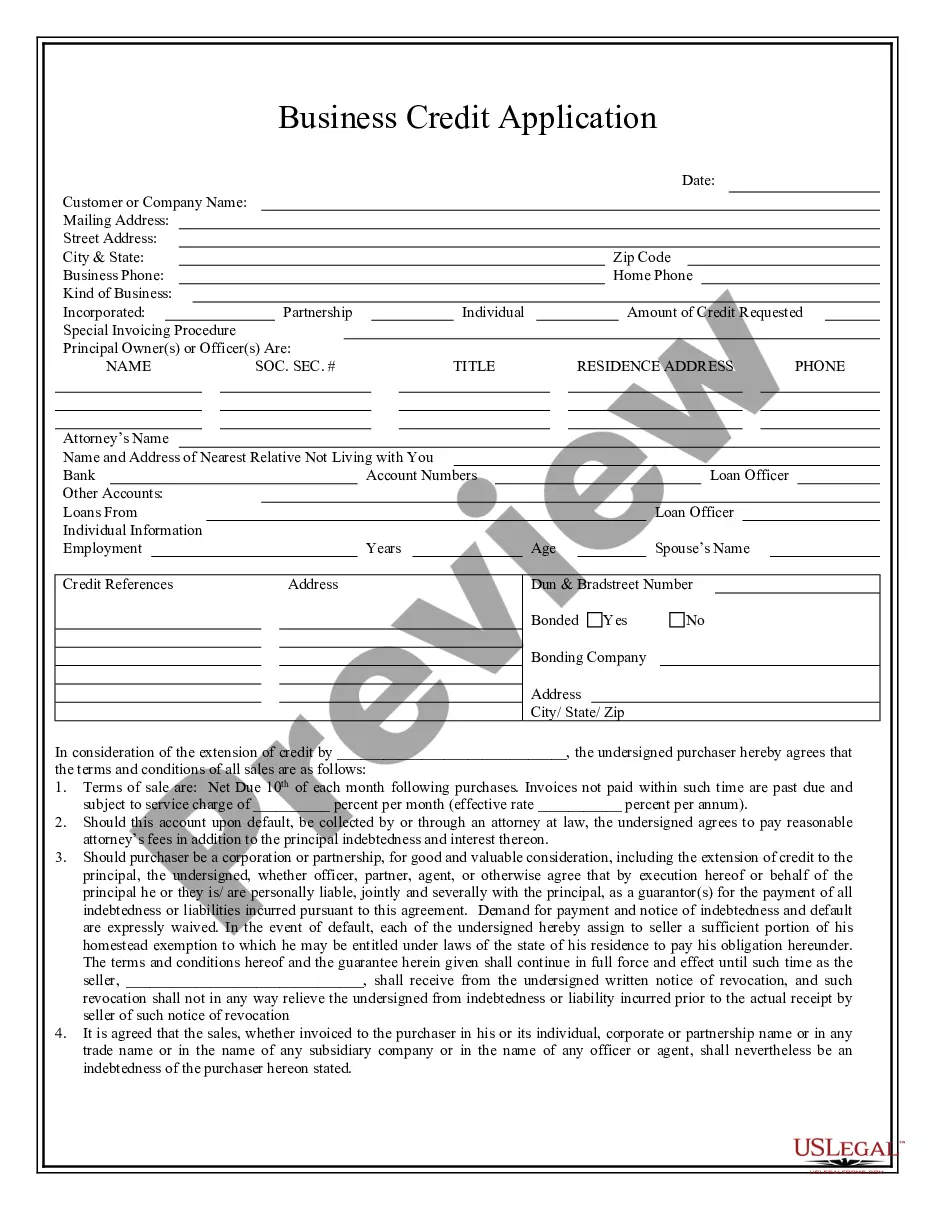

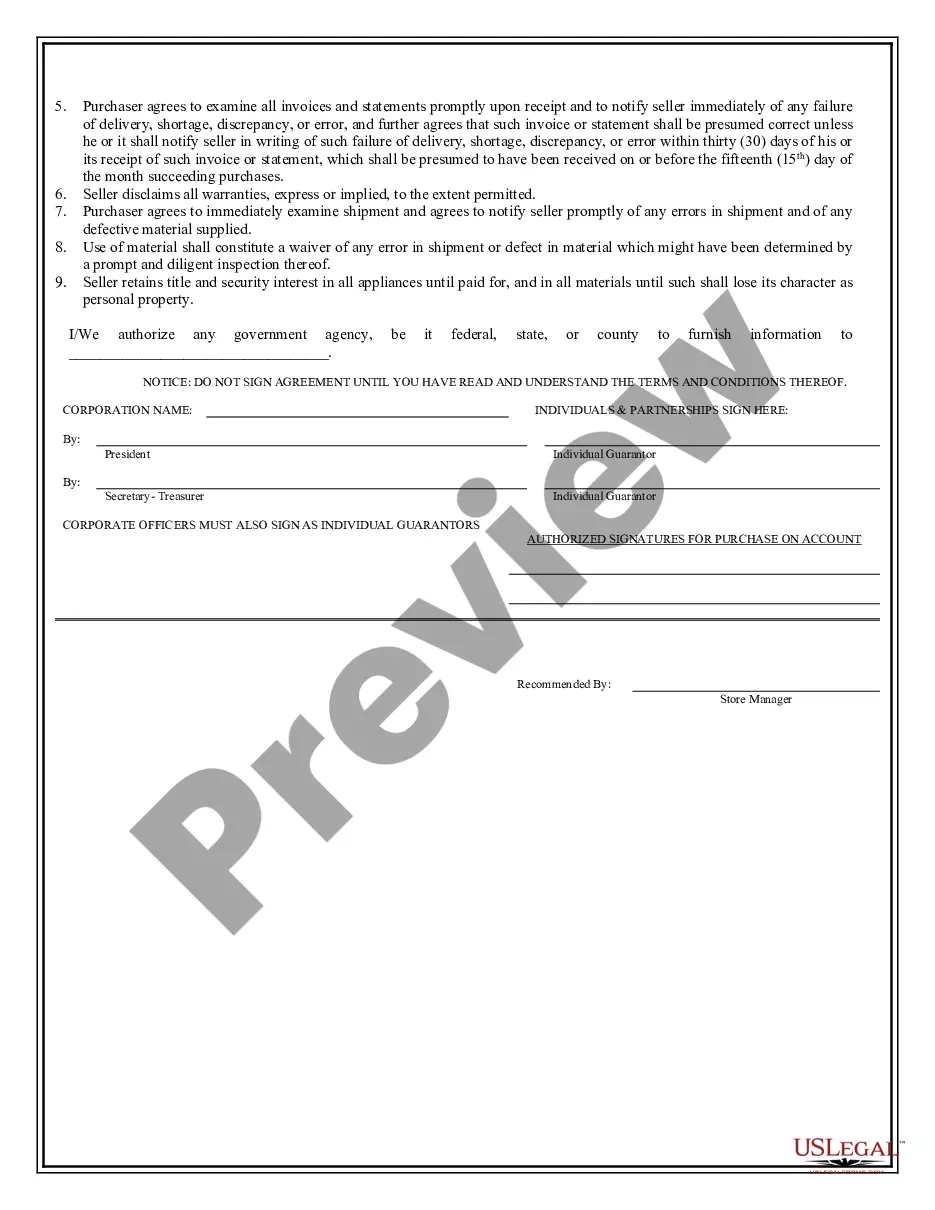

Queens New York Business Credit Application is a formal document required by financial institutions and lenders to assess the creditworthiness of businesses based in Queens, New York. This application is designed to gather crucial information about the business, its financial history, and payment capabilities to determine if it qualifies for credit or loans. The Queens New York Business Credit Application typically includes the following sections: 1. Business Information: This section collects general details about the business such as name, address, contact information, and legal structure (sole proprietorship, partnership, corporation, etc.). 2. Ownership and Management: Here, the applicant is required to provide information about the business owners and key executives, including names, positions, percentage ownership, and contact details. 3. Financial Information: This section aims to understand the financial health and stability of the business. It may require the submission of financial documents such as balance sheets, income statements, cash flow statements, tax returns, and bank statements. 4. Business History: Lenders are interested in understanding the business's background, including the year it was established, its primary activities, and any significant milestones or achievements. 5. Credit Requests: This part focuses on the desired credit amount and the purpose for which it will be used. It may also include information about existing loans or lines of credit. 6. Trade References: Applicants are often asked to provide references from suppliers, vendors, or other businesses they have established relationships with. These references can help verify the payment history and reputation of the business. 7. Collateral: If the credit application involves securing the loan with collateral, this section will require detailed information about the assets being pledged, including their value and ownership status. 8. Terms and Conditions: Applicants must carefully review and acknowledge the terms and conditions set by the lender, including interest rates, repayment schedules, late payment penalties, and default consequences. Different types of Queens New York Business Credit Applications may include industry-specific variations or be tailored to suit the lender's requirements. For instance, there might be specific applications for small businesses, startups, or established corporations. Some lenders may also offer specialized credit applications for industries such as retail, manufacturing, technology, or real estate. In conclusion, the Queens New York Business Credit Application is a crucial document for businesses in Queens, New York, seeking financing or credit facilities. By diligently completing this application and providing accurate information, businesses increase their chances of receiving favorable loan terms and expanding their operations.

Queens New York Business Credit Application

Description

How to fill out Queens New York Business Credit Application?

If you are searching for a valid form, it’s impossible to find a more convenient platform than the US Legal Forms website – probably the most considerable online libraries. With this library, you can get a huge number of document samples for organization and personal purposes by categories and regions, or key phrases. With our high-quality search function, finding the latest Queens New York Business Credit Application is as easy as 1-2-3. Furthermore, the relevance of each and every document is verified by a group of professional attorneys that on a regular basis review the templates on our platform and revise them according to the latest state and county regulations.

If you already know about our system and have a registered account, all you should do to receive the Queens New York Business Credit Application is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have found the sample you need. Read its explanation and use the Preview function (if available) to explore its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to get the needed file.

- Confirm your choice. Choose the Buy now button. Following that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your bank card or PayPal account to complete the registration procedure.

- Obtain the template. Pick the format and save it on your device.

- Make modifications. Fill out, revise, print, and sign the obtained Queens New York Business Credit Application.

Each template you add to your user profile has no expiration date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you want to get an extra duplicate for editing or printing, you may come back and save it once again at any moment.

Take advantage of the US Legal Forms professional catalogue to get access to the Queens New York Business Credit Application you were seeking and a huge number of other professional and state-specific templates on one website!