The Syracuse New York Employer's Statement of Wage Earnings for Workers' Compensation is a crucial document that serves as a proof of a worker's compensation history and earnings. This statement is typically provided by employers in Syracuse, New York, and plays a vital role in determining the appropriate compensation a worker is entitled to receive in case of an injury or disability occurring on the job. The Employer's Statement of Wage Earnings provides comprehensive information related to an employee's wages, including regular pay, overtime, bonuses, and other forms of income. It is essential to accurately record these details to ensure fair compensation and adhere to workers' compensation regulations in Syracuse, New York. Employers in Syracuse, New York, are required to complete this statement accurately and in a timely manner. Failure to provide this document can result in delays in compensation and can negatively impact the injured worker's ability to receive the benefits they are entitled to. Different types of Syracuse New York Employer's Statement Of Wage Earnings for Workers' Compensation may include: 1. Regular Wage Earnings: This section outlines the worker's regular earnings, which typically refers to the base salary or hourly wage they receive for their normal working hours. 2. Overtime Wage Earnings: If applicable, this section lists the overtime wages earned by an employee during the reporting period covered by the statement. Syracuse's employers must specify the number of overtime hours worked, the rate of pay, and the additional compensation received. 3. Bonus/Commission: This category includes any additional income sources an employee may have received, such as bonuses, commissions, or profit-sharing distributions. Employers must detail the specific nature of these additional earnings and accurately report the amounts. 4. Tips/Gratuities: If an employee regularly receives tips or gratuities as part of their job, this section should document these earnings. Syracuse's employers need to accurately report the amount of tips received by an employee during the specified period. 5. Other Compensation Categories: This section covers additional compensation sources, such as severance pay, vacation pay, sick pay, or reimbursements for job-related expenses. Employers must provide a breakdown of these earnings, specifying the nature of the compensation and the corresponding amounts. It is crucial for employers in Syracuse, New York, to carefully and accurately complete the Employer's Statement of Wage Earnings for Workers' Compensation. This statement ensures that injured workers receive fair and appropriate compensation, enabling them to cope with their injuries and maintain financial stability during their recovery. Employers must understand the importance of timely submission of this document to avoid any unnecessary delays or complications in the workers' compensation process.

Syracuse New York Employer's Statement Of Wage Earnings for Workers' Compensation

Description

How to fill out Syracuse New York Employer's Statement Of Wage Earnings For Workers' Compensation?

If you are looking for a legitimate form template, it’s incredibly challenging to discover a more user-friendly service than the US Legal Forms website – one of the largest online collections.

With this collection, you can locate thousands of document samples for business and personal purposes by categories and areas, or keywords.

Utilizing our advanced search feature, finding the most recent Syracuse New York Employer's Statement Of Wage Earnings for Workers' Compensation is as simple as 1-2-3.

Access the template. Choose the file format and download it onto your device.

Edit. Complete, modify, print, and sign the obtained Syracuse New York Employer's Statement Of Wage Earnings for Workers' Compensation. Each template you store in your account has no expiration date and belongs to you permanently. You can access them through the My documents section, so if you need to obtain an additional copy for enhancement or making a physical version, you can return and save it again at any time. Utilize the US Legal Forms professional directory to access the Syracuse New York Employer's Statement Of Wage Earnings for Workers' Compensation you were searching for and thousands of other professional and state-specific templates all on one site!

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Syracuse New York Employer's Statement Of Wage Earnings for Workers' Compensation is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have located the sample you require. Review its description and utilize the Preview function to check its content. If it does not fulfill your needs, employ the Search option at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. Then, select the desired pricing plan and provide details to create an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Nine Things You Should Look For In Your Pay Stubs Gross wages earned; Total hours worked; All deductions; Net wages earned; The inclusive dates of the period for which the employee is paid; The name of the employee and only the last four digits of his/her Social Security Number and/or Employee ID number;

The amount that a worker receives is based on his/her average weekly wage for the 52-week period immediately prior to the date of the accident. The following formula is used to calculate benefits: 2/3 x average weekly wage x % of disability = weekly benefit.

For most employees, a pay stub or wage statement must include the ?total hours worked by the employee.? If an employee's pay stub does not include total hours worked, the employer may be in violation of California wage statement laws.

Wage Statements The employee's name and address. The hours worked by the employee. The employee's wage rate. The overtime wage rate. The hours worked at the overtime rate. Any other payment to which the employee is entitled (e.g., a bonus) The amount and purpose of all deductions.

Related Definitions Wage records means all records evidencing all wages, commissions, overtime pay, gratuities, meals, board, rent, housing or lodging received from any employer during all time periods relevant to the act.

(Labor Code Section 226(a)(7)) The following information is required to be on your itemized statement: Gross wages earned. Total hours worked (not required for salaried exempt employees) The number of piece-rate units earned and any applicable piece rate if the employee is paid on a piece rate basis.

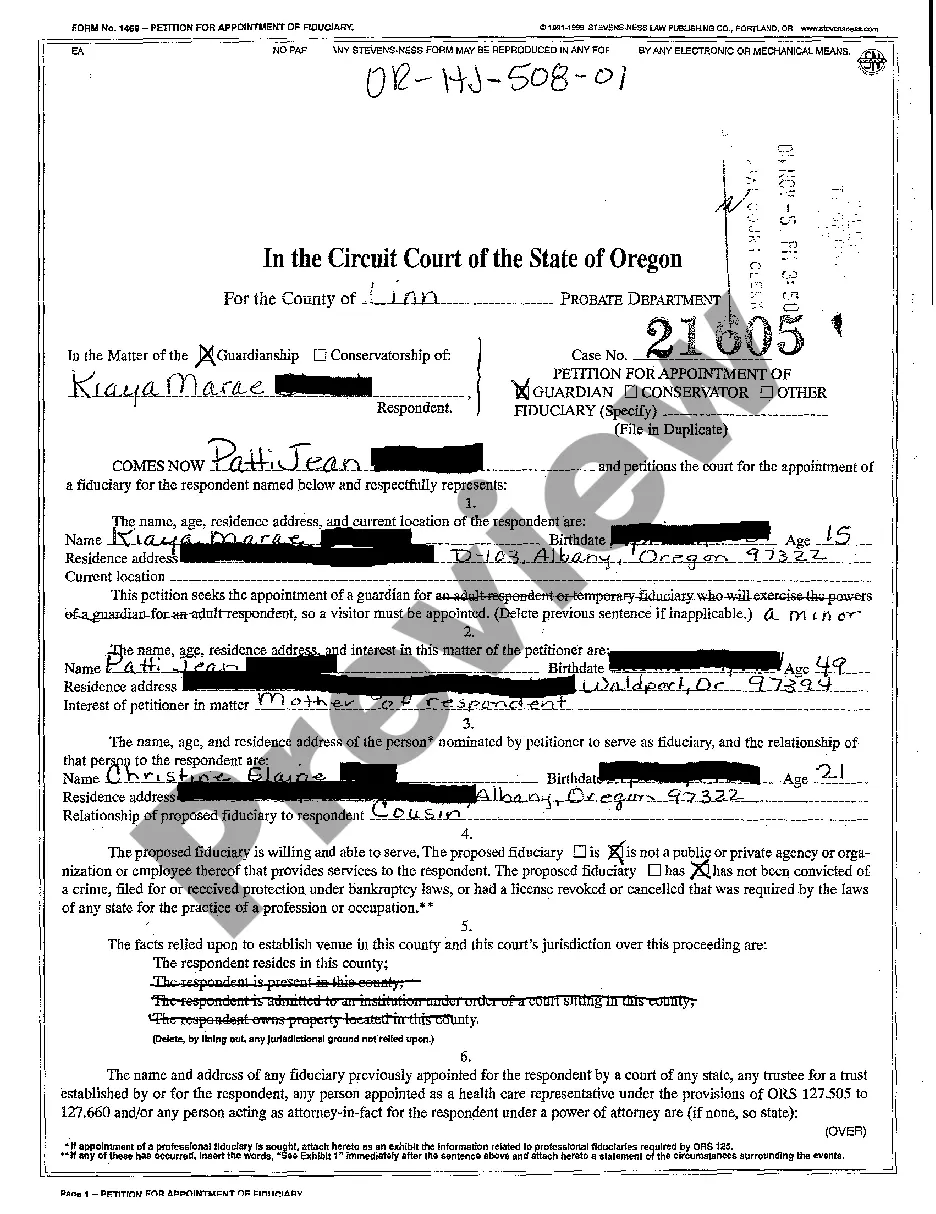

240: Employer's Statement of Wage Earnings Preceding Date of Accident. Promptly report accurate wage and attendance information about the injured worker to NYSIF by submitting Form 240 to establish the validity of a claim and the compensation rate, if awarded.

Sole-Proprietors included on workers' compensation coverage must use a minimum payroll amount of $37,700 and a maximum payroll amount of $114,400 for rating their overall workers' compensation cost. Partners and LLC must be included at a minimum of $35,100 and a maximum of $106,600.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

Earnings statements (also called pay stubs or check stubs) are important payroll records for employers and employees that document information about wages paid, hours worked, deductions made and benefits accrued by an employee.