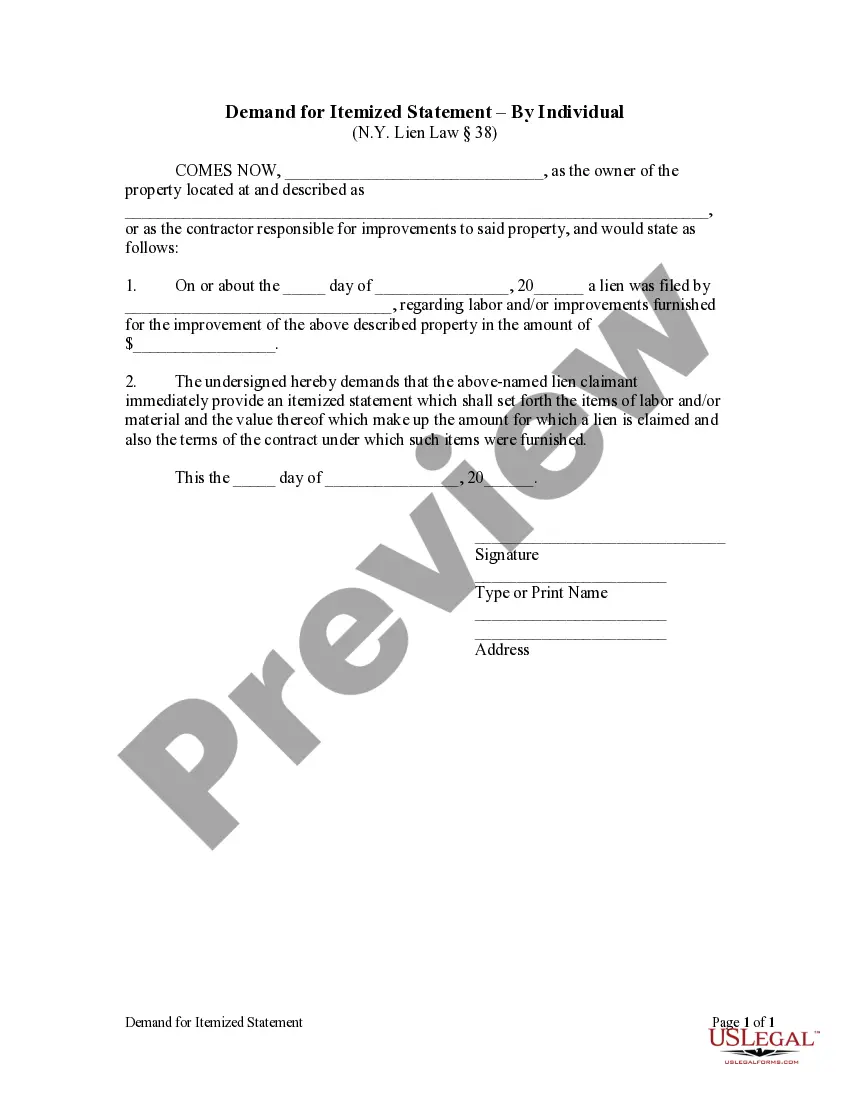

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Queens New York Demand for Itemized Statement by Corporation

Description

How to fill out New York Demand For Itemized Statement By Corporation?

We consistently aim to minimize or avert legal harm when navigating intricate legal or financial situations.

To achieve this, we pursue legal remedies that are often quite expensive.

However, not every legal issue is equally intricate. Many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform enables you to manage your affairs autonomously without the need for legal advisors.

Ensure that the Queens New York Demand for Itemized Statement by Corporation or LLC adheres to the laws and regulations applicable in your state and locality. Moreover, it's crucial to review the form's outline (if available), and should you spot any inconsistencies with your original requirements, be sure to look for an alternative form. Once you've confirmed that the Queens New York Demand for Itemized Statement by Corporation or LLC suits your situation, you can select a subscription plan and complete your payment. Thereafter, you can download the document in any format available. For over 24 years, we have assisted millions by providing customizable and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Benefit from US Legal Forms whenever you need to obtain and download the Queens New York Demand for Itemized Statement by Corporation or LLC or any other document promptly and securely.

- Simply Log In to your account and click the Get button next to it.

- If you happen to misplace the document, you can always retrieve it again from within the My documents tab.

- The process is just as simple if you are unfamiliar with the platform! You can set up your account in just a few minutes.

Form popularity

FAQ

The lien law in New York protects the rights of contractors, subcontractors, and suppliers to claim unpaid debts on construction projects. It provides procedures for filing mechanics liens, ensuring fair compensation for services rendered. Understanding this law is important for anyone engaged in construction-related work in New York. For more detailed information and resources, including claims related to the Queens New York Demand for Itemized Statement by Corporation, USLegalForms can be an excellent resource.

Contractors in New York must file a lien within eight months from the last day of work or delivery of materials on a project. This short time frame emphasizes the need for vigilance and planning. If you need assistance with this process, consider utilizing the USLegalForms platform to ensure your filing is completed correctly and promptly, especially when connected to a Queens New York Demand for Itemized Statement by Corporation.

In New York, you have a limited time frame to file a lien, which is generally within eight months after the last work was performed or materials supplied on the property. Being timely is vital to protect your rights and secure your claim. For businesses and contractors in similar situations, utilizing platforms like USLegalForms can help ensure timely filings and compliance with legal requirements.

Lien Law 38 in New York pertains to the rights of parties involved in a construction project to secure a payment claim. This law specifies the requirements for filing a mechanics lien, ensuring protections are in place for contractors and suppliers. Understanding this law is crucial when navigating the complexities of lien filings, including making a Queens New York Demand for Itemized Statement by Corporation.

Yes, liens do expire in New York. Generally, a mechanics lien remains valid for one year from the date it was filed. However, it's vital to verify specific conditions associated with your lien, as circumstances can lead to quicker expiration. If you're unsure, seeking guidance about the Queens New York Demand for Itemized Statement by Corporation can clarify your situation.

To file a mechanics lien in New York City, you need to prepare the lien form accurately, ensuring all information is correct. It is essential to include the property details and your claim amount. Then, file the lien with the appropriate county clerk's office, as this formalizes your claim. For assistance and templates, you can consider using the USLegalForms platform to streamline the process.

If you wish to sue for more than $10,000 in New York, you must file your case in a higher court, such as Supreme Court. This process can be more complex than Small Claims Court, requiring careful preparation of legal documents. Seeking legal assistance can be beneficial, especially when addressing demands for itemized statements from corporations in Queens, as a well-structured approach often yields better outcomes.

Yes, you can take someone to Small Claims Court for a claim as low as $1. However, you must ensure that the claim is worth pursuing, as the process involves time and resources. If your dispute includes demands for itemized statements from corporations, it's prudent to consider whether the effort justifies the potential return.

While the outcomes can vary, reports indicate that tenants often experience success in Small Claims Court. Common factors influencing success include clear documentation and a solid grasp of the circumstances, including any demands for itemized statements. Utilizing resources like USLegalForms can help tenants prepare compelling cases, particularly when addressing issues related to a Queens New York Demand for Itemized Statement by Corporation.

In NYC, you can sue for amounts up to $10,000 in Small Claims Court. This court provides a straightforward process for individuals to resolve disputes efficiently. If your claim involves seeking an itemized statement from a corporation in Queens, this limit allows you to pursue your case without complicated legal proceedings.