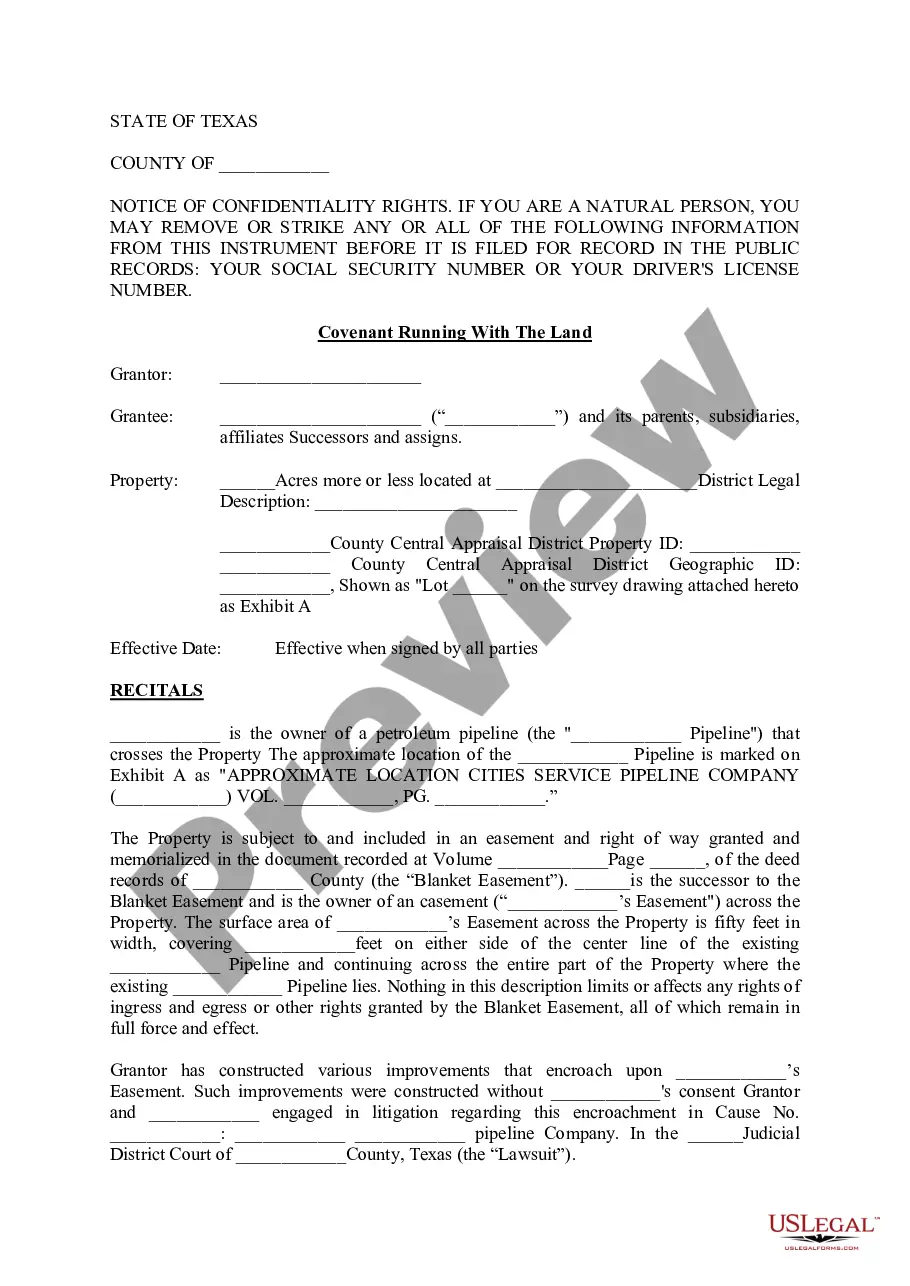

Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate is a legal document required during real estate transactions in Queens, New York. It encompasses both the Combined Transfer Tax Return and the Credit Line Mortgage Certificate, ensuring compliance with state regulations and facilitating the transfer of property ownership. The Combined Transfer Tax Return portion of the document is a comprehensive report, submitted to the appropriate authorities, that outlines the financial aspects of the property transfer. It includes details such as the names of the buyer and seller, property address, purchase price, and any applicable transfer taxes. This information helps determine the appropriate transfer tax due upon the property's transfer of ownership. The Credit Line Mortgage Certificate component is essential when property owners seek to take out a mortgage against their Queens property. It verifies the property's details and owner's information for lenders. This certificate allows property owners to secure credit lines, use their properties as collateral, or access financial assistance based on the property's value. Different types of Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate may exist based on the specific real estate transaction and requirements. For instance: 1. Residential Property Combined Transfer Tax Return and Credit Line Mortgage Certificate: This variant applies to residential real estate transactions in Queens, New York. 2. Commercial Property Combined Transfer Tax Return and Credit Line Mortgage Certificate: Designed for commercial property transfers, this type caters to transactions involving office spaces, retail buildings, warehouses, or other commercial establishments in Queens. 3. Condominium Combined Transfer Tax Return and Credit Line Mortgage Certificate: This type specifically caters to the transfer and mortgage needs related to condominium units in Queens. 4. Cooperative Combined Transfer Tax Return and Credit Line Mortgage Certificate: Focusing on the unique requirements of cooperative buildings, this certificate facilitates ownership transfer and mortgage processing for cooperative units in Queens. It's important to consult legal professionals or relevant authorities to determine the specific requirements and procedures associated with each type of Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate. Compliance with these documents ensures a smooth and legally compliant real estate transaction process in Queens, New York.

Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate

Description

How to fill out Queens New York State Combined Transfer Tax Return And Credit Line Mortgage Certificate?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any legal education to draft such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform offers a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate in minutes employing our reliable platform. In case you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

However, in case you are new to our library, ensure that you follow these steps prior to obtaining the Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate:

- Be sure the form you have found is good for your location since the regulations of one state or area do not work for another state or area.

- Preview the form and read a short outline (if provided) of cases the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start over and look for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Queens New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate once the payment is through.

You’re good to go! Now you can go on and print out the form or fill it out online. In case you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.