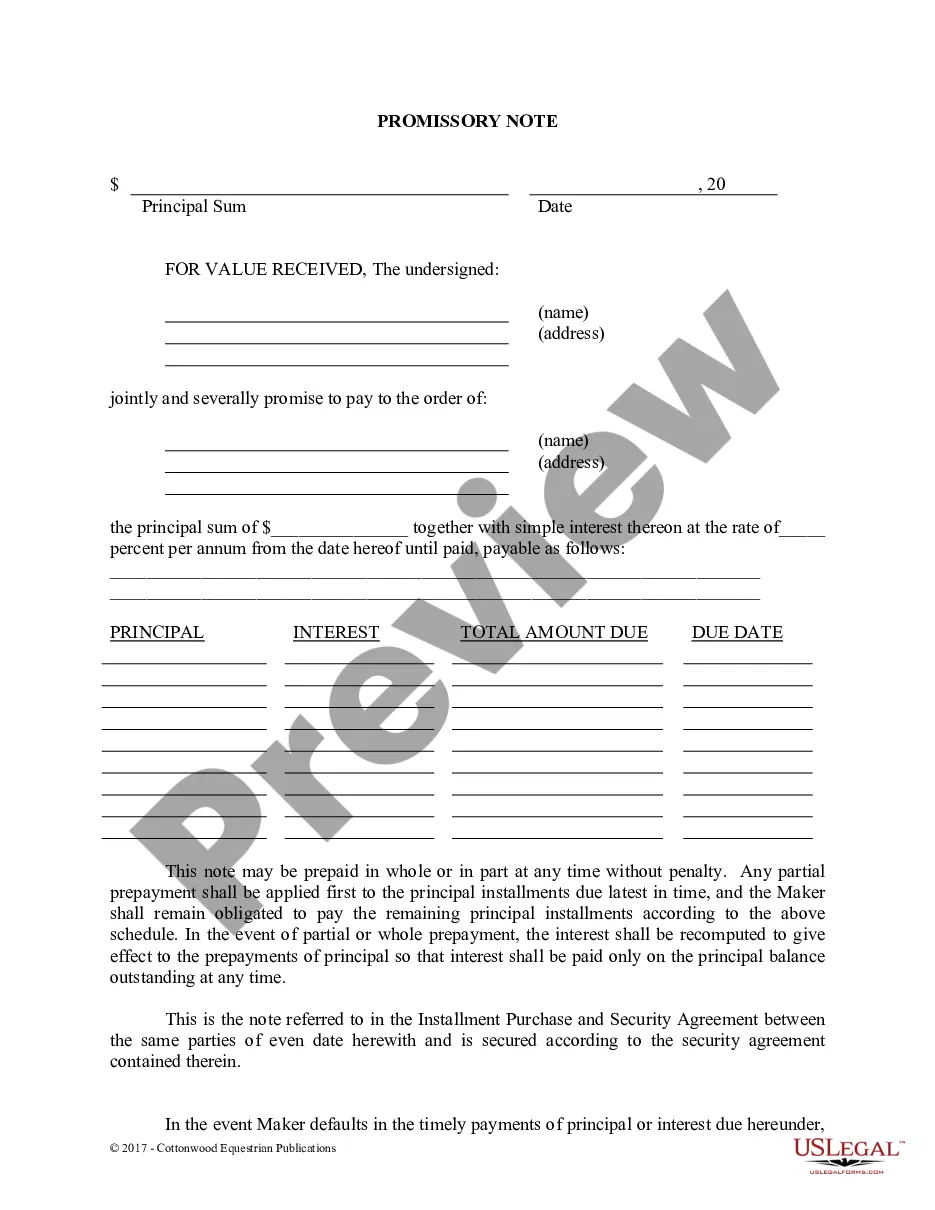

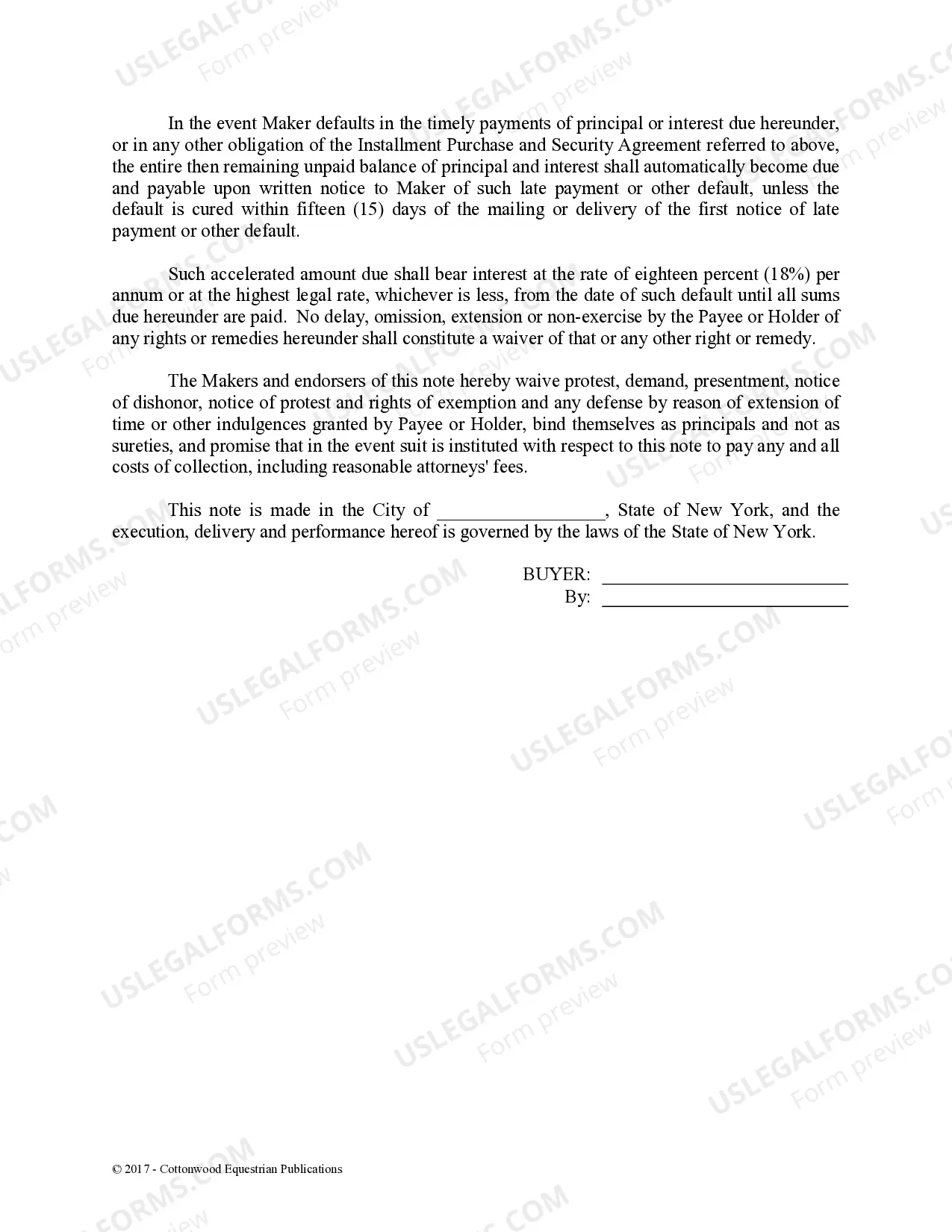

A Syracuse New York Promissory Note — Horse Equine Form is a legal document that outlines the terms and conditions under which one party (the borrower) promises to repay a specific amount of money to another party (the lender) at a later date. This particular promissory note is designed specifically for equine-related transactions and is commonly used in Syracuse, New York. Some of the key elements that are typically included in a Syracuse New York Promissory Note — Horse Equine Form may vary depending on the specific types available, but they generally include: 1. Parties involved: This section identifies the borrower (or debtor) and the lender (or creditor) involved in the promissory note agreement. 2. Terms of repayment: The promissory note specifies the amount borrowed, the interest rate (if applicable), and the repayment terms such as the repayment schedule or a lump sum payment date. 3. Collateral or security interest: In some cases, the lender may require the borrower to provide collateral as security for the loan. This may include the horse(s) or other equine-related assets. The promissory note outlines the details of such collateral. 4. Default and remedies: This section explains the consequences if the borrower fails to make the agreed-upon payments. It may outline the late fees, acceleration clauses (which allow the lender to demand immediate repayment of the entire loan if certain conditions are not met), or the repossession process. 5. Governing law: The promissory note specifies the legal jurisdiction (in this case Syracuse, New York) under which the agreement will be interpreted and enforced. 6. Signatures: Both the borrower and lender must sign the promissory note to indicate their agreement and acceptance of the terms. There may be different types of Syracuse New York Promissory Note — Horse Equine Forms available depending on the specific nature of the equine transaction. They may include: 1. Purchase financing promissory note: Used when the borrower is purchasing a horse and requires financing from the lender. 2. Breeding services promissory note: Used when the borrower is availing breeding services from the lender and agrees to repay the costs associated with these services. 3. Boarding services promissory note: Used when the borrower wants to board their horse with the lender and agrees to repay the costs associated with the boarding services. 4. Training services promissory note: Used when the borrower is acquiring training services for their horse from the lender and agrees to repay the costs. Each type of promissory note may have slightly different terms and conditions specific to the nature of the equine-related transaction involved. It is important for both parties to carefully review and understand the details outlined in the Syracuse New York Promissory Note — Horse Equine Forms before entering into a financial agreement.

Syracuse New York Promissory Note - Horse Equine Forms

Description

How to fill out Syracuse New York Promissory Note - Horse Equine Forms?

If you are searching for a valid form template, it’s impossible to choose a better platform than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can get thousands of form samples for company and personal purposes by categories and regions, or key phrases. Using our advanced search function, finding the most up-to-date Syracuse New York Promissory Note - Horse Equine Forms is as easy as 1-2-3. Additionally, the relevance of each and every document is proved by a group of expert attorneys that regularly check the templates on our platform and revise them according to the newest state and county regulations.

If you already know about our system and have an account, all you should do to receive the Syracuse New York Promissory Note - Horse Equine Forms is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have found the sample you want. Check its description and use the Preview feature (if available) to explore its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the appropriate file.

- Affirm your decision. Click the Buy now option. After that, choose your preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Get the form. Indicate the file format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained Syracuse New York Promissory Note - Horse Equine Forms.

Each and every form you add to your account has no expiry date and is yours forever. You can easily access them using the My Forms menu, so if you want to have an additional version for enhancing or printing, you may come back and save it once more at any time.

Take advantage of the US Legal Forms professional collection to get access to the Syracuse New York Promissory Note - Horse Equine Forms you were looking for and thousands of other professional and state-specific samples in a single place!