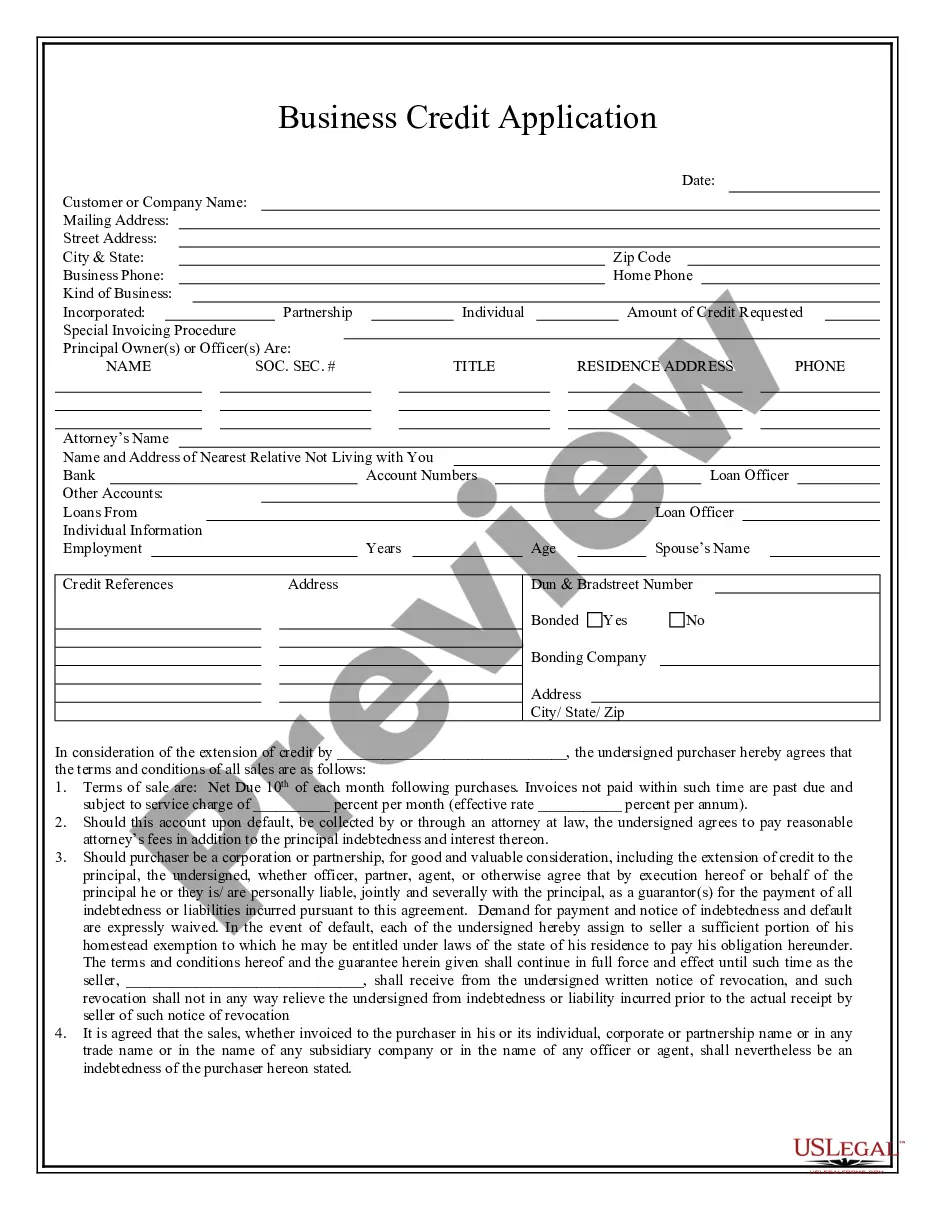

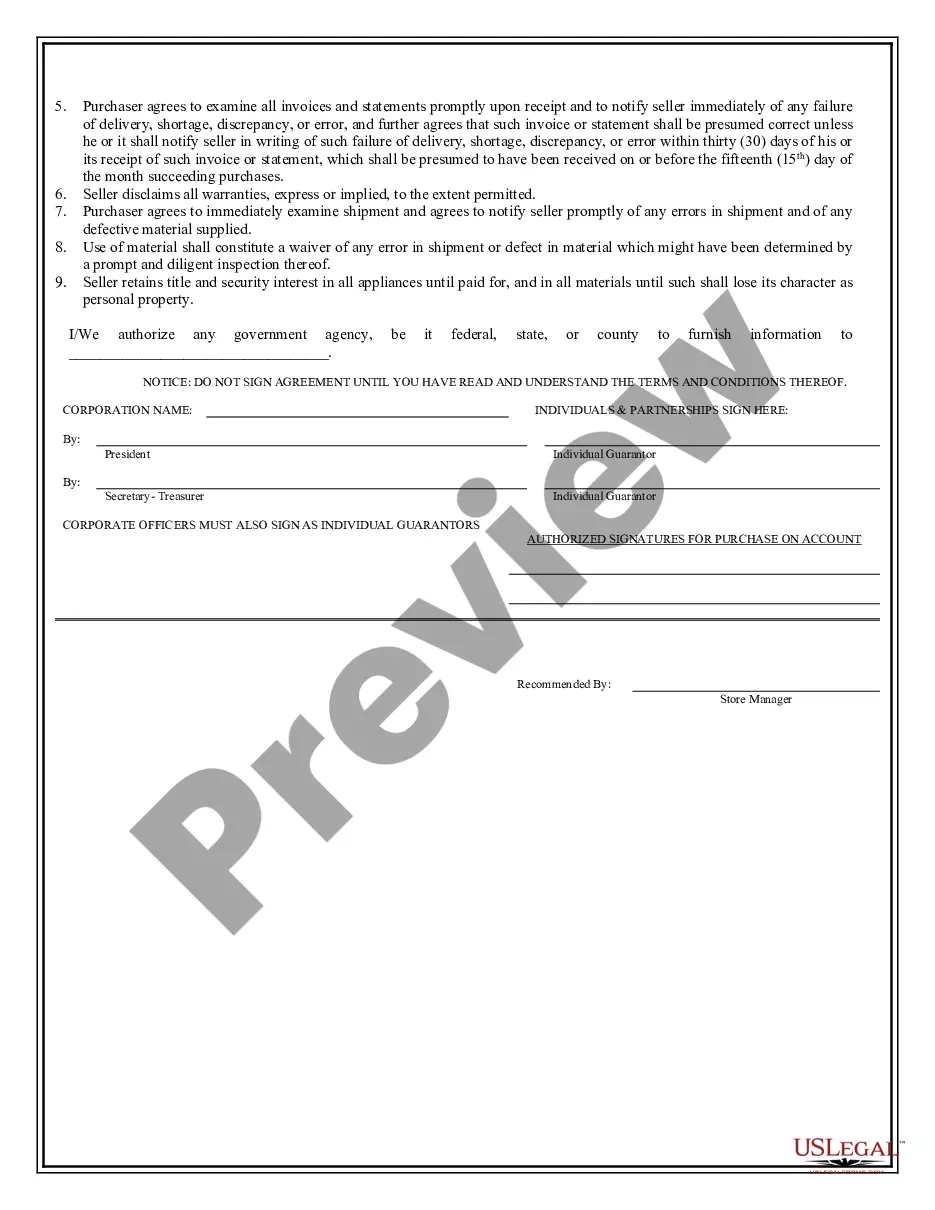

Nassau New York Business Credit Application is a crucial document that businesses in Nassau, New York need to complete when applying for credit. This application allows businesses to request credit from financial institutions or lending agencies in order to fund their operations, expand their businesses, or meet various financial needs. The Nassau New York Business Credit Application typically consists of several sections that require detailed information about the applicant's business. These sections generally include: 1. Business Information: This section requires the business name, legal structure (LLC, sole proprietorship, etc.), contact information, and the number of years the company has been operating. 2. Ownership Details: Here, applicants need to provide information about the business's owners, including their names, contact information, percentage of ownership, and social security numbers. 3. Financial Statements: This part typically asks for the company's financial statements, including balance sheets, profit and loss statements, cash flow statements, and tax returns for the past few years. These documents help lenders assess the financial health and stability of the business. 4. Business Plan and Purpose of Credit: In this section, applicants are expected to outline their business goals, plans for utilizing the credit, and how it will benefit their operations, such as purchasing new equipment, expanding inventory, or hiring additional staff. 5. Collateral Details: Some credit applications may require details about the collateral that the business is willing to put up as security for the credit. This can include real estate, inventory, accounts receivable, or any other valuable asset the business owns. 6. Personal Guarantees: If the business's financial standing isn't strong enough to secure credit on its own, owners may need to provide personal guarantees, pledging their personal assets as collateral for the loan. It is important to note that there might be variations of the Nassau New York Business Credit Application depending on the specific financial institution or lender. Some lenders might have additional sections or request supplementary documents to evaluate creditworthiness. Therefore, it is advisable for businesses to consult the specific lender's requirements and tailor their credit application accordingly. In conclusion, the Nassau New York Business Credit Application is a comprehensive form that businesses operating in Nassau, New York must complete to secure credit. It requests essential information about the company, its financial status, purpose of credit, collateral, and personal guarantees. By providing this information accurately and comprehensively, businesses can increase their chances of obtaining credit from financial institutions in Nassau, New York.

Nassau New York Business Credit Application

State:

New York

County:

Nassau

Control #:

NY-20-CR

Format:

Word;

Rich Text

Instant download

Description

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Nassau New York Business Credit Application is a crucial document that businesses in Nassau, New York need to complete when applying for credit. This application allows businesses to request credit from financial institutions or lending agencies in order to fund their operations, expand their businesses, or meet various financial needs. The Nassau New York Business Credit Application typically consists of several sections that require detailed information about the applicant's business. These sections generally include: 1. Business Information: This section requires the business name, legal structure (LLC, sole proprietorship, etc.), contact information, and the number of years the company has been operating. 2. Ownership Details: Here, applicants need to provide information about the business's owners, including their names, contact information, percentage of ownership, and social security numbers. 3. Financial Statements: This part typically asks for the company's financial statements, including balance sheets, profit and loss statements, cash flow statements, and tax returns for the past few years. These documents help lenders assess the financial health and stability of the business. 4. Business Plan and Purpose of Credit: In this section, applicants are expected to outline their business goals, plans for utilizing the credit, and how it will benefit their operations, such as purchasing new equipment, expanding inventory, or hiring additional staff. 5. Collateral Details: Some credit applications may require details about the collateral that the business is willing to put up as security for the credit. This can include real estate, inventory, accounts receivable, or any other valuable asset the business owns. 6. Personal Guarantees: If the business's financial standing isn't strong enough to secure credit on its own, owners may need to provide personal guarantees, pledging their personal assets as collateral for the loan. It is important to note that there might be variations of the Nassau New York Business Credit Application depending on the specific financial institution or lender. Some lenders might have additional sections or request supplementary documents to evaluate creditworthiness. Therefore, it is advisable for businesses to consult the specific lender's requirements and tailor their credit application accordingly. In conclusion, the Nassau New York Business Credit Application is a comprehensive form that businesses operating in Nassau, New York must complete to secure credit. It requests essential information about the company, its financial status, purpose of credit, collateral, and personal guarantees. By providing this information accurately and comprehensively, businesses can increase their chances of obtaining credit from financial institutions in Nassau, New York.

Free preview

How to fill out Nassau New York Business Credit Application?

If you’ve already used our service before, log in to your account and save the Nassau New York Business Credit Application on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Nassau New York Business Credit Application. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!