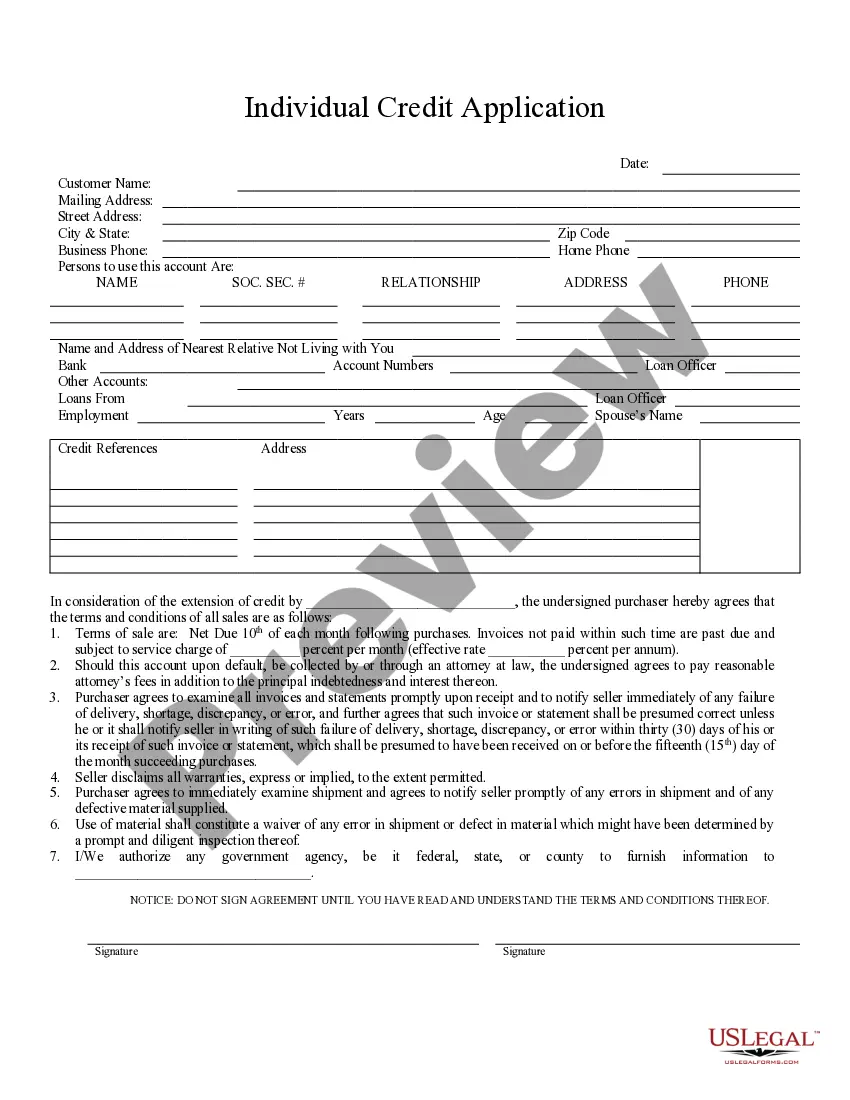

Bronx New York Individual Credit Application is a document that individuals in the Bronx, New York area complete when applying for credit from financial institutions or lenders. This application is designed to gather relevant information about the individual's financial status, credit history, and employment details to assess their creditworthiness. The Bronx New York Individual Credit Application plays a crucial role in determining whether the applicant is eligible for credit and helps lenders make informed decisions regarding loan approvals. Key elements included in the Bronx New York Individual Credit Application may include: 1. Personal Information: The application will require the applicant's full name, date of birth, social security number, contact information, and current address. Providing accurate personal details is essential for the application process. 2. Employment Details: Applicants will be required to provide information about their employment status, including their current employer's name, address, job title, and length of employment. Some applications may also ask for income details to assess the applicant's ability to repay the requested credit. 3. Financial Information: This section of the application requires the applicant to disclose their financial details, such as their income, monthly expenses, and any existing debts or liabilities. This information helps lenders to evaluate the applicant's financial stability and capacity to handle additional credit. 4. Credit History: Applicants need to provide details about their credit history, including any previous loans, mortgages, credit cards, or bankruptcies. This information helps lenders to gain insight into the applicant's past borrowing behavior and assess their creditworthiness. 5. References: Some applications may ask for personal or professional references who can provide additional information about the applicant's character and financial responsibility. References may be contacted by the lender during the application review process. Different types of Bronx New York Individual Credit Applications may include: 1. Mortgage Credit Application: Specifically designed for individuals seeking a mortgage loan in the Bronx, this application will focus on gathering information related to real estate, including property details and current market value. 2. Auto Loan Credit Application: Tailored for individuals applying for an auto loan, this application will request details about the desired vehicle, such as make, model, year, and VIN number, along with information about insurance coverage. 3. Personal Loan Credit Application: This type of credit application is suitable for individuals looking for personal loans for various purposes, including debt consolidation, medical expenses, or home improvement projects. It requires to be detailed financial information and may have specific limits or restrictions. 4. Credit Card Application: For individuals interested in obtaining a credit card, this application will focus on the individual's personal and financial details, including income, expenses, and credit history, to assess their eligibility and determine credit limits. In summary, Bronx New York Individual Credit Applications are essential documents used in the credit application process for various types of loans and credit card applications. By providing comprehensive information about an individual's financial situation, credit history, and personal details, these applications help lenders evaluate an applicant's creditworthiness and make informed decisions regarding loan approvals.

Bronx New York Individual Credit Application

Description

How to fill out Bronx New York Individual Credit Application?

Are you looking for a reliable and affordable legal forms provider to buy the Bronx New York Individual Credit Application? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Bronx New York Individual Credit Application conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is intended for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Bronx New York Individual Credit Application in any provided format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online for good.