A Nassau New York Non-Foreign Affidavit Under IRC 1445 is a legal document that is used in real estate transactions to establish the non-foreign status of the seller or transferor for the purposes of reporting and withholding taxes under the Internal Revenue Code (IRC) Section 1445. This affidavit is specifically required in Nassau County, New York, and its surrounding areas. The purpose of the Nassau New York Non-Foreign Affidavit Under IRC 1445 is to confirm that the seller or transferor is not a foreign individual or entity, as defined by the IRC. It becomes essential when the real estate property being transferred is subject to the Foreign Investment in Real Property Tax Act (FIR PTA). FIR PTA imposes withholding requirements on the buyer or transferee to ensure that taxes on the sale of real property are paid. By completing and submitting this affidavit, the seller or transferor certifies, under penalty of perjury, their non-foreign status and provides the necessary information required by the Internal Revenue Service (IRS) to comply with IRS regulations and guidelines. Below are some relevant keywords associated with the Nassau New York Non-Foreign Affidavit Under IRC 1445: 1. Nassau County, New York: The specific geographical area where this affidavit is required, referring to the county in the state of New York. 2. Non-Foreign: Referring to individuals or entities who are not considered foreign under the regulations of the IRC. 3. Affidavit: A written statement made under oath or affirmation, declaring the truthfulness of the information provided. 4. IRC 1445: The relevant section of the Internal Revenue Code that sets forth requirements for reporting and withholding taxes on the disposition of U.S. real property interests. 5. Real Estate Transactions: Refers to the buying, selling, or transferring of real property, such as land, buildings, or houses. 6. FIR PTA: Foreign Investment in Real Property Tax Act, a federal law that imposes tax withholding requirements on buyers who acquire interests in U.S. real property from foreign persons. It's important to note that "Nassau New York Non-Foreign Affidavit Under IRC 1445" does not have different types. However, variations or additional requirements may exist depending on the specific regulations of Nassau County or other local jurisdictions. It is always advisable to consult with legal professionals or tax experts familiar with the local laws and regulations to ensure compliance with all applicable requirements.

Nassau New York Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Nassau New York Non-Foreign Affidavit Under IRC 1445?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law education to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes to the rescue. Our platform offers a massive catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Nassau New York Non-Foreign Affidavit Under IRC 1445 or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Nassau New York Non-Foreign Affidavit Under IRC 1445 in minutes employing our trusted platform. If you are presently an existing customer, you can go on and log in to your account to get the needed form.

However, if you are new to our platform, make sure to follow these steps prior to downloading the Nassau New York Non-Foreign Affidavit Under IRC 1445:

- Be sure the template you have chosen is good for your location because the regulations of one state or county do not work for another state or county.

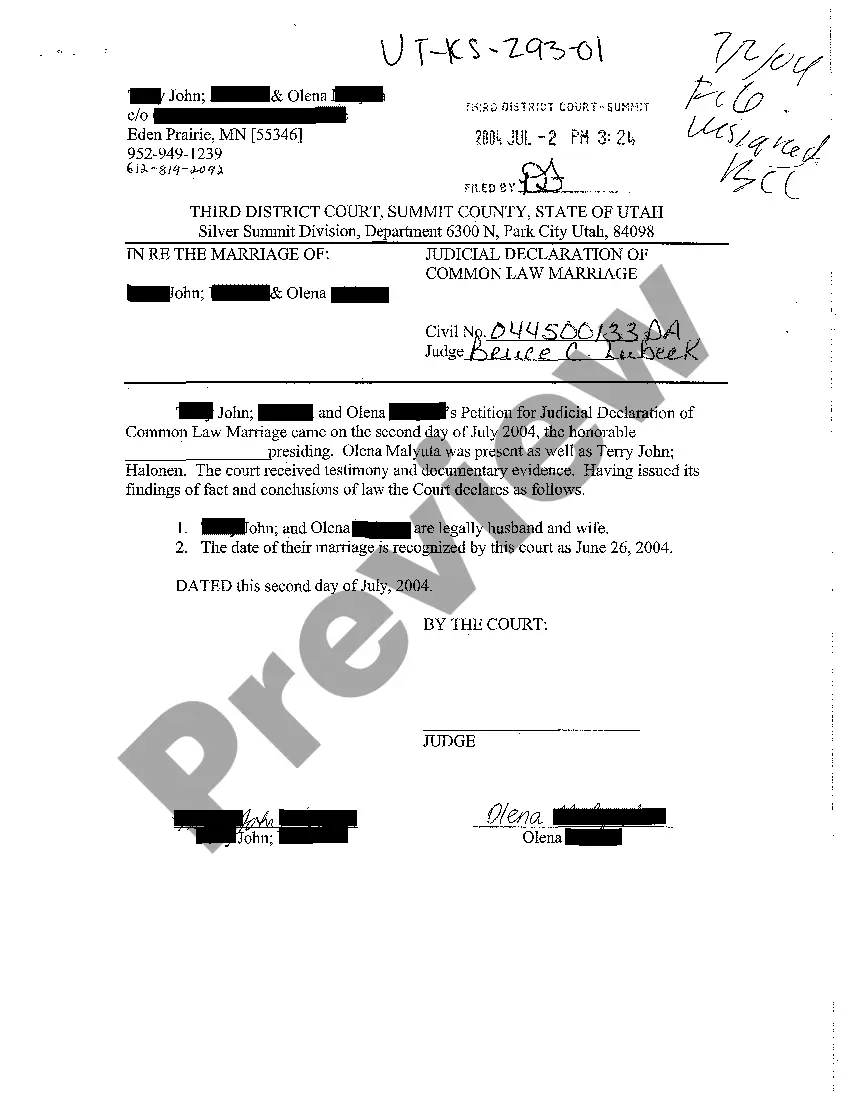

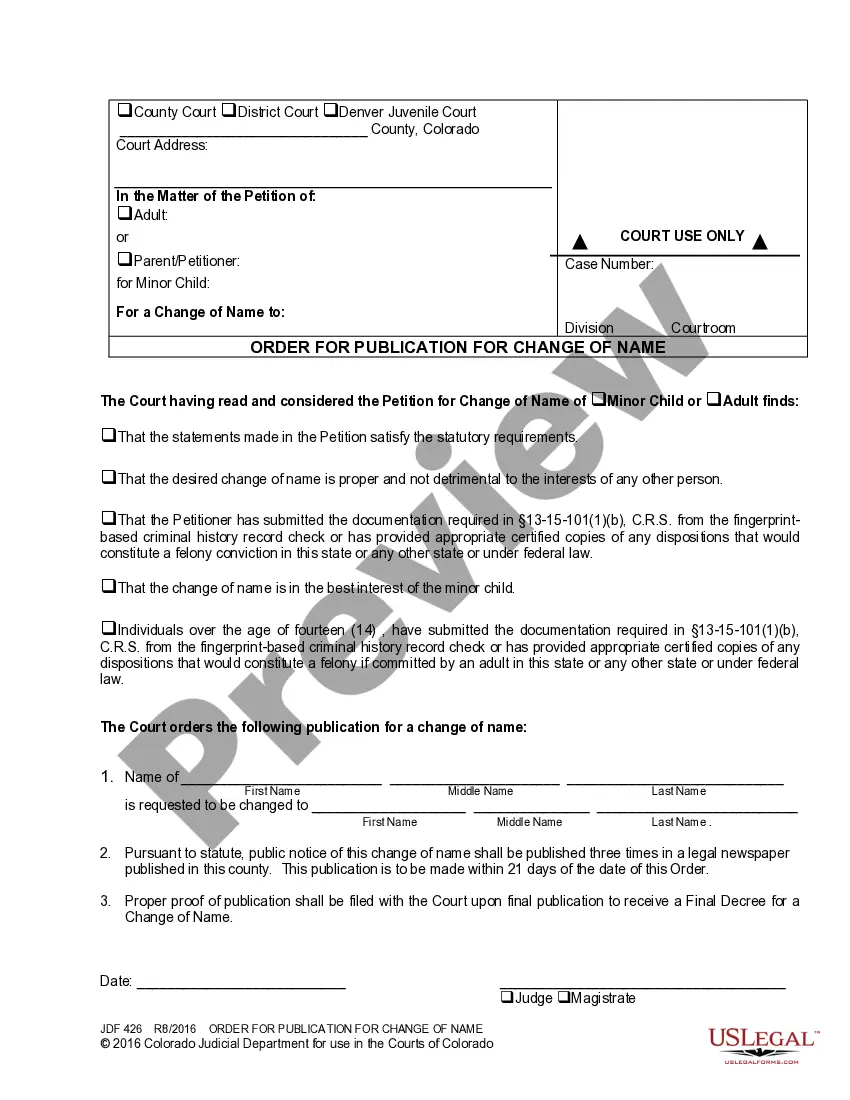

- Preview the form and go through a short description (if provided) of scenarios the document can be used for.

- If the one you picked doesn’t meet your requirements, you can start over and look for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or create one from scratch.

- Pick the payment method and proceed to download the Nassau New York Non-Foreign Affidavit Under IRC 1445 once the payment is completed.

You’re good to go! Now you can go on and print out the form or fill it out online. If you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

Non-Foreign Certification ? Transferee and Transferor. This form is provided so that the buyer and/or seller in this transaction can certify compliance with Foreign Investment in Real Property Tax Act to the escrow agent and/or buyer.

The transferor gives the transferee a certification stating, under penalties of perjury, that the transferor is not a foreign person. The certification should contain the transferor's name, U.S. taxpayer identification number, and home address (or office address, in the case of an entity).

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

A citizen or resident of the United States, ? A domestic partnership, or ? A domestic corporation, or ? An estate or trust (other than a foreign estate of foreign trust as those terms are defined in Section 7701 (a) (31) of the Code.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

The FIRPTA affidavit is required when you are dealing with the local sellers of the United States. The FIRPTA affidavit is for all those local sellers who are not foreigners.

IRS Notice 1445 is a relatively newer notice that notifies taxpayers of their ability to receive tax help in other languages. It lays out the steps needed to receive this help, to ensure that anyone can process their taxes promptly and accurately.

FIRPTA Certificate: A FIRPTA certificate is used to to notify the IRS that the seller of real estate is not a foreign-person. When a foreign person sells real estate, the IRS wants to know about it. Even though some capital gains income tax is exempt to foreign persons, real estate is not exempt.