Title: Rochester New York Release of Loan Obligation: A Comprehensive Guide to Various Types and Key Considerations Introduction: In Rochester, New York, a release of loan obligation refers to the process where a lender or creditor formally relinquishes a borrower from their legal responsibility to repay a loan or debt owed. This legally binding document provides significant relief to borrowers and is essential for various financial transactions. In this article, we will delve into the different types of release of loan obligations in Rochester, New York, and provide detailed insights into key aspects associated with them. Types of Rochester New York Release of Loan Obligation: 1. Mortgage Loan Release: — This type of release of loan obligation in Rochester, New York, pertains specifically to mortgage loans. — It releases the borrower from their obligation to repay the loan amount, allowing them to claim full ownership of the property. — Lenders issue a mortgage release upon receiving the full payment of the mortgage loan or upon another agreed-upon condition. 2. Student Loan Release: — Student loan releases are granted to borrowers in Rochester, New York, who have successfully paid off their student loans. — These releases are typically issued by the lending institution or the education department, signifying the completion of loan repayment obligations. 3. Business Loan Release: — Business loan releases are relevant for individuals or entities located in Rochester, New York, who have borrowed funds for business purposes. — Upon fulfilling the agreed-upon repayment terms and conditions, lenders issue a business loan release, absolving borrowers from further obligations. Key Considerations for Rochester New York Release of Loan Obligation: 1. Consultation and Legal Assistance: — Seeking legal advice is crucial before entering into any loan agreement or release of loan obligation. — Consulting with a skilled attorney will ensure that you fully understand your rights and obligations as a borrower or lender. 2. Proper Documentation: — Accurate and comprehensive documentation is vital during the release of loan obligation process in Rochester, New York. — All parties involved should maintain proper records, including loan agreements, payment receipts, and correspondence. 3. Effective Communication: — Clear and open communication between borrowers and lenders is essential to ensure successful loan releases. — Timely communication helps both parties stay updated on the progress and completion of the loan repayment process. 4. Financial Implications: — Borrowers should be aware of the potential impact on credit scores and financial records after the release of loan obligation. — Understanding how this process may affect future loan applications and financial standing is crucial. Conclusion: Rochester, New York, offers various types of release of loan obligations, including mortgage loan releases, student loan releases, and business loan releases. Understanding the intricacies of each type and considering key aspects such as legal assistance, proper documentation, effective communication, and financial implications ensures a smooth process. By familiarizing yourself with the release of loan obligations, borrowers and lenders alike can navigate these transactions with confidence and peace of mind.

Rochester New York Release of Loan Obligation

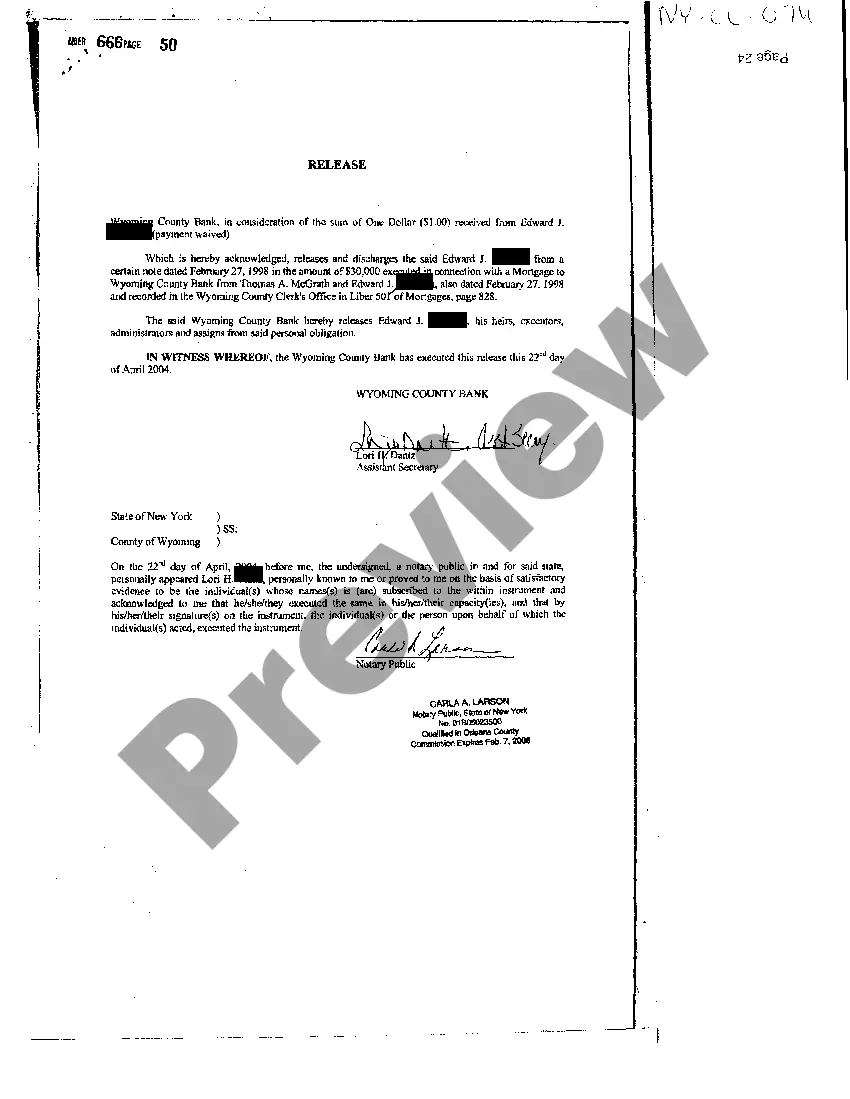

Description

How to fill out Rochester New York Release Of Loan Obligation?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Rochester New York Release of Loan Obligation becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Rochester New York Release of Loan Obligation takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Rochester New York Release of Loan Obligation. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!