The Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate is a crucial document that serves multiple purposes during property transactions in Syracuse, New York. This comprehensive form facilitates the reporting and payment of transfer taxes while also acknowledging any credit line mortgage certificates associated with the transaction. With its significance, understanding the different types of this document becomes equally important. The Syracuse New York State Combined Transfer Tax Return is an integral part of property transfers in Syracuse. This form captures all necessary details regarding the property being transferred, such as the address, property type, and legal description. Additionally, it requires information about the buyer and seller, including their names, addresses, and contact information. The return also collects data about the purchase price, mortgage amount, and any exemptions or adjustments that may apply, ensuring accurate taxation. The Credit Line Mortgage Certificate, on the other hand, is attached to the Transfer Tax Return when a credit line mortgage is involved in the transaction. This certificate provides specific information about the mortgage, such as the mortgagee's name and address, the principal amount, and the date of the mortgage. Including this certificate in the documentation allows for appropriate acknowledgment and recording of credit line mortgages, ensuring legal compliance. Furthermore, it is important to note that there may be variations of the Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate based on specific circumstances or property types. For instance, in cases where the property being transferred is a cooperative unit rather than a conventional residential or commercial property, a specialized version of the transfer tax return and certificate may be required. It is essential to consult the appropriate authorities or legal professionals to ensure the usage of the correct form for each unique transaction. In conclusion, the Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate are critical components of property transactions in Syracuse, New York. These documents enable the accurate reporting and payment of transfer taxes while also acknowledging credit line mortgages. While the basic form covers standard property transfers, variations may exist to accommodate different property types, such as cooperative units. Proper understanding and utilization of these documents are crucial to ensure compliance with Syracuse's regulations and to facilitate smooth property transfers.

Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate

State:

New York

City:

Syracuse

Control #:

NY-92398

Format:

PDF

Instant download

Public form

Description

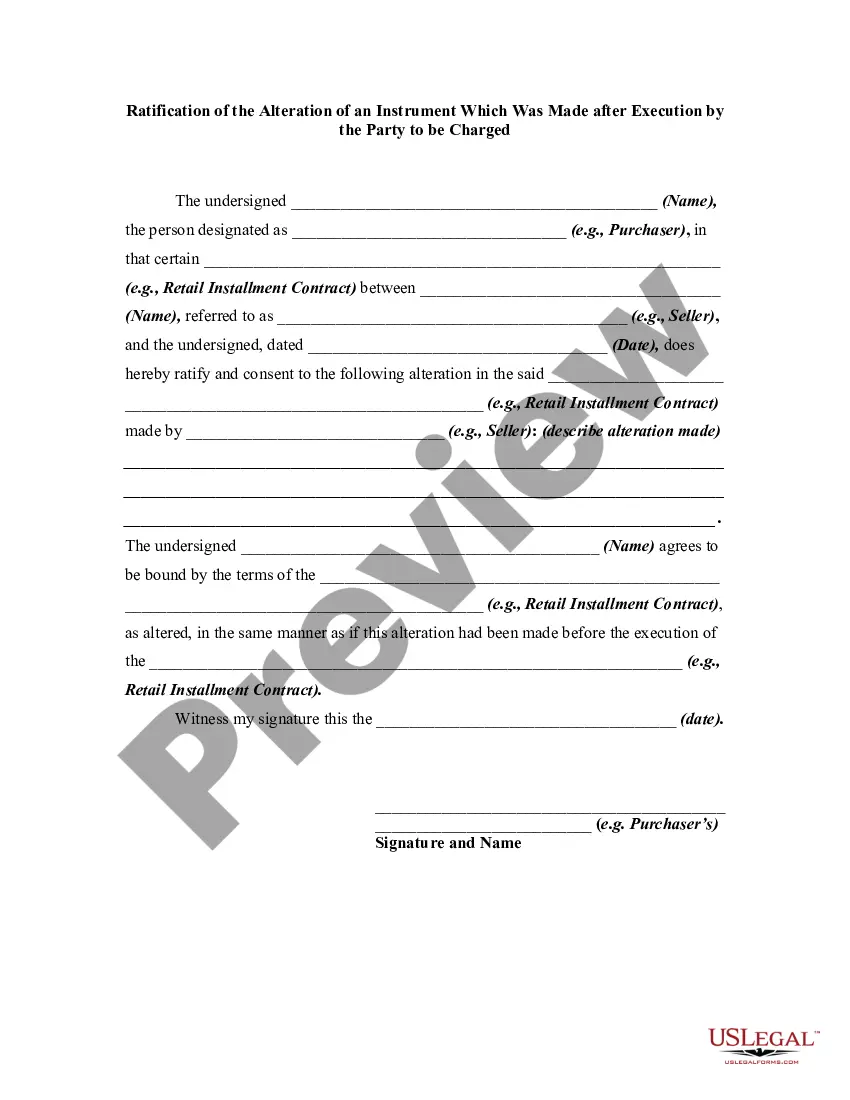

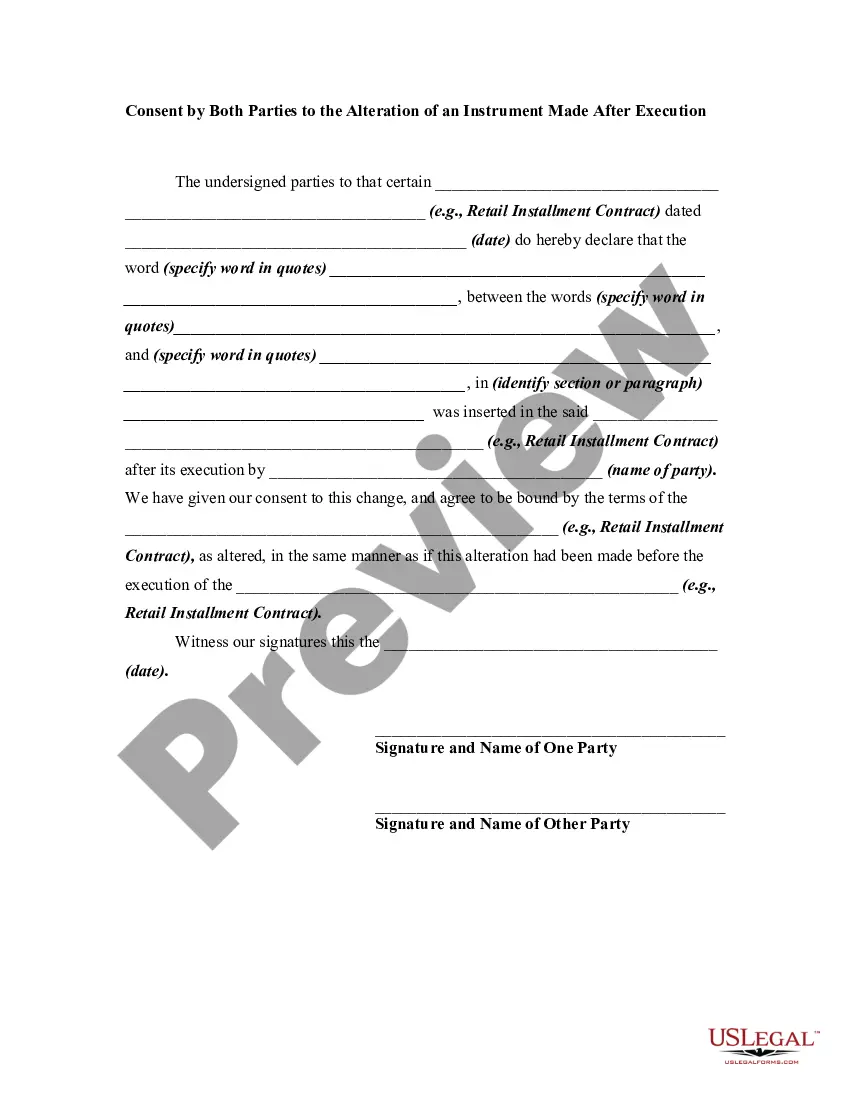

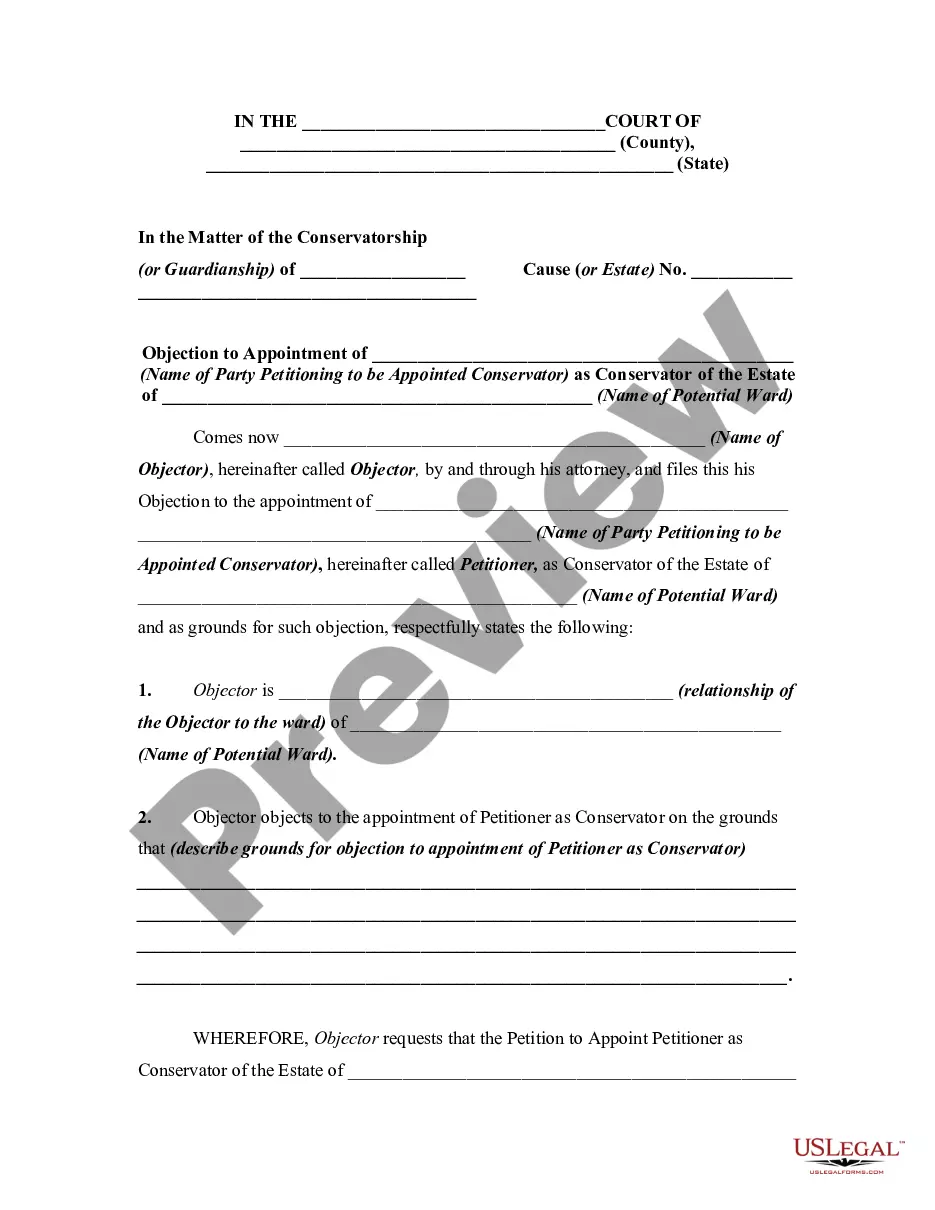

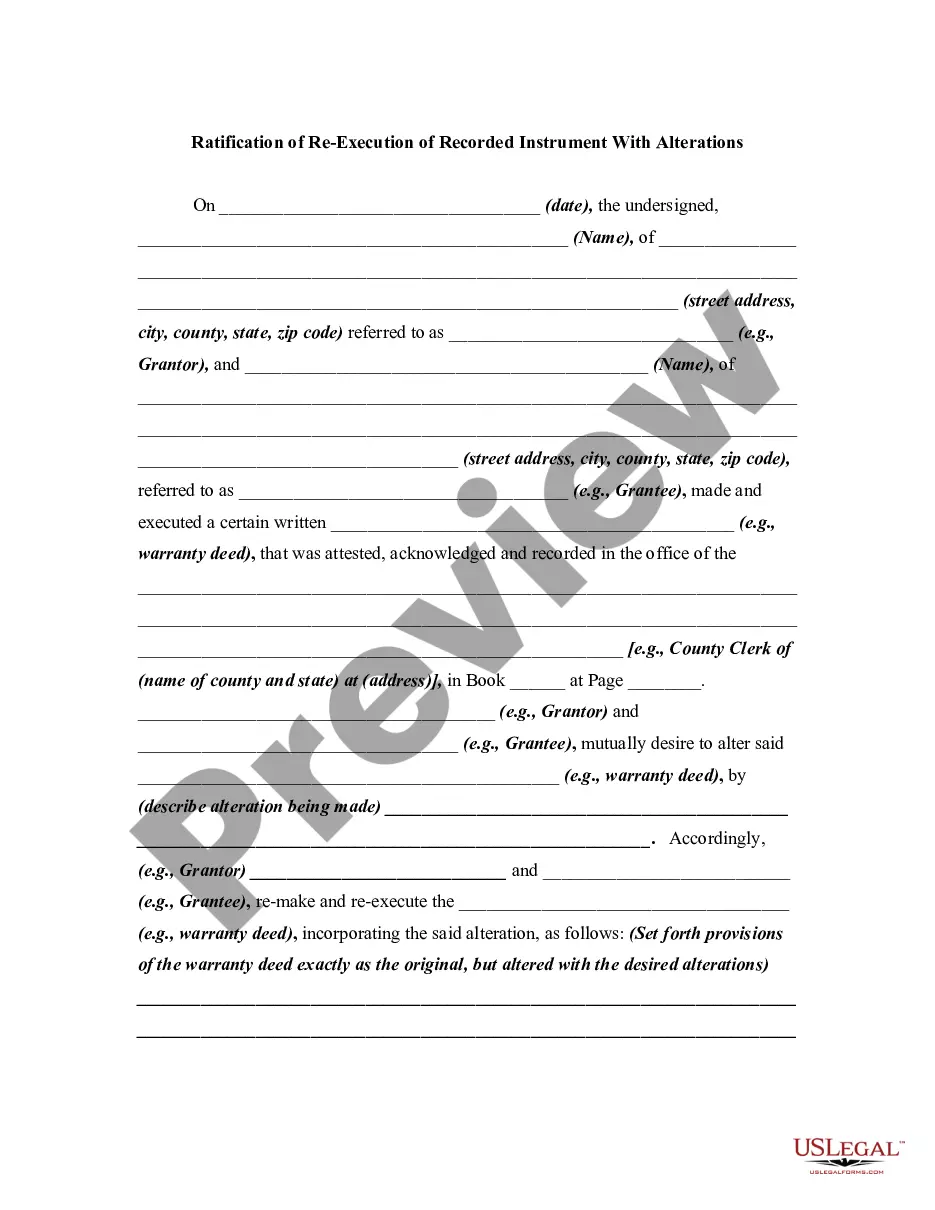

This form, a New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate, is easily completed or adapted to fit your circumstances. Available for download now.

The Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate is a crucial document that serves multiple purposes during property transactions in Syracuse, New York. This comprehensive form facilitates the reporting and payment of transfer taxes while also acknowledging any credit line mortgage certificates associated with the transaction. With its significance, understanding the different types of this document becomes equally important. The Syracuse New York State Combined Transfer Tax Return is an integral part of property transfers in Syracuse. This form captures all necessary details regarding the property being transferred, such as the address, property type, and legal description. Additionally, it requires information about the buyer and seller, including their names, addresses, and contact information. The return also collects data about the purchase price, mortgage amount, and any exemptions or adjustments that may apply, ensuring accurate taxation. The Credit Line Mortgage Certificate, on the other hand, is attached to the Transfer Tax Return when a credit line mortgage is involved in the transaction. This certificate provides specific information about the mortgage, such as the mortgagee's name and address, the principal amount, and the date of the mortgage. Including this certificate in the documentation allows for appropriate acknowledgment and recording of credit line mortgages, ensuring legal compliance. Furthermore, it is important to note that there may be variations of the Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate based on specific circumstances or property types. For instance, in cases where the property being transferred is a cooperative unit rather than a conventional residential or commercial property, a specialized version of the transfer tax return and certificate may be required. It is essential to consult the appropriate authorities or legal professionals to ensure the usage of the correct form for each unique transaction. In conclusion, the Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate are critical components of property transactions in Syracuse, New York. These documents enable the accurate reporting and payment of transfer taxes while also acknowledging credit line mortgages. While the basic form covers standard property transfers, variations may exist to accommodate different property types, such as cooperative units. Proper understanding and utilization of these documents are crucial to ensure compliance with Syracuse's regulations and to facilitate smooth property transfers.

How to fill out Syracuse New York State Combined Transfer Tax Return And Credit Line Mortgage Certificate?

If you’ve already utilized our service before, log in to your account and download the Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Syracuse New York State Combined Transfer Tax Return and Credit Line Mortgage Certificate. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!