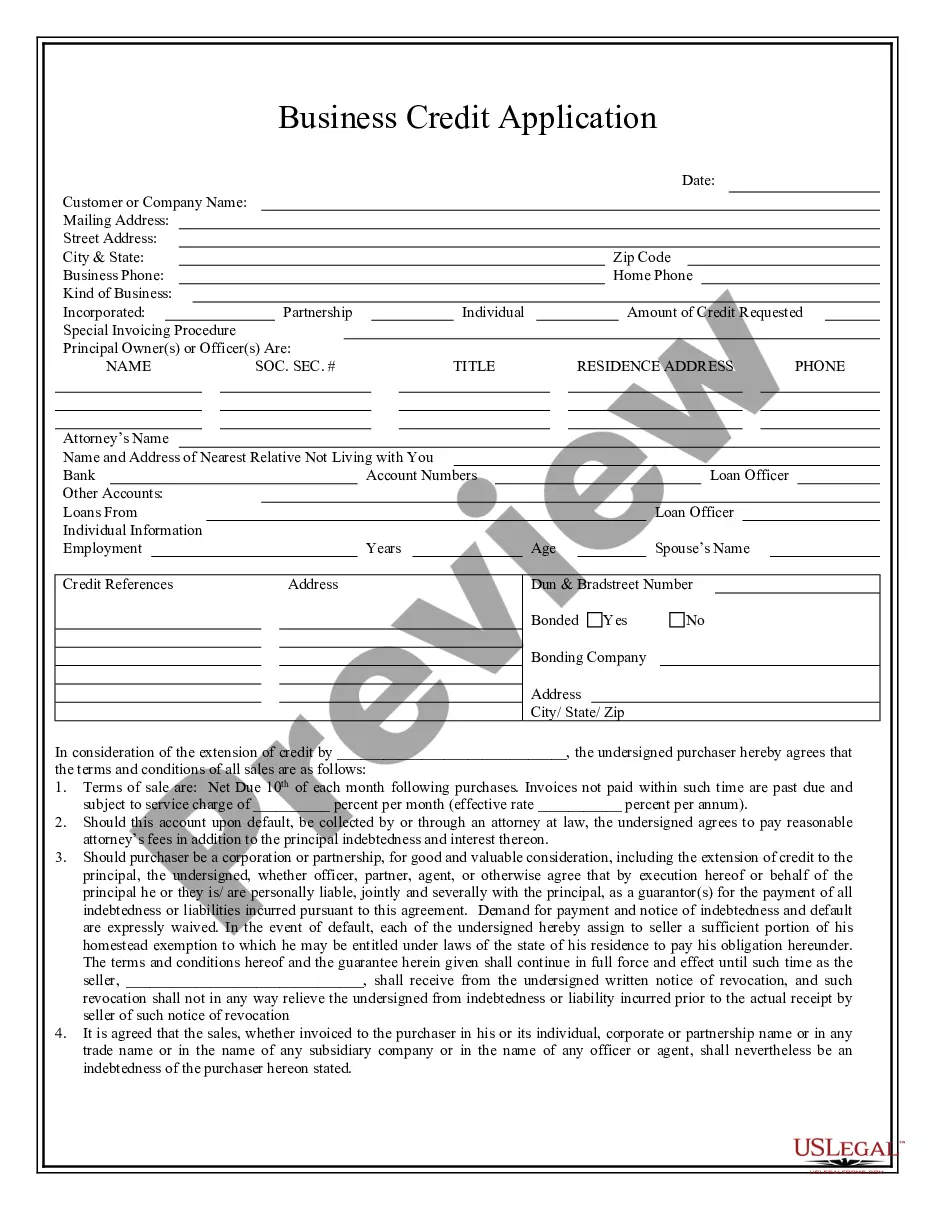

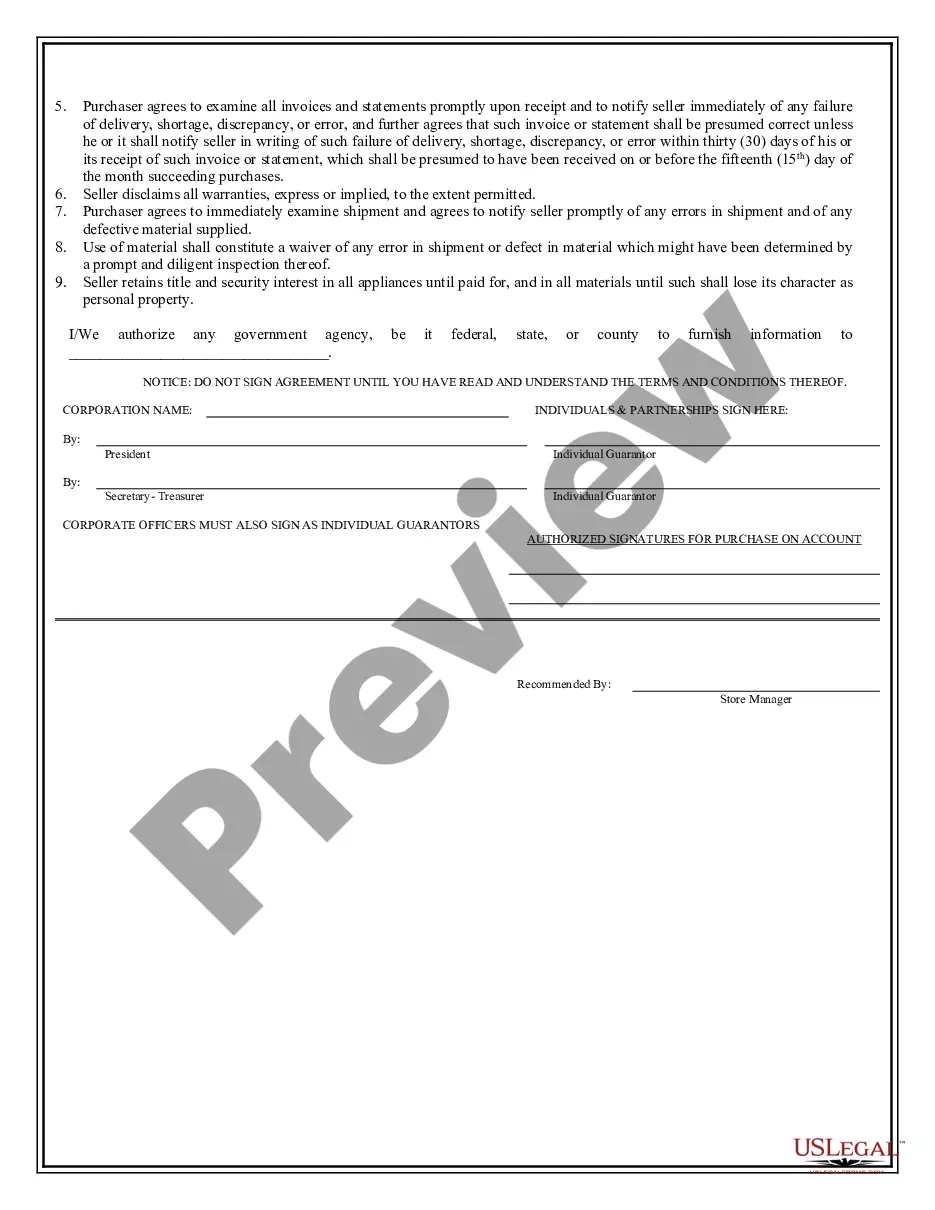

Suffolk New York Business Credit Application is a formal document used by businesses located in Suffolk County, New York, to apply for credit from financial institutions or other credit providers. This application serves as a request for a line of credit or loan, allowing businesses to obtain necessary funding for their operational expenses, expansion plans, or other financial needs. The Suffolk New York Business Credit Application typically requires detailed information about the business, including its name, address, contact details, legal structure (sole proprietorship, partnership, corporation, etc.), and the nature of its operations. Keywords: Suffolk New York, Business Credit Application, finance, funding, credit providers, line of credit, loan, operational expenses, expansion plans, financial needs, legal structure, sole proprietorship, partnership, corporation. There may be different types of Suffolk New York Business Credit Applications based on the specific requirements and nature of the credit provider. Some common types include: 1. Traditional Business Credit Application: This is the standard form used by banks or traditional financial institutions to evaluate a business's creditworthiness. It requires to be detailed financial statements, tax returns, profit and loss statements, and other relevant financial information. 2. Small Business Administration (SBA) Loan Application: The SBA offers various loan programs to support small businesses. The application process entails filling out specialized forms, providing financial documentation, and meeting specific eligibility criteria. 3. Supplier or Vendor Credit Application: Some businesses apply for credit directly with their suppliers or vendors. These applications may involve providing business references, current trade credit information, and details about the products or services the business purchases from the supplier. 4. Equipment Financing Credit Application: If a business needs to finance the purchase of new equipment, they may use an equipment financing credit application. This application typically requires information about the equipment being financed, its cost, and the expected benefits it will bring to the business. 5. Credit Union Business Loan Application: Credit unions often have their own business loan application forms, tailored to their specific lending criteria and requirements. These applications may have different sections to capture information relevant to credit union lending policies. It is important for businesses to carefully fill out the Suffolk New York Business Credit Application by providing accurate and thorough information. Banks and credit providers use this information to assess the creditworthiness of the business and determine the terms and conditions of the credit or loan.

Suffolk New York Business Credit Application

Description

How to fill out Suffolk New York Business Credit Application?

Are you looking for a reliable and inexpensive legal forms supplier to get the Suffolk New York Business Credit Application? US Legal Forms is your go-to choice.

Whether you need a basic agreement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Suffolk New York Business Credit Application conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search if the form isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Suffolk New York Business Credit Application in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending hours researching legal papers online for good.

Form popularity

FAQ

New York Limited Liability Company Formation: ~14 business days. Within 24 hours for $25 expedite fee. On the same day for $75 expedite fee. Within 2 hours of receipt for $150 expedite fee.

For corporations, limited partnerships and limited liability companies, who must file with the State, the filing fee is $25, though corporations must also pay an additional county- specific fee. The corporation county fee is $100 for any county in New York City and $25 for any other county in New York State.

Incorporating a business in New York Select a business name.Recruit and/or appoint members/managers (LLCs) or directors corporations).File the incorporation paperwork.Establish the rules and procedures.Obtain any required business licenses/permits.Determine other regulatory obligations and registrations.

For corporations, limited partnerships and limited liability companies, who must file with the State, the filing fee is $25, though corporations must also pay an additional county- specific fee. The corporation county fee is $100 for any county in New York City and $25 for any other county in New York State.

In most cases, the total cost to register your business will be less than $300, but fees vary depending on your state and business structure. The information you'll need typically includes: Business name. Business location.

New York requires all businesses operating under a business name to register as a legal entity to operate a business. Limited liability companies (LLCs) and corporations must register with the state.

In New York, a sole proprietor may use his or her own given name or may use a trade name....There are four simple steps you should take: Choose a business name. File a fictitious name certificate with the county clerk's office. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

Filing the Articles of Organization By mail, send the completed Articles of Organization with the filing fee of $200 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

Form an Entity Visit the NYS Business Wizard to determine the requirements for your business and apply for the right license or permit. Sole proprietorships and general partnerships file in the county where they're located. Business Corporations file a Certificate of Incorporation with the Department of State.

Form an Entity Visit the NYS Business Wizard to determine the requirements for your business and apply for the right license or permit. Sole proprietorships and general partnerships file in the county where they're located. Business Corporations file a Certificate of Incorporation with the Department of State.

Interesting Questions

More info

See what an average day is like in this Suffolk County business. See what a typical Suffolk County household is doing on the Internet. 72 results — Browse through businesses for sale in Suffolk County, NY on BizBuySell. The following businesses have been visited by the FBI: Suffolk County Sheriff's Office; Suffolk County District Attorney's Office; Suffolk County Police Department; Suffolk County Probation Court. There is no fee to use these applications. If you are unable to find a page to begin a purchase or a page which provides more information, please contact the Suffolk County Department of Consumer Affairs at. Learn more about the Suffolk County Businesses for Sale. Learn more about Suffolk County Businesses for Sale and read about the State Census Trends and Issues. See our State Census Trends and Issues page for information on the Suffolk County Businesses for Sale.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.