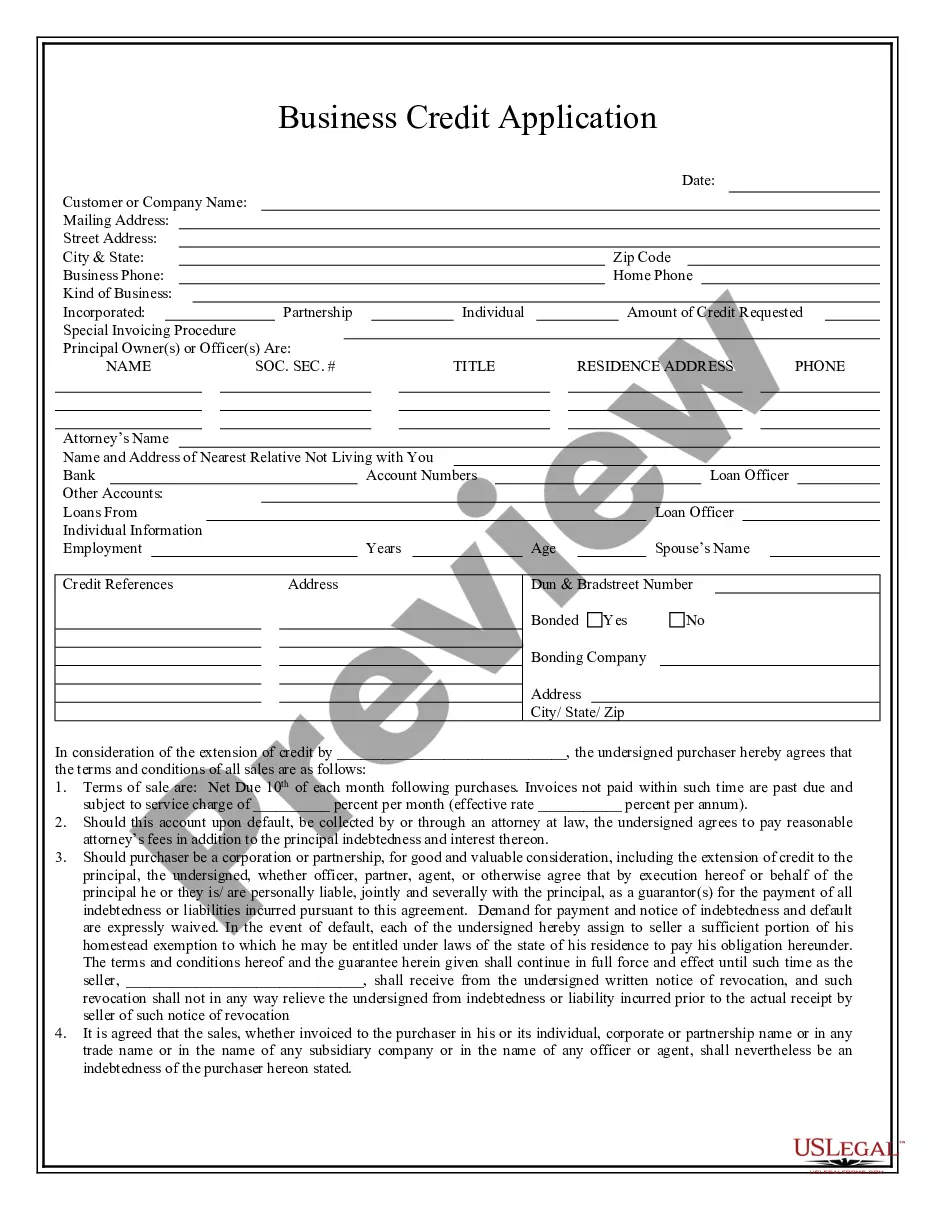

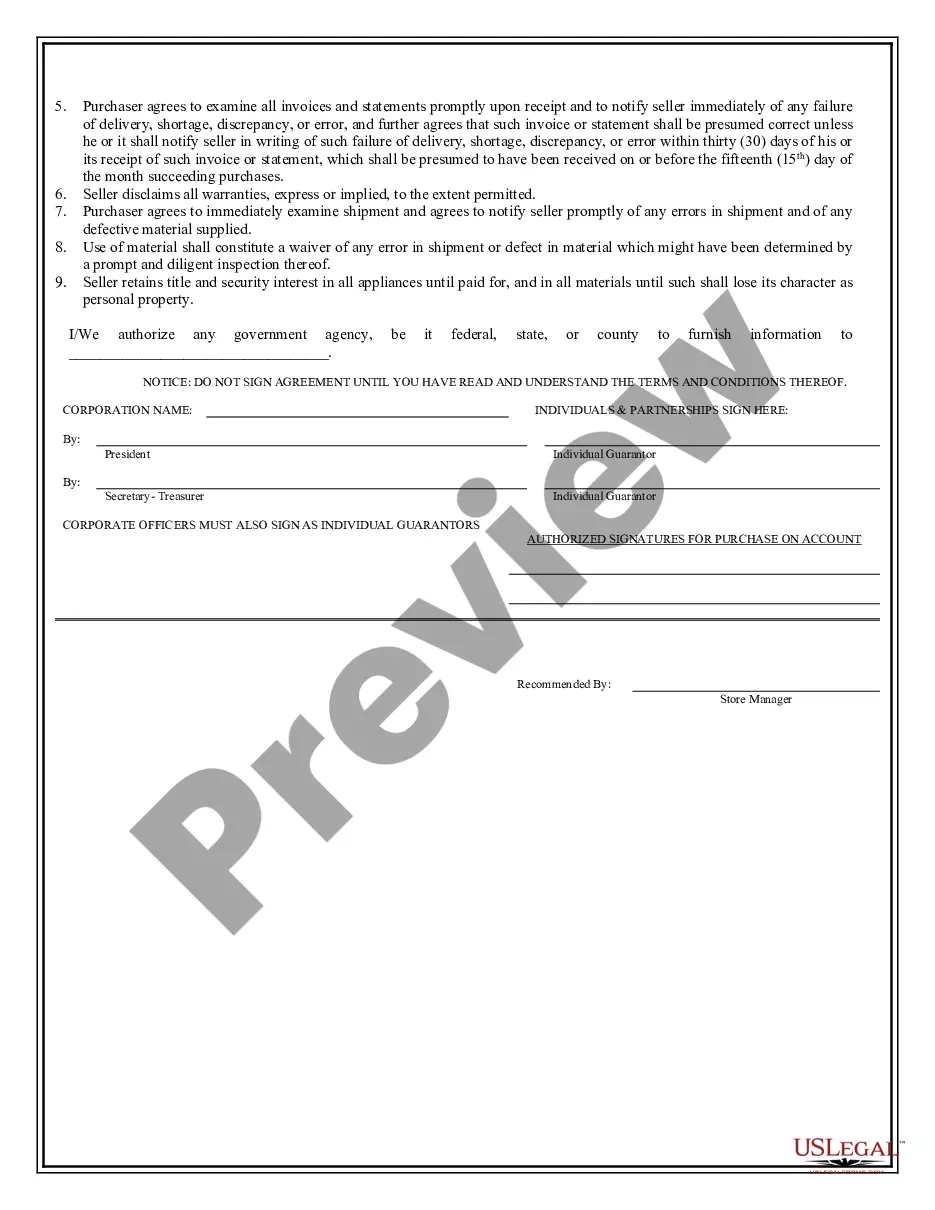

Bronx New York Business Credit Application is a comprehensive process that allows businesses in the Bronx, New York, to apply for credit services. A business credit application is an effective method for companies to establish creditworthiness and gain access to financial resources necessary for growth and expansion. The following are different types of Bronx New York Business Credit Application: 1. Small Business Credit Application: Designed specifically for small businesses in the Bronx, this application enables local entrepreneurs and startups to request credit lines to finance their operations, purchase inventory, or invest in equipment. 2. Micro-Business Credit Application: This type of credit application caters to micro-businesses operating in the Bronx, typically with fewer than ten employees. It offers financial support to these businesses, allowing them to sustain day-to-day operations and meet their growth objectives. 3. Corporate Credit Application: This application is tailored for established corporations in the Bronx, including medium to large-sized companies. It allows them to access significant credit lines to support major business initiatives, such as mergers and acquisitions, large-scale investments, or international expansion. 4. Nonprofit Credit Application: Nonprofit organizations in the Bronx also have access to credit resources through this application. It assists these entities in securing the necessary funds to support their charitable activities, ranging from community development and social welfare programs to educational initiatives. Regardless of the type, a Bronx New York Business Credit Application typically requires businesses to fill out detailed information such as company name, legal structure, years in operation, industry type, revenue and profit figures, relevant financial statements, ownership details, and business address. Furthermore, applicants may be asked to provide personal and business credit history, including credit scores, debt obligations, and previous borrowing experiences. This information helps lenders assess the creditworthiness of the business and determine the terms and conditions for the credit facility. Bronx-based credit institutions, banks, and financial service providers often offer various credit applications tailored to meet the specific needs of businesses in the area. These applications serve as the initial step towards securing financial assistance and establishing a strong credit profile for the business, enabling them to flourish and contribute to the local economy.

Bronx New York Business Credit Application

Description

How to fill out Bronx New York Business Credit Application?

If you are searching for a relevant form template, it’s impossible to choose a more convenient platform than the US Legal Forms website – one of the most considerable libraries on the web. Here you can get a large number of form samples for company and personal purposes by types and states, or keywords. With our advanced search function, getting the most up-to-date Bronx New York Business Credit Application is as elementary as 1-2-3. Moreover, the relevance of every file is verified by a team of expert attorneys that regularly review the templates on our website and revise them in accordance with the latest state and county laws.

If you already know about our platform and have an account, all you should do to get the Bronx New York Business Credit Application is to log in to your profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have opened the sample you want. Check its information and make use of the Preview function to explore its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to find the proper file.

- Affirm your choice. Click the Buy now button. Next, choose the preferred subscription plan and provide credentials to sign up for an account.

- Make the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the template. Pick the file format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the received Bronx New York Business Credit Application.

Each template you save in your profile has no expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you need to receive an additional copy for enhancing or printing, you may return and export it once again at any time.

Make use of the US Legal Forms professional catalogue to gain access to the Bronx New York Business Credit Application you were seeking and a large number of other professional and state-specific templates on one platform!