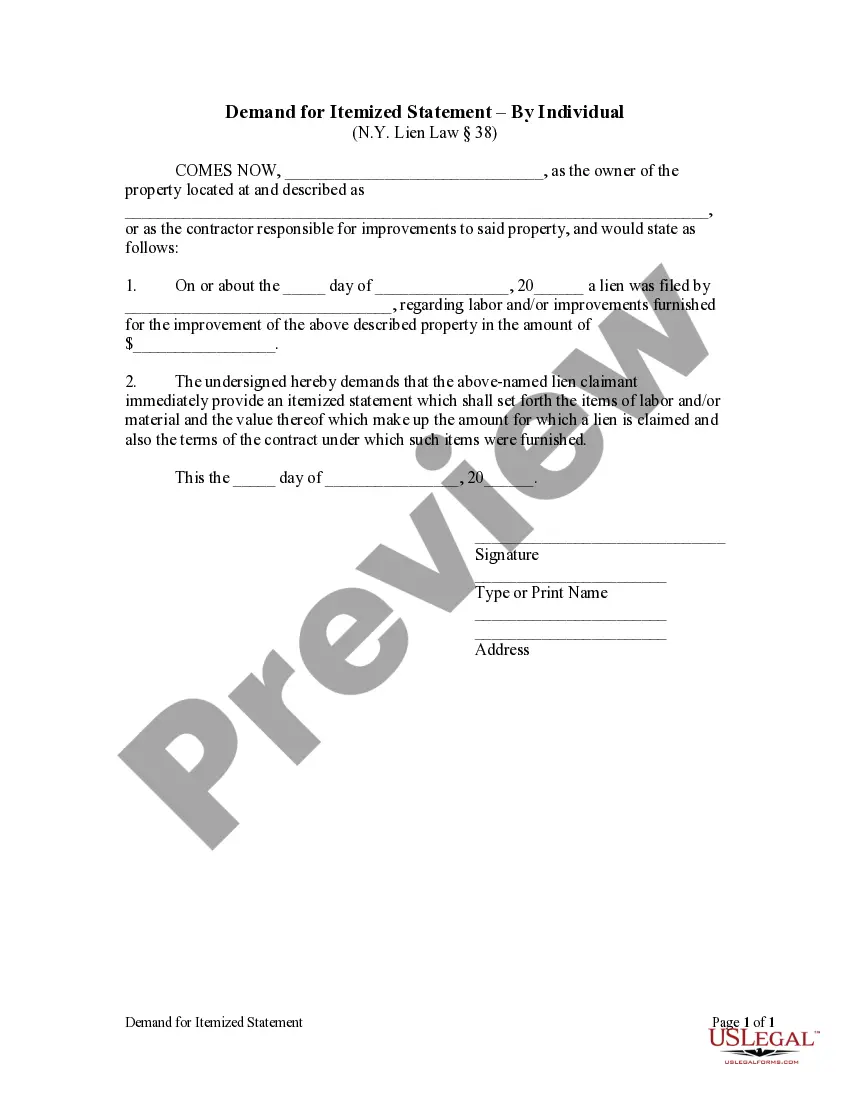

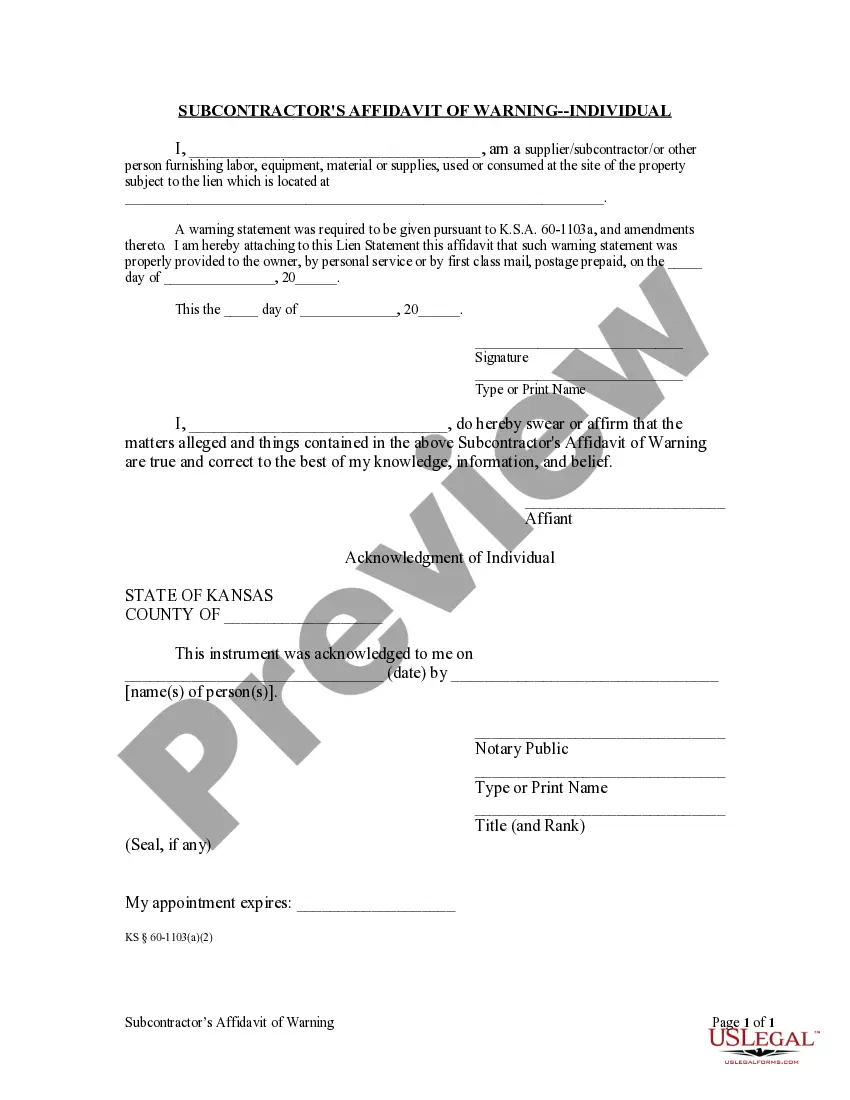

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Nassau New York Demand for Itemized Statement by Corporation

Description

How to fill out New York Demand For Itemized Statement By Corporation?

Do you require a trustworthy and cost-effective provider of legal forms to purchase the Nassau New York Demand for Itemized Statement by Corporation or LLC? US Legal Forms is your ideal selection.

Whether you seek a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to move your divorce process forward in court, we've got you covered. Our platform offers over 85,000 current legal document templates for personal and business use. All the templates we provide are tailored and structured according to the specific laws of individual states and counties.

To retrieve the document, you must Log In, locate the desired template, and select the Download button adjacent to it. Please note that you can download your previously acquired form templates at any time from the My documents section.

Is this your first time using our service? No problem. You can easily create an account, but first, ensure to do the following.

Now you can establish your account. Then select the subscription option and proceed to payment. After the payment is processed, download the Nassau New York Demand for Itemized Statement by Corporation or LLC in any provided format. You can return to the site anytime and redownload the document at no extra cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and stop wasting hours searching for legal papers online once and for all.

- Verify if the Nassau New York Demand for Itemized Statement by Corporation or LLC aligns with the laws of your jurisdiction.

- Review the form’s description (if available) to determine who and what the document is intended for.

- Reinitiate the search if the template doesn’t fit your legal needs.

Form popularity

FAQ

A mechanic's lien in New York lasts for one year unless it is extended through certain legal procedures. It is essential to act promptly if you have a lien in place, especially in cases involving a Nassau New York Demand for Itemized Statement by Corporation. Stakeholders should be aware of the mechanisms for renewing or enforcing the lien within this timeframe. Staying proactive is key to protecting your rights.

A mechanic's lien in New York provides a legal claim against a property to secure payment for unpaid work or materials. When a contractor files a lien, it acts as a notification to the property owner of the outstanding debt. For those facing a Nassau New York Demand for Itemized Statement by Corporation, it is vital to recognize the process involved in filing or contesting a lien. Proper management of these liens can safeguard your financial interests.

Yes, liens can expire in New York. Generally, a lien remains valid for a specified timeframe depending on the type of lien. In the case of mechanics liens, it usually lasts for one year, but this period can change based on specific circumstances. If you are dealing with a Nassau New York Demand for Itemized Statement by Corporation, it's essential to stay informed about lien timelines to ensure your rights are protected.

New York Corporation Incorporation: ~2-4 weeks. ~1 business day for $25 expedite fee. Same-day for $75 expedite fee, must be received by noon.

How much does it cost to form an LLC in New York? The New York Department of State Division of Corporations charges a $200 fee to file the Articles of Organization. It will cost $20 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

Business Fees in New York In New York, both single-member LLCs and multi-member LLCs are typically required to pay an annual filing fee. The amount of filing fee you are required to pay depends on the gross income of your LLC that comes from New York in the previous tax year. The fee can vary from $25 to $4,500.

The completed Certificate of Incorporation, together with the statutory filing fee of $125, should be forwarded to: New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

But every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York State sources, must file a return on Form IT-204, regardless of the amount of its income (see Specific instructions on page

file options lectronically file your Form IT204LL using New York Stateapproved software. For more information, see file Approved Software Developers for Partnership.

Where can I obtain a copy of my deed or mortgage? The fastest way to obtain this information is to come to the Nassau County Clerk's office here at 240 Old Country Rd, Mineola, NY 11501 with the section, block, and lot of the property. If you want to mail your request download the instructions (PDF).