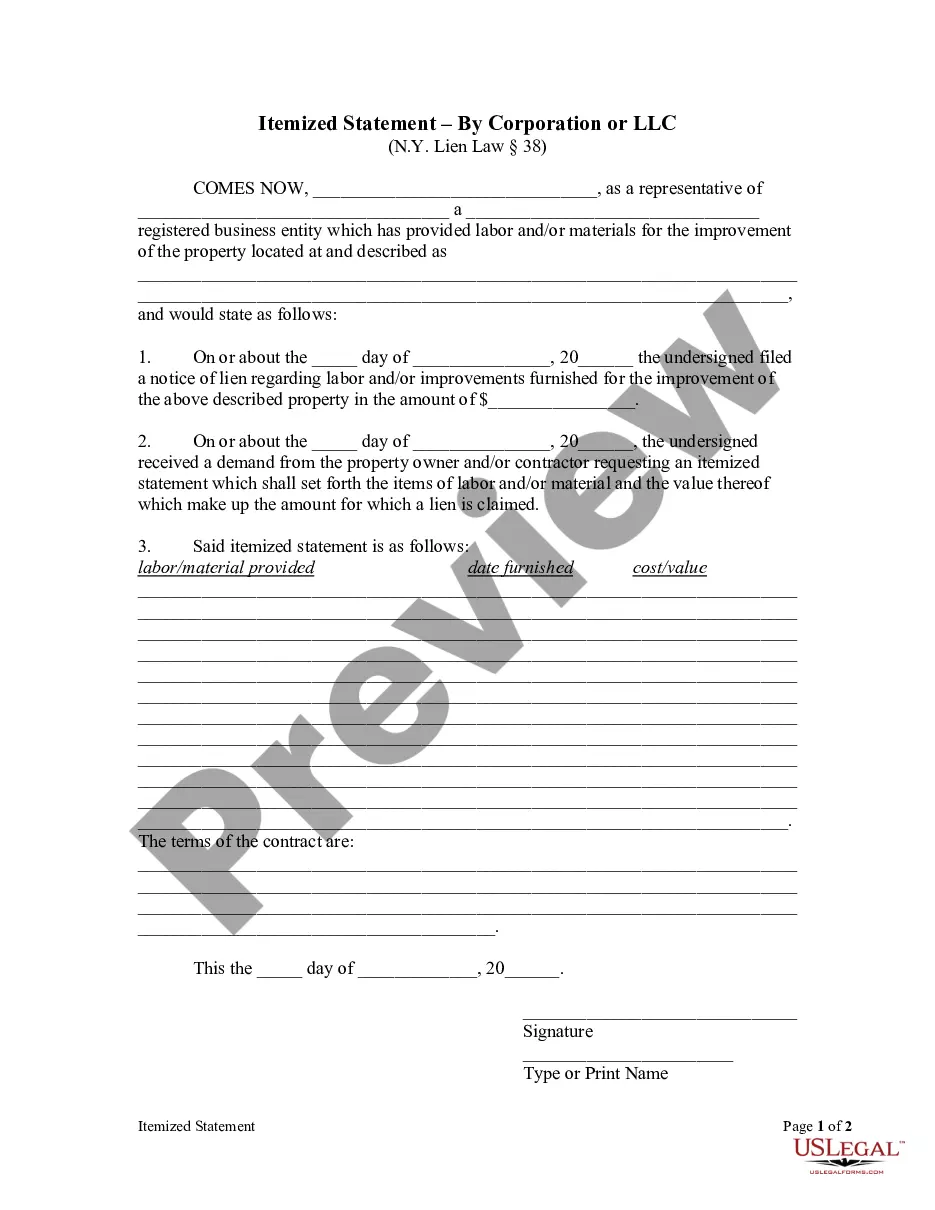

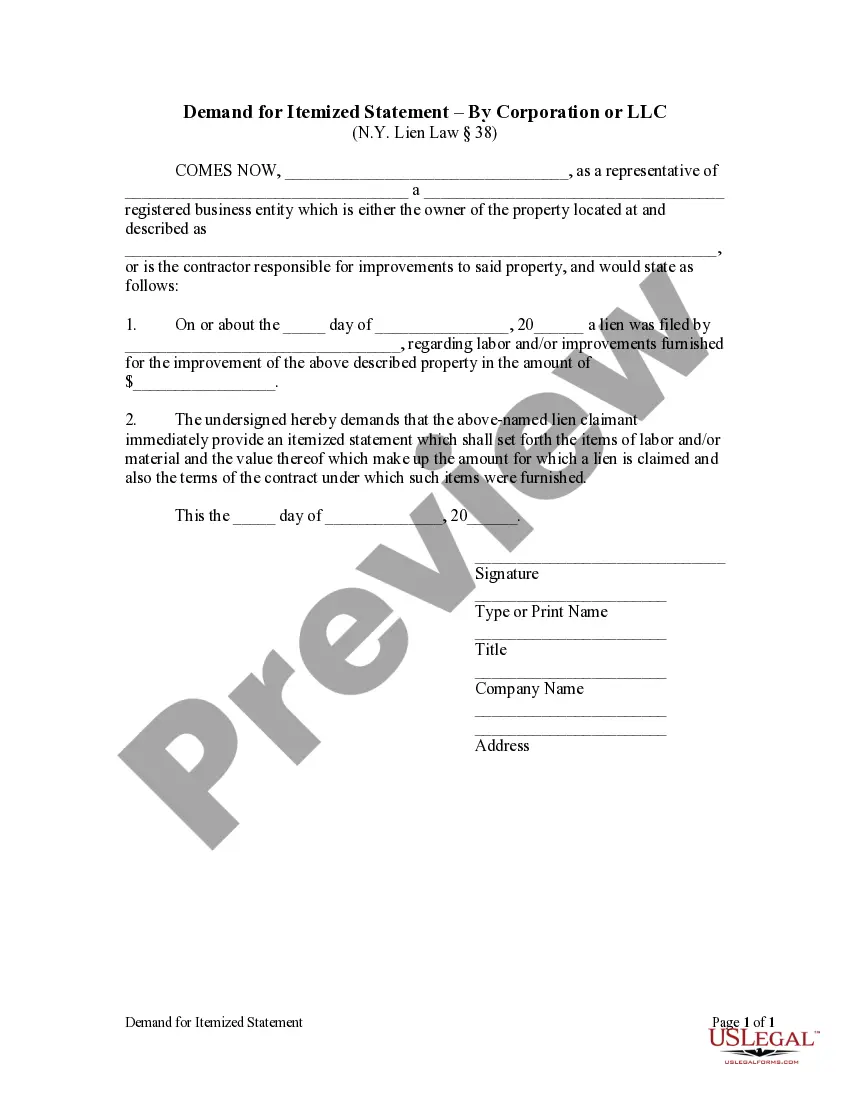

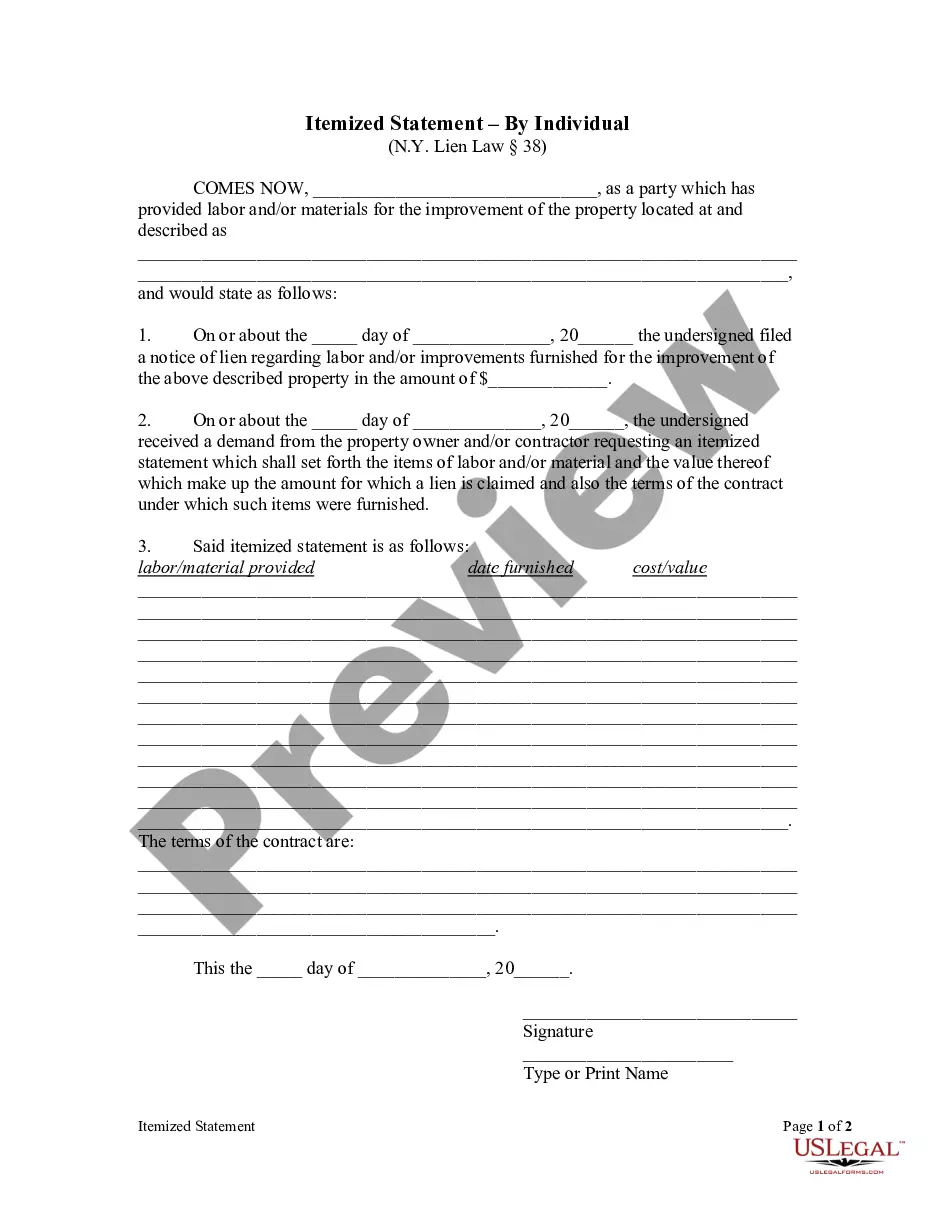

A property owner or contractor may issue a written demand that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Syracuse New York Itemized Statement by Corporation

Description

How to fill out New York Itemized Statement By Corporation?

Acquiring validated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

It’s a web-based compilation of over 85,000 legal documents catering to both personal and business needs as well as various real-life situations.

All the files are systematically categorized by usage area and jurisdiction, making it as simple as ABC to find the Syracuse New York Itemized Statement by Corporation or LLC.

Acquire the document. Click on the Buy Now button and choose your preferred subscription plan. You will need to create an account to gain access to the library’s resources.

- Familiarize yourself with our service if you have used it before; obtaining the Syracuse New York Itemized Statement by Corporation or LLC takes just a few clicks.

- Simply Log In to your account, select the required document, and click Download to save it on your device.

- New users will have a few additional steps to complete.

- Verify the Preview mode and form description. Ensure you’ve selected the correct document that aligns with your needs and complies with your local jurisdiction.

- Search for another template, if necessary. If you notice any discrepancies, use the Search tab above to find the appropriate document. If it meets your criteria, proceed to the next step.

Form popularity

FAQ

Yes, you can deduct state income tax as part of your itemized deductions. This applies when you prepare a Syracuse New York Itemized Statement by Corporation. Remember, understanding how this deduction impacts your overall tax situation is essential. For assistance, USLegalForms offers resources that help clarify what can be included, making the filing process smoother.

Yes, you can choose to itemize deductions for your state taxes while taking the standard deduction for federal taxes. This flexibility can benefit your overall tax strategy, especially when preparing your Syracuse New York Itemized Statement by Corporation. However, you must check the specific state rules and guidelines to ensure compliance. Using services like USLegalForms can help confirm your options.

To report your itemized deductions in New York, you typically use form IT-201 or IT-203. This is crucial for filing a Syracuse New York Itemized Statement by Corporation. By filling out these forms correctly, you can ensure you are maximizing your potential deductions. USLegalForms can help you navigate these forms easily, ensuring accuracy in your filing.

Yes, if your corporation conducts business in New York, you must file a corporate tax return. This requirement includes providing a Syracuse New York Itemized Statement by Corporation if you are itemizing deductions. Ensure you meet all filing deadlines to avoid penalties. Platforms such as USLegalForms can assist you in preparing and filing your corporate taxes accurately.

New York does not offer a standard deduction for state taxes as part of your Syracuse New York Itemized Statement by Corporation. Instead, it requires taxpayers to calculate their itemized deductions. This means you should keep detailed records of your deductions to optimize your tax filing process. Utilizing services like USLegalForms can simplify compiling your itemization.

In New York, itemized deductions are reported on the IT-201 form along with the NY Form 196, which serves as the Itemized Deduction Schedule. This combination enables taxpayers to detail their deductions and ensure accuracy. To enhance your filing experience, consider the Syracuse New York Itemized Statement by Corporation for clear guidance through the process.

Filling out an itemized deduction involves listing all eligible expenses on Schedule A of Form 1040. Begin by gathering receipts, documents, and any relevant information related to your expenses. Using a Syracuse New York Itemized Statement by Corporation can streamline this process, as it organizes your deductions for easier reporting and ensures you capture every eligible item.

To report itemized deductions on your federal tax return, you should use Schedule A of Form 1040. This form provides a detailed list of your deductible expenses. When preparing your Syracuse New York Itemized Statement by Corporation, completing Schedule A can help you obtain a clear understanding of your potential tax savings.

NY Form 196 is the New York State Itemized Deduction Schedule. This form allows residents to report their itemized deductions while filing their state taxes. When preparing your Syracuse New York Itemized Statement by Corporation, be sure to include this form to accurately reflect your deductions and ensure compliance with New York State tax regulations.

Choosing between standard deduction and itemized deduction depends on your financial situation. Generally, if your itemized deductions exceed the standard amount, it is beneficial to opt for itemization. In Syracuse, utilizing a Syracuse New York Itemized Statement by Corporation can help you analyze your deductions and make an informed choice for your tax return.