Title: Yonkers New York Release of Loan Obligation: A Comprehensive Overview Keywords: Yonkers New York, release of loan obligation, types, detailed description, legal process Introduction: The Yonkers New York Release of Loan Obligation is a legal document that declares the discharge or release of an individual or entity from any liabilities or obligations associated with a loan. This process is crucial as it establishes the termination of the borrower's responsibility towards the lender. In Yonkers, New York, there are several types of Yonkers New York Release of Loan Obligation processes, including (mention the types). Types of Yonkers New York Release of Loan Obligation: 1. Full Release: The Full Release is the most common type of Yonkers New York Release of Loan Obligation. It signifies the complete and final discharge of the borrower from any financial obligations stated in the loan agreement. 2. Partial Release: In certain cases, the borrower may be eligible for a Partial Release of Loan Obligation. This type of release relieves the borrower from specific portions of the loan, while the remaining obligations stay intact. 3. Conditional Release: A Conditional Release of Loan Obligation is applicable when certain predetermined conditions, as mentioned in the loan agreement, are met. It provides a temporary relief until the specific conditions are fulfilled. 4. Release of Guarantor Obligation: This type of release focuses on the guarantor's obligations. When the guarantor's responsibilities are released, they are no longer liable for the borrower's repayment in default situations. How the Yonkers New York Release of Loan Obligation Works: The Yonkers New York Release of Loan Obligation process involves several essential steps: 1. Reviewing Loan Agreement: To initiate the release process, both the borrower and the lender should review the original loan agreement meticulously. This ensures that all parties are aware of the terms and conditions specified in the contract. 2. Requesting Release: The borrower should formally request the release of loan obligation from the lender. This can be done through a written request, providing relevant documentation and identification. 3. Lender Verification: Upon receiving the borrower's request, the lender will assess the loan agreement and validate the borrower's eligibility for release. This step ensures that all loan obligations have been fulfilled, and no outstanding liabilities persist. 4. Documentation: Once the lender approves the release, a legal document known as the Yonkers New York Release of Loan Obligation is prepared. This document specifies the terms of the release and is signed by both parties involved. 5. Filing and Decoration: After the release document is signed, it should be filed with the appropriate authorities in Yonkers, New York, and recorded in the public records. This step is crucial to provide legal proof of the release and to protect all involved parties. Conclusion: The Yonkers New York Release of Loan Obligation serves as an integral legal process to declare the release of a borrower's obligation towards a loan. Understanding the different types of releases and following the proper procedures ensures a legally binding and secure transaction for both borrowers and lenders in Yonkers, New York.

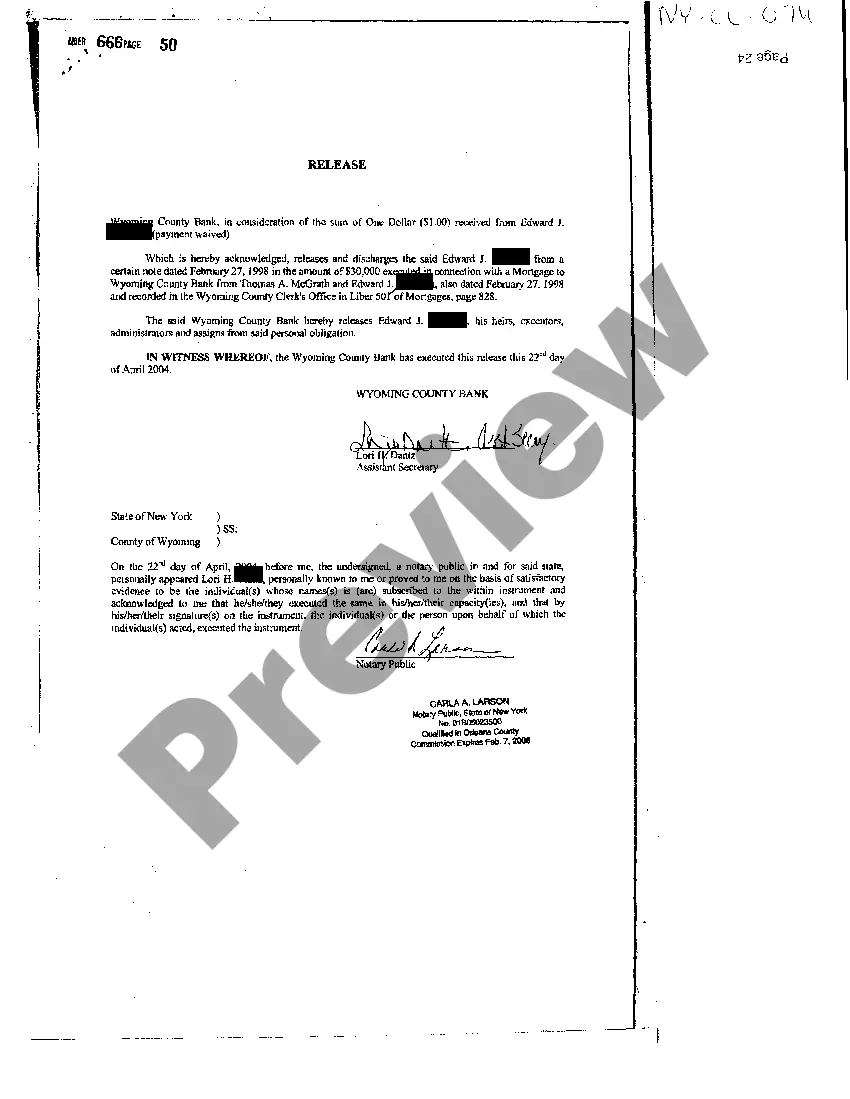

Yonkers New York Release of Loan Obligation

Description

How to fill out Yonkers New York Release Of Loan Obligation?

Do you need a reliable and affordable legal forms provider to get the Yonkers New York Release of Loan Obligation? US Legal Forms is your go-to option.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Yonkers New York Release of Loan Obligation conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is good for.

- Start the search over if the form isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is done, download the Yonkers New York Release of Loan Obligation in any provided format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal papers online once and for all.