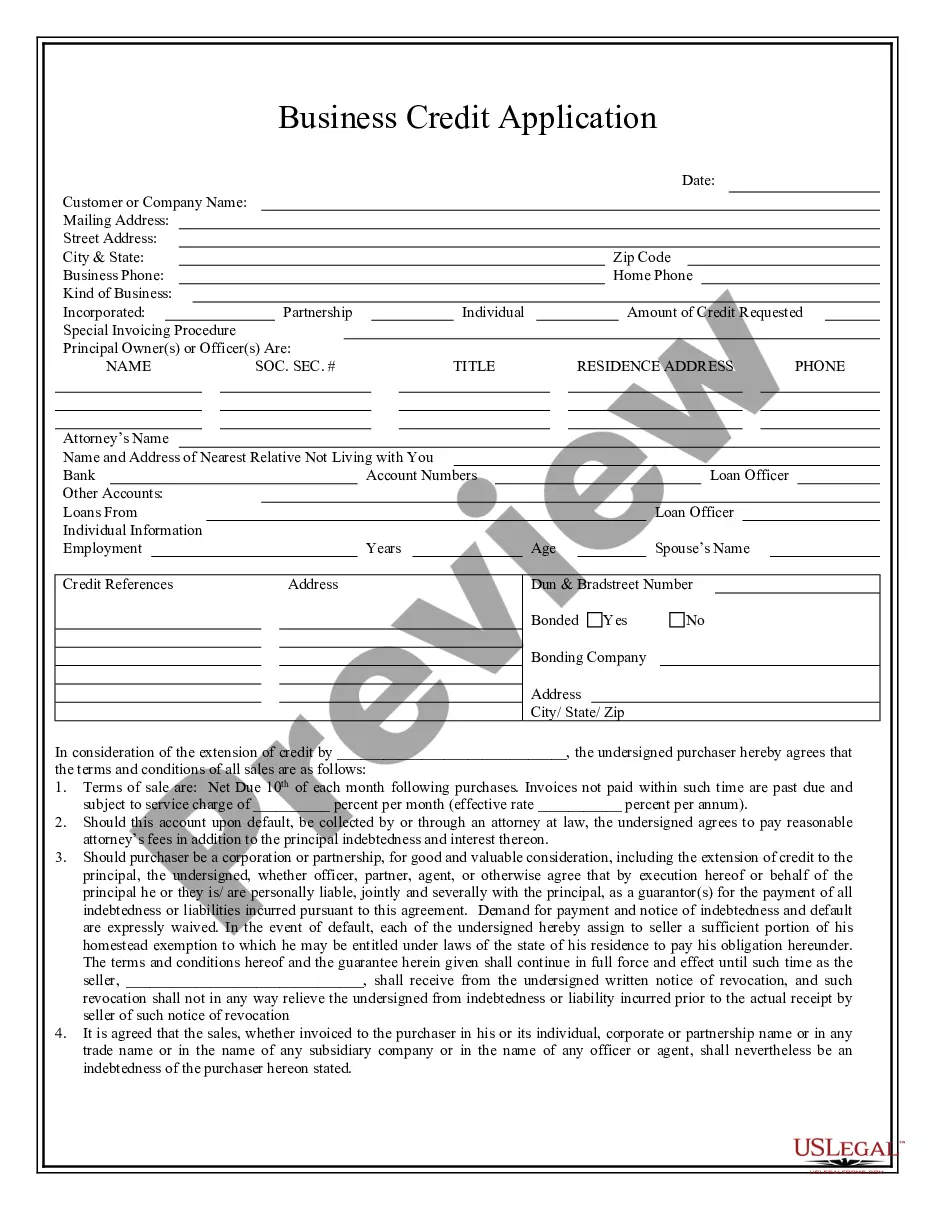

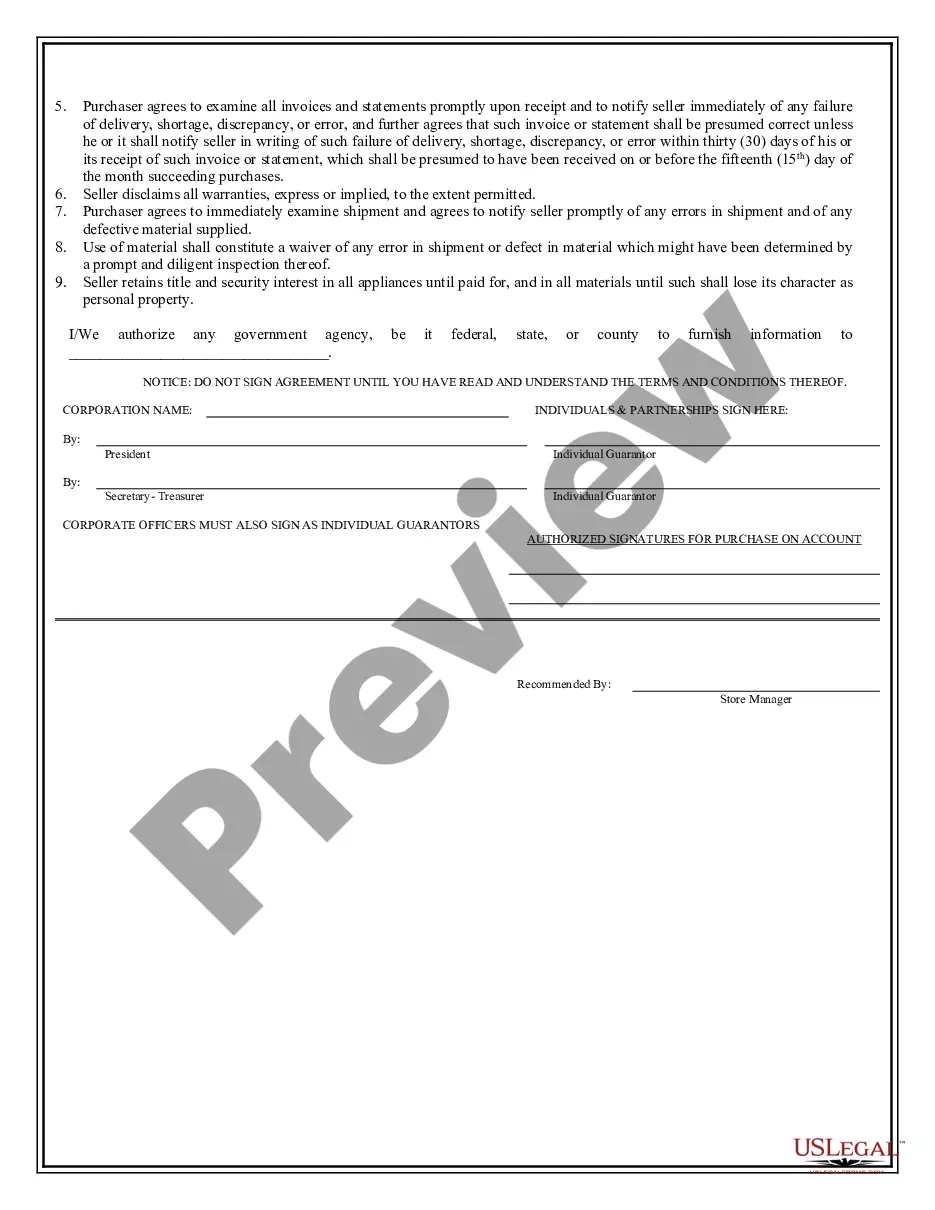

Kings New York Business Credit Application is an essential document for businesses seeking financial assistance from Kings New York, a renowned financial institution. This comprehensive application is designed to gather pertinent information about the business, its financial history, and future prospects to evaluate its eligibility for credit. The Kings New York Business Credit Application encompasses various sections that aim to capture different aspects of the business's financial standing and requirements. These sections typically include: 1. Business Information: This section collects details about the business, such as its legal name, address, contact information, and industry type. It also seeks information about the ownership structure, including the names and contact details of key stakeholders. 2. Financial Statements: Kings New York Business Credit Application requires businesses to provide their financial statements, such as income statements, balance sheets, and cash flow statements. These documents give the lender insights into the business's financial performance and its ability to repay the credit. 3. Business Plan: Businesses are often required to submit a detailed business plan outlining their objectives, strategies, target market, competitive analysis, and growth projections. This section helps Kings New York evaluate the business's viability and potential to generate sufficient returns to repay the credit. 4. Purpose of Credit: Here, applicants must specify how they intend to utilize the credit. Whether it is for inventory purchase, equipment acquisition, expansion, or other specific purposes, this information allows Kings New York to assess the appropriateness of the requested credit amount. 5. Collateral and Guarantees: Kings New York may ask for information regarding collateral or guarantees offered to secure the credit, such as property, vehicles, or personal guarantees from the business owners. Key Types of Kings New York Business Credit Application: 1. Small Business Line of Credit Application: Designed for small businesses requiring ongoing access to funds, this application assists in securing a revolving credit line for working capital needs, inventory management, or business expansion. 2. Equipment Financing Application: Geared towards businesses seeking funds to purchase or lease equipment, this application streamlines the process of acquiring credit for essential equipment, such as machinery, vehicles, or technology upgrades. 3. Business Credit Card Application: For businesses in need of a flexible payment tool, this application allows for a customized business credit card with competitive interest rates, rewards, and benefits catered to the specific needs of the business. In conclusion, Kings New York Business Credit Application serves as a crucial document for businesses seeking financial support from Kings New York. By providing comprehensive information about the business, its financials, and purpose of credit, this application helps Kings New York evaluate the creditworthiness and suitability of the business for different types of credit offerings.

Kings New York Business Credit Application

Description

How to fill out Kings New York Business Credit Application?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we apply for legal services that, usually, are very expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Kings New York Business Credit Application or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Kings New York Business Credit Application adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Kings New York Business Credit Application is suitable for you, you can select the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!