An assignment is the transfer of a property right or title to some particular person or entity under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, chattel, or other thing assigned. An assignment is distinguished from a grant in that an assignment is usually limited to the transfer of intangible rights, including contractual rights, choses in action, and rights in or connected with property, rather than, as in the case of a grant, the property itself. For example, the payee may assign his or her rights to collect the note payments to a bank.

Rochester New York Assignment of Lease and Rent from Borrower to Lender

Description

How to fill out New York Assignment Of Lease And Rent From Borrower To Lender?

We consistently endeavor to reduce or avert legal harm when engaging with intricate law-related or financial issues.

To achieve this, we enroll in legal services that are generally quite costly.

Nonetheless, not all legal challenges are overly complicated.

The majority of them can be managed by ourselves.

Utilize US Legal Forms whenever you seek to locate and download the Rochester New York Assignment of Lease and Rent from Borrower to Lender or any other document efficiently and securely. Simply Log In to your account and click the Get button beside it. If you misplace the document, you can always retrieve it again from the My documents tab. The process is equally simple if you're new to the platform! You can register your account in just a few minutes. Ensure to verify that the Rochester New York Assignment of Lease and Rent from Borrower to Lender complies with the laws and regulations of your state and region. Additionally, it’s essential to review the form's description (if available), and if you find any inconsistencies with what you initially sought, look for a different template. Once you've confirmed that the Rochester New York Assignment of Lease and Rent from Borrower to Lender suits your case, you can select the subscription option and continue to payment. Afterwards, you can download the document in any desired format. For more than 24 years in the market, we’ve assisted millions by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms today to conserve effort and resources!

- US Legal Forms is an online directory of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to take control of your affairs without needing to consult an attorney.

- We offer access to legal form templates that aren't always publicly available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

To perfect the assignment of leases and rents, it is essential to document the agreement clearly and ensure all parties sign off on the transfer. Additionally, notifying tenants and possibly obtaining their consent may also be necessary for the assignment to be legally binding. In cases dealing with the Rochester New York Assignment of Lease and Rent from Borrower to Lender, utilizing platforms like USLegalForms can streamline the process and ensure legal compliance.

An assignable lease is a rental agreement that permits the tenant to transfer their lease rights to another party as specified in the lease terms. This flexibility can benefit tenants seeking to leave a property while ensuring the landlord continues to receive rental income. By examining agreements related to the Rochester New York Assignment of Lease and Rent from Borrower to Lender, you can grasp the importance of having assignable lease provisions.

A lease transfer involves relinquishing all rights and responsibilities of a tenant to a new tenant, while an assignment allows the original tenant to retain some responsibilities. In an assignment, the original tenant remains responsible for the lease terms, whereas in a transfer, the new tenant takes over completely. Understanding these distinctions is significant when navigating the Rochester New York Assignment of Lease and Rent from Borrower to Lender.

The assignment of lease involves transferring the rights and responsibilities from one tenant to another within a rental agreement. This process can be crucial in maintaining rental income for property owners and maximizing lease agreements. With respect to the Rochester New York Assignment of Lease and Rent from Borrower to Lender, this concept is pivotal for ensuring a seamless continuation of rental agreements.

Rent assignment refers to the process by which a property owner transfers their rights to collect rent from tenants to another entity, usually as a part of a financing arrangement. This type of assignment ensures that the lender receives timely payments directly, thus reducing their risk. For those involved in the Rochester New York Assignment of Lease and Rent from Borrower to Lender, understanding rent assignment is key to navigating financial agreements.

A general assignment of rents is the assignment by the lessor to his creditor of rents under unspecified leases, which may or may not be in existence and which may or may not be registered.

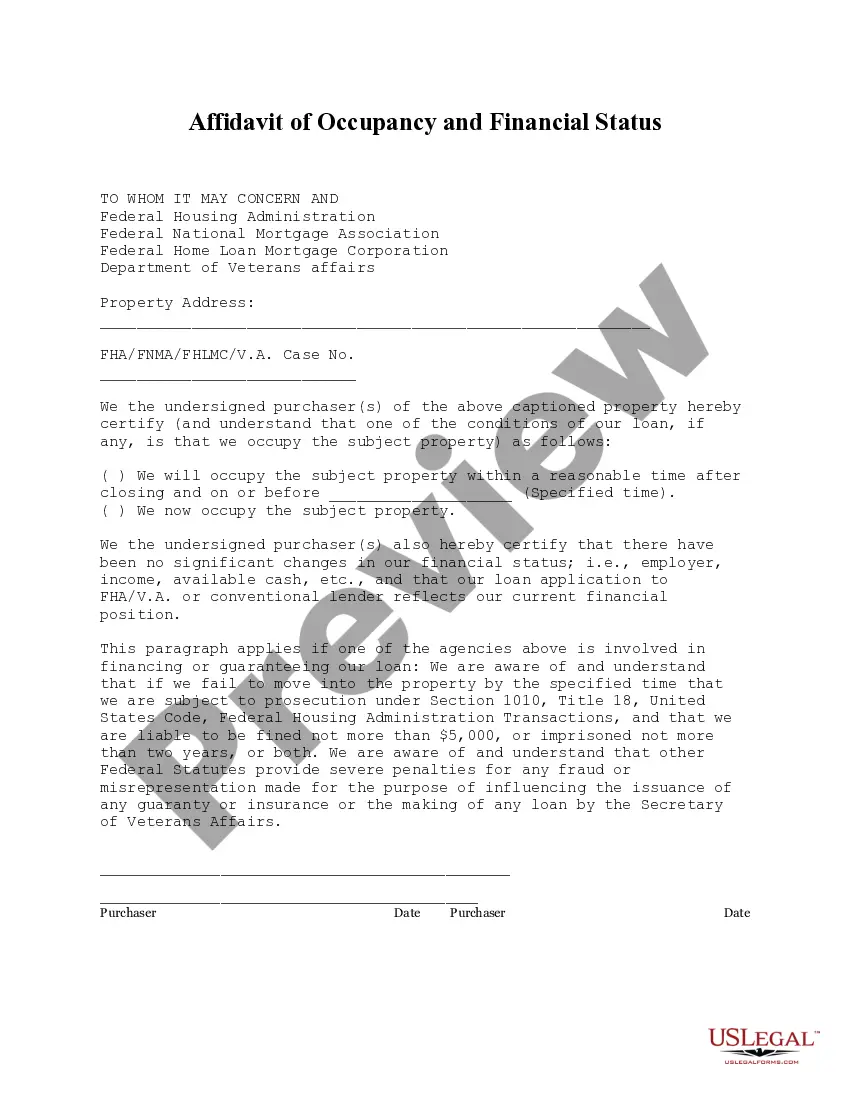

The assignment of leases and rents, also known as the assignment of leases rents and profits, is a legal document that gives a mortgage lender right to any future profits that may come from leases and rents when a property owner defaults on their loan. This document is usually attached to a mortgage loan agreement.

An ?assignment of rents? allows the lender to collect the rent payments, if the borrower defaults on their loan payments.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

An assignment is when the tenant transfers their lease interest to a new tenant using a Lease Assignment. The assignee takes the assignor's place in the landlord-tenant relationship, although the assignor may remain liable for damages, missed rent payments, and other lease violations.