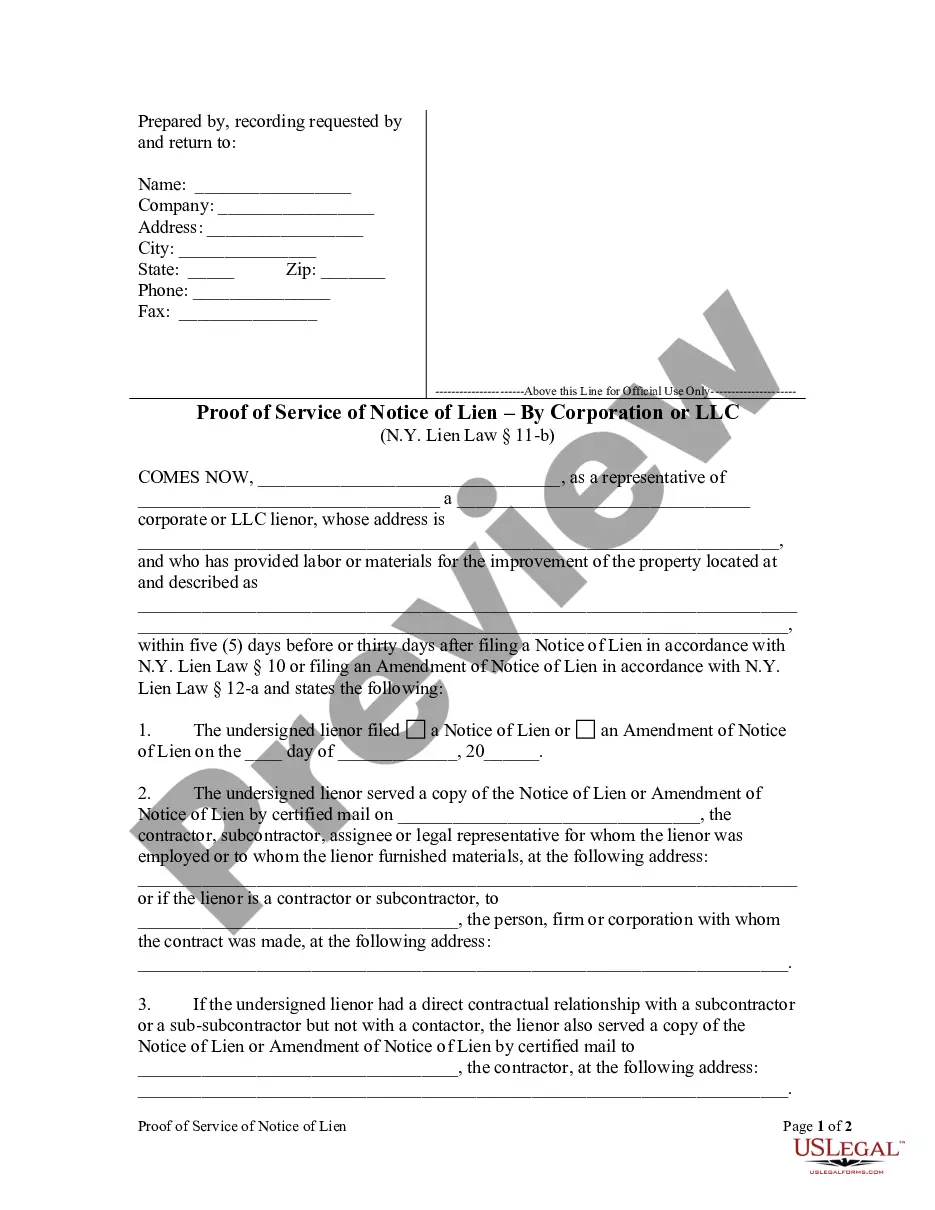

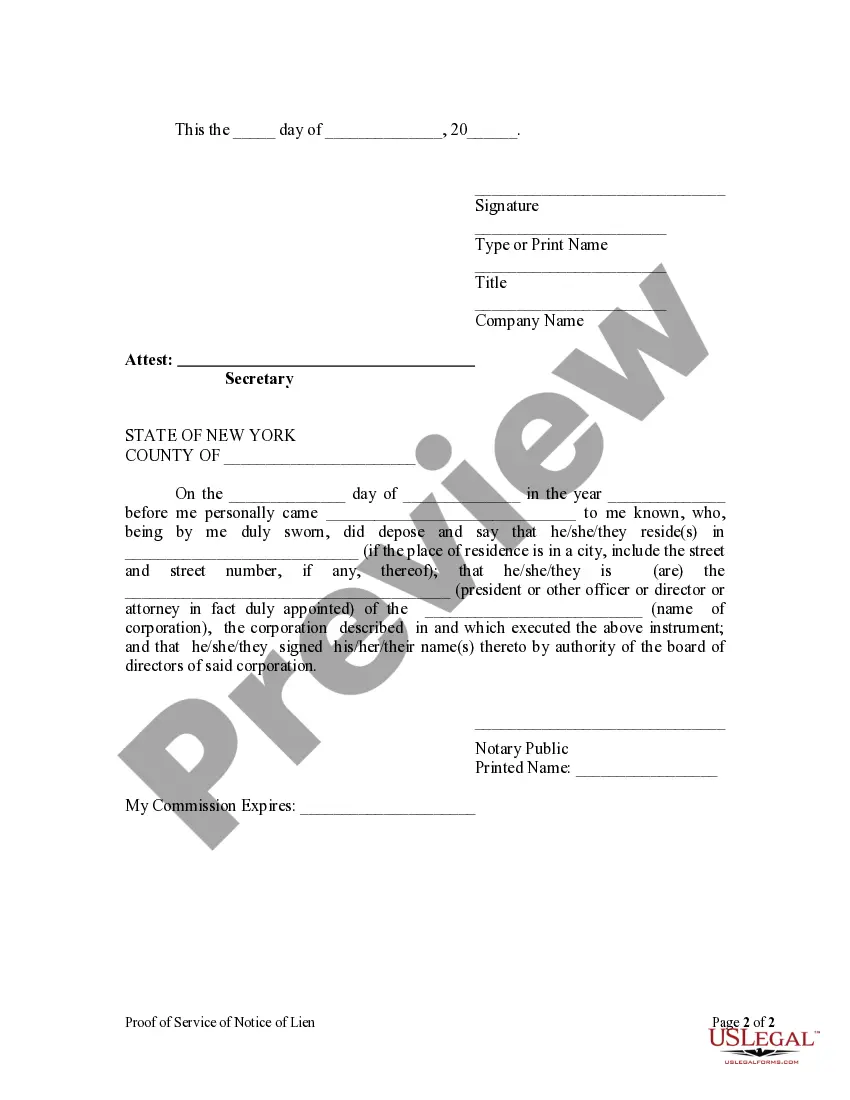

This Proof of Service of Notice of Lien form is for use by a corporate lienor, within five days before or thirty days after filing a Notice of Lien or an Amendment of Notice of Lien, to state that the lienor served a Notice of Lien or an Amendment of Notice of Lien by certified mail on the contractor, subcontractor, assignee or legal representative for whom the lienor was employed or to whom the lienor furnished materials; the person, firm or corporation with whom the contract was made, if the lienor is a contractor or subcontractor; or the contractor, if the lienor had a direct contractual relationship with a subcontractor or a sub-subcontractor but not with a contractor.

Bronx New York Proof of Service of Notice of Lien — Corporation or LLC is a legal document that serves as evidence of notice given to a business entity regarding the placement of a lien against their property or assets in the Bronx, New York. This document is essential for ensuring transparency and compliance with the legal processes involved in securing a lien against a corporation or limited liability company (LLC) operating in the Bronx. Keywords: Bronx New York, Proof of Service, Notice of Lien, Corporation, LLC. There can be different types of Bronx New York Proof of Service of Notice of Lien — Corporation or LLC, depending on the specific circumstances and the type of lien being filed. Let's discuss them below: 1. Mechanic's Lien Notice: This type of lien is typically filed by contractors, subcontractors, or suppliers who haven't been paid for work or materials provided to improve a property in the Bronx. By serving a Notice of Lien on the corporation or LLC, the claimant is stating their right to a lien on the property and initiating the legal process to secure payment. 2. Tax Lien Notice: When a corporation or LLC fails to pay its taxes to the state or federal government, tax authorities have the power to place a lien on their property or assets. The Proof of Service of Notice of Lien — Corporation or LLC in this case would provide evidence that the business entity was officially notified of the tax lien being placed against them. 3. Judgement Lien Notice: If a corporation or LLC is found liable and owes a certain amount of money to a creditor through a court judgement, the creditor can file a lien on their property or assets to ensure repayment. The Proof of Service of Notice of Lien — Corporation or LLC in this scenario would serve as proof that the business entity was duly notified of the judgement lien against them. 4. Mortgage Lien Notice: When a corporation or LLC borrows money from a lender to purchase or refinance a property, the lender typically places a mortgage lien on the property. In case the corporation or LLC defaults on the loan, the lender may initiate foreclosure proceedings. The Proof of Service of Notice of Lien — Corporation or LLC for a mortgage lien indicates that the business entity was formally notified of the lien placed on their property. It is important to note that each type of lien carries specific legal requirements and procedures to be followed in the Bronx, New York. Ensuring proper service of the Notice of Lien to the corporation or LLC and gathering appropriate proof of service is crucial for avoiding legal complications and enforcing lien rights successfully.Bronx New York Proof of Service of Notice of Lien — Corporation or LLC is a legal document that serves as evidence of notice given to a business entity regarding the placement of a lien against their property or assets in the Bronx, New York. This document is essential for ensuring transparency and compliance with the legal processes involved in securing a lien against a corporation or limited liability company (LLC) operating in the Bronx. Keywords: Bronx New York, Proof of Service, Notice of Lien, Corporation, LLC. There can be different types of Bronx New York Proof of Service of Notice of Lien — Corporation or LLC, depending on the specific circumstances and the type of lien being filed. Let's discuss them below: 1. Mechanic's Lien Notice: This type of lien is typically filed by contractors, subcontractors, or suppliers who haven't been paid for work or materials provided to improve a property in the Bronx. By serving a Notice of Lien on the corporation or LLC, the claimant is stating their right to a lien on the property and initiating the legal process to secure payment. 2. Tax Lien Notice: When a corporation or LLC fails to pay its taxes to the state or federal government, tax authorities have the power to place a lien on their property or assets. The Proof of Service of Notice of Lien — Corporation or LLC in this case would provide evidence that the business entity was officially notified of the tax lien being placed against them. 3. Judgement Lien Notice: If a corporation or LLC is found liable and owes a certain amount of money to a creditor through a court judgement, the creditor can file a lien on their property or assets to ensure repayment. The Proof of Service of Notice of Lien — Corporation or LLC in this scenario would serve as proof that the business entity was duly notified of the judgement lien against them. 4. Mortgage Lien Notice: When a corporation or LLC borrows money from a lender to purchase or refinance a property, the lender typically places a mortgage lien on the property. In case the corporation or LLC defaults on the loan, the lender may initiate foreclosure proceedings. The Proof of Service of Notice of Lien — Corporation or LLC for a mortgage lien indicates that the business entity was formally notified of the lien placed on their property. It is important to note that each type of lien carries specific legal requirements and procedures to be followed in the Bronx, New York. Ensuring proper service of the Notice of Lien to the corporation or LLC and gathering appropriate proof of service is crucial for avoiding legal complications and enforcing lien rights successfully.