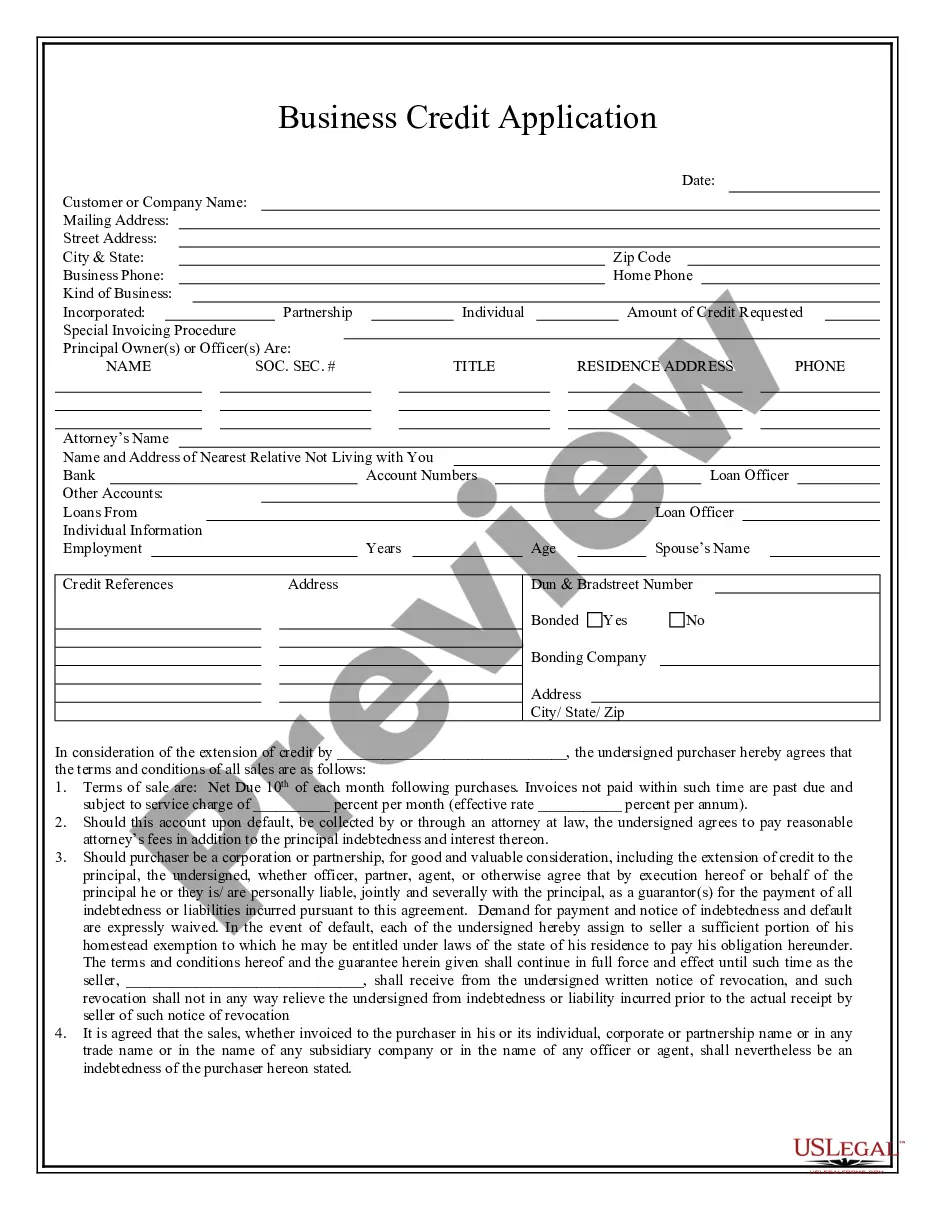

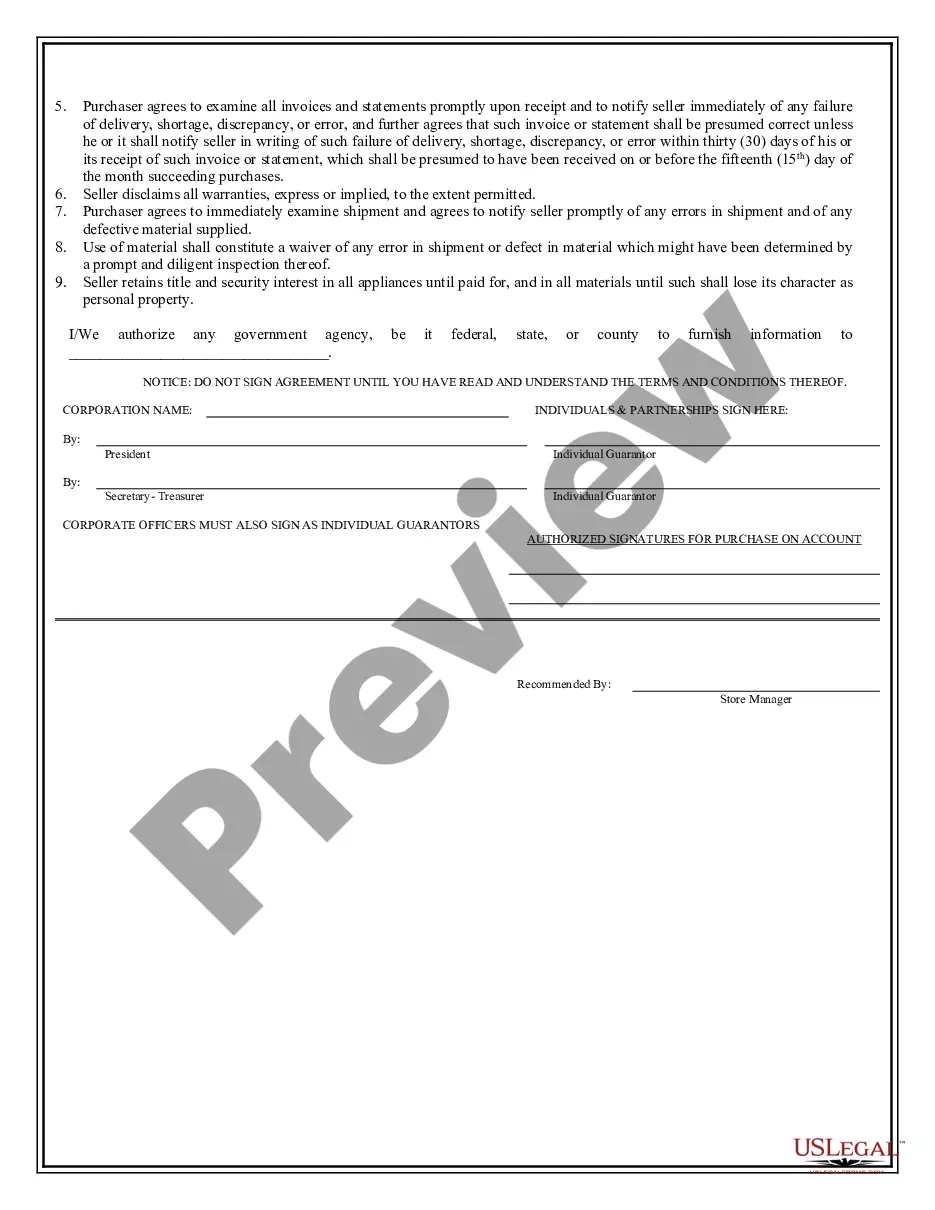

Rochester New York Business Credit Application is an essential document that allows businesses in Rochester, New York, to apply for credit from financial institutions or lenders. This formal request enables businesses to obtain funding and establish a credit line that can be used for various commercial purposes. The Rochester New York Business Credit Application includes detailed information about the business that is applying for credit. This typically includes the legal name of the company, contact information, tax identification number, ownership structure, and the type of business entity (e.g., corporation, partnership, sole proprietorship). Furthermore, the application requires businesses to provide comprehensive financial information. This includes details about the company's revenue and expenses, assets and liabilities, bank statements, and other supporting documents that demonstrate the financial health and stability of the business. Additionally, the credit application may require businesses to disclose their credit history, including any outstanding loans or lines of credit. This information helps lenders evaluate the creditworthiness of the business and determine the appropriate credit limit and terms. Different types of Rochester New York Business Credit Applications may exist to cater to specific industries or financing needs. Some common variations include: 1. Small Business Credit Application: Designed for small businesses or startups seeking modest amounts of credit. 2. Corporate Credit Application: Catering to established corporations or larger enterprises that require significant credit limits. 3. Line of Credit Application: Specifically focused on applying for a revolving line of credit that allows businesses to borrow funds as needed up to a predetermined limit. 4. Equipment Financing Credit Application: Tailored for businesses seeking financing to acquire new equipment or upgrade existing equipment. 5. Trade Credit Application: Pertains to businesses applying for credit terms with suppliers or vendors, allowing them to defer payment for goods or services. These variations may have specific requirements or additional sections in the credit application based on the nature of credit being sought. In summary, the Rochester New York Business Credit Application is a comprehensive document that enables businesses in Rochester to request credit from financial institutions. By providing detailed financial and business information, applicants can present a strong case for receiving credit and establish a reliable credit line for their commercial operations.

Rochester New York Business Credit Application

Description

How to fill out Rochester New York Business Credit Application?

If you are searching for a relevant form template, it’s difficult to choose a better service than the US Legal Forms site – probably the most considerable libraries on the internet. With this library, you can get a huge number of templates for company and individual purposes by types and regions, or keywords. Using our advanced search option, discovering the latest Rochester New York Business Credit Application is as easy as 1-2-3. Moreover, the relevance of each and every document is proved by a group of expert attorneys that on a regular basis check the templates on our platform and revise them based on the latest state and county regulations.

If you already know about our system and have a registered account, all you should do to receive the Rochester New York Business Credit Application is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the sample you want. Check its explanation and utilize the Preview feature to check its content. If it doesn’t meet your needs, use the Search option near the top of the screen to find the proper file.

- Affirm your decision. Choose the Buy now button. After that, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Indicate the file format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the received Rochester New York Business Credit Application.

Each and every form you add to your profile has no expiration date and is yours permanently. You can easily gain access to them via the My Forms menu, so if you need to get an extra version for modifying or creating a hard copy, you may return and save it once more at any time.

Take advantage of the US Legal Forms professional collection to get access to the Rochester New York Business Credit Application you were seeking and a huge number of other professional and state-specific templates on a single website!