This form is an official State of New York Family Court sample form, a detailed Order Determining Objection to Adjusted Order - Cost of Living Adjustment (COLA).

Suffolk New York Order Determination of Objections To Adjusted Order COLA

Description

How to fill out New York Order Determination Of Objections To Adjusted Order COLA?

If you've previously utilized our service, Log In to your profile and retrieve the Suffolk New York Order Determining Objection to Adjusted Order - Cost of Living Adjustment - COLA on your device by selecting the Download button. Ensure your subscription remains active. If it's not, renew it based on your payment arrangement.

If this is your inaugural use of our service, adhere to these straightforward instructions to acquire your document.

You have continuous access to every document you've purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Take advantage of the US Legal Forms service to conveniently discover and store any template for your personal or business purposes!

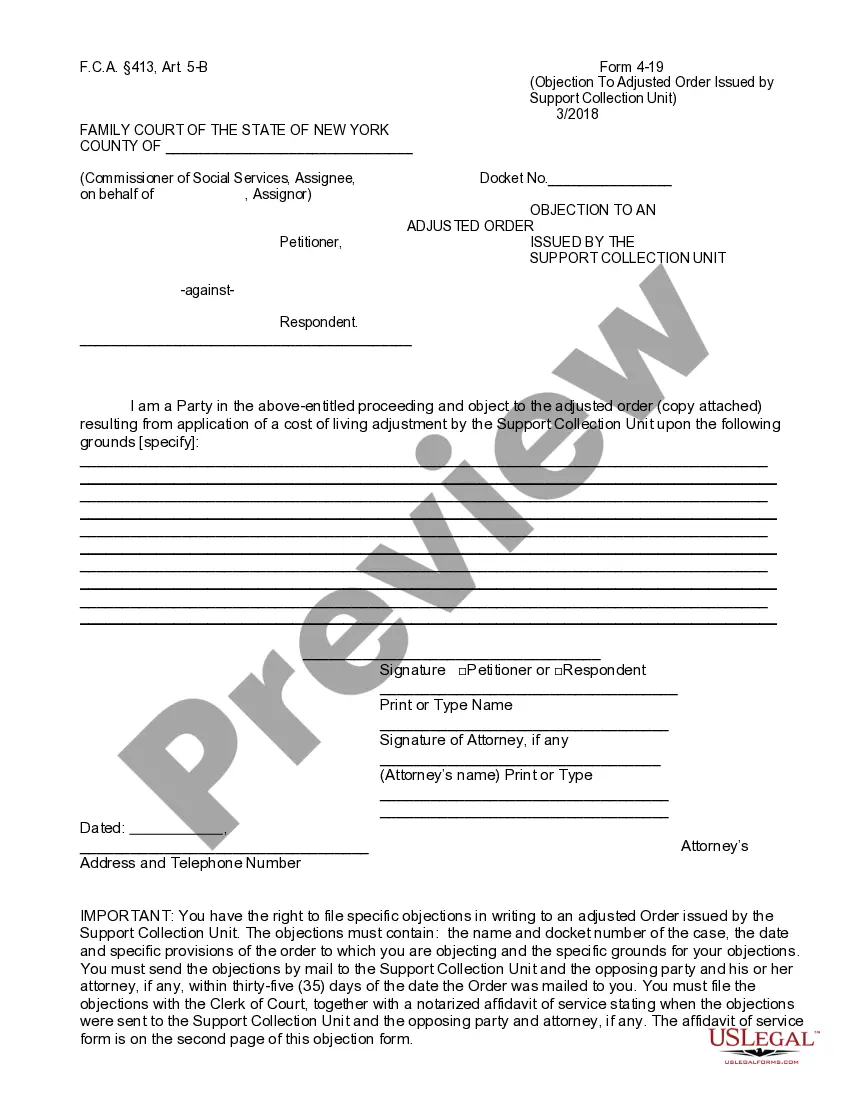

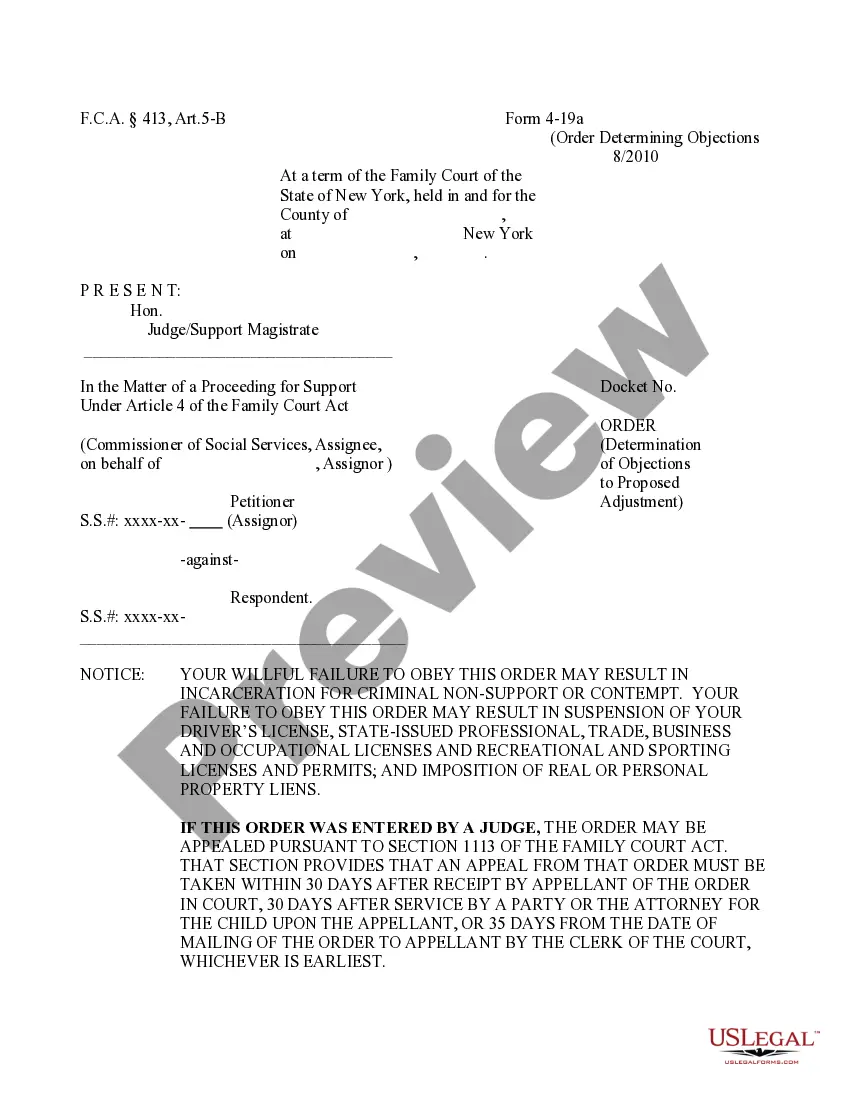

- Confirm you've located a suitable document. Review the summary and utilize the Preview feature, if applicable, to verify it satisfies your requirements. If it does not suit you, utilize the Search tab above to find the correct one.

- Acquire the template. Press the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and finalize your payment. Input your credit card information or use the PayPal option to complete the transaction.

- Receive your Suffolk New York Order Determining Objection to Adjusted Order - Cost of Living Adjustment - COLA. Select the file format for your document and save it to your device.

- Complete your form. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

In New York, while it's common to wait three years before requesting a modification, this is not a strict requirement if you have experienced a significant change in circumstances. If circumstances dictate a change in child support sooner, you may file for modification without waiting. Thus, understanding provisions related to the Suffolk New York Order Determination of Objections To Adjusted Order COLA is crucial for timely adjustments.

To file a petition for modification of child support in New York, start by gathering relevant financial documents and evidence of changes in circumstances. Complete the modification petition form and submit it to the family court in Suffolk, New York. This process is crucial for addressing any necessary adjustments you may want to initiate with regard to the Suffolk New York Order Determination of Objections To Adjusted Order COLA.

The average child support payment for one child in New York typically falls between 17% and 25% of the non-custodial parent’s income, depending on various factors. These factors can include the combined income of both parents and specific needs of the child. Understanding these averages can provide insight when considering adjustments under the Suffolk New York Order Determination of Objections To Adjusted Order COLA.

Filing a written objection involves drafting a formal document that outlines your reasons for disagreeing with a child support order. Make sure to submit your objection to the relevant court in Suffolk, New York, and include any necessary paperwork to support your claim. Following this process is crucial for navigating the complexities involved in the Suffolk New York Order Determination of Objections To Adjusted Order COLA.

When writing a letter for modification of child support, be sure to include your contact information, the case number, and a clear request for modification. Explain the reasons for the modification, perhaps related to changes in income or expenses. It's important to be thorough in the letter, as this will help in your case under the Suffolk New York Order Determination of Objections To Adjusted Order COLA.

To file an objection to a child support order, start by drafting a written objection that clearly states your reasons for the appeal. Submit this document to the appropriate court in Suffolk, New York, along with any required supporting evidence. Following these steps is essential to ensure your concerns are properly reviewed under the Suffolk New York Order Determination of Objections To Adjusted Order COLA.

Writing a written objection requires clarity and conciseness. Start by stating the purpose of your objection, referencing the Suffolk New York Order Determination of Objections To Adjusted Order COLA as necessary. Clearly outline your objections, supported by facts and any relevant documentation. Finally, ensure you follow the court’s filing requirements and include your contact information for any follow-up.

States vary in how they enforce child support obligations, but some are known for stringent measures. Generally, states like New York have rigorous enforcement policies regarding child support. Individuals facing challenges can refer to the Suffolk New York Order Determination of Objections To Adjusted Order COLA for guidance on addressing their specific issues. Always research state-specific laws that may impact your situation.

When writing a letter to request a reduction in child support payments, begin by clearly stating your case. Mention the Suffolk New York Order Determination of Objections To Adjusted Order COLA as you outline your reasons for the reduction. Include any relevant financial changes, such as job loss or increased expenses, that support your request. Conclude with a polite request for the court to consider your situation and guide you on the next steps.

To object to a child support order, you must formally file an objection with the court that issued the order. Reference the Suffolk New York Order Determination of Objections To Adjusted Order COLA in your filing to ensure it’s processed correctly. Make sure to provide clear reasons for your objection, supported by evidence, and follow all court rules for submissions. Consider utilizing legal resources to help navigate this process.