The Suffolk New York Individual Credit Application is a comprehensive form used by individuals in Suffolk County, New York, to apply for credit. This application collects essential personal and financial information necessary for evaluating an individual's creditworthiness and determining their eligibility for different types of credit products, such as personal loans, credit cards, auto loans, and mortgages. The Suffolk New York Individual Credit Application is tailored specifically to meet the requirements and regulations of Suffolk County, ensuring compliance with local laws and regulations governing credit transactions. This application serves as a standardized document that financial institutions and lenders in the area used to assess an applicant's creditworthiness and make informed decisions regarding granting credit. To accurately evaluate an individual's creditworthiness, the Suffolk New York Individual Credit Application requests various personal information, including their full legal name, date of birth, social security number, and contact details. Additionally, the application requires information about an individual's employment, including their current employer and position held. This helps lenders assess the stability and consistency of an applicant's income source, crucial to determine their ability to repay the borrowed funds. Furthermore, the application collects detailed financial information, including an individual's current assets, liabilities, monthly expenses, and outstanding debts. This information aids lenders in assessing an individual's debt-to-income ratio and managing their financial obligations effectively. Individuals are also required to disclose their housing status, whether they rent or own a property, as well as details about their monthly rent or mortgage payment. Moreover, the Suffolk New York Individual Credit Application may include additional sections specific to certain credit products. For instance, a mortgage credit application section might require detailed information about real estate holdings, current mortgage information, and property values. By providing accurate and comprehensive details through the Suffolk New York Individual Credit Application, applicants enable lenders to make informed decisions regarding credit approvals, interest rates, and credit limits. It is essential for individuals to carefully review their application, ensuring accuracy and completeness, as incomplete or inaccurate information may lead to delays or a denial of credit. Overall, the Suffolk New York Individual Credit Application streamlines the credit evaluation process for individuals in Suffolk County, New York, and assists lenders in assessing an applicant's creditworthiness effectively. Successful completion of this application may lead to the approval and acquisition of various credit products, enabling individuals to meet their financial needs and goals.

Suffolk New York Individual Credit Application

State:

New York

County:

Suffolk

Control #:

NY-21-CR

Format:

Word;

Rich Text

Instant download

Description

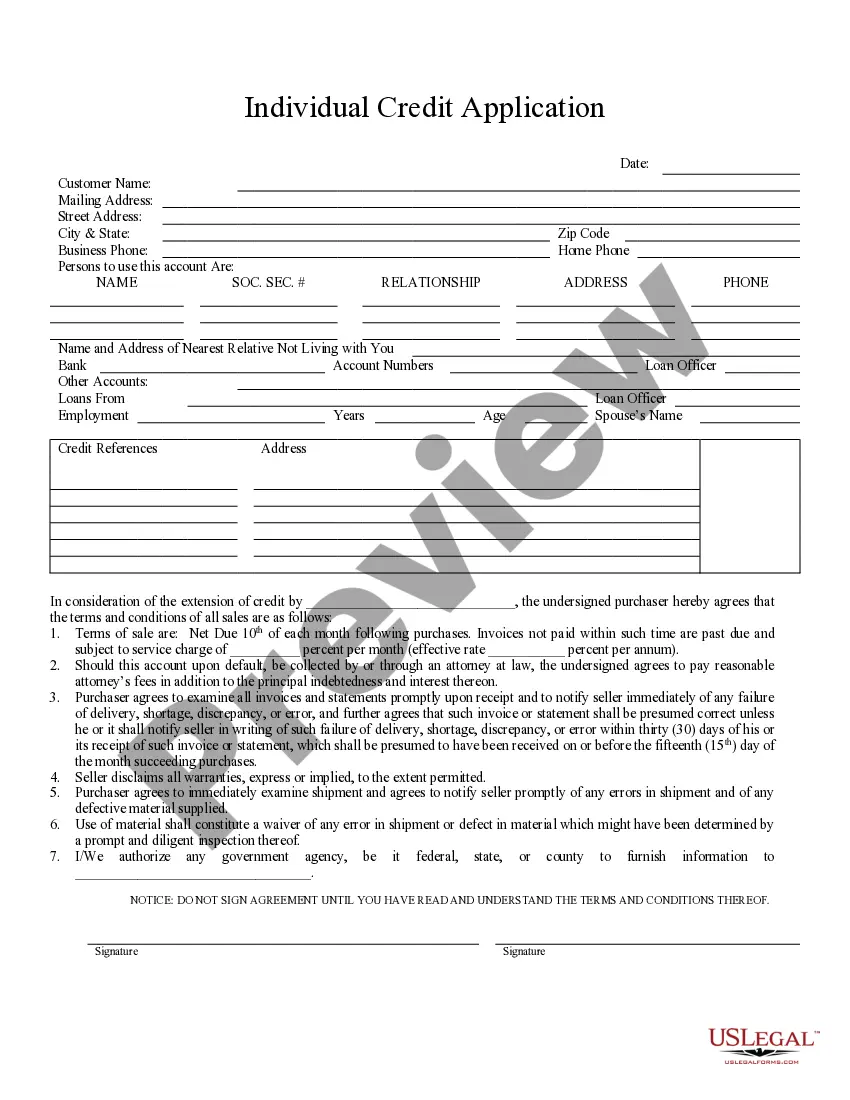

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

The Suffolk New York Individual Credit Application is a comprehensive form used by individuals in Suffolk County, New York, to apply for credit. This application collects essential personal and financial information necessary for evaluating an individual's creditworthiness and determining their eligibility for different types of credit products, such as personal loans, credit cards, auto loans, and mortgages. The Suffolk New York Individual Credit Application is tailored specifically to meet the requirements and regulations of Suffolk County, ensuring compliance with local laws and regulations governing credit transactions. This application serves as a standardized document that financial institutions and lenders in the area used to assess an applicant's creditworthiness and make informed decisions regarding granting credit. To accurately evaluate an individual's creditworthiness, the Suffolk New York Individual Credit Application requests various personal information, including their full legal name, date of birth, social security number, and contact details. Additionally, the application requires information about an individual's employment, including their current employer and position held. This helps lenders assess the stability and consistency of an applicant's income source, crucial to determine their ability to repay the borrowed funds. Furthermore, the application collects detailed financial information, including an individual's current assets, liabilities, monthly expenses, and outstanding debts. This information aids lenders in assessing an individual's debt-to-income ratio and managing their financial obligations effectively. Individuals are also required to disclose their housing status, whether they rent or own a property, as well as details about their monthly rent or mortgage payment. Moreover, the Suffolk New York Individual Credit Application may include additional sections specific to certain credit products. For instance, a mortgage credit application section might require detailed information about real estate holdings, current mortgage information, and property values. By providing accurate and comprehensive details through the Suffolk New York Individual Credit Application, applicants enable lenders to make informed decisions regarding credit approvals, interest rates, and credit limits. It is essential for individuals to carefully review their application, ensuring accuracy and completeness, as incomplete or inaccurate information may lead to delays or a denial of credit. Overall, the Suffolk New York Individual Credit Application streamlines the credit evaluation process for individuals in Suffolk County, New York, and assists lenders in assessing an applicant's creditworthiness effectively. Successful completion of this application may lead to the approval and acquisition of various credit products, enabling individuals to meet their financial needs and goals.

How to fill out Suffolk New York Individual Credit Application?

If you’ve already utilized our service before, log in to your account and save the Suffolk New York Individual Credit Application on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Suffolk New York Individual Credit Application. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!