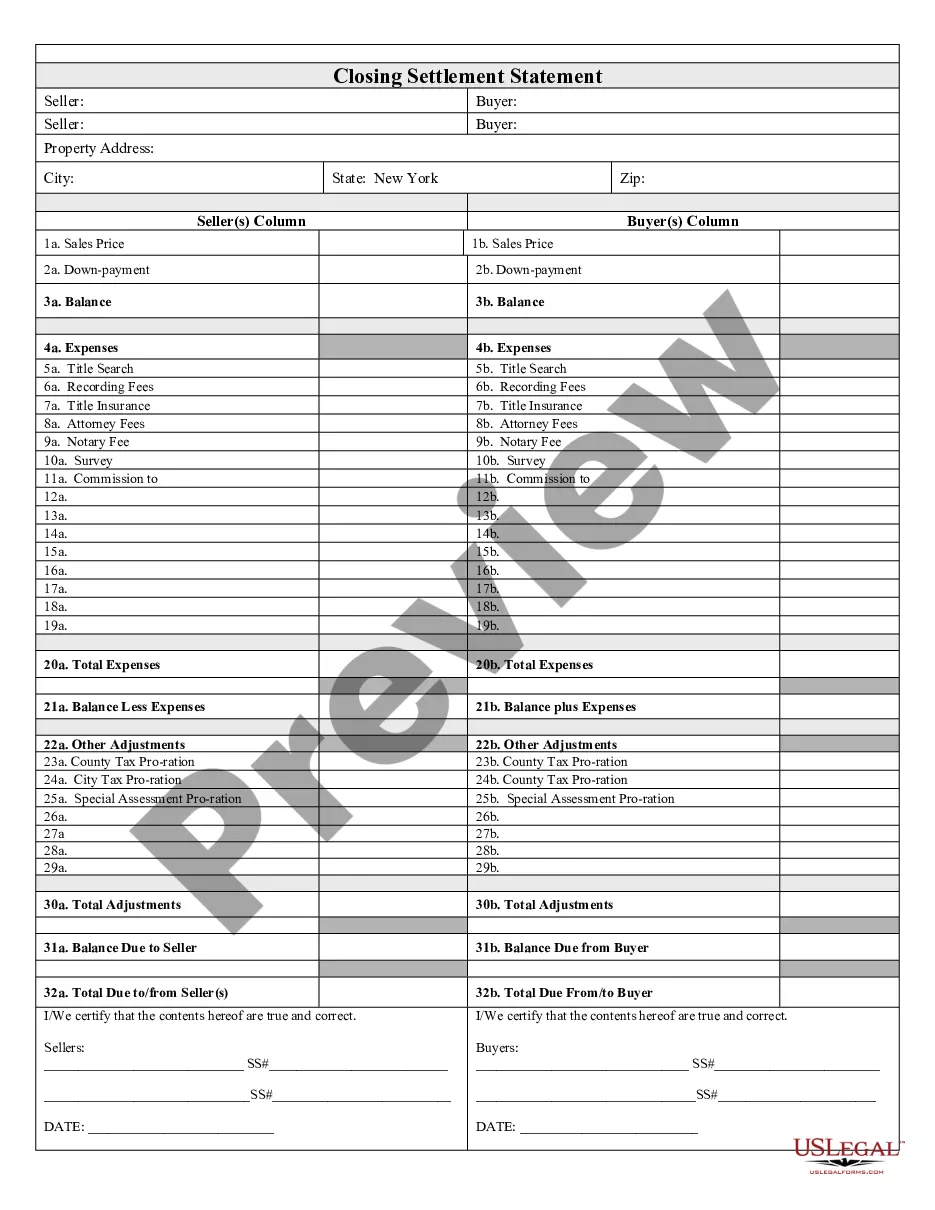

Nassau New York Closing Statement

Description

How to fill out New York Closing Statement?

If you are searching for a pertinent form template, it’s challenging to discover a more suitable location than the US Legal Forms website – likely the most comprehensive collections on the internet.

With this collection, you can acquire a vast number of templates for corporate and personal aims by categories and regions, or keywords.

With the superior search functionality, obtaining the latest Nassau New York Closing Statement is as effortless as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Select the file format and download it onto your device.

- Furthermore, the applicability of each document is verified by a group of expert attorneys that frequently evaluate the templates on our platform and refresh them based on the latest state and county directives.

- If you are already familiar with our system and possess a registered account, all you need to receive the Nassau New York Closing Statement is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have accessed the form you need. Review its details and use the Preview feature (if available) to assess its content. If it doesn’t meet your needs, utilize the Search option near the top of the page to locate the suitable document.

- Validate your selection. Click the Buy now option. After that, choose your desired pricing plan and provide information to register an account.

Form popularity

FAQ

A CPLR note of issue in New York is a formal document filed to indicate readiness for trial under the Civil Practice Law and Rules. This filing ensures that all procedural requirements have been met, leading to a streamlined trial process. It's vital to prepare an accurate Nassau New York Closing Statement to support this filing and clarify the case's important aspects.

Yes, many cases settle before the discovery phase begins. Factors such as negotiation, mediation, or a change in circumstances can prompt a resolution early on. However, understanding the elements highlighted in a Nassau New York Closing Statement helps ensure that any settlement accurately reflects the case's merits.

Filing a note of issue formally indicates to the court that a party believes their case is ready for trial. This filing is a significant step in the litigation process, marking the transition from discovery to trial preparation. A well-crafted Nassau New York Closing Statement should accompany this filing, highlighting all relevant issues.

The note of issue for discovery signifies that a party has completed pre-trial discovery and is ready to proceed to trial. This document informs the court that the necessary evidence has been collected and prepared. Ensuring an accurate and complete Nassau New York Closing Statement is critical during this stage to avoid any delays in the trial process.

Issue discovery refers to the stage in a legal process where parties identify the questions or issues that need resolution. During this phase, evidence is gathered to support each party's position. It is essential for preparing a comprehensive Nassau New York Closing Statement that outlines all pertinent facts related to the case.

A motion to vacate a note of issue requests the court to cancel or set aside the filing of the note. This action often occurs when new evidence surfaces or if procedural errors are identified in the original filing. Understanding the implications of a Nassau New York Closing Statement is crucial, as it may affect the overall timeline of your case.

Appealing to the Supreme Court in New York begins with a thorough understanding of the case at hand. You must first decide if your case qualifies for appeal based on defined criteria. Prepare and submit a petition for leave to appeal, and if granted, your case will be scheduled for review. Utilizing tools like the Nassau New York Closing Statement facilitates clarity throughout this complex process.

To file a notice of appeal in the New York Supreme Court, start by completing the notice form accurately. Include important details such as your case number and the judgment you are appealing. Then, file it in person or by mail, ensuring you adhere to the filing deadlines. Remember to keep your Nassau New York Closing Statement handy; it serves as a reference to ensure all necessary steps are followed correctly.

The New York appeals process involves several steps. Initially, you must file a notice of appeal to the appropriate appellate division. Following that, you will prepare a record on appeal, which includes trial transcripts and relevant documents. Throughout this process, having resources like a Nassau New York Closing Statement can clarify the documentation needs and requirements for a successful appeal.

Yes, you can appeal a decision from the New York Supreme Court, but only under certain circumstances. Generally, if you believe there was a legal error made, you have the right to seek an appeal. This process allows you to have the decision reviewed. It is crucial to understand the specific rules surrounding such appeals and how they relate to your Nassau New York Closing Statement.