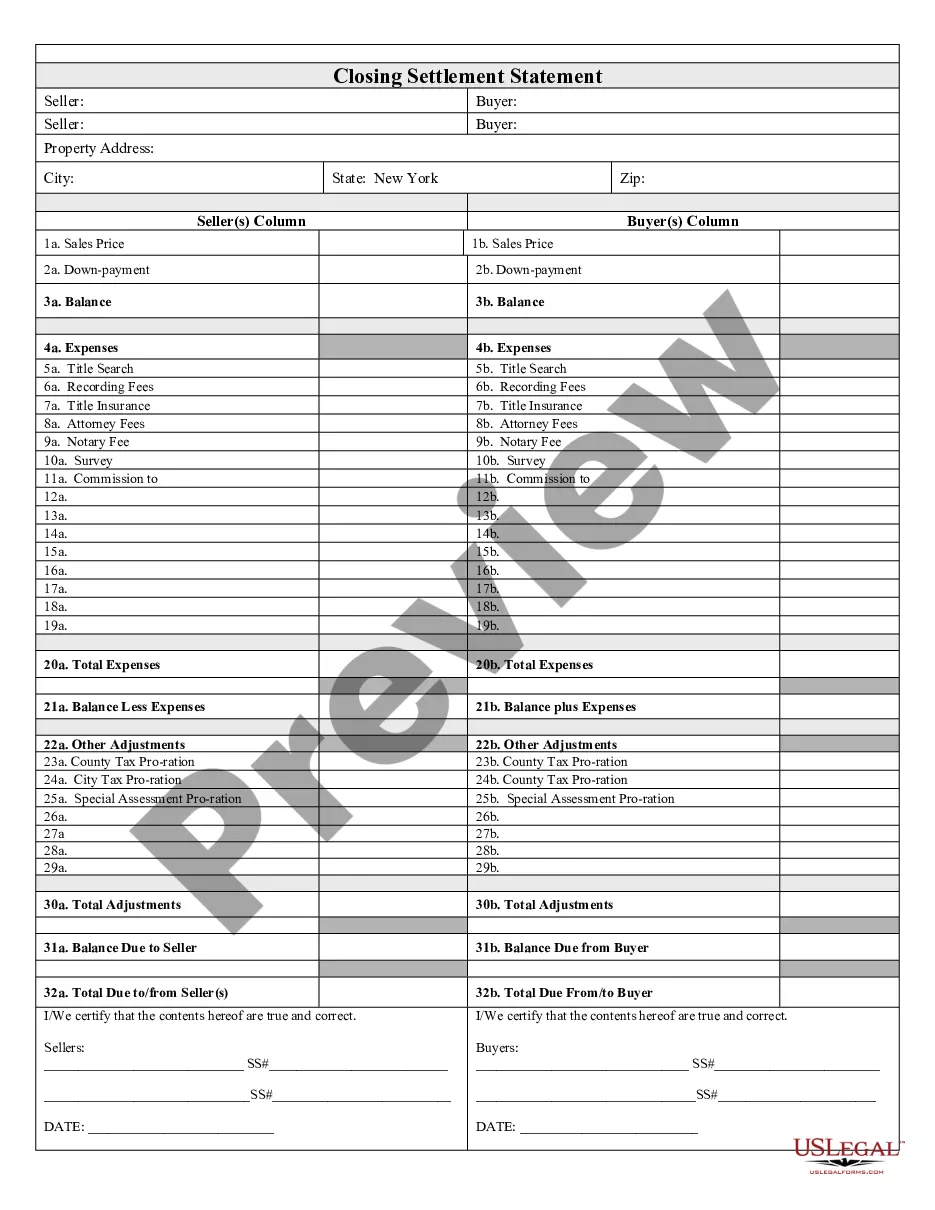

Suffolk New York Closing Statement is a legal document that summarizes all the financial transactions and details involved in a real estate transaction or a business agreement being closed in Suffolk County, New York. It serves as evidence of a completed transaction and includes important information, such as the final purchase price, earnest money deposit, prorated taxes, closing costs, and any outstanding debts or liens. The purpose of a Suffolk New York Closing Statement is to provide a clear breakdown of all financial obligations and ensure that both parties involved in the transaction have met their respective obligations. It is prepared by the closing agent or the attorney representing one of the parties and is typically reviewed and approved by all parties involved before signing. Keywords: Suffolk New York, Closing Statement, legal document, financial transactions, real estate transaction, business agreement, Suffolk County, evidence, completed transaction, purchase price, earnest money deposit, prorated taxes, closing costs, outstanding debts, liens, closing agent, attorney. Different types of Suffolk New York Closing Statements may include: 1. Real Estate Closing Statement: This type of closing statement is prepared in the context of a real estate transaction, such as buying or selling a residential or commercial property in Suffolk County, New York. It includes all the relevant financial details related to the sale, such as the purchase price, down payment, closing costs, loan amounts, and adjustments. 2. Business Closing Statement: This form of closing statement is utilized in business transactions, such as the sale or acquisition of a business or assets, partnership dissolution, or mergers and acquisitions involving companies located in Suffolk County, New York. It encompasses financial information such as the purchase price, allocation of assets and liabilities, outstanding debts, and any other relevant financial considerations. 3. Estate Closing Statement: In the event of a deceased person's estate being settled in Suffolk County, New York, an estate closing statement is prepared. It details the financial transactions related to the distribution of assets, payment of debts, inheritance taxes, and any other financial matters concerning the estate. 4. Contract Closing Statement: This type of closing statement is used for various contractual agreements, such as lease agreements, purchase agreements, or any other legally binding contracts being closed in Suffolk County, New York. It summarizes the financial obligations and details outlined in the contract and ensures that all parties involved have met their obligations before finalizing the agreement. Remember, it's essential to consult with a licensed attorney or a qualified professional for precise information and advice regarding Suffolk New York Closing Statements, as legal requirements and procedures may vary.

Suffolk New York Closing Statement

Description

How to fill out Suffolk New York Closing Statement?

If you’ve already utilized our service before, log in to your account and save the Suffolk New York Closing Statement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Suffolk New York Closing Statement. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!

Form popularity

FAQ

II. To File a Notice of Change of Address in an ECF Case: Complete the Notice of Change of Address form to request a Notice of Change of Address for actions pending at the United States District Court Southern District of New York. Print the form. Sign the form. Scan the form and save it as a PDF file.

You may pay fines, surcharges, and fees: by mail by timely mailing a check or money order payable to the Clerk of the District Court. If your check is not honored by the bank, there will be an additional $20 fee and the immediate entry of a default judgment.

NOTICE OF DISCONTINUANCE TAKE NOTICE that the Plaintiff discontinues the whole of the claim against the First Defendant or: withdraws that part of the claim against the First Defendant by which the Plaintiff claims (specify relief to be withdrawn).

The notice of discontinuance simply informs the court that the case has been discontinued either without or with prejudice. After this point, the case will usually be closed without further action, and the parties and their lawyers will be discharged from any further responsibility with the lawsuit.

(a) before the close of pleadings, by serving on all parties who have been served with the statement of claim a notice of discontinuance (Form 23A) and filing the notice with proof of service; (b) after the close of pleadings, with leave of the court; or (c) at any time, by filing the consent in writing of all parties.

A summons with notice is a type of summons. The summons with notice is not served with the complaint. It contains all of the information described above for the summons, plus a brief description of the type of case and the relief the plaintiff is asking the court to grant.

How do I notify the court and other side if my address changes while my case is pending? Step 1: Fill out a Notice of Current Address form. Fill out the form completely in blue or black ink. Step 2: File.Step 3: Send.Step 4: (If Applicable) -State Case Registry/Office of Attorney General.

(a) before the close of pleadings, by serving on all parties who have been served with the statement of claim a notice of discontinuance (Form 23A) and filing the notice with proof of service; (b) after the close of pleadings, with leave of the court; or (c) at any time, by filing the consent in writing of all parties.

What is a Notice of Discontinuance? If a Claimant discontinues a claim against a Defendant which they have pursued, they will do so by filing a Notice of Discontinuance to the relevant Court. When doing so, costs consequences will apply pursuant to Civil Procedure Rules 38.6 (1).

Generally speaking, these documents set forth the claims that are being asserted against the defendant(s). Typically, though not required in all instances, the plaintiff will verify the complaint. ?A verification is a statement under oath that the pleading is true to the knowledge of the deponent .?? CPLR § 3020 (a).

Interesting Questions

More info

Entrepreneurial Mindset. Bank better at Suffolk Federal, the local Long Island credit union with a location convenient to you in Suffolk County, NY. Expand Collapse All. Offer Details. New York Credit Union. Expand Collapse All. Offers are subject to change without notice. New York Credit Union. Expand Collapse All. Offer terms and conditions subject to change without notice. New York Credit Union. Expand Collapse All. New York Credit Union. Expand Collapse All. Offers are subject to change without notice. This offer is contingent upon the execution of a valid and binding agreement prior to September 20, 2018. Please visit the New York Credit Union website for more information. New York Credit Union. Expand Collapse All. Offer terms and conditions subject to change without notice. New York Credit Union. Expand Collapse All. Offer terms and conditions subject to change without notice.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.