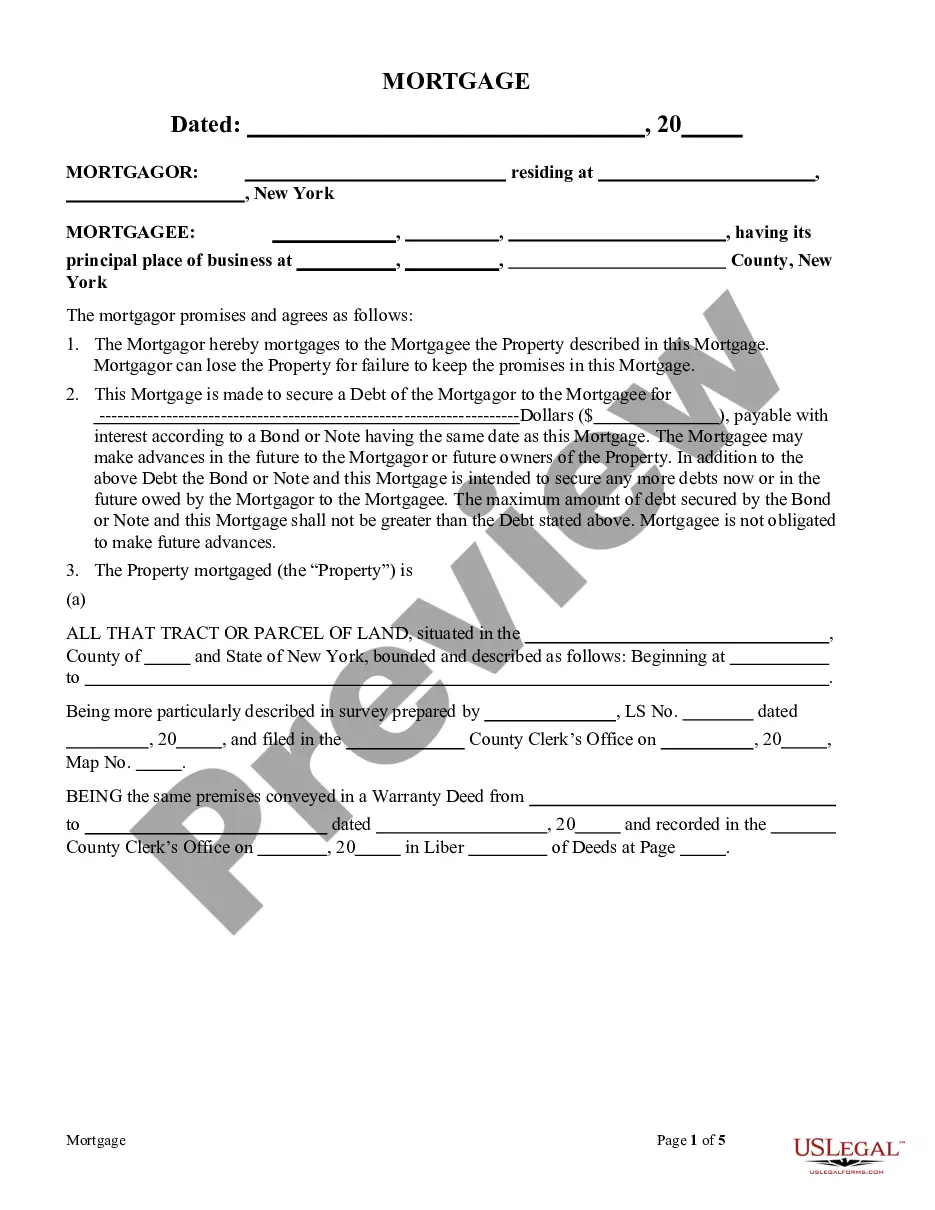

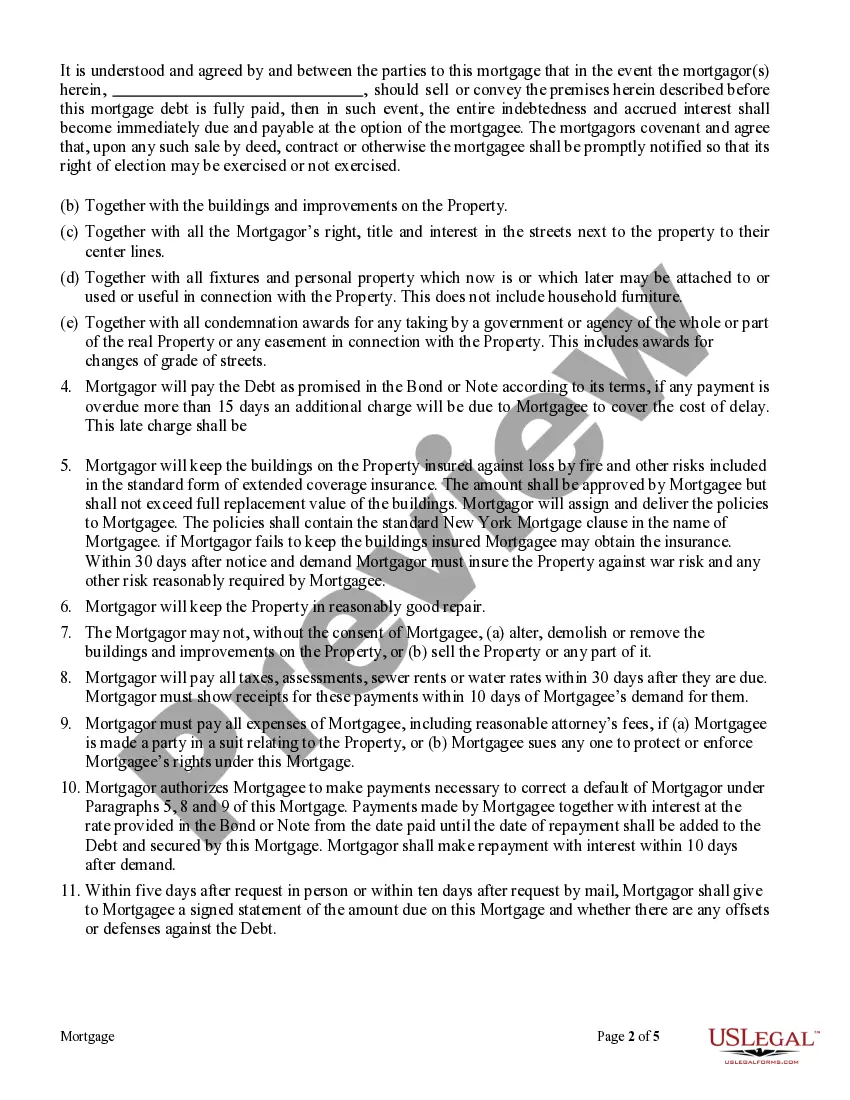

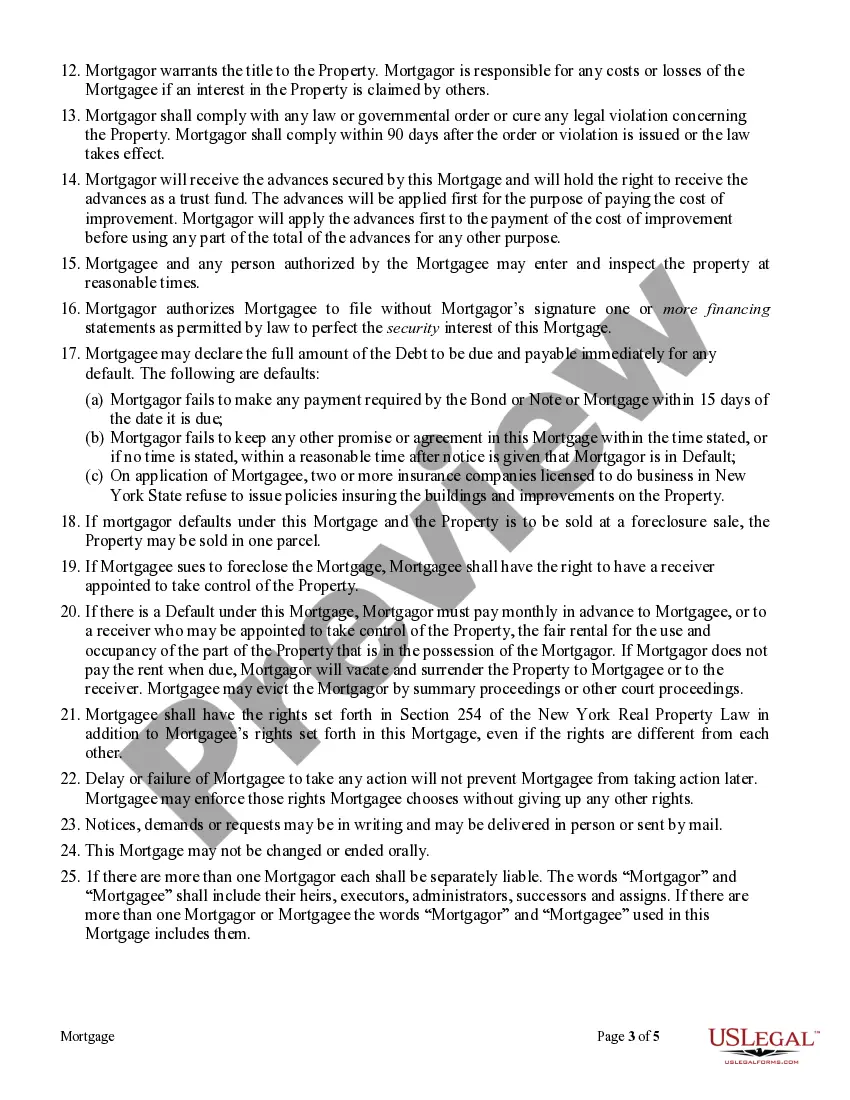

Syracuse New York Mortgage — Less Complex Form: A Detailed Description If you are considering applying for a mortgage in Syracuse, New York, you might encounter the term "Less Complex Form." This refers to a specific type of mortgage application process that aims to simplify and streamline the borrowing procedure for prospective homeowners. By using relevant keywords, let's delve into what Syracuse New York Mortgage — Less Complex Form entails and highlight any distinct variations that exist. The Less Complex Form option is generally offered by mortgage lenders in Syracuse, New York, to provide a quicker and more accessible method for individuals seeking mortgage loans. It aims to simplify the application process, reducing paperwork and the overall complexity typically associated with mortgage applications. This option is particularly beneficial to those who prefer a more streamlined approach or have limited time to invest in lengthy application procedures. The Syracuse New York Mortgage — Less Complex Form is typically characterized by a user-friendly online interface, allowing borrowers to complete the application digitally from the comfort of their homes. By utilizing an intuitive layout and clear instructions, lenders ensure a seamless experience for applicants. This online platform enables borrowers to input their personal information, financial details, and property information in a series of straightforward steps, making the process less time-consuming and hassle-free. It is important to note that while the Less Complex Form approach ensures simplicity and convenience, it still requires borrowers to provide accurate and comprehensive information to assess their eligibility for a mortgage. Applicants will typically be required to provide details such as their employment history, income, credit score, and any outstanding debts. Additionally, information on the property being financed, such as its value and location, may also be required. As for the different types of Syracuse New York Mortgage — Less Complex Form, lenders may offer various loan options tailored to the specific needs of borrowers. Some common variations include fixed-rate mortgages, adjustable-rate mortgages (ARM's), government-insured loans (such as FHA or VA loans), and jumbo loans for higher loan amounts. Each type of mortgage offers different terms, interest rates, and eligibility criteria, so it's crucial for applicants to thoroughly research and select the option that best suits their financial circumstances and long-term goals. In summary, Syracuse New York Mortgage — Less Complex Form refers to a user-friendly and digitally accessible alternative for individuals seeking mortgage loans in Syracuse. By simplifying the application process and leveraging an intuitive online interface, lenders aim to streamline the borrowing procedure, making it more convenient and time-efficient. However, it is essential for borrowers to understand that despite the simplified approach, accurate and comprehensive information is still required. Success in securing a mortgage ultimately depends on meeting lenders' eligibility criteria and selecting the most appropriate mortgage type based on individual financial circumstances.

Syracuse New York Mortgage - Less Complex Form

Description

How to fill out Syracuse New York Mortgage - Less Complex Form?

Take advantage of the US Legal Forms and have immediate access to any form you require. Our helpful website with a large number of documents makes it simple to find and obtain virtually any document sample you need. It is possible to download, complete, and sign the Syracuse New York Mortgage - Less Complex Form in just a matter of minutes instead of browsing the web for many hours attempting to find an appropriate template.

Utilizing our library is a great way to raise the safety of your record submissions. Our professional lawyers on a regular basis check all the records to make sure that the templates are appropriate for a particular state and compliant with new acts and polices.

How can you obtain the Syracuse New York Mortgage - Less Complex Form? If you already have a profile, just log in to the account. The Download button will appear on all the documents you look at. Additionally, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the instruction below:

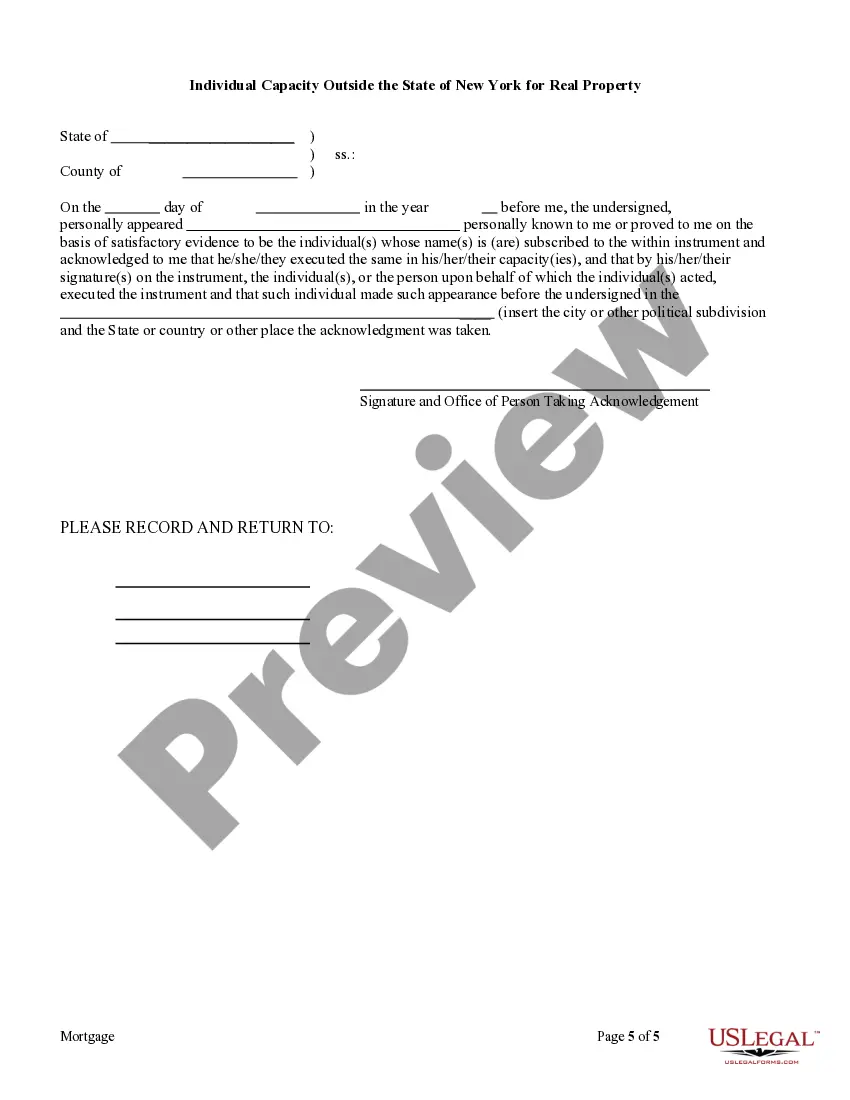

- Find the form you require. Ensure that it is the form you were looking for: check its name and description, and use the Preview option if it is available. Otherwise, utilize the Search field to find the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Select the format to get the Syracuse New York Mortgage - Less Complex Form and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable form libraries on the internet. Our company is always ready to help you in any legal case, even if it is just downloading the Syracuse New York Mortgage - Less Complex Form.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!