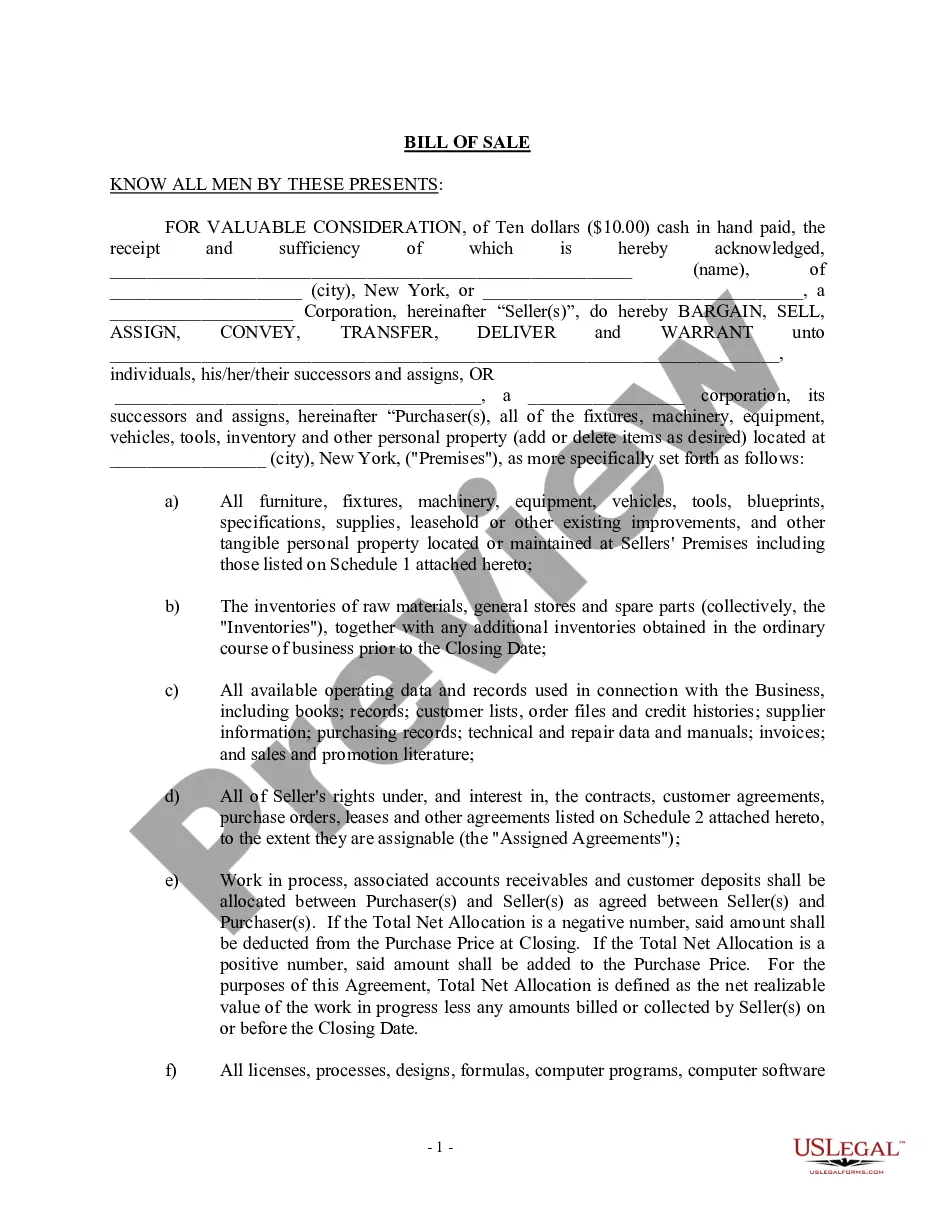

Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out New York Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

If you are seeking a legitimate document, it’s hard to find a more suitable destination than the US Legal Forms website – one of the most extensive collections available online.

Here, you can obtain thousands of templates for both business and personal needs categorized by type and region, or by relevant keywords.

With our advanced search capability, locating the latest Rochester New York Bill of Sale Related to the Sale of a Business by Individual or Corporate Seller is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

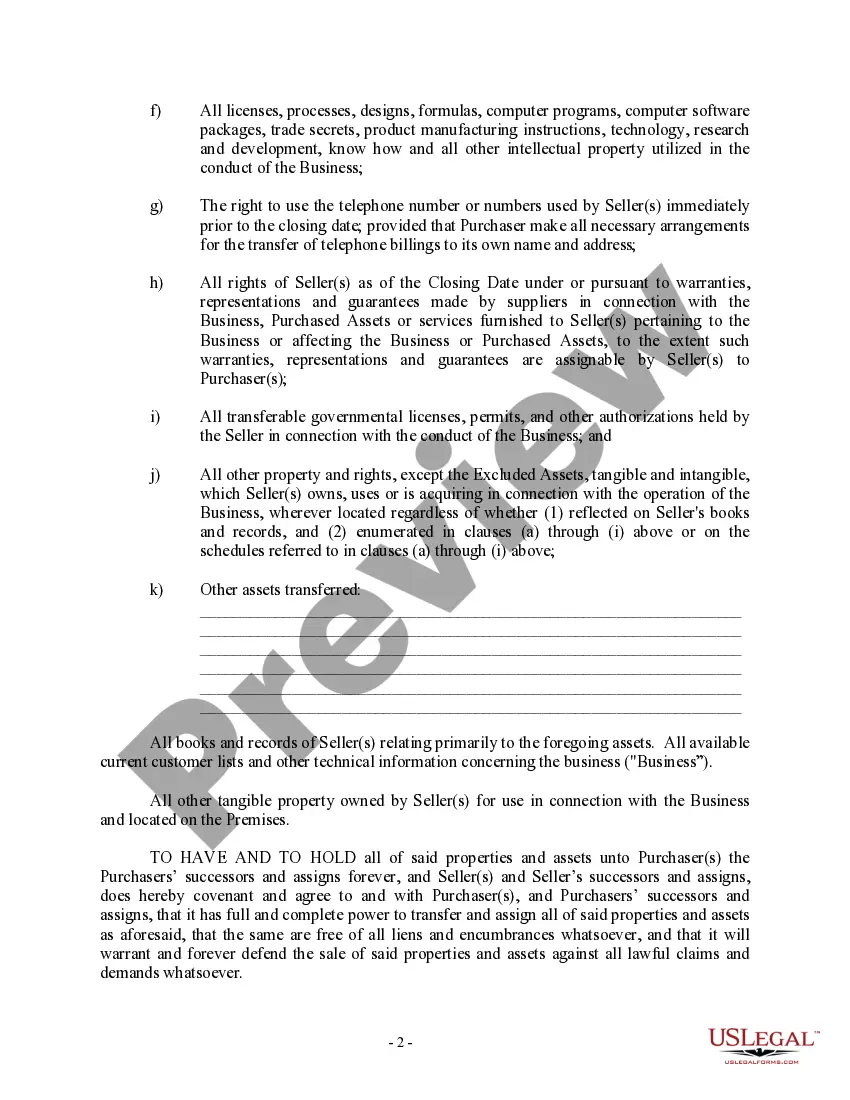

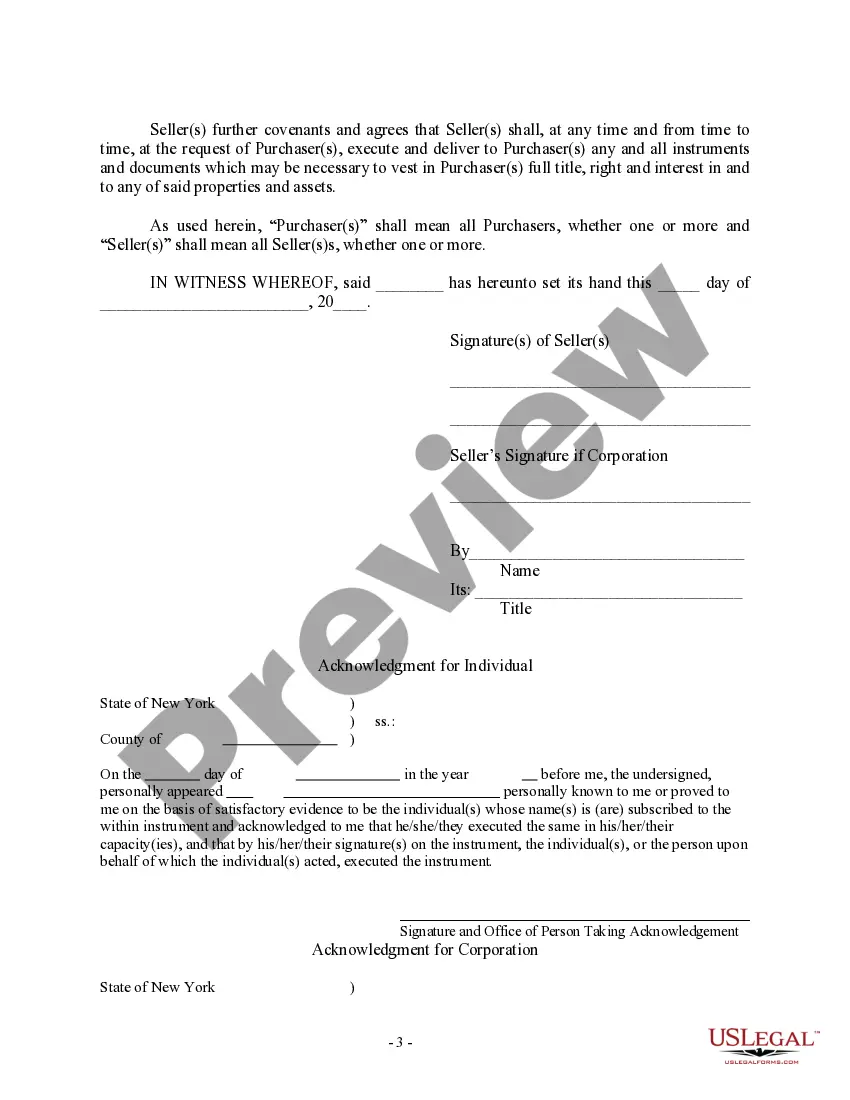

Obtain the form. Choose the file format and download it to your device. Make changes. Fill in, modify, print, and sign the obtained Rochester New York Bill of Sale Related to the Sale of a Business by Individual or Corporate Seller.

- Moreover, the relevance of each document is validated by a team of experienced attorneys who regularly evaluate the templates on our site and update them according to the latest state and county guidelines.

- If you are already familiar with our platform and have a registered account, all you need to obtain the Rochester New York Bill of Sale Related to the Sale of a Business by Individual or Corporate Seller is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have located the form you need. Review its details and utilize the Preview feature to view its content. If it doesn’t satisfy your needs, use the Search box at the top of the screen to find the required document.

- Confirm your choice. Click the Buy now button. Then, select your preferred pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

In New York, a bill of sale is typically required to register a vehicle. It proves the ownership transfer from the seller to you. Utilizing a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can also help when registering vehicles owned by businesses to ensure a smooth registration process.

Sales tax must be collected by any seller engaged in retail sales of tangible personal property or services in New York. This obligation includes businesses that have a physical presence and those that meet online sale thresholds. Ensuring proper tax collection is critical when drafting a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to comply with state laws.

To verify a New York resale certificate, you can check the seller's information against their name and the certificate number provided. The New York State Department of Taxation and Finance has resources available for this purpose. This step is important when you are involved in transactions that require a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, as it ensures that sales tax exemptions are valid.

The process to obtain a certificate of authority to collect sales tax in New York typically takes around two to three weeks if all paperwork is submitted correctly. This certificate is crucial for businesses planning to engage in sales tax transactions. If you’re involved in the sale of a business, secure this certificate as part of the Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller to ensure compliance.

Generally, the seller is required to collect sales tax from the buyer on taxable goods or services sold in New York State. The seller then remits this tax to the state. When using a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it’s crucial to clarify who is responsible for the sales tax as part of the transaction’s terms.

In New York State, the seller typically pays the bulk sales tax during a bulk sale, which often involves significant inventory or assets transferred as part of a business sale. This tax applies to ensure that the state collects taxes on transactions that may be structured to avoid sales tax. For businesses, understanding the implications of the bulk sales tax requires careful planning, especially in transactions documented with a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Yes, you can write your own bill of sale in New York; however, you should ensure it meets specific legal requirements. When drafting a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, include details such as the names of the buyer and seller, a description of the business being sold, and terms of the sale. Consider using a platform like uslegalforms for templates and guidance, which can help you create a clear and legally sound document.

To report the sale of your business, you need to notify the relevant local and state authorities in Rochester, New York. Typically, this involves completing the appropriate forms and, if applicable, filing a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. This document serves as an important record of the transaction, ensuring that both parties acknowledge the change of ownership. You may also consider consulting with a legal professional to ensure compliance with all applicable laws.

To obtain a certificate of authority in New York, you must apply through the New York State Department of Taxation and Finance. This involves submitting a completed application along with the appropriate fees. If you’re planning to conduct sales related to a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, securing this certificate is a vital step for compliance with New York sales tax regulations.

In New York, certain items are exempt from sales tax, like food for home consumption, prescription medications, and certain educational materials. Understanding what qualifies for exemption can greatly benefit both buyers and sellers. When executing transactions using a Rochester New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, it’s important to clarify which items may be exempt to avoid unnecessary tax charges.