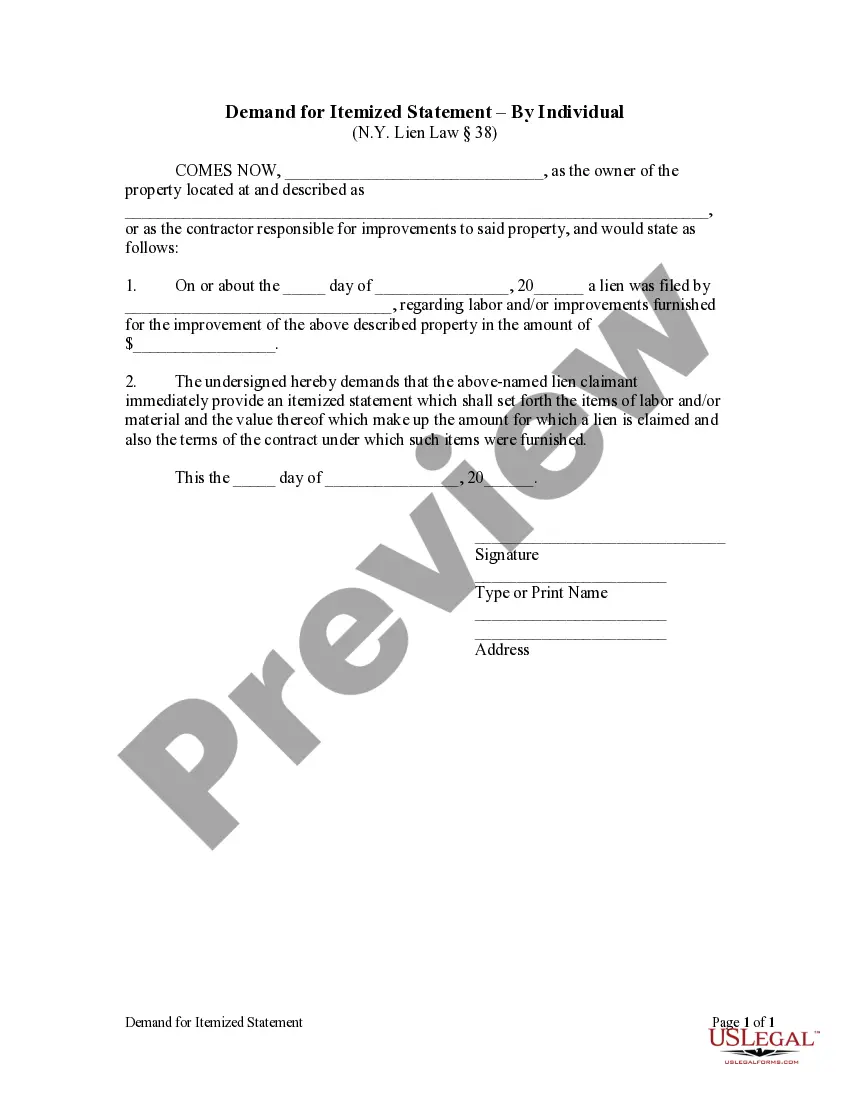

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Syracuse New York Demand for Itemized Statement by Corporation

Description

How to fill out New York Demand For Itemized Statement By Corporation?

Do you require a reliable and affordable legal documents provider to obtain the Syracuse New York Demand for Itemized Statement by Corporation or LLC? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a compilation of papers to progressing your separation or divorce through the legal system, we have you supported. Our service offers over 85,000 current legal document templates for personal and business applications. All templates we provide are not generalized and are tailored based on the regulations of specific states and regions.

To acquire the form, you must Log In to your account, find the necessary template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My documents section.

Is this your first visit to our platform? No problem. You can create an account in minutes, but first, ensure you do the following.

Now you can establish your account. Then select a subscription plan and continue to payment. Once payment is completed, you can download the Syracuse New York Demand for Itemized Statement by Corporation or LLC in any offered file format. You can revisit the website at any time and redownload the form without charge.

Locating current legal documents has never been more straightforward. Try US Legal Forms today, and put an end to spending hours sifting through legal paperwork online.

- Verify if the Syracuse New York Demand for Itemized Statement by Corporation or LLC meets the standards of your state and locality.

- Review the form’s specifics (if available) to determine for whom and what the form is designed.

- Restart the search if the template does not align with your particular situation.

Form popularity

FAQ

A final waiver of lien is a legal document that confirms the release of a mechanic's lien once payment has been received. This document protects both the property owner and the contractor by indicating that the lien has been fully satisfied. If you are involved in a Syracuse New York Demand for Itemized Statement by Corporation, understanding the importance of a final waiver of lien can help mitigate future disputes.

In New York, a mechanic's lien is generally valid for one year from the date it is filed. However, this period can be extended under certain circumstances, provided that the lienor takes appropriate actions. For those dealing with a Syracuse New York Demand for Itemized Statement by Corporation, it is crucial to be aware of the validity period to ensure timely management of any claims.

A demand for a bill of particulars is a formal request for more detailed information about the claims made in a legal case. In New York, this demand helps clarify the allegations and defenses in a lawsuit. If you are navigating legal matters related to a Syracuse New York Demand for Itemized Statement by Corporation, submitting this demand may provide essential insights to strengthen your understanding and position.

Lien Law 34 in New York primarily addresses the rights of contractors and suppliers regarding unpaid labor and materials in a construction project. It allows these parties to file a mechanic's lien if they do not receive payment. This law is significant for anyone seeking a Syracuse New York Demand for Itemized Statement by Corporation because understanding lien rights can help protect your financial interests in a construction project.

To obtain a copy of articles of organization in New York, you can request them from the New York Department of State. This can be done online, by mail, or in person. For a smooth experience and if you need to file any additional requests, check out the services of USLegalForms to manage aspects related to the Syracuse New York Demand for Itemized Statement by Corporation.

You can verify if a business is registered by searching the New York State Department of State's Corporation & Business Entity Database. This online tool provides essential details about business registrations. In cases where you require formal documentation or itemized statements, consider leveraging USLegalForms for help with the Syracuse New York Demand for Itemized Statement by Corporation.

To look up a corporation in New York State, visit the New York Department of State’s website and access the Corporation & Business Entity Database. Enter the name or ID number of the corporation to find the necessary information. If you need assistance in filing requests, look into the offerings of USLegalForms, particularly for the Syracuse New York Demand for Itemized Statement by Corporation.

To find an old business in New York City, you can use the online databases provided by the New York State Department. Search using the business name or known details. If you require an itemized statement and more information on the business's historical records, consider the services offered by USLegalForms which can assist with the Syracuse New York Demand for Itemized Statement by Corporation.

Looking up a corporation in New York is straightforward. You can visit the New York Department of State's Corporation & Business Entity Database online. This database allows you to search by entity name or identification number, making it easier for you to gather needed information, including for the Syracuse New York Demand for Itemized Statement by Corporation.

To obtain a copy of your New York State certificate of authority, you may visit the New York Department of State's website. You can request a copy online, by mail, or in person. Utilizing the USLegalForms platform can streamline this process, especially when dealing with the Syracuse New York Demand for Itemized Statement by Corporation.