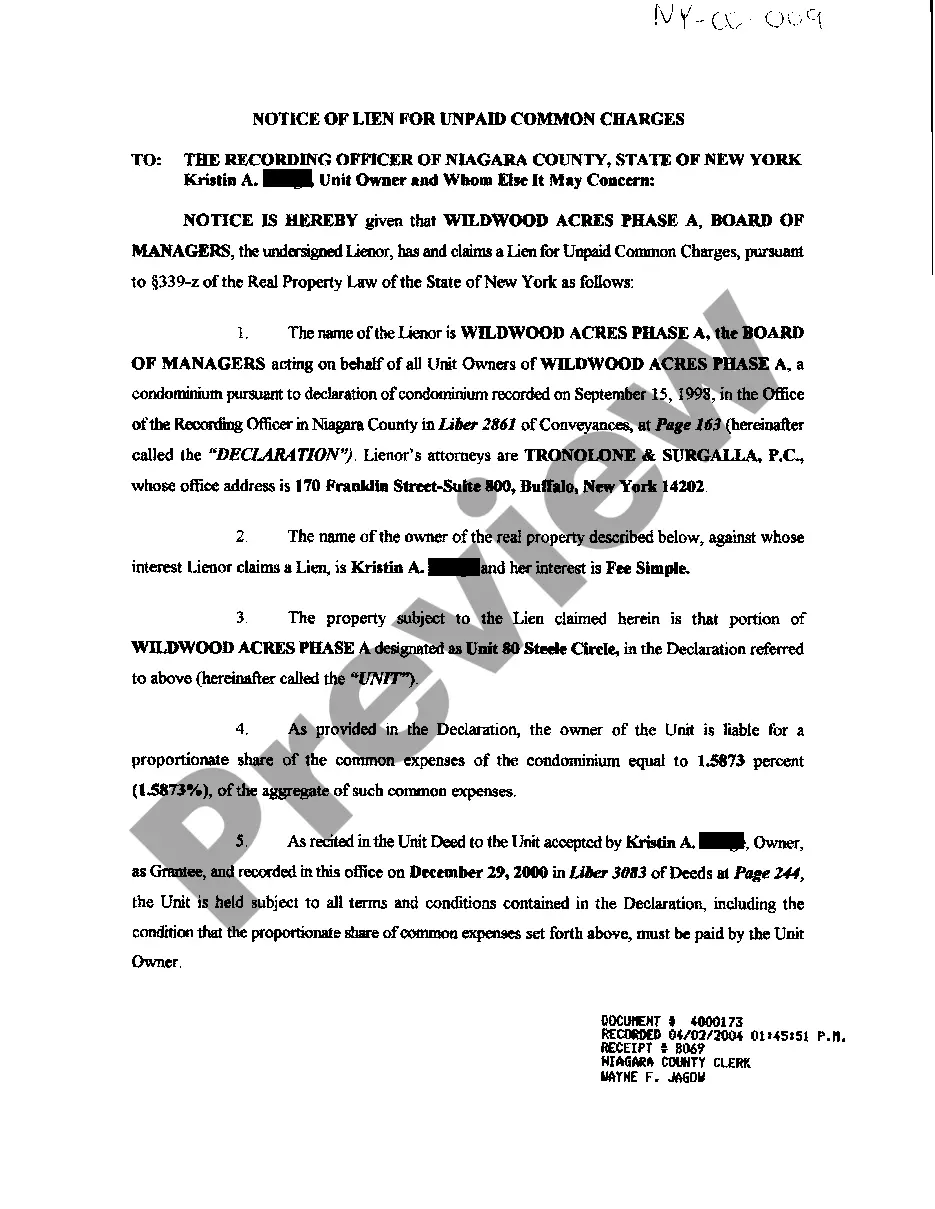

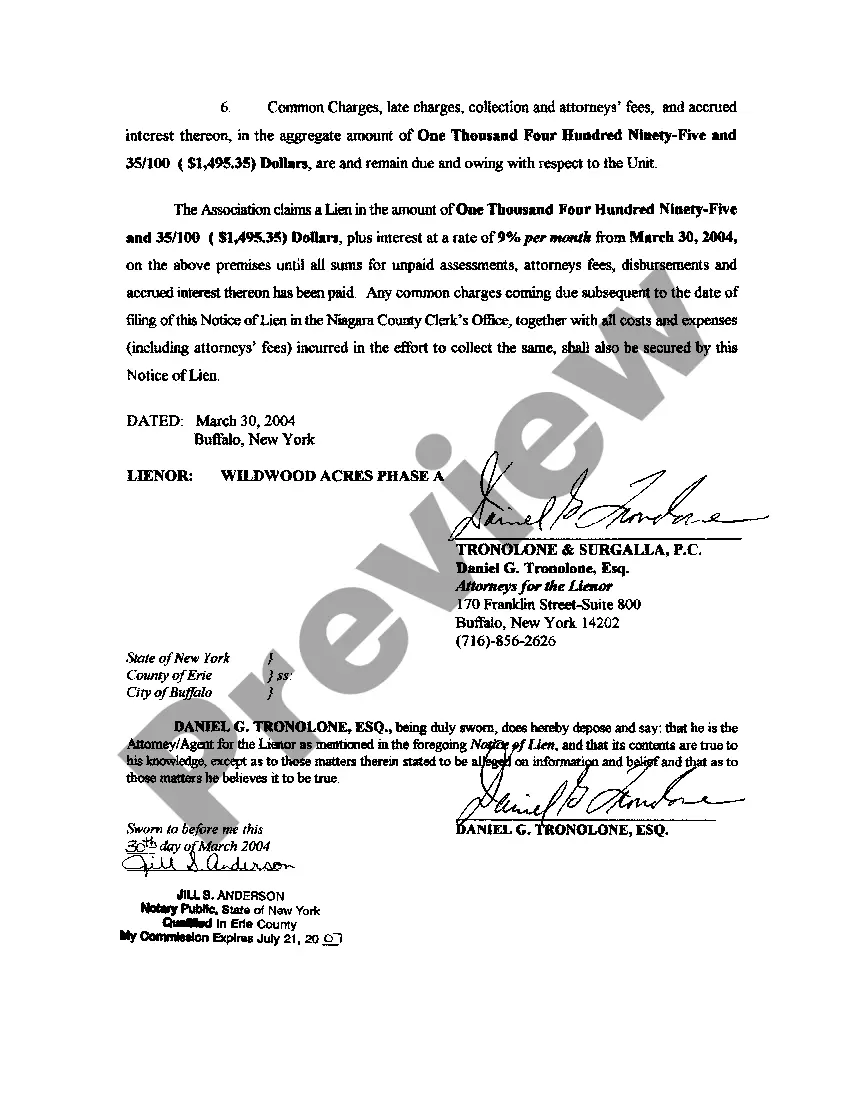

Suffolk New York Notice of Lien for Unpaid Common Charges is a legal document that serves as a notice to homeowners that they have failed to pay their common charges, which are fees or dues required for the maintenance and operation of shared amenities within a co-op or condominium. When a homeowner neglects to pay their common charges, the board of directors or the management association may file a Notice of Lien, providing notice to all interested parties that the property has an outstanding debt. This document is a crucial step in the collection process, as it places a lien on the property, establishing the association's legal right to claim the unpaid charges through foreclosure if necessary. In Suffolk County, New York, there are various types of Notice of Liens for Unpaid Common Charges that homeowners should be aware of: 1. Suffolk New York Notice of Lien — Non-Payment of Common Charges: This type of notice is filed when a homeowner fails to fulfill their financial obligations related to common charges. It outlines the specific amount owed and warns of potential consequences if the payment is not rendered promptly. 2. Suffolk New York Notice of Lien — Assessments and Fines: In addition to common charges, a co-op or condominium association may also levy assessments or fines against homeowners for non-compliance with association rules or special projects. This kind of notice informs the property owner about outstanding charges related to these additional assessments. 3. Suffolk New York Notice of Lien — Legal Fees and Interest: In certain situations, when homeowners refuse to cooperate or continually default on their obligations, legal proceedings may be initiated. This type of notice signifies the inclusion of legal fees and interest incurred by the association as a result of the delinquent homeowner's actions. It is crucial for Suffolk County homeowners to take any Notice of Lien seriously. Failure to address the unpaid charges within a specific timeframe could lead to foreclosure, the loss of property, and potential damage to one's creditworthiness. If unsure about the best course of action, homeowners should seek legal advice to understand their rights and explore potential resolutions.

What Is A Lien In Simple Terms

Description

How to fill out Suffolk New York Notice Of Lien For Unpaid Common Charges?

Make use of the US Legal Forms and obtain instant access to any form you need. Our beneficial website with a huge number of documents simplifies the way to find and obtain almost any document sample you require. You can download, complete, and certify the Suffolk New York Notice of Lien for Unpaid Common Charges in just a couple of minutes instead of surfing the Net for many hours seeking the right template.

Using our catalog is a superb strategy to increase the safety of your document filing. Our experienced lawyers on a regular basis review all the documents to make sure that the forms are relevant for a particular region and compliant with new acts and polices.

How do you obtain the Suffolk New York Notice of Lien for Unpaid Common Charges? If you have a profile, just log in to the account. The Download button will appear on all the documents you view. Furthermore, you can find all the previously saved records in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

- Open the page with the form you require. Make sure that it is the template you were hoping to find: examine its title and description, and take take advantage of the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the file. Select the format to obtain the Suffolk New York Notice of Lien for Unpaid Common Charges and revise and complete, or sign it for your needs.

US Legal Forms is among the most significant and trustworthy document libraries on the web. We are always happy to help you in any legal procedure, even if it is just downloading the Suffolk New York Notice of Lien for Unpaid Common Charges.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!