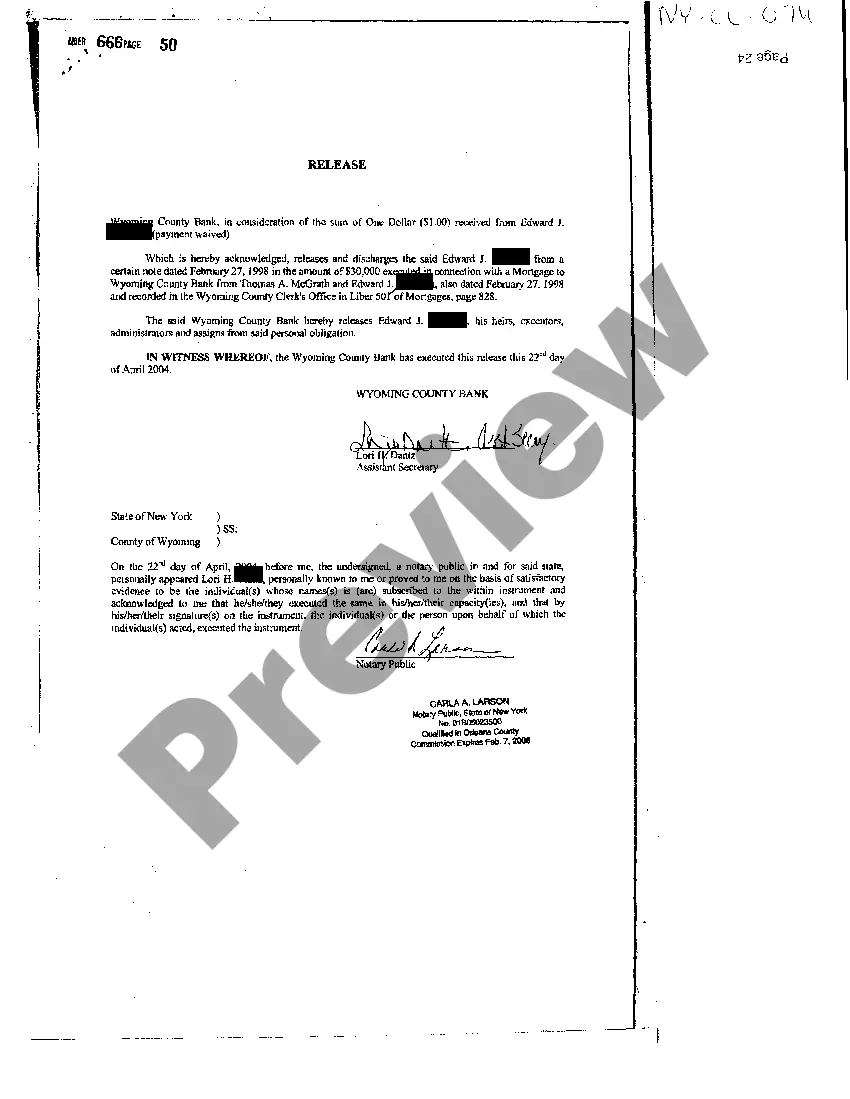

Syracuse New York Release of Loan Obligation: A Detailed Description The Syracuse New York Release of Loan Obligation refers to a legal document or agreement that releases a borrower from the responsibility of repaying a loan in Syracuse, New York. This document is crucial for both the lender and the borrower as it officially acknowledges the satisfaction of the loan and ensures that all parties involved are aware of the loan's discharge. Keywords: Syracuse New York, release of loan obligation, legal document, borrower, lender, repayment, satisfaction, discharge. Types of Syracuse New York Release of Loan Obligation: 1. Full and Final Release: This type of release of loan obligation signifies that the borrower has completely fulfilled their repayment obligations. It validates the borrower's commitment to repaying the loan in entirety and signifies the successful conclusion of the lending relationship. 2. Partial Release: Sometimes, borrowers may secure multiple loans against different assets or properties. In such cases, a partial release of loan obligation is utilized to discharge the borrower from their responsibilities for a specific loan while maintaining the outstanding obligations for other loans. This allows the borrower to clear their liabilities for a particular loan while continuing repayment for others. 3. Mortgage Release: A Syracuse New York Release of Loan Obligation can also be specific to mortgage loans. This type of release is commonly used when a property owner has successfully paid off their mortgage debt, entitling them to a release of loan obligation, thereby freeing the property from any encumbrances. 4. Student Loan Release: Student loans are often a significant financial burden for individuals pursuing higher education. However, there are instances where borrowers may be eligible for a release of loan obligation under certain circumstances, such as disability, bankruptcy, or public service. This type of release relieves the borrower from the legal obligation to repay their student loans, assisting them in managing their financial stability. Regardless of the type of Syracuse New York Release of Loan Obligation, the agreement should include essential details such as the names of the parties involved, loan amount, specific loan being discharged, effective date of release, and any other supporting documentation required by the lender to acknowledge loan satisfaction. Note: It is crucial to consult with a legal professional to ensure that all necessary steps and requirements are handled properly during the process of obtaining a Syracuse New York Release of Loan Obligation.

Syracuse New York Release of Loan Obligation

Description

How to fill out Syracuse New York Release Of Loan Obligation?

Regardless of one's social or occupational standing, completing legal-related documents is a regrettable obligation in today's professional landscape.

Often, it’s nearly impossible for anyone lacking a legal background to create such documents from scratch, primarily due to the complex language and legal subtleties they entail.

This is where US Legal Forms provides support.

Ensure the document you found is suitable for your area since the regulations of one state or county do not apply to another state or county.

Evaluate the form and read a brief summary (if available) of the circumstances for which the document can be utilized.

- Our platform features an extensive library of over 85,000 ready-to-use state-specific documents that are suitable for virtually any legal scenario.

- US Legal Forms also acts as an excellent resource for associates or legal advisors looking to optimize their time by using our DIY forms.

- Whether you require the Syracuse New York Release of Loan Obligation or another document relevant to your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how you can obtain the Syracuse New York Release of Loan Obligation swiftly through our dependable platform.

- If you are currently a subscriber, you can simply Log In to your account to retrieve the required form.

- However, if you are new to our platform, be sure to follow these steps before downloading the Syracuse New York Release of Loan Obligation.

Form popularity

FAQ

After a bank releases a lien, it's essential to obtain the formal lien release document. This document serves as proof that the debt is settled, and the lien is no longer valid. You should file this release with your local county clerk or recorder's office to update property records. This process is crucial to ensure your title is clear, especially if you plan to sell or refinance your property in the future.

Forgiveness, cancellation, or discharge of your loan means that you are no longer required to repay some or all of your loan.

If you do not pay your tax when due, we will charge you a penalty in addition to interest. The penalty may be waived if you can show reasonable cause for paying late. The penalty charge is: 0.5% of the unpaid amount for each month (or part of a month) it is not paid, up to a maximum of 25%

For instance, New York's Real Property Tax Law states that the county may start a foreclosure after two years of property tax delinquency.

NY State Statute of Limitations for Tax Collection New York or the DTF has 20 years to collect tax liabilities. It is 20 years from the date the DTF could file a warrant. While the IRS has ten years to legally collect the taxes, NY State has 20 years.

Any student loan debt that is forgiven under this program will not be subject to tax under New York State tax law.

The New York State Department of Taxation and Finance has 20 years from the date that the tax warrant not 20 years from the date of the tax liability was filed to collect on the tax liability.

As a general rule, there is a ten year statute of limitations on IRS collections. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. Subject to some important exceptions, once the ten years are up, the IRS has to stop its collection efforts.

That is, New York tax liens have a 20 year statute of limitations). So, while the State has six years from the time of assessment to file a tax warrant, the related lien remains in place for 20 years once the warrant has been filed.

New York State Tax Law generally places a three-year statute of limitations on our right to assert additional tax due (generally, three years after your return was filed).