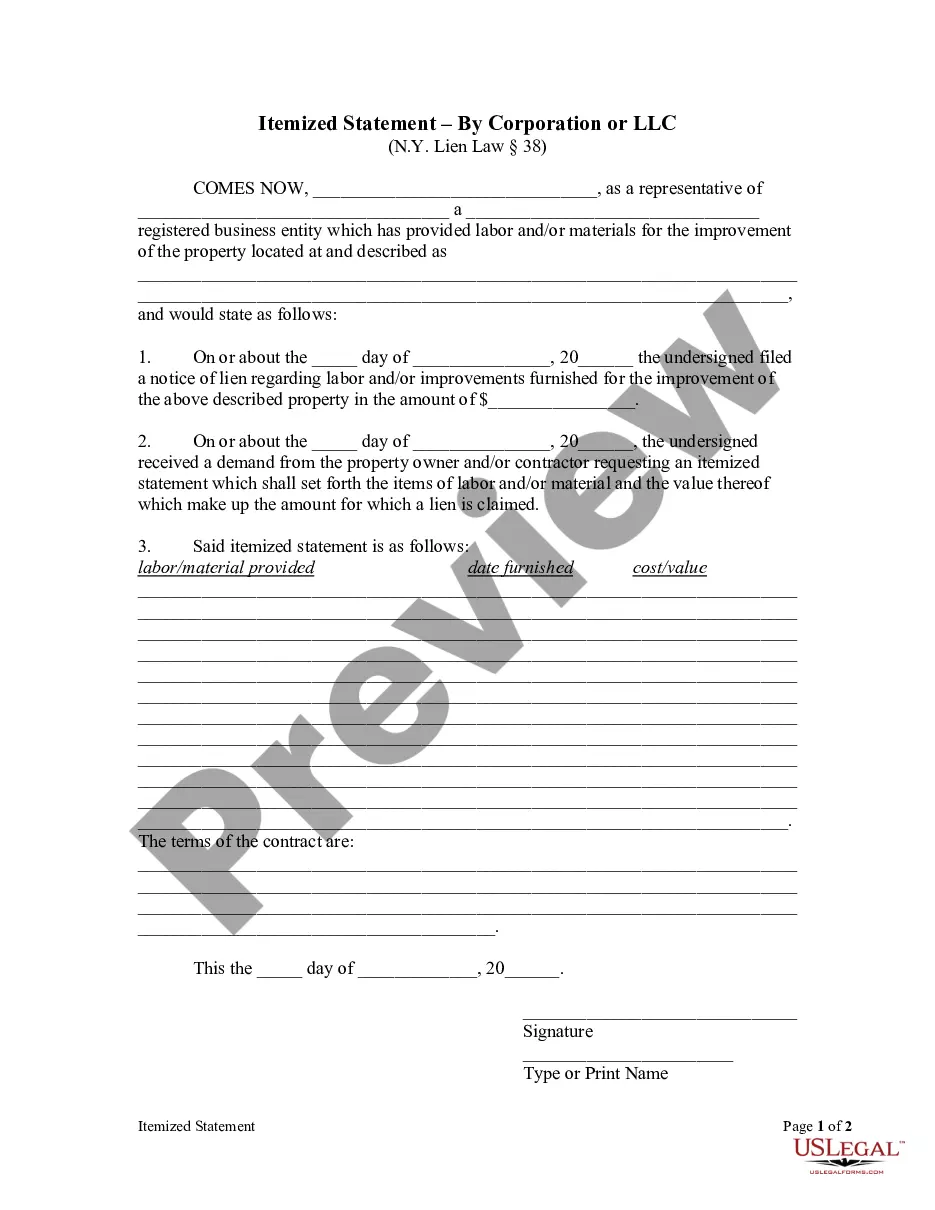

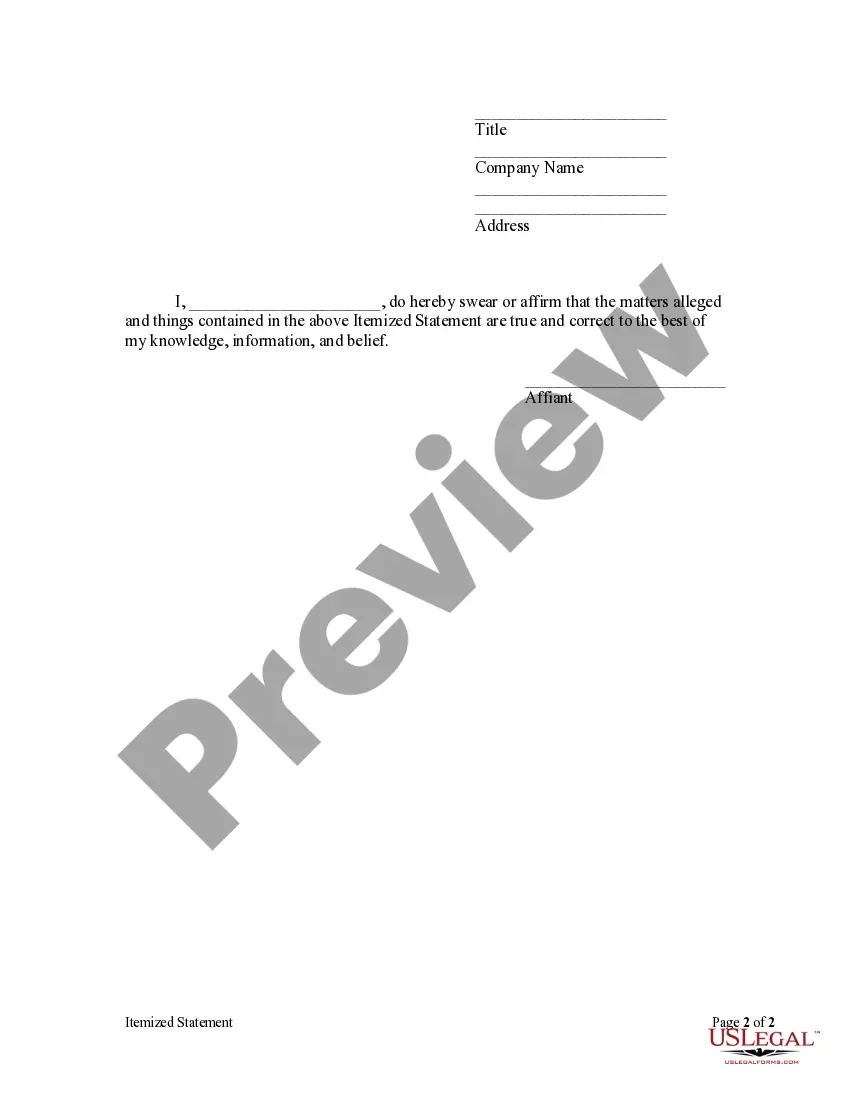

Itemized Statement by Corporation

Note: This summary is not intended to be an all inclusive

discussion of New York's construction or mechanic's lien laws, but does

include basic provisions.

What is a construction or mechanic's lien?

Every State permits

a person who supplies labor or materials for a construction project to

claim a lien against the improved property. While some states differ

in their definition of improvements and some states limit lien claims to

buildings or structures, most permit the filing of a document with the

local court that puts parties interested in the property on notice that

the party asserting the lien has a claim. States differ widely in

the method and time within which a party may act on their lien. Also

varying widely are the requirements of written notices between property

owners, contractors, subcontractors and laborers, and in some cases lending

institutions. As a general rule, these statutes serve to prevent

unpleasant surprises by compelling parties who wish to assert their legal

rights to put all parties who might be interested in the property on notice

of a claim or the possibility of a claim. This by no means constitutes

a complete discussion of construction lien law and should not be interpreted

as such. Parties seeking to know more about construction laws in

their State should always consult their State statutes directly.

Who can file a lien in this State?

New York law permits "A contractor, subcontractor,

laborer, materialman, landscape gardener, nurseryman

or person or corporation selling fruit or ornamental

trees, roses, shrubbery, vines and small fruits, who performs labor

or furnishes materials for the improvement

of real property with the consent or at the request of the owner

thereof, or of his agent, contractor or subcontractor,

and any trust fund to which benefits and wage supplements are due

or payable for the benefit of such laborers, to have a lien for

the principal and interest, of the value,

or the agreed price, of such labor, including benefits and wage supplements

due or payable for the benefit of any laborer,

or materials upon the real property improved or to be improved and upon

such improvement, from the time of filing a notice of such lien..." N.Y.

Lien Law §3.

How long does a party have to file a lien?

A notice of lien

may be filed at anytime during the progress of

the work and the furnishing of the materials, or, within eight months after the completion of the contract,

or the final performance of the work, or the final furnishing

of the materials, dating from the last

item of work performed or materials furnished; provided, however, that

where the improvement is related to real property improved

or to be improved with a single family dwelling, the notice of lien may

be filed at any time during the progress of the work

and the furnishing of the materials, or, within four months after

the completion of the contract, or the final performance of the work, or

the final furnishing of the materials, dating from the last item of work

performed or materials furnished. N.Y. Lien Law §10.

What kind of notice is required prior to filing

a lien?

"Within five days before

or thirty days after filing the notice of lien, the lienor shall

serve a copy of such notice upon the

owner, if a natural person, (a) by delivering the same

to him personally, or if the owner cannot be found, to his

agent or attorney, or (b) by leaving it at his last known place of residence

in the city or town in which the real property or some part thereof

is situated, with a person of suitable age and discretion,

or (c) by registered or certified mail addressed to his last known place

of residence, or (d) if such owner has no such residence

in such city or town, or cannot be found, and he has no agent or attorney,

by affixing a copy thereof conspicuously on such property,

between the hours of nine o'clock in the forenoon and four o'clock in the

afternoon; if the owner be a corporation, said service shall be made

(i) by delivering such copy to and leaving the same with the president,

vice-president, secretary or clerk to the corporation,

the cashier, treasurer or a director or managing agent

thereof, personally, within the state, or (ii) if such

officer cannot be found within the state

by affixing a copy thereof conspicuously on such property between the hours

of nine o'clock in the forenoon and four o'clock

in the afternoon, or (iii) by registered or certified mail addressed to

its last known place of business. Failure to file proof of

such a service with the county clerk within thirty-five days after the

notice of lien is filed shall terminate the notice as a lien."

N.Y. Lien Law §10.

How long is a lien good for?

"Any lien created under

New York law shall be a lien for a period longer than one year after the

notice of lien has been filed, unless within that time an action is commenced

to foreclose the lien, ..." or the appropriate steps are taken to request

that the court grant an extension. N.Y. Lien Law §17.

Are liens assignable?

Yes. New York

statutes provide for the assignment of valid liens. The assignment

must be in writing and acknowledged by the lien holder. N.Y. Lien

Law §13.

Does this State require or provide for a notice

from subcontractors and laborers to property owners?

Yes. A contractor

working on a public improvement may issue a written demand that a state

agency provide a notice of completion and acceptance. Also, a subcontractor

or other party who furnishes labor and or materials for the improvement

of property may issue a demand to the owner or contractor demanding that

the owner or contractor provide a statement of the terms of the contract

between the owner and the contractor.

Does this State require or provide for a notice

from the property owner to the contractor, subcontractor, or laborers?

Yes. Under New

York law a property owner whose property has been the subject of a notice

of lien may demand in writing that the lien claimant provide an itemized

statement of the labor and/or materials provided and their value.

Does this State require a notice prior to starting

work, or after work has been completed?

No. New York statutes

do not require a Notice of Commencement or a Notice of Completion as required in

some other States.

Does this State permit a person with an interest

in property to deny responsibility for improvements?

No. New York statutes

do not have a provision which permits the denial of responsibility for

improvements.

Is a notice attesting to the satisfaction of a

lien provided for or required?

No. New York statutes

do not provide for or require that a lien holder who has been paid produce

or file a notice to that effect.

By what method does the law of this State permit

the release of a lien?

A lien claimed

under New York law may be discharged by the issuing of a certificate by

the lien holder, filed in the court where the lien notice was filed, acknowledging

the satisfaction and release of said lien. Otherwise, the lien will

dissolve automatically within one year of filing if no legal action is

taken to foreclose on said lien.

Does this State permit the use of a bond to release

a lien?

Yes.

New York law permits a party with an interest in the property in question

to file a bond in the amount unpaid under the contract.