Nassau New York Release of Loan Obligation is a legal process that is executed to relieve individuals or entities from their loan obligations in Nassau County, New York. This comprehensive and detailed procedure is crucial in ensuring that borrowers are formally discharged from their financial responsibilities associated with a loan. The Nassau New York Release of Loan Obligation is applicable to various types of loans, including personal loans, mortgage loans, business loans, student loans, and more. Each type of loan may have specific requirements and procedures that need to be followed for the release of the loan obligation. Here are some common types of Nassau New York Release of Loan Obligation: 1. Personal Loan Release: This form of release is utilized for individuals who have borrowed money for personal reasons, such as medical expenses, debt consolidation, or home improvements. The borrower must fulfill the necessary requirements and submit the required documentation to be considered for loan obligation release. 2. Mortgage Loan Release: This pertains specifically to individuals who have obtained a loan to finance the purchase of a property. Once the mortgage is repaid in full or refinanced, the borrower can initiate the release process to remove the loan obligation from their property. 3. Business Loan Release: Businesses that have borrowed funds to finance their operations or expansion plans can apply for a release of loan obligation upon full repayment of the loan. This allows them to establish a stronger financial standing and expand their borrowing capabilities in the future. 4. Student Loan Release: Students who have successfully paid off their education loans in Nassau County, New York, can seek the release of their loan obligation. This is particularly significant for graduates who want to improve their creditworthiness and focus on building their financial future. Regardless of the loan type, the Nassau New York Release of Loan Obligation requires specific documentation to be submitted to the appropriate authorities. This may include a release form, loan repayment evidence, and other supporting documents as required by the lender or relevant governing bodies. It is crucial to engage the services of legal professionals or experts who specialize in loan obligations and releases in Nassau County, New York. They can guide borrowers through the entire process, ensuring compliance with all legal requirements and increasing the chances of a successful release. In summary, the Nassau New York Release of Loan Obligation is a significant legal process that allows borrowers to obtain formal relief from their loan responsibilities in Nassau County, New York. The different types of releases cater to personal, mortgage, business, and student loans, each with its specific requirements and procedures. Seeking professional guidance and understanding the appropriate documentation are vital steps in ensuring a successful loan obligation release.

Nassau New York Release of Loan Obligation

Description

How to fill out Nassau New York Release Of Loan Obligation?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Nassau New York Release of Loan Obligation becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Nassau New York Release of Loan Obligation takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

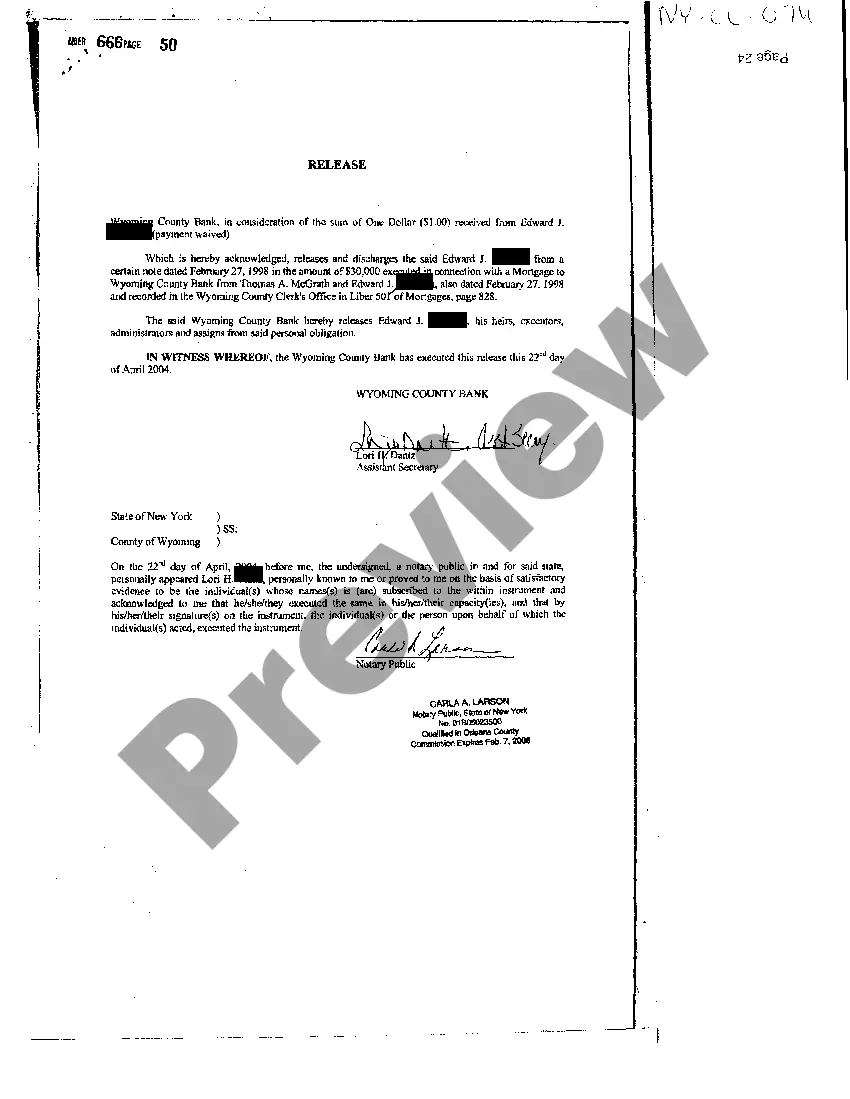

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Nassau New York Release of Loan Obligation. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!