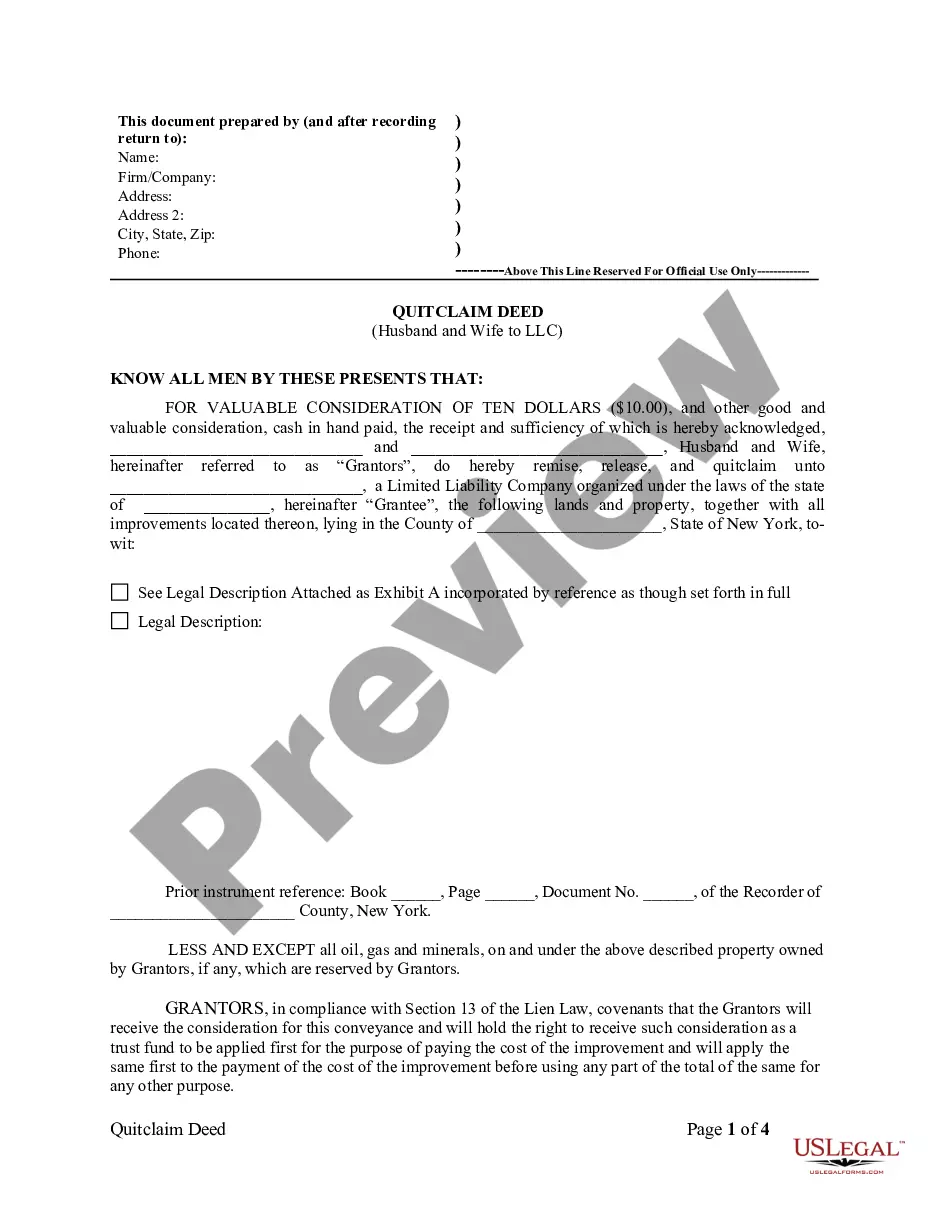

A Queens New York Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of property ownership from a married couple to a limited liability company (LLC) in Queens, New York. In this type of transfer, the couple relinquishes their rights, interests, and claims to the property, transferring them to the LLC. There are a few different types of Queens New York Quitclaim Deeds from Husband and Wife to LLC, which may vary based on specific circumstances and requirements. These may include: 1. Voluntary Transfer: This type of quitclaim deed occurs when a married couple willingly decides to transfer ownership of their property to an LLC. It is typically used when the couple wants to protect their assets or separate their personal holdings from business ventures. 2. Asset Protection: In some cases, a married couple may choose to execute a quitclaim deed to an LLC as a means of protecting their property from potential legal liabilities. By transferring ownership to the LLC, they create a legal barrier between their personal assets and any potential future claims. 3. Business Purpose: This type of quitclaim deed is typically used when a married couple intends to use the property for business purposes. By transferring ownership to an LLC, they can take advantage of certain tax benefits and liability protections provided by the LLC structure. Important keywords relating to a Queens New York Quitclaim Deed from Husband and Wife to LLC may include: Queens, New York, quitclaim deed, transfer of property ownership, husband and wife, limited liability company, LLC, legal document, relinquishing rights, interests and claims, voluntary transfer, asset protection, business purpose, tax benefits, liability protection, personal assets. When preparing a Queens New York Quitclaim Deed from Husband and Wife to LLC, it is crucial to consult with a qualified attorney or a real estate professional who is familiar with the laws and requirements specific to Queens, New York. This will ensure that the process is executed correctly and in compliance with all necessary legal procedures.

Queens New York Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out New York Quitclaim Deed From Husband And Wife To LLC?

If you are in search of a pertinent form, it’s incredibly challenging to find a superior location than the US Legal Forms website – arguably the largest libraries on the internet.

Here you can discover numerous templates for commercial and personal use categorized by types and locations or keywords.

With our sophisticated search functionality, locating the most recent Queens New York Quitclaim Deed from Husband and Wife to LLC is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and download it to your device.

- Additionally, the validity of each document is confirmed by a group of skilled attorneys who frequently evaluate the templates on our site and update them according to the latest state and county requirements.

- If you are familiar with our platform and possess a registered account, all you need to do to obtain the Queens New York Quitclaim Deed from Husband and Wife to LLC is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, simply adhere to the steps outlined below.

- Ensure you have located the template you require. Review its details and use the Preview option (if available) to verify its contents. If it does not satisfy your needs, utilize the Search feature at the top of the page to find the suitable document.

- Verify your selection. Click the Buy now button. After that, select your preferred pricing plan and provide information to create an account.

Form popularity

FAQ

A quitclaim deed is a legal document that allows a husband to transfer his interest in a property to his wife. This process is common in various situations, including marriage or estate planning. Specifically, in the context of a Queens New York Quitclaim Deed from Husband and Wife to LLC, it helps in protecting family assets and simplifying property ownership. Using trusted platforms like USLegalForms can guide you through this process smoothly, ensuring all legal requirements are met.

To quitclaim your property to an LLC, prepare a Queens New York Quitclaim Deed from Husband and Wife to LLC that includes all necessary information about the parties involved. After completing the form, sign it before a notary public. Then, file the deed with the county clerk’s office to officialize the transfer of ownership. This process can also provide liability protection for your personal assets.

One significant problem with a quitclaim deed is the lack of warranty, meaning the grantee receives no assurances regarding the property's title. If issues arise, such as hidden liens, the grantee bears the responsibility. Also, in a Queens New York Quitclaim Deed from Husband and Wife to LLC, misunderstandings over ownership can occur if not clearly documented. It's recommended to consult legal advice to mitigate potential risks.

The usual reason for using a quitclaim deed is to clarify ownership between family members or other parties. In many cases, couples use a Queens New York Quitclaim Deed from Husband and Wife to LLC to protect assets or facilitate estate planning. This deed allows for a swift transfer without warranty or guarantees about the property's condition.

Adding a spouse to a property deed can be considered a gift for tax purposes. This may trigger tax implications since the IRS could view it as transferring half of the property's value to your spouse. Additionally, using a Queens New York Quitclaim Deed from Husband and Wife to LLC ensures clear documentation of this transfer. Consulting with a tax professional for personalized advice is always a good move.

The primary beneficiaries of a quitclaim deed are usually the individuals who want to transfer ownership easily. In the case of a Queens New York Quitclaim Deed from Husband and Wife to LLC, both spouses can simplify property transfers while ensuring the LLC's involvement. This method is particularly beneficial in estate planning and asset protection.

Filling out a quit claim deed in New York involves several essential steps. You need to include the names of the parties involved, the property's description, and the consideration amount, if any. Make sure to have the document signed in front of a notary public and then file it with the appropriate county office. This will officially update the property ownership.

To quitclaim property to an LLC, prepare a Queens New York Quitclaim Deed from Husband and Wife to LLC. Ensure you write your names as the owners and the LLC's name as the new owner. Sign the document before a notary and file it with your local county clerk. This process formalizes the transfer of property ownership and helps protect your personal assets.

Filling out a quit claim deed in New York requires specific information. Start with the grantor's name, followed by the grantee's name, ensuring you include your spouse and the LLC if applicable. Describe the property accurately, and include the necessary legal description. Finally, sign the deed in front of a notary and file it with the county clerk for it to be legally effective.

To fill out a quit claim deed to add your spouse, start by obtaining a template that meets New York state requirements. Clearly state the names of both spouses as grantors and include the LLC as the grantee. Remember to specify the property details and include a valid legal description of the property. Once completed, both spouses must sign the deed before a notary public.

Interesting Questions

More info

He was in private practice in this office from 1962 until his death. During the last ten decades, Mr. Green, an attorney, served in his community as a trustee at several local churches. He was a member of the board of the New York Zoological Society of New York, president of the Brooklyn Cyclists' Club, a trustee of the New York County Urban Development Corporation, a trustee of the New York Community Trust, a board member of the Brooklyn Historical Society, a member of the board of the East River Waterfront Corporation, and served on the borough's Historical Advisory Committee. He was a member of the Board of Trustees of Forest Park Cemetery. Furthermore, he served on several local boards and committees, including the Board of Supervisors, the New York State Advisory Committee for Community Development, and the Board of Estimate of Central Brooklyn.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.