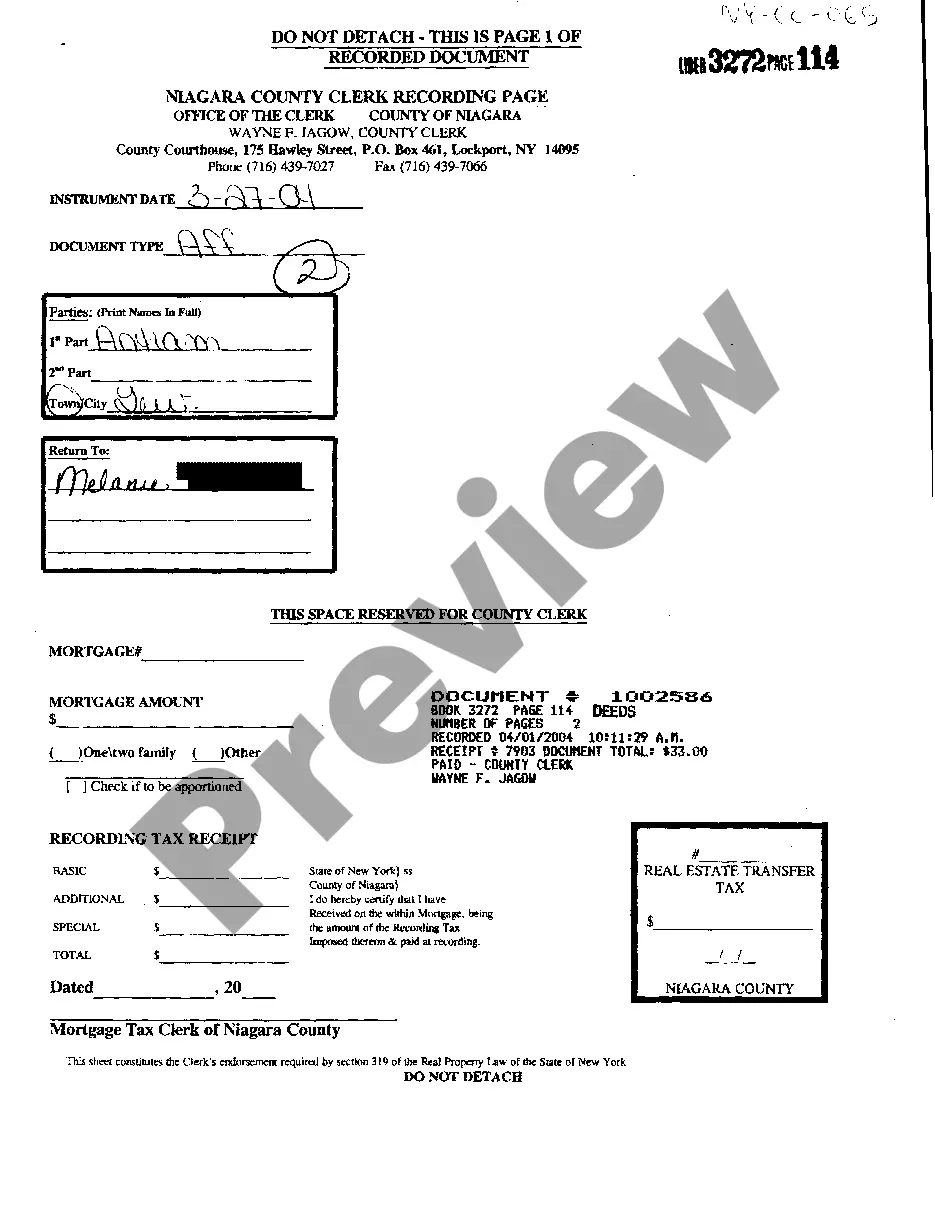

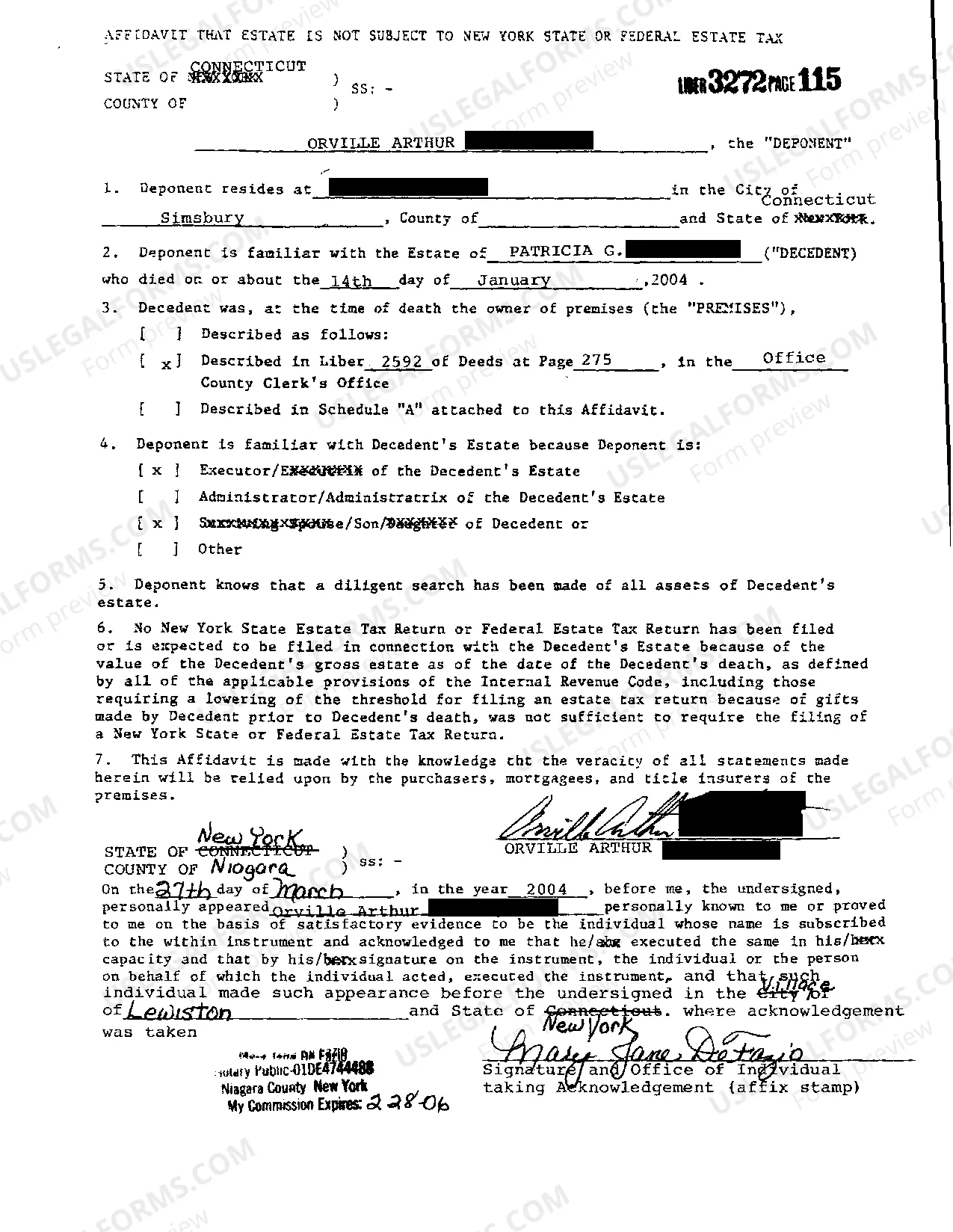

Bronx New York Affidavit Estate Not Subject To Federal or State Tax In Bronx, New York, an affidavit estate not subject to federal or state tax is a legal document used to establish the exemption of an estate from taxation. This affidavit provides individuals with a means to declare that their estate does not qualify for taxation by either the federal government or the state of New York. The purpose of this affidavit is to eliminate the need for estate administrators to go through a lengthy and often complicated tax filing process. By completing and submitting this document, individuals can ensure that their loved ones receive their assets without the burden of tax obligations. There are two main types of Bronx New York Affidavit Estate Not Subject To Federal or State Tax: 1. Small Estate Affidavit: This affidavit is applicable to estates valued below a specified threshold, typically determined by state law. In New York, if the total value of the estate is below $30,000, this option may be available. The small estate affidavit allows for a simplified process, saving time and effort for the parties involved. 2. Affidavit or Waiver of Tax: If the estate value exceeds the threshold for a small estate affidavit, a more comprehensive affidavit or waiver of tax may be required. This document ensures that the estate is not subject to federal or state tax, providing a legal basis for exemption. To complete the Bronx New York Affidavit Estate Not Subject To Federal or State Tax, individuals will typically need to provide detailed information regarding the deceased, as well as an inventory of the estate assets. It is essential to consult an attorney or seek legal guidance to ensure accuracy and compliance with the relevant laws and regulations. In summary, the Bronx New York Affidavit Estate Not Subject To Federal or State Tax is a crucial legal document that allows the exemption of certain estates from taxation. Whether it is through a small estate affidavit or a comprehensive waiver of tax, individuals can simplify the process and ensure a smooth transfer of assets to their beneficiaries.

Bronx New York Affidavit Estate Not Subject To Federal or State Tax

Description

How to fill out Bronx New York Affidavit Estate Not Subject To Federal Or State Tax?

If you’ve already used our service before, log in to your account and save the Bronx New York Affidavit Estate Not Subject To Federal or State Tax on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Bronx New York Affidavit Estate Not Subject To Federal or State Tax. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!

Form popularity

FAQ

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

How to avoid New York's Fiscal Cliff There are many ways our estate tax attorneys can help you avoid this cliff and safeguard your wealth.Credit Shelter Trusts. Non-Grantor Trusts. Changing Your Domicile. Strategic Gifting. Charitable Formula Gifts. Discounted Valuation of Closely-Held Businesses.

While New York doesn't charge an inheritance tax, it does include an estate tax in its laws. The state has set a $6.11 million estate tax exemption, meaning if the decedent's estate exceeds that amount, the estate is required to file a New York estate tax return.

For dates of deaththe BEA isJanuary 1, 2022, through December 31, 2022$6,110,000January 1, 2021, through December 31, 2021$5,930,000January 1, 2020, through December 31, 2020$5,850,000January 1, 2019, through December 31, 2019$5,740,0004 more rows ?

The estate of a New York State resident must file a New York State estate tax return if the following exceeds the basic exclusion amount: the amount of the resident's federal gross estate, plus. the amount of any includible gifts.... For dates of deaththe BEA isApril 1, 2014, through March 31, 2015$2,062,5007 more rows ?

There is no federal inheritance tax?that is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022.

Non-NY residents can essentially copy this legal structure for other property by creating a special residence trust or LLC for their NY property. These structures convert the NY tangible property to intangible property and avoid the imposition of the NY estate tax for non-NY residents.

Generally, for NY estate tax purposes, if the value of assets passing to beneficiaries other than a spouse or charity is below a certain threshold ($6.11 million in 2022), the assets are fully exempt from tax and no NY estate taxes will be due.

New York Estate Tax Exemption This means that if a person's estate is worth less than $6.11 million and they die in 2022, the estate owes nothing to the state of New York.

More info

New York Death Benefit Statute Title 18 of the New York State Penal Code, Section If death occurs in New York and there are no surviving individuals (childless adults×, and the heir's estate is worth less than 500, an heir may have a 3,000 death benefit as a single person. If the estate is valued at 500, (1,000, in addition to the 3,000 death benefit×. New York Inheritance Tax Consideration Your New York estate taxes can add up fast. In fact, if you're planning to leave your heirs a nice legacy of money, be aware of this fact that New York can make certain types of inherited estates much taller.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.