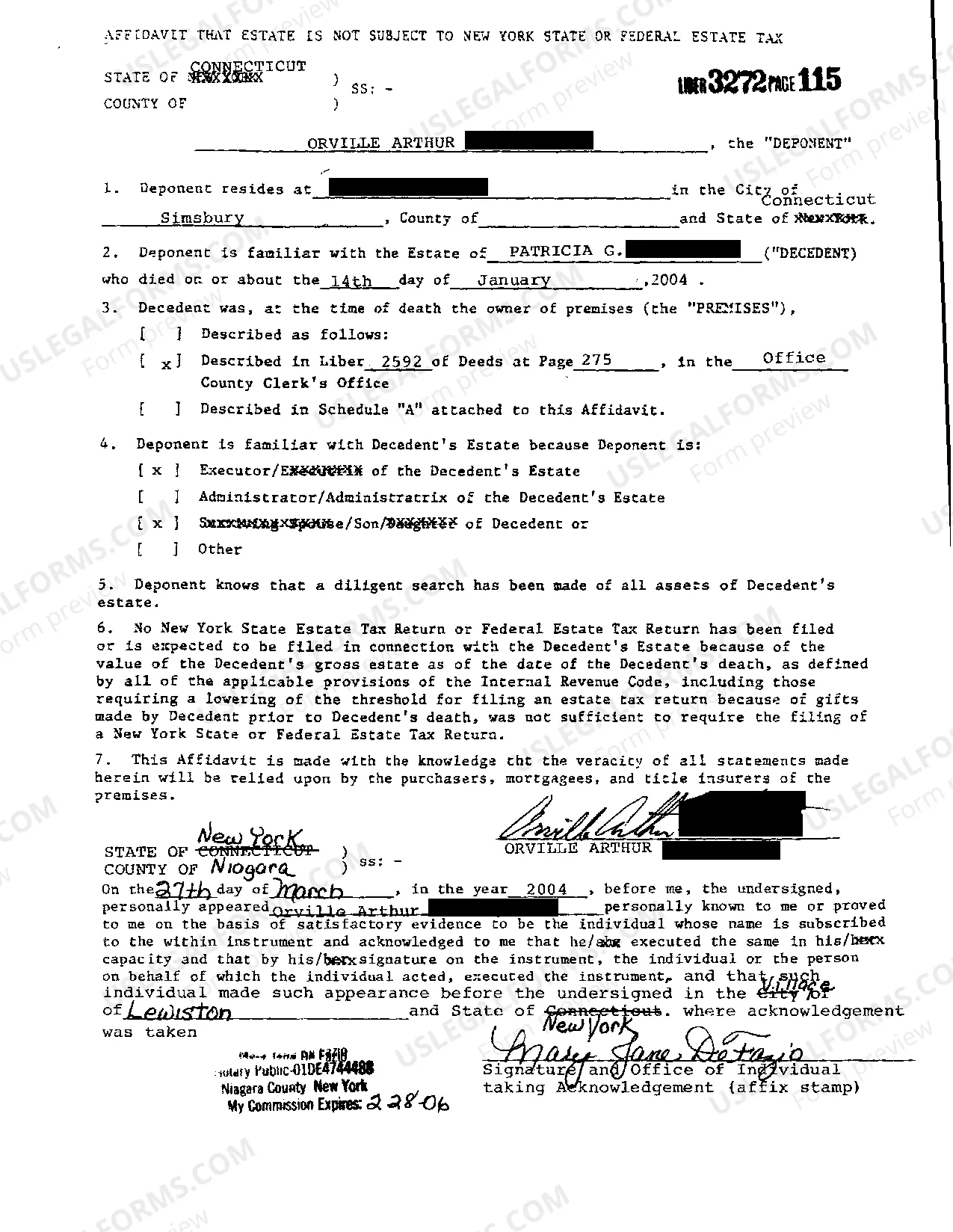

Yonkers New York Affidavit Estate Not Subject To Federal or State Tax: A Comprehensive Guide If you are involved in an estate in Yonkers, New York, it is important to understand the intricacies of the Affidavit Estate Not Subject To Federal or State Tax. This affidavit is a legal document that confirms that an estate does not owe any federal or state taxes. The Yonkers New York Affidavit Estate Not Subject To Federal or State Tax is a crucial document that estate executors and beneficiaries need to be aware of. It provides assurance that the estate is exempt from both federal and state tax obligations. This exemption is usually granted under specific circumstances outlined by federal and state tax laws. There are different types of Yonkers New York Affidavit Estate Not Subject To Federal or State Tax, which are named based on the specific situations in which they are applicable. They include: 1. Small Estate Affidavit: This affidavit is typically used when the total value of the estate falls below a specific threshold as defined by federal and state laws. It allows for a simplified probate process and acknowledges that the estate is not subject to federal or state tax obligations. 2. Spousal Affidavit: If the decedent's surviving spouse inherits the entire estate, they may be able to utilize a spousal affidavit. This document confirms that the estate passes entirely to the surviving spouse without any tax liabilities. 3. Affidavit for Assets Passing Outside of Probate: In cases where certain assets, such as life insurance proceeds or retirement accounts, pass directly to beneficiaries without going through the probate process, an affidavit may be used to declare that these assets are not subject to federal or state tax. 4. Affidavit for Exemption of Property Taxes: While not directly related to federal or state tax obligations, this affidavit can be submitted to claim exemptions from specific property taxes imposed by local authorities in Yonkers, New York. It is important to note that each type of Yonkers New York Affidavit Estate Not Subject To Federal or State Tax may have specific requirements and eligibility criteria. Consulting with an experienced estate attorney or tax professional is crucial to ensure compliance and accuracy when preparing and submitting these affidavits. By understanding the different types of Yonkers New York Affidavit Estate Not Subject To Federal or State Tax and their specific applications, estate executors and beneficiaries can navigate the estate settlement process with confidence. These affidavits play a significant role in ensuring a smooth and efficient distribution of assets while providing reassurance that the estate does not owe any federal or state taxes.

Yonkers New York Affidavit Estate Not Subject To Federal or State Tax

Description

How to fill out Yonkers New York Affidavit Estate Not Subject To Federal Or State Tax?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for legal solutions that, as a rule, are very expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to an attorney. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Yonkers New York Affidavit Estate Not Subject To Federal or State Tax or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Yonkers New York Affidavit Estate Not Subject To Federal or State Tax adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Yonkers New York Affidavit Estate Not Subject To Federal or State Tax is suitable for you, you can choose the subscription option and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!