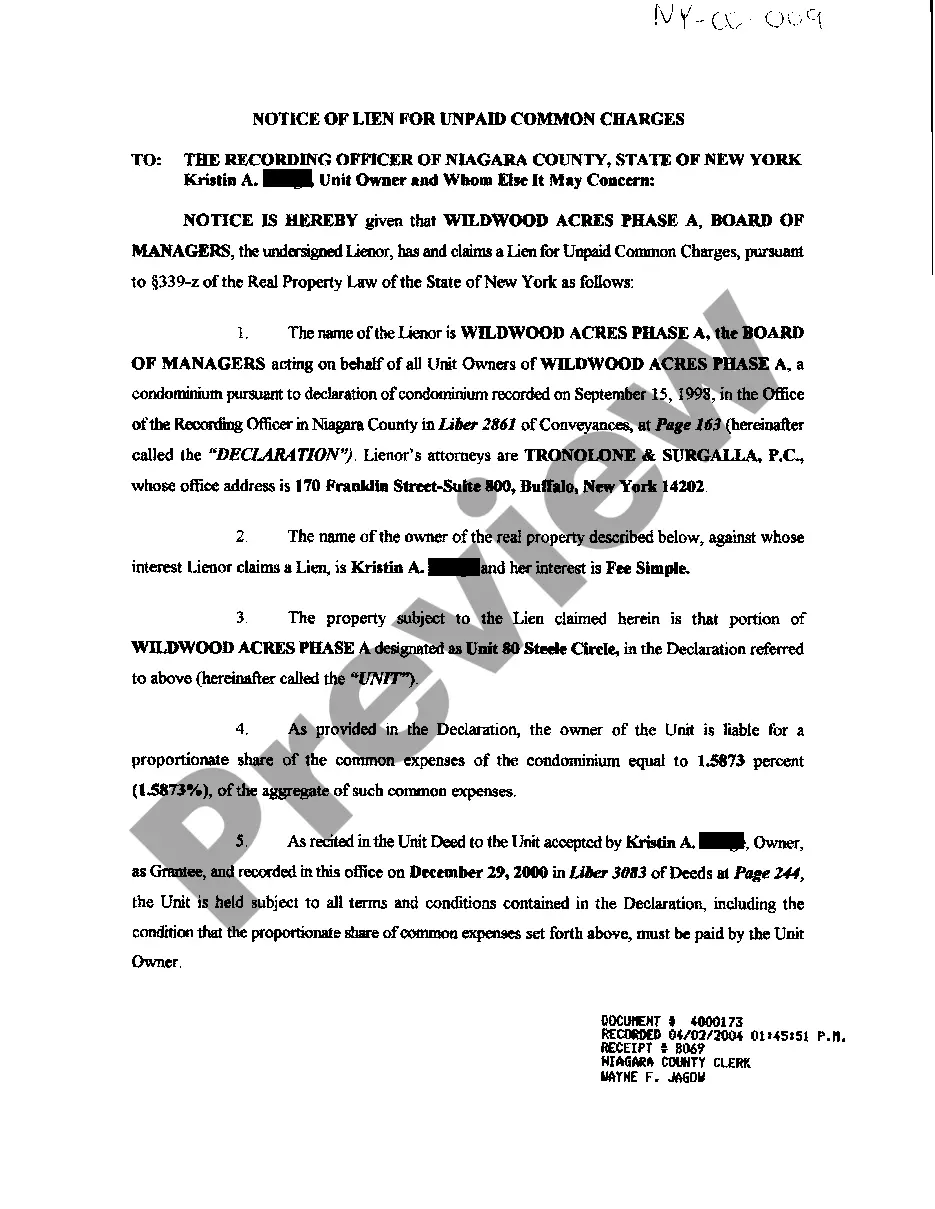

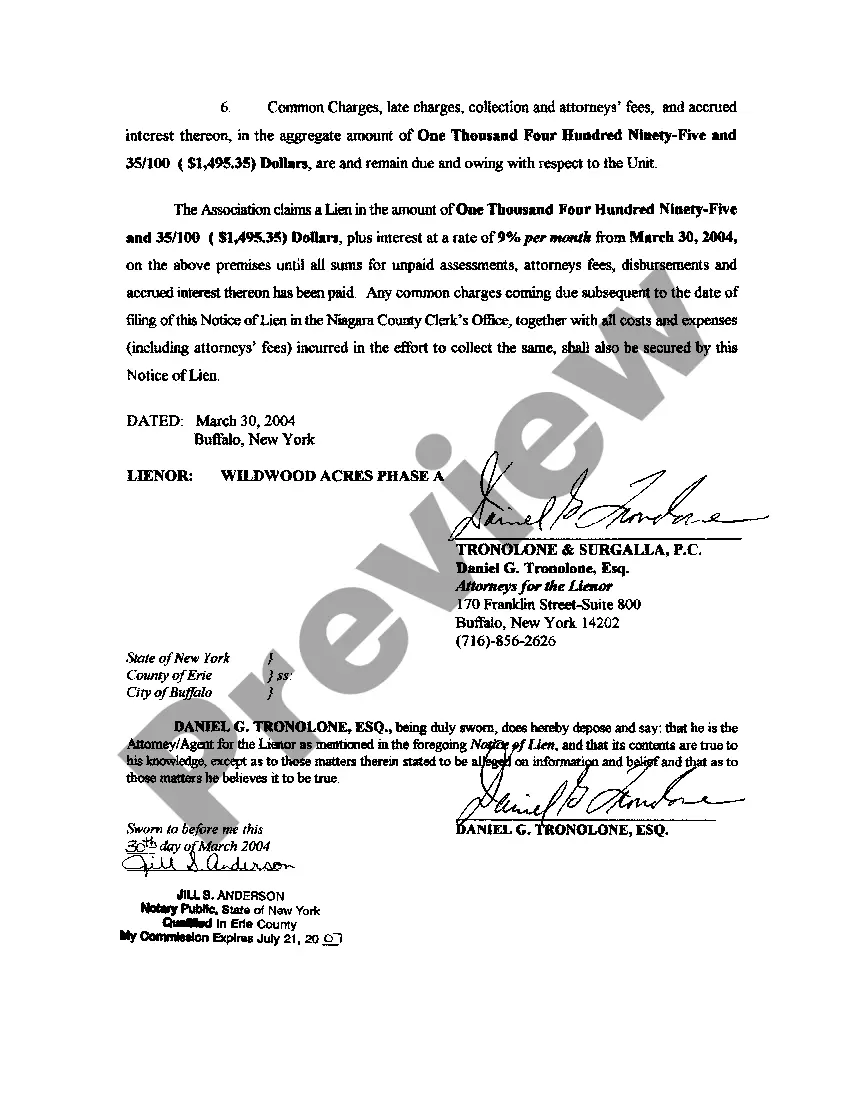

A Queens New York Notice of Lien for Unpaid Common Charges is a legal document that notifies property owners in Queens, New York about the outstanding common charges they owe to their homeowners' association or cooperative. Common charges typically include expenses for building maintenance, payment of staff, insurance, and other shared amenities. When a property owner fails to pay their common charges, the homeowners' association or cooperative board can file a Notice of Lien with the Queens County Clerk's Office. This lien, often referred to as "liens for common charges," acts as a legal claim on the property, ensuring that the outstanding debts are satisfied before any other claims. The purpose of the Queens New York Notice of Lien for Unpaid Common Charges is to protect the rights of the homeowners' association or cooperative and attempt to recover the delinquent payments. Once the lien is filed, it becomes a matter of public record, alerting potential buyers and lenders of the existing debt. Understanding the types of Queens New York Notice of Lien for Unpaid Common Charges is essential, as different scenarios may lead to different liens. Some common variations of these liens include: 1. General Notice of Lien: This type of lien is filed by the homeowners' association or cooperative board when a property owner fails to pay their common charges. It ensures that the association has a legal claim on the property rather than chasing after the individual for payment. 2. Foreclosure Notice of Lien: If the outstanding common charges remain unpaid for an extended period, the homeowners' association or cooperative board may escalate the situation by filing a foreclosure notice of lien. This step can potentially lead to a forced sale of the property to recoup the unpaid debts. 3. Lien Release Notice: This notice is filed when the delinquent common charges are paid in full, indicating that the lien has been released from the property's title and the property owner is no longer subject to the outstanding liabilities. It is important for property owners in Queens, New York to take prompt actions in addressing unpaid common charges to avoid the consequences of a Notice of Lien. Failure to resolve these dues can lead to legal complications, including the potential loss of the property through foreclosure proceedings. By understanding the purpose and implications of a Queens New York Notice of Lien for Unpaid Common Charges, property owners can ensure compliance with their homeowners' association or cooperative rules and protect their property rights. Prompt payment of common charges is crucial in maintaining a harmonious community and avoiding legal issues.

Queens New York Notice of Lien for Unpaid Common Charges

Description

How to fill out Queens New York Notice Of Lien For Unpaid Common Charges?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Queens New York Notice of Lien for Unpaid Common Charges becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Queens New York Notice of Lien for Unpaid Common Charges takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Queens New York Notice of Lien for Unpaid Common Charges. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

Environmental Liens are filed in the office of the Clerk of the County where the real estate is located. New York has a first priority Super Lien Statute for clean up of hazardous waste. N.Y. Envtl.

About twenty states have laws that give HOA assessment liens superior lien status under certain conditions. In the state of Florida, a purchase money mortgage is superior to other liens, except those issued by a government agency.

If legally allowed, your HOA can sue you for the unpaid dues, fines and any interest that's accumulated. If this happens, your HOA may have the right to garnish your wages to take what's owed from your bank accounts.

It means that certain liens, like association liens, will have a level of priority for debt recovery in the event of a foreclosure on a property, ignoring priority normally given to recording dates. However, not all states have this legislation, which is why those that do are referred to as ?super lien states.?

Filing a New York mechanics lien involves 3 steps: Fill out the proper NY mechanics lien form. New York law sets specific requirements for the form to use when filing a mechanics lien claim.Serve a copy of the lien on the property owner.Record the lien with the NY county recorder.File an Affidavit of Service.

A notice of pendency lasts for a period three years, which a court may renew for good cause.

Georgia is Not an HOA Superlien State Rather, because the state does not give HOA liens priority status, in Georgia, HOAs tend not to foreclose on their liens. Instead, they will more often use other means of collection, like garnishing a homeowner's wages or a bank account.

Individuals file a lis pendens in a New York county clerk's office in the location of the affected property. State law requires a lis pendens to be served on the property owner within 30 days after its recording. This notice is common in divorce cases dealing with the division of assets and in foreclosure cases.

What is a lis pendens? lis pendens, or notice of pendency in New York, is a notice filed by the plaintiff with the county clerk where the real estate is located, stating that the real estate is subject to a legal dispute.

Filing a New York mechanics lien involves 3 steps: Fill out the proper NY mechanics lien form. New York law sets specific requirements for the form to use when filing a mechanics lien claim.Serve a copy of the lien on the property owner.Record the lien with the NY county recorder.File an Affidavit of Service.

Interesting Questions

More info

The first day to sell real estate at a sheriff sale is the beginning of the auction. The date is determined by the last day of a county's fiscal year, which is usually two months from July 1. For details of where to search your local county sales, visit the New York State Department of State, Office of Real Estate. If your county is not listed, you have a couple of ways to look. First, call your local sheriff or sheriff department. You can call your local sheriff's office to see if there is a real estate auction. Second, you can write in at their office requesting a search. Make sure to put your own phone number on your letter, so they get an identification of your request. If the sheriff or auction manager cannot or will not search, call your state's real estate division and ask what you need to search. The best way to find out what's going on are some local newspapers. Make sure to read all the articles you can get in the newspapers.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.