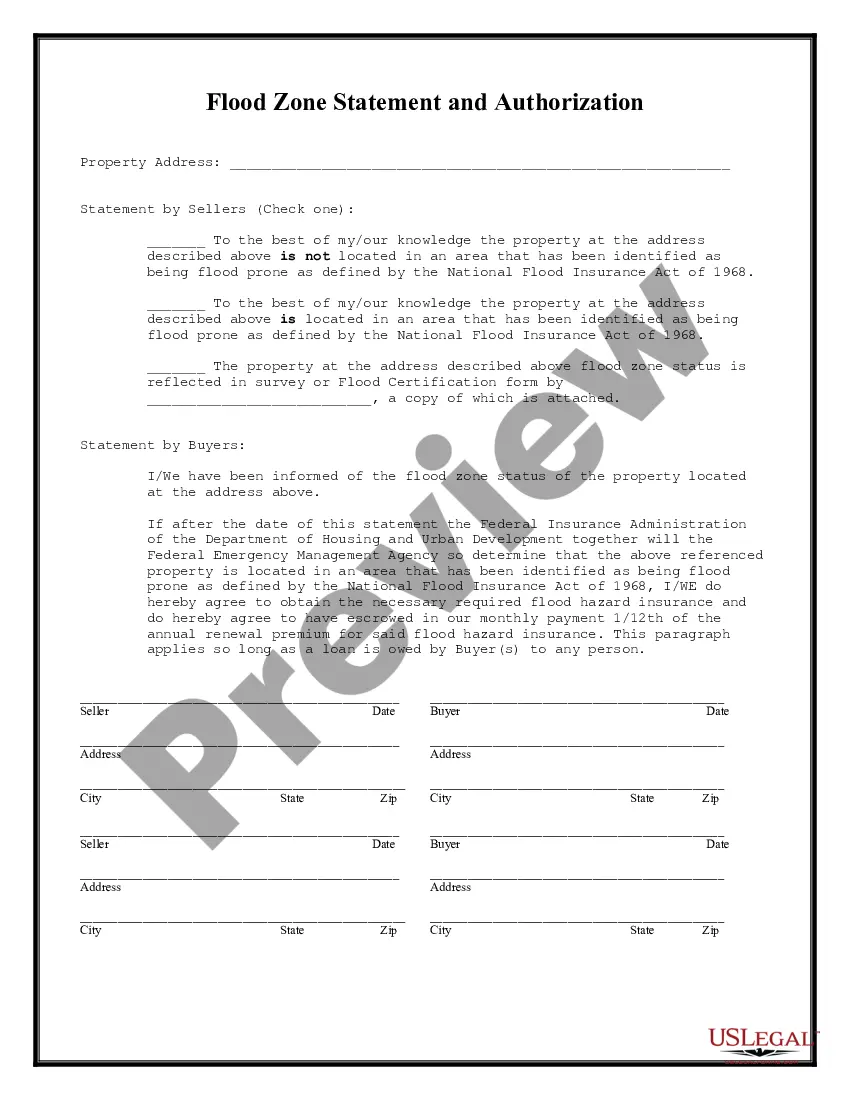

The Rochester New York Flood Zone Statement and Authorization is a crucial document that outlines the flood risk assessment for properties located in Rochester, New York. This statement and authorization are typically required by lenders, insurance companies, and government agencies to assess the potential flood hazards associated with a property. It ensures that the property owner or potential buyer is well-informed about the flood risks and can take necessary precautions. This document includes various relevant keywords such as flood zone, Rochester, New York, statement, authorization, flood risk assessment, lenders, insurance companies, government agencies, flood hazards, property owner, buyer, and precautions. There are different types of Rochester New York Flood Zone Statement and Authorization that can be named based on specific requirements: 1. Standard Flood Hazard Determination Form: This is a commonly used form that is completed by a licensed surveyor or an authorized representative. It provides essential information about the flood zone status of the property, such as the Special Flood Hazard Area (FHA) designation, Base Flood Elevation (BFE), and Flood Insurance Rate Map (FIRM) details. 2. Elevation Certificate: This documentation is typically needed for properties located within SFH As. It is completed by a licensed surveyor or engineer and includes detailed information about the property's elevation in relation to the Base Flood Elevation. It provides an accurate assessment of the property's flood risk and determines flood insurance rates. 3. Letter of Map Amendment (COMA): In cases where the property owner believes that their property is incorrectly included in a high-risk flood zone, they can submit a COMA request. This allows them to challenge the official designation and potentially remove the property from the FHA. The COMA demonstrates that the property's actual elevation is above the BFE. 4. Flood Insurance: While not strictly a type of statement or authorization, obtaining flood insurance is often a requirement if a property is located within a designated flood zone. Lenders typically mandate flood insurance to protect their investment. Flood insurance policies provide coverage for property damage and losses caused by flooding. In conclusion, the Rochester New York Flood Zone Statement and Authorization encompass various forms and documents that assess, determine, and communicate the flood risks associated with properties in Rochester, New York. These documents are essential for property owners, buyers, lenders, insurance companies, and government agencies to make informed decisions regarding flood protection and insurance.

Rochester New York Flood Zone Statement and Authorization

Description

How to fill out Rochester New York Flood Zone Statement And Authorization?

Are you looking for a reliable and affordable legal forms provider to buy the Rochester New York Flood Zone Statement and Authorization? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Rochester New York Flood Zone Statement and Authorization conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Start the search over in case the template isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Rochester New York Flood Zone Statement and Authorization in any provided file format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online for good.